The fallout from Alibaba’s huge data breach

Chinese tech giant Alibaba is at the centre of a huge data-breach scandal – and the clampdown on the sector could now intensify.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Chinese e-commerce giant Alibaba Group Holdings has been hit by “what appears to be one of the biggest data breaches in history”, says Cissy Zhou in Nikkei Asia. Its shares fell by 6% last Friday after executives were called in by the Shanghai police to be questioned about the affair.

The problem began a fortnight ago when a hacker offered to sell online records from the Shanghai police database. He said he had “information about one billion Chinese citizens” and posted a sample of 750,000 records. The Chinese authorities are furious that the data, which reportedly contains “names, ID numbers, phone numbers, addresses, criminal records and even online orders” appears to have been stolen from a server hosted by Alibaba.

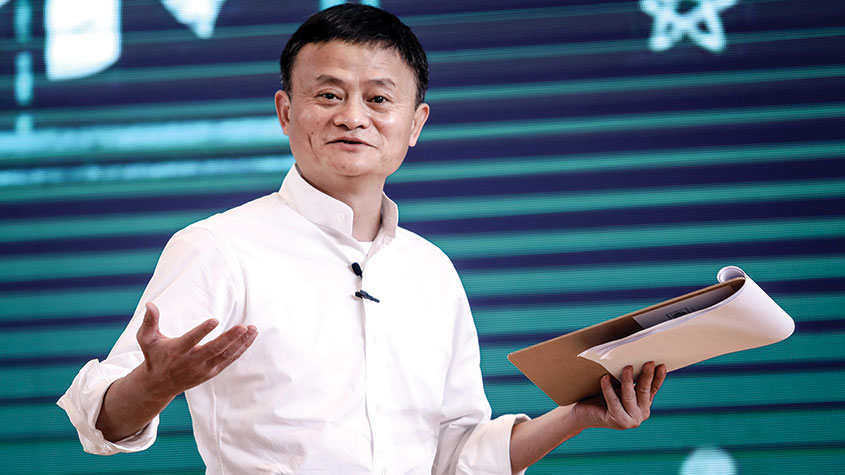

The leak is particularly embarrassing for Alibaba given that founder Jack Ma “was an early evangelist of the use of data in policing and social control”, says Karen Hao in the Wall Street Journal. Indeed, Ma’s claims that Big Data “would help the public security agencies track down thieves and predict terrorist attacks” has helped Alibaba become “the biggest public cloud-service provider in China”.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But this relationship has not always been smooth. The ministry in charge of technology suspended a cybersecurity partnership with Alibaba’s cloud-computing unit last December after Beijing alleged the company “failed to report a global software vulnerability to it in a timely manner.”

Was it the government’s fault?

Still, it looks like Alibaba is being made a “scapegoat” for the Chinese government’s failings, especially its “astonishing lack of cybersecurity caution despite its own user data protection mandate”, says Yawen Chen on Breakingviews.

It seems that in this case the government left the data “sitting around without a password”, which means that “anyone could have accessed [it] if they knew the web address”. However, even if Alibaba wasn’t at fault, this may not matter, as the scandal could dent other clients’ confidence, “especially those from the public sector”.

Alibaba isn’t the only firm worried about the fallout, say Sarah Zheng and Coco Liu on Bloomberg. This episode may only “fuel Beijing’s resolve to clamp down on domestic tech giants and accelerate a move away from their private cloud services”. Such a migration is already under way, with the ongoing crackdown on “formerly high-flying tech giants” nudging risk-averse institutions toward state-owned providers.

Technology firms are now also likely to be affected by a new Chinese competition law, says Lex in the Financial Times. The law, which comes into force in August and requires Chinese companies with global sales of $1.8bn to receive government approval before merging, doesn’t target the technology sector specifically, but it will have an “outsized impact” on the industry. Before the pandemic and the clampdown, Alibaba and Tencent “accounted for nearly half of all venture-capital flow for acquisitions in mainland China”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.