Automatic Data Processing is making big profits from organising offices – should you invest?

Automatic Data Processing provides software for the management of human resources. The group has established itself as a one-stop shop for managing the workplace

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Automatic Data Processing. (ADP) is a global technology company worth $123 billion and the world leader in human capital management. The software group boasts several desirable features for investors, offering them enduring competitive advantages, a share price up 119% in five years and a 2% yield from a dividend that has been increased every year for 50 years.

The group’s share buybacks have reduced the share count by an average of 1% per year over the past 10 years. ADP’s medium-term target is an annual total shareholder return of 13%-15%, with 2% of this figure from the dividend and 1% from the reduction in the share count.

For more than 75 years ADP has been helping small, medium-sized and large businesses by providing efficient services such as payroll and tax administration; time and attendance management; benefits management (retirement plans, health insurance); HR outsourcing (HRO); and complete human capital management (HCM).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The last includes processes ranging from recruitment and training to performance management. All the group’s services are now cloud-based.

ADP has 1.1 million payroll clients from a wide range of business sectors and pays more than 42 million employees across 140 countries.

In the US, its software consistently serves one-sixth of all employees. US non-farm employment has been increasing month by month in 2025, with payrolls up by 1.06 million between January to July, so ADP’s largest market is still growing.

For every one of the past 18 years, ADP has been listed in Fortune magazine’s ranking of the world’s 1,000 most-admired companies and was placed within the top quartile in 2024. Over the past 10 years, ADP’s revenue has increased by 88% and it has returned $30 billion to shareholders.

How Automatic Data Processing is fending off rivals

ADP’s enduring competitive advantage over rivals – its “moat” – is based on switching costs, intangible assets and scale. For a customer to switch to another company would be an expensive hassle because of the potential disruption of payrolls and possible loss of data. This is reflected in ADP’s 92% client retention.

Intangible assets include ADP’s strong and trusted reputation in payroll, its record of maintaining the highest levels of data security and privacy, and its deep understanding of the many regulations surrounding compliance and taxes around the world.

Scale benefits derive from ADP being the largest payroll provider in the US and the leader in mid-market HCM. ADP’s 2025 revenue was $20.6 billion, only 11.8% of the total potential market of $175 billion. The market is expected to grow at 5%-6% per year from 2025 onwards, with ADP’s medium-term strategy aiming for 7%-8% annual sales growth.

Growth will be a mixture of organic expansion and acquisitions. Organic growth is driven by this year’s $1 billion investment in research and development, digital transformation and artificial intelligence. Acquisitions are chosen to add strategic value. ADP has two business segments: Employer Services (ES) and Professional Employer Organisation services (PEO). ES’s revenue is twice PEO’s. ES provides human capital management and à la carte human resources outsourcing, whereas in PEO, ADP acts as a co-employer, with its smaller business customers providing a comprehensive HRO solution.

This has advantages, since ADP can combine several firms’ needs to negotiate keener prices on benefits and healthcare for its customers. ADP also has a third source of revenue – the interest on customers’ cash balances.

Growth should come from rising employment, cross-selling to increase revenue per customer, gains in market share, increasing interest from higher customer cash balances, and bolt-on acquisitions.

Automatic Data Processing: steady growth and rising income

ADP’s results for the year to 30 June 2025 showed revenue up 7% to $20.6 billion, adjusted earnings before interest and tax (Ebit) up 9% to $5.3 billion and adjusted diluted earnings per share (EPS) up 9% to $10.01.

The balance sheet showed long-term debt of $3.97 billion, with 84% of it matched by cash of $3.35 billion. Funds held for clients came to $30.9 billion, on which ADP earned interest of $1.2 billion (up 16% from the year before). The Employer Services (ES) division recorded revenues of $13.88 billion with a margin of 36.1%, while the Professional Employer Organisation (PEO) services division had revenues of $6.69 billion, with a margin of 14.2%.

ADP is using generative AI in supporting service associates, driving implementation efficiencies and in ADP Assist, launched in 2024. This is an AI-powered cross-platform solution to provide next-generation payroll and HCM solutions. In 2025, ADP launched Lyric, which is its new global HCM platform. The company’s guidance for full year 2026 comprises revenue growth of 5%-6%, an increase of 50-70 basis points in the adjusted operating margin and diluted EPS growth of 8%-10%.

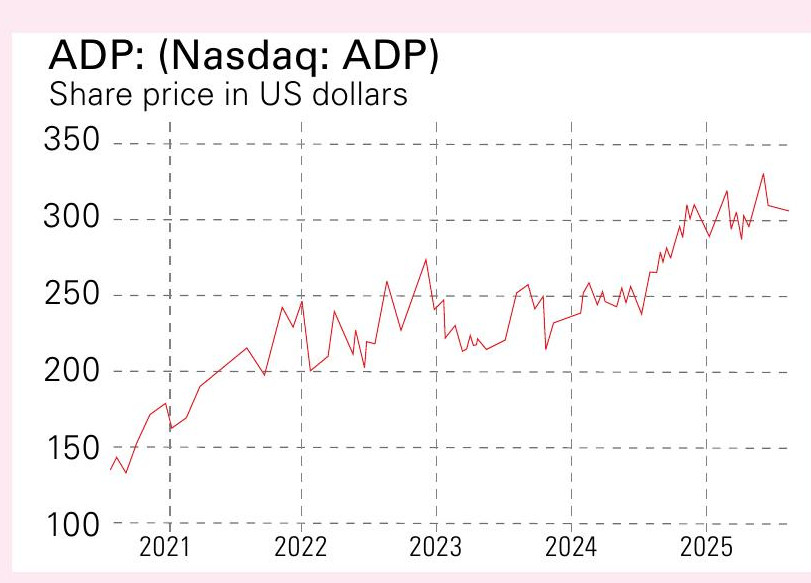

ADP’s (Nasdaq: ADP) recent share price of $305 implies a forward price/earnings (p/e) ratio of 27.9 with a forward dividend yield of 2%. Analysts have pencilled in an EPS estimate of $13.05 for 2028, giving a p/e of 23.4.

ADP’s shares have gained 294% over 10 years, 119% over five years and 16% over one. ADP’s strong position in its sector, wide moat, high customer retention and continuous development of its products enable it to generate steady, profitable growth and a reliable dividend (raised every year for the last 50), making it a sound long-term investment.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems