Features

Latest

-

Properties with courtyards and secret gardens

Features From a Grade II-listed property with follies in an Area of Outstanding Natural Beauty in Lancashire to an 18th-century bastide in Provence with a walled garden, we bring you seven of the best properties with courtyards and secret gardens.

By moneyweek Published

-

Anton Vaino's “recipe for global domination”

Profiles Anton Vaino, Putin's new chief of staff, has some bizarre – some say frightening – notions.

By MoneyWeek Published

-

If you’d invested in: DJI Holdings and Gulf Marine Services

Features Knutsford-based DJI Holdings provides software for sales and distribution of lottery products in China.

By Ben Judge Published

-

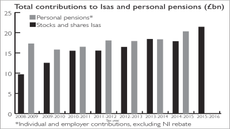

Will Isas replace pensions?

Features Individual savings accounts (Isas) could be on track to replace personal pensions as the standard way to invest for the long term.

By David Prosser Published

-

Two different ways to enjoy riches

Features The only people who say money doesn't make you happy are rich people who want it to be a secret.

By moneyweek Published

-

Stephen Jen: "don’t write off sterling"

Features Well-known currency strategist and hedge fund manager Stephen Jen believes the UK will perform very well outside the EU.

By moneyweek Published

-

Moneymakers: How the EpiPen became a $1bn blockbuster and caused a political storm

Features Price gouging has become a hot topic for the pharmaceutical industry in America. The latest storm involves the EpiPen, a device that delivers a shot of adrenaline for patients suffering a life-threatening allergic reaction.

By Alex Williams Published

-

Korea’s beauty boom

Features Korean cosmetics companies may be small fry compared with multinationals, but they have been profiting nicely from a growing interest in Korean culture across Asia, says Alex Williams.

By Alex Williams Published

-

Wine of the week: a red to impress fastidious wine bores

Features This 2013 Wirra Wirra should be a dead cert for your cellar, says Matthew Jukes.

By moneyweek Published

-

Caterham's ride on the wild side

Features The Caterham Seven R300 is the stuff of legends; everything about it is just right.

By moneyweek Published

-

Three adventures in the north

Features Chris Carter looks at holidaying in the remote north of the planet, including Svalbard, the world’s most northerly community.

By Chris Carter Published

-

Three defensive investment trusts

Features The FTSE 100 has had a volatile year, and it is during periods such as these that defensive investment trusts show their worth, says Sarah Moore.

By Sarah Emly Published

-

Betting on politics: the Labour leadership

Features Already nearly £1m has been wagered on the Labour leadership contest, with the betting markets casting their vote in favour of Corbyn.

By Dr Matthew Partridge Published

-

The best cashback deals

Features The days of bumper cashback earnings from credit cards are drawing to a close. Ruth Jackson looks at the best deals still available.

By Ruth Jackson-Kirby Published

-

Miners are still cheap – buy now

Features This week in MoneyWeek: why it’s time to buy gold miners; could Isas replace pensions; and should you buy a pub?

By Ben Judge Published

-

The assets to buy now – September 2016

Features Asset allocation is at least as important as individual share selection. So where should you be putting your money? Here’s our monthly take on the major asset classes.

By moneyweek Published

-

The world’s greatest investors: Louis Simpson

Features Louis Simpson looks for shares that combine growth with value, and operates a disciplined, low turnover approach to portfolio management

By Dr Matthew Partridge Published

-

Share tips of the week

Features MoneyWeek’s comprehensive guide to this week’s share tips from the rest of the financial press.

By moneyweek Published

-

ETFs: the road to serfdom?

Features Cheap trackers, exchange-traded funds and passive investing have been accused of undermining capitalism. Matthew Partridge exmines why.

By Dr Matthew Partridge Published

-

The Bank of England is driving up your personal pension deficit

Features The pension deficit problem is worsening as “emergency” monetary policy continues. And it’s not just affecting company schemes, it hurts anyone with a "defined contribution" pension. John Stepek explains why.

By John Stepek Published

-

Peru: Latin America’s success story

Features Improved political stability, the commodities boom and sound management have made Peru very attractive to investors.

By MoneyWeek Published

-

Chart of the week: wheat mountain weighs on prices

Charts In 2008, wheat prices briefly spiked above $13 a bushel, sparking food riots in emerging markets. Since then, they have slumped by more than 70%.

By moneyweek Published

-

Trouble ahead for multinationals

Editor's letter Everyone thinks multinationals are a safe investment. But they are not, says Merryn Somerset Webb. They are facing a new set of risks from politicians around the world.

By Merryn Somerset Webb Published

-

Could passive investing destroy capitalism as we know it?

Features Passive funds are accused of being “worse than Marxism”, undermining the very fabric of capitalism. John Stepek looks at the growth of passive investing, and what it means for investors.

By John Stepek Published

-

Fund in focus: emerging markets coming out of earnings recession

Features Emerging markets may finally be coming out of a multi-year period of earnings recession, says Edward Lam, Manager of Somerset Emerging Markets Dividend Growth Fund.

By Sarah Moore Published

-

The big government threat to big corporations – and small states

Features Apple's potential €13bn tax bill should sound a warning to investors, says John Stepek. Governments have finally worked out how to raid big multinationals' balance sheets.

By John Stepek Published

-

Why a pension beats a buy-to-let flat hands down

Opinion It used to make some sense to forget about saving for a pension and get a buy-to-let flat instead, says Merryn Somerset Webb. But not any more. You’d be mad not to take advantage of the current benefits of saving for a pension.

By Merryn Somerset Webb Published

-

Central bankers to governments: it’s time to spend, spend, spend

Features Central bankers have been using ever-more radical monetary policy to bolster the global economy. But they're reaching the end of their tether. Now they want governments to start spending.

By John Stepek Published

-

The “Bank of Mum and Dad” is just like any other bank – it wants a return on its money

Opinion Research suggests more and more parents are helping other people’s children get on to the property ladder. But they’re not doing it out of kindness, says Merryn Somerset Webb. They’re doing it for the money.

By Merryn Somerset Webb Published