How to avoid online purchase scams

Online purchase scams are on the rise, warn Santander and Gumtree. But how do these marketplace scams work and how can you stay safe?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you’re planning to buy a new camera or house-hunting online, keep your eyes peeled for suspicious ads or scam posts.

There is a chance that you may get tricked by a fraudster and end up losing valuable money or private information.

The latest Santander and Gumtree data reveals that online purchase scams - where criminals pose as sellers - are on the rise.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Last year, Santander customers lost out on £7.3 million to online purchase scams - a 32% increase from 2022. An average customer lost about £500, and 80% of the purchase scams reported were initiated on online marketplaces or selling platforms.

Gumtree also saw over 42,000 ads that were blacklisted for appearing to be suspicious, and a 24% increase in ‘for sale’ listings between February and April 2023.

This is a serious cause of concern, especially for those looking to buy a property or new homeowners who are just stepping foot into the housing market.

We have already seen copycat banking websites take control of people’s hard-earned cash, and a rise in Amazon, WhatsApp, romance, crypto and holiday scams.

But with the rise of AI, fraudsters have become increasingly sophisticated and it has become harder to spot a scam, which means more people can fall into such traps. So you have to be vigilant every time you click on a website, and look beyond typos or fake web addresses.

“More than ever, scammers are homing in on our love of grabbing a bargain, whether it’s that ‘impossible’ to come by collectable or a new phone,” says Chris Ainsley, head of fraud risk management at Santander.

While Ainsley warns customers to be wary of sale items that appear too good to be true, he thinks that more can be done to “stop criminals from creating these posts in the first place”.

We look at how online purchase scams work and measures you can take to stay safe.

What are online purchase scams?

Purchase scams are methods used by fraudsters to steal customers’ money by appearing as legitimate adverts on marketplaces and digital platforms. Such scams are infamous for offering sale items that don’t exist, and making use of money transfer methods that are not protected so that buyers are left in the dark.

“We’ve invested heavily in recent years in technology to prevent scam posts making it to our site and thanks to this, the volume of suspicious listings we’re having to remove is falling month on month,” says Joseph Rindsland, head of trust and safety at Gumtree.

“But scammers are tenacious, and we still removed tens of thousands of posts in 2023.”

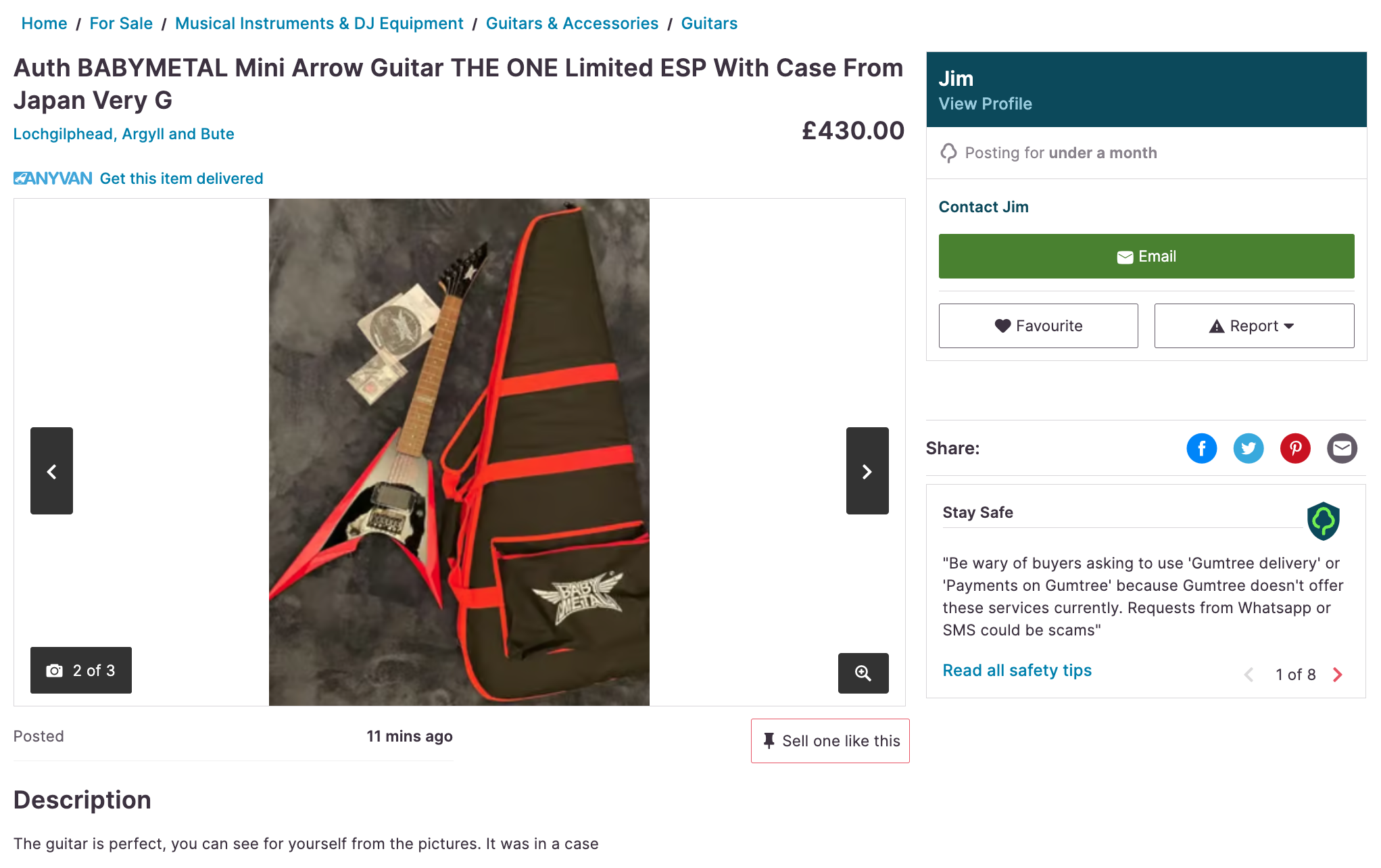

The most common items that scammers create fake advertisements about include smartphones, gaming consoles, digital cameras, headphones, dogs, guitars and collectables, maybe a vinyl you’ve been eyeing recently.

High value items like guitars are one of the most common items used in online purchase scams

How to identify online purchase scams

Purchase scams work exactly how genuine marketplaces do - criminals advertise items on social media or through ad listings, and once a buyer has caught interest in it, they will contact the ‘seller’.

However, some red flags can help you identify fake websites or ad listings. Here are a few to be mindful of:

Pushy seller: The ‘seller’ will be very adamant or pushy to get you to make a purchase. They can give reasons such as limited availability, high demand or any form of urgency that will convince you to buy it then and there.

Fake or no images: In some cases, you won’t be able to view the item, and the ‘seller’ will give you various kinds of excuses for it. Or, you could be faced with images that are taken from social media, and aren’t true to the item that is being advertised to you.

Suspicious or new profiles: Fraudulent sellers often create fake profiles and start posting multiple listings within a short time frame. The price is usually too good to be true, below market average, and the product doesn’t have enough detail to it. You should also beware of listings available in multiple locations that appear suspicious.

Unusual payment methods: The ‘seller’ will often use a payment method that doesn’t have any protection, such as a PayPal service or bank transfer to an unknown name or bank account.

Always take time to think things through: It may seem like a stroke of luck to you if you come across such ‘bargains’, but they are far from one. Though marketplaces can be handy to find good deals, there are always a handful of bad apples which could result in you having a negative shopping experience. So you should always be mindful of where you put your money and if it’s worth the gamble for a deal that could instead cost you.

How to report a purchase scam

If you come across an ad listing or marketplace offer that appears too good to be true or find it suspicious, you can report it to Action Fraud on its website or by calling on 0300 123 2040 between 8am and 8pm on Monday to Friday.

Action Fraud is the national reporting centre for fraud and cybercrime in England, Wales and Northern Ireland. If you’re based in Scotland, you can directly report these incidents to Police Scotland.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Oojal has a background in consumer journalism and is interested in helping people make the most of their money.

Oojal has an MA in international journalism from Cardiff University, and before joining MoneyWeek, she worked for Look After My Bills, a personal finance website, where she covered guides on household bills and money-saving deals.

Her bylines can be found on Newsquest, Voice.Cymru, DIVA and Sony Music, and she has explored subjects ranging from politics and LGBTQIA+ issues to food and entertainment.

Outside of work, Oojal enjoys travelling, going to the movies and learning Spanish with a little green owl.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how