Working households exposed to higher inflation than retirees – is the triple lock justified?

High inflation has thrown the triple lock into focus in recent years, with critics calling the measure unfair and expensive. Are they right?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

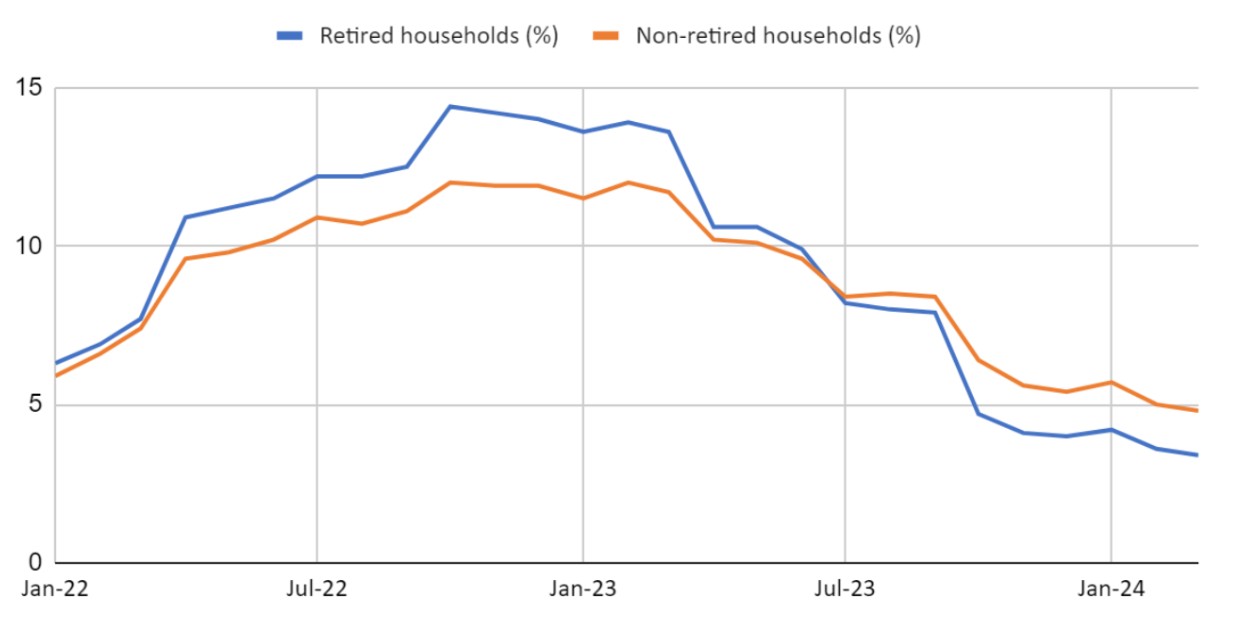

Since July last year, working households have been suffering a higher rate of inflation than retirees, according to the Office for National Statistics (ONS).

Each month, the ONS releases its household cost indices. These reveal how much prices are rising across a range of different groups of the population.

In the year to March, working households saw their costs go up by 4.8%. That’s significantly higher than the 3.4% inflation experienced by retired households.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

These figures differ to the overall headline inflation rate, known as the Consumer Prices Index (CPI). CPI is the UK’s main inflation indicator.

The good news is that the cost-of-living crisis is easing. CPI came in at 2.3% in April, just a whisker away from the Bank of England’s 2% target.

However, the disparity between price rises for working and retired households raises some important questions. Is this a consistent trend and, if so, can the state pension triple lock be justified? We take a closer look.

Why are working households facing higher inflation than retirees?

Mortgage payments are the main reason working households are suffering a heavier inflation burden.

Mortgage rates skyrocketed in the aftermath of Liz Truss’s disastrous mini-Budget in September 2022. They have remained high ever since – at least compared to the averages seen towards the end of the 2010s.

Mortgage rates rose even higher last summer as markets started to question if and when inflation (and interest rates) would start to come down. In August, average mortgage rates weren’t too far off 7%.

While mortgage rates have fallen from their peak, costs remain high. The average two and five-year fixed rates today are 5.93% and 5.50% respectively, according to Moneyfacts.

Lots of mortgage holders would have managed to avoid suffering the effects of these rises initially – especially if they locked into a five-year fixed deal before rates went up.

However, the bad news is that around 1.6 million mortgage holders will see their fixed-rate deals expire this year, forcing them to take on big increases in monthly costs.

Far fewer retirees have mortgages, having paid them off already. This is a key factor in their lower household inflation rate right now.

What’s more, energy prices have now fallen considerably from their peak. Electricity, gas and other fuel prices fell by 18.3% in the twelve months to March.

Research from the Resolution Foundation has previously pointed out that “older age groups are more likely to live in larger and less energy efficient homes”, which means they are more exposed to changes in energy prices.

This meant they suffered at the height of the cost-of-living crisis when energy prices skyrocketed, but they are now benefitting from energy prices coming down.

What is the state pension triple lock – and does this bolster arguments against it?

The triple lock is a measure that was introduced in 2010 to protect the value of the state pension. The government committed to raising the amount paid out each year in line with whichever measure is highest – inflation, earnings growth, or 2.5%.

For pensioners, this is a valuable protection. Recipients of the state pension saw their payments increase by 8.5% from April this year given the high rate of inflation.

This took the weekly payment to £221.20 for full recipients of the new state pension (up from £203.85). Meanwhile, full recipients of the old state pension saw their weekly payments increase from £156.20 to £169.50.

The downside is that the measure is very expensive. The Office for Budget Responsibility (OBR) estimated that the state pension would cost £125 billion in 2023/4.

What’s more, the Conservative Party’s “triple lock plus” election pledge now gives additional concessions to pensioners. This election policy promises to raise pensioners’ personal allowance each year in line with the same three protections.

This effective tax cut would ensure pensioners never have to pay income tax on their state pension, the Conservatives have said.

While younger taxpayers will be pleased for their parents and grandparents, they won’t be quite so overjoyed at having to shoulder the larger tax burden. This comes at a time when their own personal allowances have been frozen, leaving them at the mercy of fiscal drag.

“If inflation for non-retired households remains stubbornly high and above that of retired households, it will only serve to raise questions around how fair and well-targeted this ‘Triple Lock Plus’ policy is,” says Simon Kew, head of market engagement at consultancy firm Broadstone.

To be fair to pensioners, it is worth pointing out that they have suffered their fair share of inflationary woes in recent years too. Prior to July 2023, their rate of household inflation was higher than that of workers, as the below chart shows.

On top of this, the state pension is many older people’s main source of retirement income.

People of working age have the option of changing jobs or taking on additional work – even if that option isn’t always easy or desirable. The same cannot be said for retirees.

However, the ONS also points out that the above chart isn’t reflective of the longer-term trend. Retired and non-retired households experienced a similar level of inflation between 2010 and 2021.

With this in mind, many believe there are fairer ways of protecting the value of the state pension other than linking it to the rate of inflation.

Alternatives to the state pension triple lock

Given the challenges we have seen in recent years, some have been arguing for reform.

“A more sensible approach rather than constant tinkering would be to link pensions more closely to average earnings,” says Kirsty Anderson, a retirement specialist at Quilter. “This model not only aligns pension growth with national economic performance but also fosters a fairer distribution of wealth across generations.”

She adds: “This approach would mitigate the financial unpredictability associated with the triple lock, creating an easier way to effectively budget and ensure that pension increases do not disproportionately benefit one demographic at the expense of another.”

For now, the triple lock is safe with both Labour and the Conservatives committing to keep it as part of their general election pledges. However, the matter is far from put to bed. It’s likely that another government will be forced to take the bull by the horns at some undefined point further down the line.

We looked at some triple lock alternatives in a recent MoneyWeek article.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how