Winter Fuel Payment – what is it and who can get it?

Pensioners with incomes less than £35,000 will be eligible for the Winter Fuel Payment this year after a policy flip flop – but scammers are targeting the confusion. We explain how it works, and how to spot a Winter Fuel Payment scam.

Ruth Emery

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The majority of pensioners will get the Winter Fuel Payment this winter after the government rowed back on its controversial decision to remove the allowance for millions of people.

The Treasury says nine million pensioners in England and Wales will qualify for the payment, worth up to £300, this winter.

It will be welcome news for retirees struggling with the cost of heating their homes as energy prices remain much higher than they were before the energy crisis in 2022.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The price of energy increased in the final quarter of 2025, with the price cap for October to December rising by 2%, taking the average annual gas and electricity bill on a variable tariff to £1,755.

However, about two million people over state pension age who have taxable incomes of more than £35,000 will not be eligible for the Winter Fuel Payment. They will have to pay the allowance back to the government through tax unless they have already opted out.

We look at what the Winter Fuel Payment is, who gets it, and how it works.

What is the Winter Fuel Payment?

The Winter Fuel Payment is an annual tax-free allowance worth £200 per eligible household, or up to £300 if the household contains someone aged 80 or over.

It aims to help pensioners pay their energy bills during the coldest months of the year.

Pensioners have been eligible for some support towards energy bills since 1997, but universal help was removed for millions of pensioners in the 2024 Autumn Budget, when the Winter Fuel Payment became means-tested.

Following a significant policy climbdown by Labour, the government announced in April that, while the benefit will remain means-tested, the eligibility criteria will be significantly widened when payments are made in winter 2025/26.

Who gets the Winter Fuel Payment?

Eligibility is based on a person’s age and place of residence during the qualifying week, which is 15 to 21 September 2025 for this winter's payment.

To receive and keep the Winter Fuel Payment, you will now need to meet two criteria:

- You will need to have reached the official state pension age. For the 2025/26 allowance, a person needed to have reached this by 21 September 2025

- You will also need to have an income of, or below, £35,000 a year

The Treasury says the “vast majority” – over three quarters – of pensioners will meet these criteria and that the threshold is “well above” the income level of pensioners in poverty.

Pensioners won’t need to take any action to receive the benefit as they will automatically be paid the allowance. Meanwhile, those with incomes above the threshold will have it automatically recovered by HMRC.

The requirements to claim the benefit are much less stringent than they were in 2024 when pensioners had to be claiming certain other state benefits, such as Pension Credit or Universal Credit.

Chancellor Rachel Reeves said “no pensioner on a lower income will miss out” on the Winter Fuel Payment this year.

She added: “Targeting Winter Fuel Payments was a tough decision, but the right decision because of the inheritance we had been left by the previous government. It is also right that we continue to means-test this payment so that it is targeted and fair, rather than restoring eligibility to everyone including the wealthiest.”

How will the Winter Fuel Payment be claimed back from pensioners?

Retirees whose income is over £35,000 will not be eligible for the Winter Fuel Payment, and will need to repay it if they receive it.

HMRC will take the Winter Fuel Payment back from you in one of two ways.

Tax code

The first, and the most likely, way it could be taken back is by HMRC adjusting your tax code automatically. This applies to people who usually pay tax through PAYE on their pension or wages.

In this case, HMRC will change your tax code for the 2026/27 tax year and deduct money from your income each month.

For example, for a typical Winter Fuel Payment of £200, the taxman will deduct around £17 from your pension income per month.

However, the government has said that in the 2027/28 tax year, this deduction will rise to around £33 as HMRC will collect payments for both 2026 and 2027. The deduction will return to £17 per month for the 2028/29 tax year.

Self-assessment

The second way the Winter Fuel Payment could be taken back is through a self-assessment tax return.

HMRC says that in this case it will include the payment on your 2025/26 tax return as part of your income automatically if you complete a self-assessment tax return each year.

If you file your tax returns on paper then you will need to manually add the payment on the return.

Can you opt out of the Winter Fuel Payment?

If you don’t wish to receive the £200 to £300 Winter Fuel Payment, then you are able to opt out.

To opt out for winter 2025/26, you had to complete the opt out form on gov.uk on or before 14 September 2025, or call the helpline (0800 731 0160) before 6pm on 12 September 2025.

If you opted out and at a later time decide you would like to get the payment, then you can opt back in by contacting the centre. You will need to get in touch before 31 March 2026 to get the payment this winter (2025/26).

Can you opt out of the Winter Fuel Payment?

If you don’t wish to receive the £200 to £300 Winter Fuel Payment, then you are able to opt out.

To do this, you will need to complete the opt out form on gov.uk on or before 14 September 2025. Or, you can call the helpline (0800 731 0160) before 6pm on 12 September 2025.

If at a later time you decide you would like to get the payment, then you can opt back in by contacting the centre.

If you have opted out and changed your mind, you will need to get in touch before 31 March 2026 to get the payment this winter (2025/26).

How much is the Winter Fuel Payment and when will you receive it?

If you live alone and qualify for the Winter Fuel Payment but are under 80 years old, you will receive £200. If you are 80 or over, you will receive £300. The payment is per household, so if you live with someone else and you both qualify, you will only receive one payment. The same age thresholds apply.

If you are eligible for the Winter Fuel Payment, you will receive a letter in October or November telling you how much money you can expect to receive. If you do not receive a letter but think you are eligible for the benefit, you can check whether you need to make a claim using the government website.

Most payments are then made in November or December.

How to claim the Winter Fuel Payment

You should receive the Winter Fuel Payment automatically, if you are the correct age and have an income of, or below, £35,000.

If you meet the criteria then you will not need to complete any extra steps to be given the payment, the Treasury said.

One exception is if you live abroad. In this instance, you will need to claim the payment by post or by phone. Further information including contact details and cut-off dates can be found on the government website.

Keep an eye on your post in October and November for a letter telling you how much Winter Fuel Payment you will get. If you do not receive this but think you should be eligible for the payment, it is possible that something has gone wrong.

You can contact the Winter Fuel Payment Centre if you have any concerns. Contact details can be found on the government website.

Winter Fuel Payment scams surge by over 150% – how to spot one

Fraudsters are attempting to exploit people who could be eligible for the Winter Fuel Payment, with millions at risk of being scammed.

Pensioners are increasingly being targeted by a ‘phishing’ scam that harvests recipients’ personal and financial data, potentially leaving victims’ bank accounts compromised.

Reports of scam texts surged by 154% in the last week of September when compared to the previous week, new data from HMRC shows.

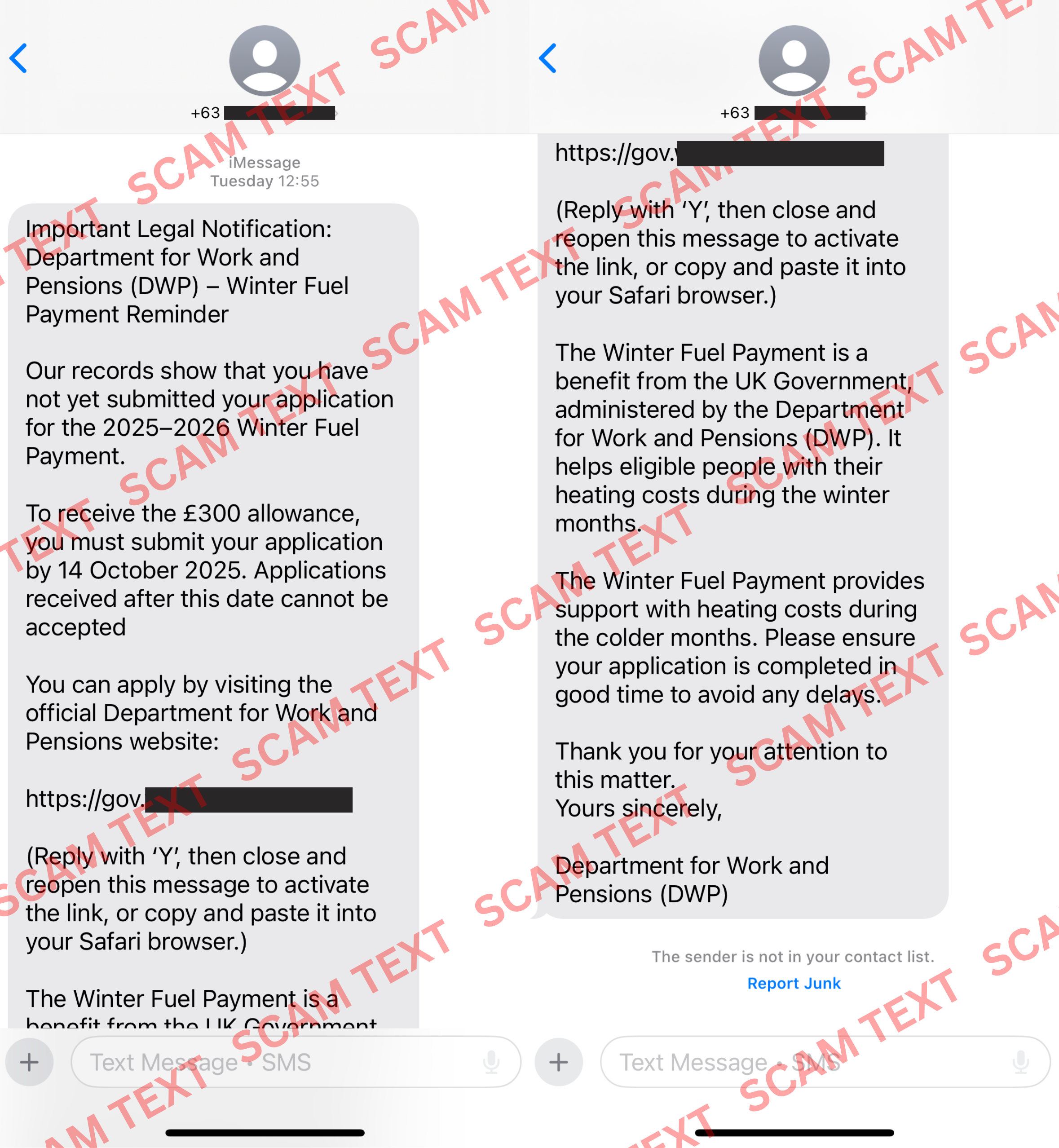

These scams are circulating in different forms, but almost all of them pretend to be a government department and ask you to register for the Winter Fuel Payment by using a link included in the text.

The government says Winter Fuel Payments are almost always made automatically and they will never ask for bank details by text.

As part of the scam, criminals claim the recipient is eligible for the Winter Fuel Payment but must register by a certain date, either by text or by clicking a link within the text or email.

The link included in the text does not actually go to a government website and instead sends all the data entered straight to the scammers, letting them steal victims' personal and financial information.

Scammers claim that if you fail to click on the link, the Winter Fuel Payment will be taken from you. In reality, almost all people eligible for the Winter Fuel Payment will receive it automatically and do not need to provide any personal information.

Even in the unlikely situation that some pensioners need to provide the government with extra information in order to receive the Winter Fuel Payment, this information should never be given by text.

MoneyWeek saw an example of a Winter Fuel Payment scam text. It purported to be from the Department for Work and Pensions and wanted the recipient to send personal details through a fictitious link.

The government has urged anybody who receives a text message like this to report it to the authorities by forwarding it to 7726 before deleting it. If you receive a similarly suspicious email, you can also report that by forwarding it to phishing@hmrc.gov.uk.

Never click on a link in one of these messages, and never reply with any personal or financial details.

Work and Pensions Secretary Pat McFadden said: “If you get a text message about Winter Fuel Payments, it’s a scam. They will be made automatically so you do not need to apply.

“These despicable attempts by criminals to target people are on the rise. We are raising awareness to make it harder for fraudsters to succeed. If you receive a suspicious message about Winter Fuel Payments, don’t engage – forward it to 7726 and delete it immediately.”

Data from trade body UK Finance shows fraudsters scammed Brits out of £1.17 billion in 2024 alone, while Citizens Advice says around nine million people were victims of financial scams in the same year.

Meanwhile, the Financial Conduct Authority (FCA), the City watchdog, warned in August that cyber criminals were impersonating them to steal money from older people in a similar ‘phishing’ scam.

To make sure you are not among them, follow these top tips:

- Do not click on links in unexpected text messages or emails, especially if the message is about government payments.

- Do not give out your personal information or financial details in response to a colder caller, unsolicited email, text message or request online.

- Never give debit or credit card numbers, PIN codes, or other personal information in response to a cold caller, unsolicited email, text or online request. A genuine bank or official organisation will never contact you for this information or ask you to move money into another account.

For more on fraud, read our article on the top investment scams to beware of.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Daniel is a financial journalist at MoneyWeek, writing about personal finance, economics, property, politics, and investing.

He covers savings, political news and enjoys translating economic data into simple English, and explaining what it means for your wallet.

Daniel joined MoneyWeek in January 2025. He previously worked at The Economist in their Audience team and read history at Emmanuel College, Cambridge, specialising in the history of political thought.

In his free time, he likes reading, walking around Hampstead Heath, and cooking overambitious meals.

- Ruth EmeryContributing editor

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Winter Fuel Payment cut to hit ‘1.5 million’ pensioners - what support does your energy supplier offer?

Winter Fuel Payment cut to hit ‘1.5 million’ pensioners - what support does your energy supplier offer?Advice The Winter Fuel Payment is being scrapped for most pensioners this year. But you may be able to access extra support from your energy supplier. Here’s what’s on offer.

-

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings account

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings accountUlster Bank is offering savers the chance to earn 5.2% on their cash savings, but you need to act fast as easy access rates are falling. We have all the details

-

Moneybox raises market-leading cash ISA to 5%

Moneybox raises market-leading cash ISA to 5%Savings and investing app MoneyBox has boosted the rate on its cash ISA again, hiking it from 4.75% to 5% making it one of top rates. We have all the details.

-

October NS&I Premium Bonds winners - check now to see what you won

October NS&I Premium Bonds winners - check now to see what you wonNS&I Premium Bonds holders can check now to see if they have won a prize this month. We explain how to check your premium bonds

-

The best packaged bank accounts

The best packaged bank accountsAdvice Packaged bank accounts can offer great value with useful additional perks – but get it wrong and you could be out of pocket

-

Bank of Baroda closes doors to UK retail banking

Bank of Baroda closes doors to UK retail bankingAfter almost 70 years of operating in the UK, one of India’s largest bank is shutting up shop in the UK retail banking market. We explain everything you need to know if you have savings or a current account with Bank of Baroda

-

How to earn cashback on spending

How to earn cashback on spendingFrom credit cards and current accounts to cashback websites, there are plenty of ways to earn cashback on the money you spend

-

John Lewis mulls buy now, pay later scheme

John Lewis mulls buy now, pay later schemeThe CEO of John Lewis has said the retailer will consider introducing buy now, pay later initiatives for lower-priced items.