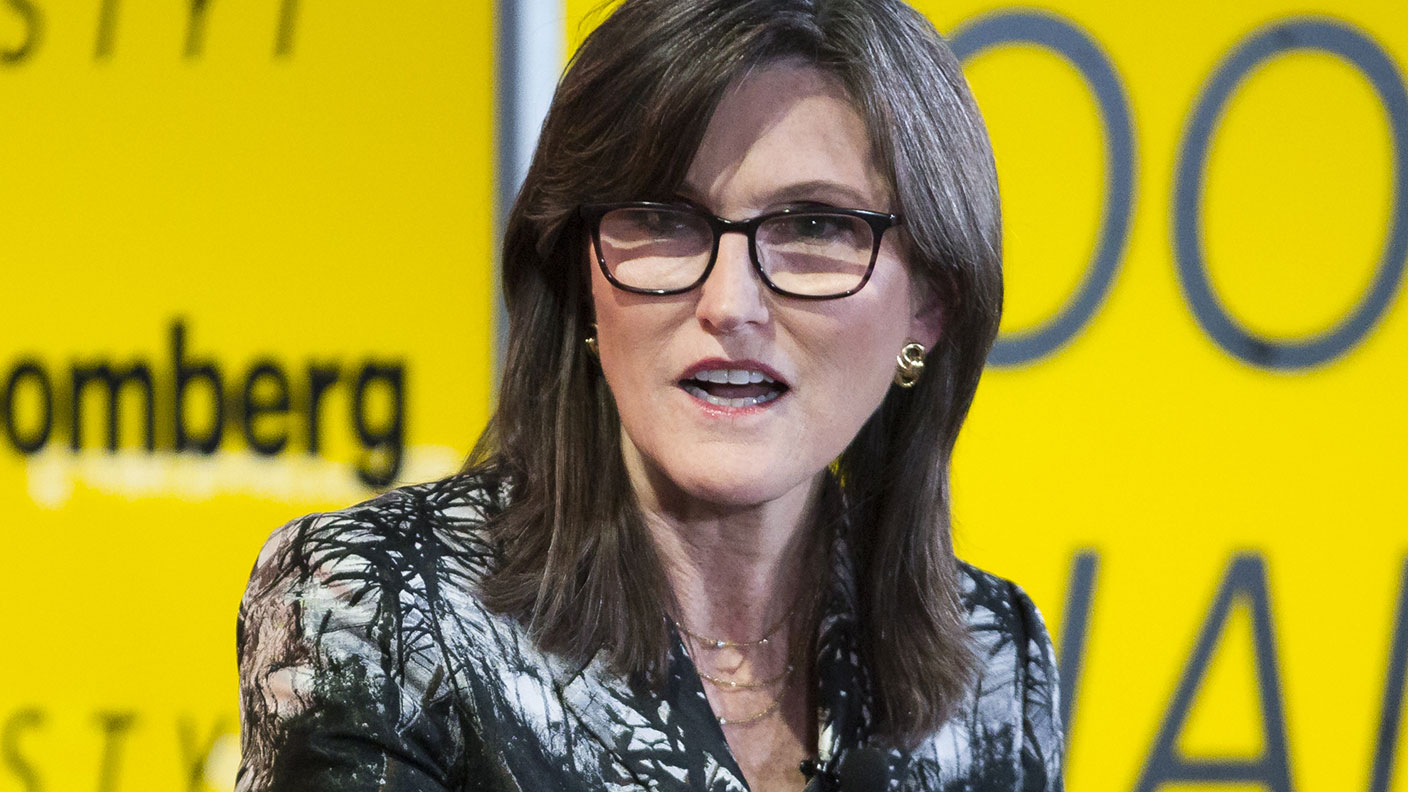

Cathie Wood’s ARK Invest to launch bitcoin ETF

Cathie Wood, the “star stock-picker”, bitcoin bull and founder and CEO of asset management firm ARK Invest, is hoping to launch an ETF to track the price of bitcoin. Saloni Sardana investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Cathie Wood, the veteran fund manager behind ARK Invest, is launching a bitcoin ETF – the ARK 21Shares Bitcoin ETF – in partnership with Switzerland-based 21Shares.

What is the fund and what could it mean for cryptocurrencies?

The ARK 21Shares Bitcoin ETF’s objective is to “track the performance of bitcoin, as measured by the performance of the S&P Bitcoin Index”, says a filing with the Securities and Exchange Commission (SEC), the US regulator.

Until now, ARK has been piling into companies with heavy exposure to digital currencies, including the likes of Coinbase Global and Grayscale Bitcoin Trust. But launching a crypto ETF is big news even for a prominent crypto-bull like Wood.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The ARK ETF is still pending approval from the SEC, so the fund may not launch for some time yet. But it’s not the only one in the pipeline. As Bloomberg points out, 14 cryptocurrency ETFs are currently awaiting approval from the SEC.

News of ARK’s ETF comes just days after the SEC postponed a decision on whether to scrap or accept a bitcoin ETF application from asset manager VanEck and from Valkyrie Digital Assets.

So what is the US stance on crypto ETFs?

As with the UK’s Financial Conduct Authority, the SEC is worried about the risks surrounding cryptocurrencies (cryptocurrency exchanges in the US are regulated by a variety of agencies at both state and federal level).

Last month, the SEC issued a scathing notice to investors last month warning them about the risks of bitcoin futures held in mutual funds (which are the only investment vehicles that are allowed to hold bitcoin futures). It urged investors to consider “the risk disclosure of the fund, the investor’s own risk tolerance, and the possibility, as with all investing, of investor loss”.

The SEC’s warning has led analysts to speculate that it may become more difficult for US ETFs to get the green light.

So could Wood’s bitcoin ETF persuade the FCA to lift its ban on ETFs?

In the UK, the Financial Conduct Authority does not regulate cryptocurrencies, but it has banned the sale, marketing and distribution of all crypto derivatives, including contracts for difference, options, futures and exchange-traded notes that reference unregulated transferable crypto assets by firms acting in or from the UK.

The ban which came into effect in January was prompted by extreme “volatility of underlying assets,” the FCA said. This effectively closes the door –for now – for any UK-listed bitcoin ETFs.

Any change in its stance depends on whether the backlog of ETFs is approved by the SEC or not. If they are not approved, it could ultimately seal the fate of crypto ETFs both in the US and the UK. But of course if the US does start approving more crypto ETFs, it theoretically raises the chance of crypto ETFs becoming accepted here in the UK

Until regulators don’t change course, cryptocurrencies remain a highly speculative investment.

While UK investors can’t buy crypto ETFs, they can still speculate on the currencies themselves. So educate yourselves on the subject, but treat them with extreme caution –cryptocurrencies remain a highly speculative and volatile investment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Bitcoin 'has become the reserve asset of the internet'

Bitcoin 'has become the reserve asset of the internet'Opinion The cryptocurrency has established itself as the electronic version of gold, says ByteTree’s Charlie Morris

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

Crypto scams – what to look out for

Crypto scams – what to look out forFraudsters are using cryptocurrency scams to lure investors desperate for high returns - here is how to spot and avoid them

-

Investment platforms rapped over low interest offered on cash holdings

Investment platforms rapped over low interest offered on cash holdingsFinancial Conduct Authority (FCA) threatens action against investment platforms paying poor rates on cash balances

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.