What will 2024 general election mean for UK house prices?

UK house prices have been seeing a spring bounce. But has Rishi Sunak’s snap election changed the property market’s outlook?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The UK general election campaign is hotting up as the major parties jostle for voters. One area that we've only just started hearing about is housing.

The Labour Party has pledged to reintroduce home building targets and to implement a Freedom to Buy scheme. Meanwhile, the Conservatives have promised not to increase the current stamp duty thresholds and to resurrect the Help to Buy housing support initiative.

It comes as homeowners and prospective buyers could face higher mortgage rates for longer as the election looks set to delay interest rate cuts.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is against the backdrop of a housing supply crisis - an issue banks say needs to be prioritised when Parliament returns in mid-July.

So, what could the campaign period and the election itself mean for the housing market?

Has the general election affected UK house prices?

Given not much time has passed since Rishi Sunak called the general election on 22 May, it’s too soon to say with any certainty what the impact on house prices has been. It’s unlikely we will be able to get an impression of how the market has reacted until late-June.

When the PM went to the polls, the country was seeing a growing north-south divide in house price inflation, alongside a muted spring bounce. There were also hopes that prices would grow more than expected over 2024 as a whole, despite 16-year high interest rates posing mortgage affordability challenges. This optimism may be partly down to greater pragmatism from buyers when it comes to the type and size of property they go for.

According to research by non-partisan think tank the Institute for Fiscal Studies (IFS), the proportion of home ownership among 25 to 34-year-olds has also only recently recovered to 2010 levels. As of the end of the 2022/23 financial year, the percentage of younger adults who owned their own home stood at 39%. This figure is 20-percentage points lower than what it was in the year 2000.

The IFS also pointed out that the home ownership challenge was moving into higher age brackets, with the number of homeowners aged 45 to 59 down seven percentage points compared to 2010.

So far, according to property data firm TwentyEA, the housing market doesn't appear to have been derailed by the general election.

The brand examined market data across the 14 days following the election announcement on 22 May and found the number of properties listed as sold subject to contract (SSTC) was 51,025, a 9% rise on 46,802 from the same period in 2023.

At the same time, the supply of new instructions was 70,049 – a rise of 3.4% from 67,753 last year. Both the demand and supply metrics are more aligned with the same 14 days in 2019 – the last normal market prior to the pandemic.

How have UK house prices reacted to previous elections?

To help us understand what could happen to the housing market, both in the run up to the election and in the period afterwards, several property market analysts have looked at how it reacted around previous national polls.

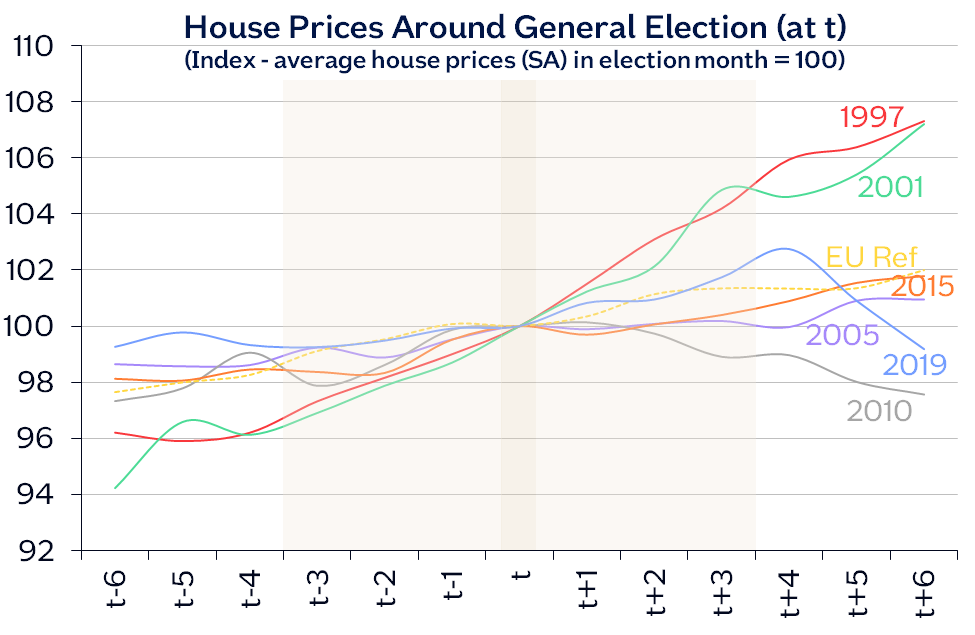

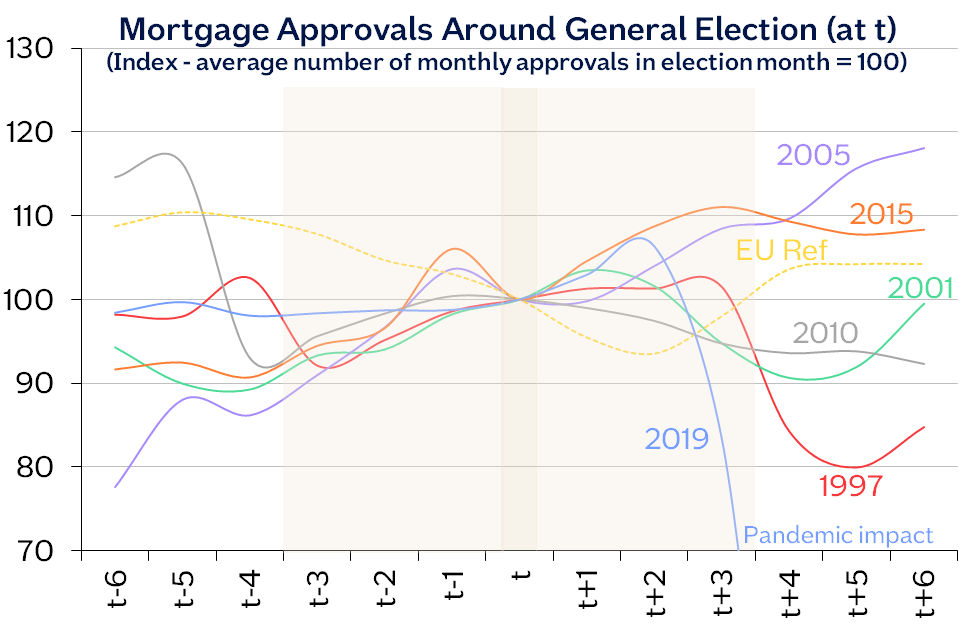

Nationwide, which tracks house prices at the mortgage approval stage, has found that the broad price growth trends seen in the six months leading up to an election (it has also included the 2016 Brexit referendum) tend to continue in a similar vein over the six months after the polling date. The notable exception was the 2019 election, when prices plummeted in its aftermath as a result of the Covid-19 pandemic.

When it comes to mortgage approvals around elections, the pattern is less clear. Nationwide recorded a big dip in the wake of the 1997 election, which coincided with then-Chancellor Gordon Brown making the Bank of England independent. The 2019 election also prompted a sharp decline for the reasons MoneyWeek outlined above.

Chief economist at the building society, Robert Gardner, said: “It appears that housing market trends have not traditionally been impacted around the time of general elections. Rightly or wrongly, for most homebuyers, elections are not foremost in their minds while buying or selling property.”

This finding was echoed by Rightmove. Its spring survey, which gathered more than 14,000 responses between 18 and 23 May, found that 95% of prospective buyers said a general election would not change their plans.

The listing website’s property expert, Tim Bannister, said: “Over the past four years, home-movers have faced numerous challenges, including a global pandemic, a shortage of housing supply, and rapidly changing prices. For many, 2024 is finally the year to make their move, and they’re determined to proceed with their plans to secure their next home.”

Rightmove’s own research into buyer demand in the run up to the 2015 and 2019 elections showed that it remained steady. It measured demand by recording the number of people sending enquiries about properties for sale on its website.

However, in both instances, demand rocketed by a double-digit percentage in the election’s immediate aftermath. In 2015, when the Conservatives secured a majority under David Cameron, demand in the month after the month of the polling date grew 18% year-on-year. In 2019, when Boris Johnson recorded a landslide victory, enquiries rose 14% compared to the previous year.

What does the housing market think could change after the general election?

Industry insiders have broadly welcomed Labour's plans for a Freedom to Buy scheme, a permanent version of the current Mortgage Guarantee, and Sunak's promise to maintain stamp duty thresholds.

However, Labour has refused to rule out returning the first-time buyer stamp duty exemption from £425,000 to £300,000 as currently planned for the end of March 2025.

Meanwhile, the Conservatives have also unveiled plans to resurrect Help to Buy.

The scheme, which required a 5% deposit and provided a 20% government loan to purchase a new-build property was first launched in 2013 and ended in March 2023.

But the Tory general election manifesto has promised a "new and improved"Help to Buy scheme for first-time buyers, with an equity loan on interest terms that they can afford. The scheme will be part funded by contributions from house builders.

The manifesto also said the Mortgage Guarantee Scheme, currently set to end in June 2025, would continue.

One of the most referenced wishes by the experts MoneyWeek spoke to was political stability.

Since 2010, there have been 15 housing ministers (or 16 if you take into account the fact that the incumbent, Lee Rowley, has held the role twice), with the ministerial churn having become something of a joke in Westminster. At the same time, housing construction targets have been missed, homeownership rates have stalled, and long-term housing reforms - like the Renters Reform Bill - have struggled to make it through Parliament.

Matt Thompson, head of sales at estate agency Chestertons, said that “increased certainty of the political landscape” would help to “support confidence in the market” and would also “encourage more house hunters” to buy. Robin Thomas, a consultant at Recoco Property Search, added that he hoped there would be a “clear majority” for the next government to give the market “the confidence it currently lacks”.

Other reforms that are high on the industry’s wish list include accelerating the rate of house building in the UK and greater support for first-time buyers. Bannister said: “One way that could help to accelerate house-building is to streamline the planning process, which is highly complex and challenging.

“If the government can create smoother processes, working closely with all key stakeholders, it could transform the delivery of new homes and produce more affordable housing. Not only could this help first-time buyers, it could also open up a big opportunity to help downsizers move to greener homes with lower running costs.”

Rightmove said it would also like to see the “chronic shortage” of build-to-rent homes reversed by the next government. Stamp duty reform came high up on its list too, with the property listing site urging the next crop of ministers to make the existing thresholds permanent, and to index thresholds to regional performance. Before the election was called, Jeremy Hunt was understood to be considering raising the 0% threshold to £300,000.

Another industry bugbear that several experts want to see fixed is the length of time it takes for sales to complete in England and Wales. John Newhouse, managing director of Teeside estate agency Roseberry Newhouse - which is a member of The Guild of Property Professionals (TGPP) - said greater digital integration would “speed up transactions” and reduce fall-through rates. He was echoed by fellow TGPP member Melfyn Williams from North Wales estate agency Williams & Goodwin. He said the Land Registry needs reforming: “This modernisation would include extending current title documents to encompass material information, thereby facilitating quicker and smoother transactions.”

Is now a good time to sell?

So, if you’re considering whether the general election should change your plans to sell up, what’s the latest advice? Generally, the advice is to plough on and take advantage of the spring market.

The estate agency Winkworths said delaying a sale or purchase could mean people miss out on “the best time of year in the property calendar”. Its analysis of HMRC figures found that over the last five years (excluding Covid-affected 2020), spring made up for the highest proportion of annual sales of any region. It also found that properties took 10 fewer days to sell than in winter (51 days compared to 61).

Bannister also suggested it may be a good time to take the plunge now - although he also said he expects that there will be an unusually strong market this summer: “An election in the summer, when the market is traditionally slower, could have less impact on housing market activity than if one had been called for the Autumn. So, as we head towards this election, the housing market is likely to stay active, with activity ramping up once the election is over and things become clearer. It could mean that we’re gearing up for a stronger than usual August, especially if we see interest rates finally start to fall.”

But other experts said sellers may have to expect some hurdles in the run up to the election. Zoopla’s executive director Richard Donnell, said he expects that the campaign “will slow the pace at which new sales are agreed”. He added that current ‘buyer’s market’ conditions meant sellers should “price their homes realistically if they want to achieve a sale” this year.

Another potential fly in the ointment is affordability. The Bank of England is likely to delay an interest rate cut to beyond the election - it has never cut rates just before a national poll since it went independent in 1997. Analysis by Capital Economics in the wake of the Halifax HPI for May said the recent rise in mortgage rates "has a little further to go" due to delays in base rate cuts. But it added that house prices could have "renewed impetus next year" if rates come down in the second-half of the year, as expected.

BestInvest’s personal finance analyst, Alice Haine, said she also expects affordability to ease: “Election fever can create uncertainty in an economy, with lenders likely to remain cautious, potentially delaying any significant rate changes until the results are in.

“Provided a decisive victory is secured, then coupled with easing inflation and future bank rate reductions, mortgage rates are likely to improve as the year goes on, improving the affordability crunch for buyers. However, those sitting on the fence may be willing to hold off until a rate cut has happened and the dust settles after the election before they plough into the market.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

General election 2024: who’s in the Labour cabinet?

General election 2024: who’s in the Labour cabinet?A new Labour cabinet has been appointed by Keir Starmer after his party won the general election. Here’s the latest on who’s in it

-

What does the Labour election win mean for your money? Key manifesto points after landslide

What does the Labour election win mean for your money? Key manifesto points after landslideNews The Labour election win was not as large as some polls had predicted. But the new government’s majority will mean it can enact significant changes.

-

What would a Labour supermajority mean for capital markets?

What would a Labour supermajority mean for capital markets?The Conservative Party has warned that a Labour supermajority would be bad for democracy. But what impact could a big win for Keir Starmer have on the markets?

-

SNP manifesto 2024: what money policies did John Swinney announce?

SNP manifesto 2024: what money policies did John Swinney announce?The SNP manifesto has been launched in Scotland, and makes several key commitments, including a pledge to end austerity and a commitment to rejoin the EU.

-

Labour pledges to open 'at least' 350 banking hubs over next Parliament

Labour pledges to open 'at least' 350 banking hubs over next ParliamentNews The Labour Party claims it will ‘bring banking back to the high street’ if it forms the next government after the 2024 general election.

-

What does the Labour manifesto say about property? Key 2024 general election pledges

What does the Labour manifesto say about property? Key 2024 general election pledgesNews The Labour manifesto has made several promises around rental reforms, the leasehold system and housing market support. Here’s what a Keir Starmer government means for property.

-

Green Party manifesto 2024: key personal finance general election policies

Green Party manifesto 2024: key personal finance general election policiesA Green Party government would introduce a wealth tax, increase National Insurance Contributions for high earners, and move towards a universal basic income.

-

Conservatives pledge to raise high income child benefit threshold – how much could you save?

Conservatives pledge to raise high income child benefit threshold – how much could you save?News The high income child benefit charge threshold could be doubled to £120,000 if the Conservative Party wins the general election, Chancellor Jeremy Hunt has pledged.