Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Clothing retailer Next (LSE: NXT) has long been a favourite of long-term investors. Those who bought the stock at its nadir in the early 1990s (the share price fell as low as 7p in December 1990) and somehow had the nerve and gumption to hang on, would have made many, many multiples of their money. Even in the past five years alone, the stock has returned nearly 250%, including reinvested dividends.

However, the company rattled investors last week as the chief executive, Simon Wolfson, warned that 2016 was shaping up to be its toughest year since 2008. The share price fell by more than 10% during the day, while rival retailers such as Marks & Spencer and Debenhams slipped as well. Next cut its sales and profit guidance "for the second time in three months", noted Reuters, with a "worst-case scenario" of a 4.5% fall in profit and a 1% drop in sales.

Wolfson blamed a deteriorating backdrop for consumer spending, and also suggested that consumers may be spending more money on going out and holidaying, rather than buying clothes.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As Jonathan Guthrie notes in the FT's Lombard column, Wolfson "has form as a doomster". That said, adds Lex, it's not just about the gloomy backdrop. There are company-specific issues too "Next is struggling to draw customers to its credit offering" and its Next Directory catalogue and online business "is maturing and needs investment as rivals catch up". All told, it's no disaster but on a price/earnings ratio of nearly 13 and a dividend yield of 2.9%, Next is hardly a screaming buy either.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Defeat into victory: the key to Next CEO Simon Wolfson's success

Defeat into victory: the key to Next CEO Simon Wolfson's successOpinion Next CEO Simon Wolfson claims he owes his success to a book on military strategy in World War II. What lessons does it hold, and how did he apply them to Next?

-

Next’s results stand out against a tough retail backdrop

Next’s results stand out against a tough retail backdropAnalysis FTSE 100 retailer Next is dealing well with the tough conditions on the high street, with rising profits and a plan that's working. Rupert Hargreaves looks at the numbers.

-

Why Next is the only retailer I’d want to own in my portfolio

Why Next is the only retailer I’d want to own in my portfolioNews The retail sector is brutally competitive. But high street stalwart Next is exploiting and building on its significant competitive advantages, says Rupert Hargreaves.

-

Next shares soar as sales smash expectations – is the stock a buy?

Next shares soar as sales smash expectations – is the stock a buy?News High street and online retailer Next has reported a big rise in sales and profits. John Stepek looks at its performance and asks if it's worth buying Next shares.

-

Little cheer on the high street

Little cheer on the high streetFeatures Profit warnings from Debenhams and Mothercare are more evidence that traditional retailers are fighting a losing battle against nimbler online competitors, says Ben Judge.

-

Next: Out of fashion

Features Clothing retailer Next has released gloomy results, yet the firm’s shares rallied strongly. Why? Ben Judge reports.

-

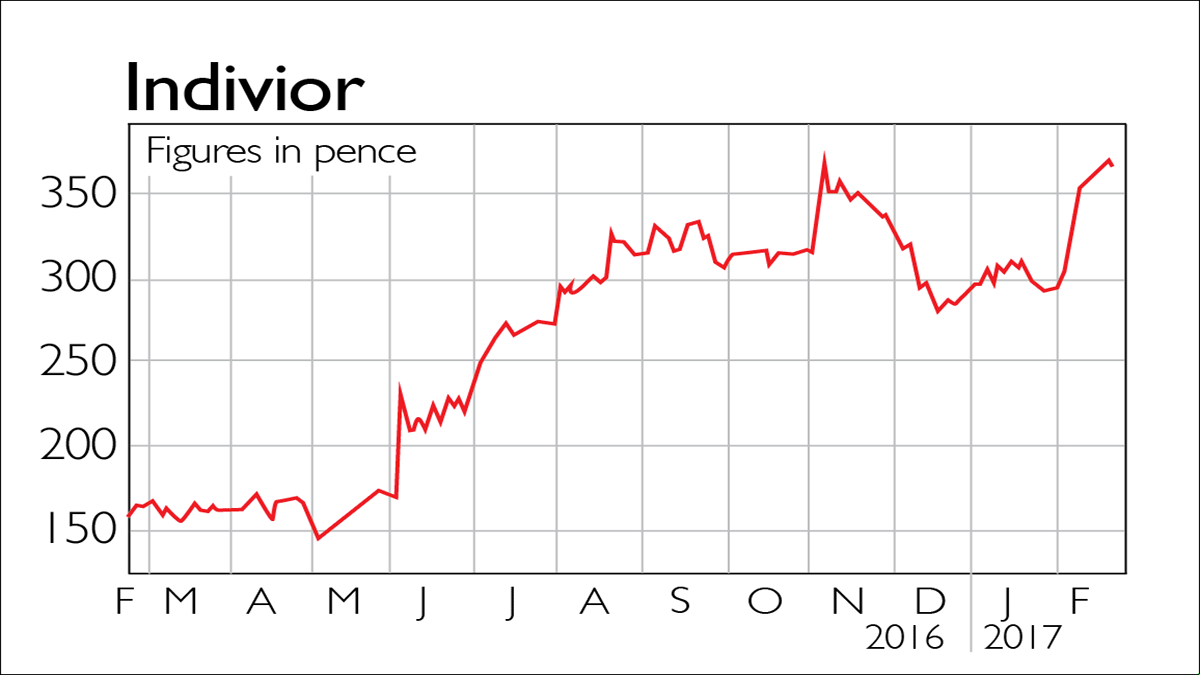

If you’d invested in: Indivior and Next

If you’d invested in: Indivior and NextFeatures Drugmaker Indivior is on the up, while retailer Next, once a favourite with investors, has lost its way.

-

Shares in focus: Next is a rare star in the retail sector

Shares in focus: Next is a rare star in the retail sectorFeatures Fashion retailer Next has been an exception to the rule of the declining high street. Phil Oakley investigates to see if the shares are still worth buying.