Okta: an undervalued cybersecurity play

Okta provides vital security services and appears cheap considering AI’s growing prominence

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The rise of artificial intelligence (AI) has made it incredibly easy for criminals to attack computer systems. Defending against these attacks is now at the front of mind for many of the world’s businesses and consumers. Indeed, a quick online search for the word “cyberattack” shows the scale of the problem. At the end of August, US AI company Anthropic said its technology had been “weaponised” by hackers “to commit large-scale theft and extortion of personal data”. It said its tools had been used to hack 17 organisations, including government bodies. And that’s just one headline.

So it’s no surprise an arms race has developed between cybercriminals and security experts. Okta (Nasdaq: OKTA) is one of the businesses in the vanguard. The US firm offers a platform that enhances security by verifying users’ identities. It provides secure identity verification, single sign-on (SSO) and multi-factor authentication (MFA) to protect identities and enable users to access apps from any device.

How Okta missed out on a rally

SSO allows users to sign on to multiple platforms with a single set of credentials, removing the need to remember numerous passwords. That’s especially important as AI’s ability to crack passwords improves. The current best practice for passwords today is to use unique, randomly generated pass phrases of 12-16+ characters, combining uppercase letters, lowercase letters, numbers and symbols. Many users resort to simple, easy-to-remember passwords and reuse the same password across multiple platforms.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Okta’s MFA provides other authentication methods to approve a sign on, adding a critical layer of security. It’s a step-up from the two-factor authentication process that’s become universal in the banking industry over the past five years. Two-factor authentication comprises two forms of identification, such as a password and a code sent via text message. MFA can include three or more layers, including biometrics and a random number code generator app.

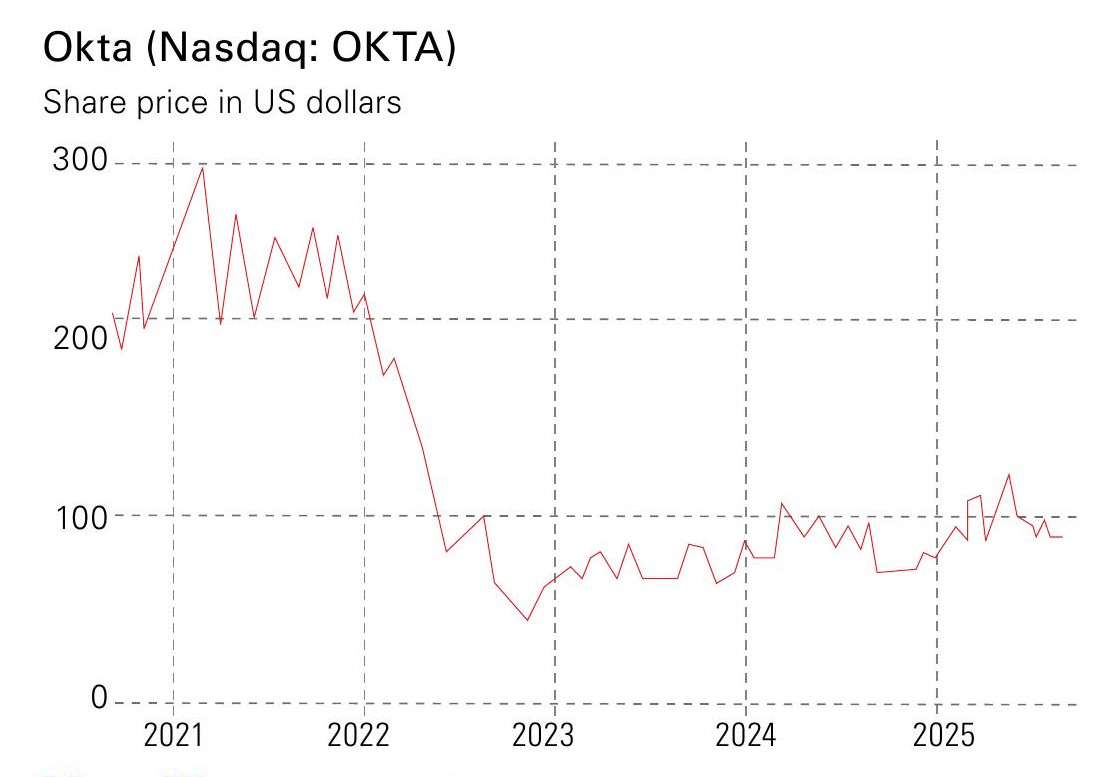

Demand for the company’s authentication software is brisk. Okta is forecasting sales of just under $2.9 billion for the 2026 financial year, up from $234 million in 2021, a compound annual growth rate of 36.1%. However, over the past five years, the shares have lost 55% of their value and Okta has missed out on much of the AI-fuelled rally that’s taken place over the past 12 months.

There are two reasons for the company’s lacklustre performance. Firstly, while revenue has grown exponentially over the past five years, it has slowed in the past three, falling to a compound annual growth rate of about 15%. The second issue was that in 2022, the shares fell by more than 70% after it was revealed that hackers had stolen information on all users of its customer support system in a network breach. It has taken Okta a few years to conduct a thorough review of this breach and make changes to stop it happening again.

Okta's return to growth

Okta appears to be moving past the issues that have plagued the business over the past three years. Its second-quarter earnings release blew past Wall Street and management expectations. A key part of the growth came from US government contracts. Despite Trump’s plans to cut spending, the overall trend across government contracts was positive, according to the company. Overall for the quarter, the company’s net retention rate, a metric to show growth with existing customers, came to 106% in the quarter, unchanged from three months ago. This rate, according to UBS, should accelerate over the coming quarters as the headwinds of the Covid-cohort of customers roll off and Okta returns to organic growth with its new, improved tools.

Management believes there’s a huge opportunity to profit from the growth of AI agents, autonomous software systems powered by generative AI that can reason, plan and execute tasks. This market is expected to grow from $5.7 billion in 2024 to $52.1 billion by 2030, according to the Boston Consulting Group, with a compound annual growth rate of 45%. Okta has built a niche in agent-to-app and app-to-app access, and last month it paid $100 million to acquire Axiom, a start-up specialising in non-human identity security.

Despite its potential, there’s still scepticism surrounding the company and its outlook. This could present an opportunity. Right now the shares are trading at a forward price-to-earnings ratio (p/e) of 27.1, on UBS estimates, falling to just 16.6 by 2030. Strip out Okta’s $2.4 billion projected year-end net cash balance ($13 per share) and the ratio falls to 23. The company’s cash generation is even more impressive. It’s trading at a free cash-flow yield of 4.8%, making it somewhat of an outlier among tech stocks. For fiscal 2026, UBS has the company generating a free cash flow of $819 million with a free cash flow margin of 28.4%.

Okta’s valuation also appears cheap compared to Palo Alto’s recent acquisition of CyberArk. The two companies both specialise in securing access points within networks, with CyberArk focusing on the mission-critical, highest risk accounts. Still, Palo Alto paid $25 billion to get its hands on the group’s technology, for a business generating just $1.3 billion in annual recurring revenue as of the second quarter. Analysts believe the deal could be a net positive for Okta’s shares due to the dwindling number of opportunities in the space. UBS also believes the deal could be a positive development for Okta’s sales as customers look for an independent option, one that’s not controlled by one of the tech sector’s most prominent players.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?