Indivior’s miracle drug wears off

Indivior’s opioid addiction treatment has been exposed to generic competition. Can the drugmaker fight back? Alice Gråhns reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Indivior's opioid addiction treatment has been exposed to generic competition. Can the drugmaker fight back? Alice Grhns reports.

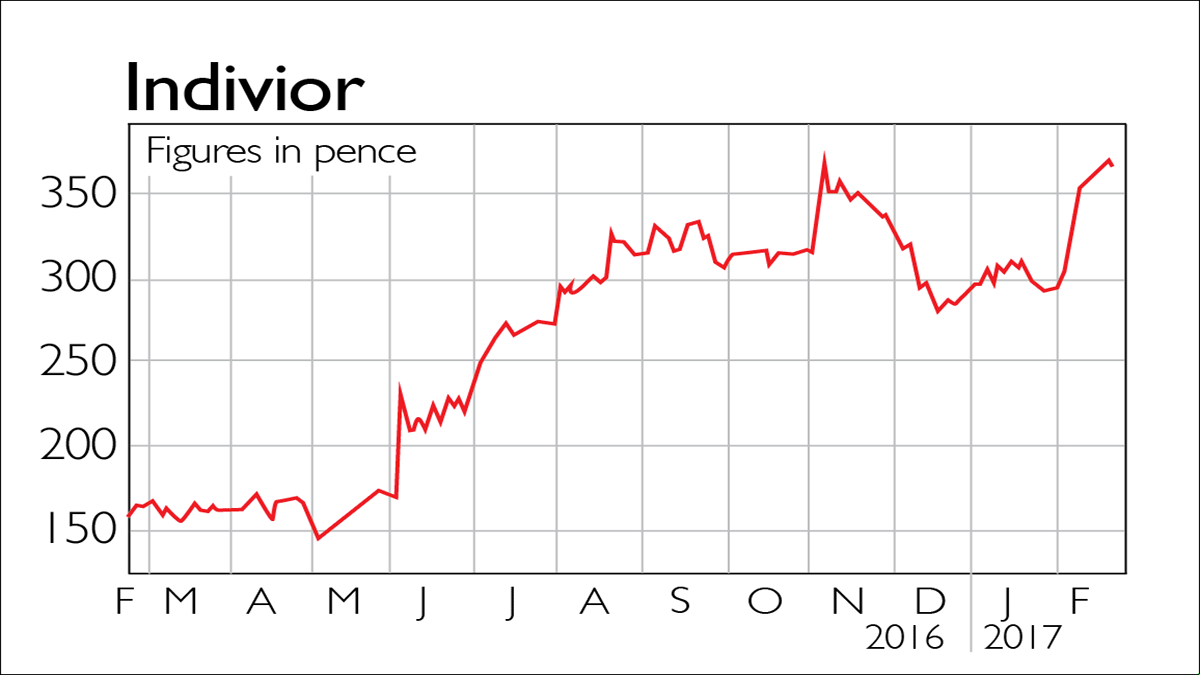

"Indivior investors must have thought they'd found a miracle drug," says Alistair Osborne in The Times. "The more Suboxone they took, the better they felt." The shares, spun off from Reckitt Benckiser at 120p in December 2014, soared to 420p last month. But "after the high, the comedown". Last Friday Indivior's stock plummeted 40%, wiping £1bn off the firm's value, as a US court ruling opened the door to a generic imitation of Indivior's opioid addiction treatment from the Indian pharmaceuticals group Dr Reddy's.

Now shareholders will be suffering "cold sweats". Indivior's Suboxone Film, a daily drug slipped under the tongue, has 61%of the opioid addiction market "and the patents that go with it". It's a burgeoning industry, considering 140 people a day are dying from overdoses. Indivior says Suboxone comprises 80% of sales and a US generic could result "in it losing up to 80% of its market share in months".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"In the boom/bust pharmaceutical industry all major companies must face the reality of a loss of patents at some point," says Peter Stephens on Fool.co.uk. The trouble in this case, however, is that Suboxone is a major drug in terms of sales. For other companies the loss of a patent could be offset by other products, but "for Indivior, that may not be the case". The future now appears "highly uncertain".

Don't panic just yet, says Rupert Hargreaves, also on Fool.co.uk. Management has known about the possible generic threat since the firm floated in 2014 and has developed new products, reinforced relationships with distributors and bulked up its marketing team. Indeed, Indivior has been here before, as Lex points out in the Financial Times. By developing a slow-release film dispensing buprenorphine, a "powerful panacea" for addicts in withdrawal, it managed to fend off competition from generic groups keen to sell buprenorphine pills. "It may outpace rivals again," if a version of its drug delivered by monthly injection is taken up by US doctors.

Meanwhile, as Alistair Osborne points out, the arrival of the generic competitor isn't a done deal. It requires approval from the Food and Drug Administration, and Indivior is appealing against the ruling. Given this backdrop, the sell off "has gone too far", says Lex; the shares look cheap compared with Dr Reddy's or Hikma, a UK-listed generics group. "Shareholders should sit tight. Indivior may emerge from rehab in good shape."

Vivendi: firing on one cylinder

The French media conglomerate Vivendi "looks like a one-legged stool", says Liam Proud in Breakingviews. It reported unexpectedly strong sales in the first half of the year, but that was largely due to Universal Music Group, which accounts for half of group revenues. It is profiting from a digital-streaming boom, thanks to services such as Spotify. Like-for-like sales rose by an annual 14%. The other half of Vivendi includes TV unit Canal Plus, which is still shrinking, albeit a tad more slowly than before, with first-half operating profit down 42%. Beyond Canal Plus, there's a video-game company that barely breaks even, a stake in Italy's former state telecom company, and, following a takeover in July, the advertising agency Havas, says Stephen Wilmot in The Wall Street Journal.

Havas recently abandoned its target for full-year organic growth after posting the second-lowest results of its peer group. This would be less irksome for shareholders "if the marriage with Havas made strategic sense", says Leila Abboud on Bloomberg Gadfly. But "it doesn't".

Instead, "Vivendi is now likely to end up significantly overpaying", given major brands are cutting their marketing spending. Since Vivendi said in May it would pay €9.25 in cash for each Havas share, the advertising industry has been reeling. Vivendi's shareholders have "cause to grumble, while Havas's shareholders can only be relieved".

City talk

Reckitt Benckiser's focus on brands such as Cillit Bang, Nurofen and Durex "has made it the star of Britain's consumer sector", says Alex Brummer in the Daily Mail. However, investors need to keep an eye on governance. "Careless selling" of its Oxy disinfectant product in South Korea has been linked to 100 deaths. In Australia it was fined for misleading advertising of Nurofen spin-offs. It has also "caught a nasty cold" with its "abject response" to the cyberattacks in June. Chief executive Rakesh Kapoor took a pay cut last year from £25.5m to £14.6m, but he "still looks grossly overpaid".

Public relations firm Bell Pottinger "has provided a textbook example of how not to manage a crisis", says Nils Pratley in The Guardian. First it denied any wrongdoing in its work for the Gupta family. When the facts suggested otherwise, and highlighted the group's "poisonous campaign based on stoking racial division", it fired a mid-ranking partner. Then CEO James Henderson and company founder Timothy Bell squabbled over who was to blame. Being expelled from its trade body makes Bell Pottinger's prospects "substantially bleaker". But tough luck. "Sometimes ugly spin has to be seen to catch up with the spinner."

"It's good to be reassured by bankers that we are in a new era of sensible lending," says Simon English in the Evening Standard. But hang on, what's this? According to a survey by Citizens Advice, 18% of people struggling financially have had their credit limit raised, even though they didn't request an increase. This applies to only 12% of credit-card holders overall. "Serial debtors are highly profitable for banks, for a while, until they go completely under, when they become a strain on balance sheets and society. Still, that won't happen today or tomorrow, so is not worth considering."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn