Will Isas replace pensions?

Individual savings accounts (Isas) could be on track to replace personal pensions as the standard way to invest for the long term.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

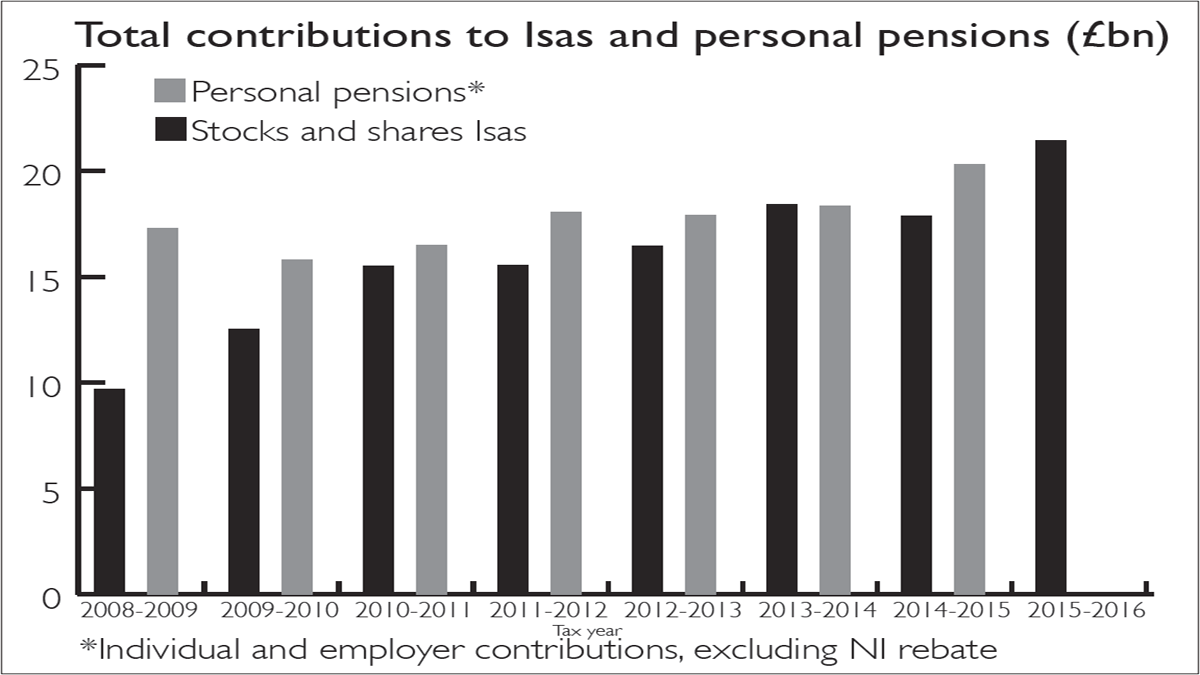

Individual savings accounts (Isas) could be on track to replace personal pensions as the standard way to invest for the long term, new figures from HMRC suggest. Investors put £21.4bn into stocks and shares Isas in the 2015-2016 tax year, up bya fifth since 2014-2015, and the highest total since Isas were launched in 1999. By comparison, around £20.3bn was paid into personal pensions by individuals and employers combined in the 2014-2015 tax year, the most recent for which figures are yet available.

The growing popularity of stocks and shares Isas underline how finely balanced the choice now is between Isas and pension plans for many savers. In some respects, tax breaks still give pensions an edge: pension contributions get upfront tax relief and up to 25% of the final fund can be taken tax-free. While subsequent withdrawals are taxable, many higher earners will pay lower rates of income tax in retirement, so they may get relief on their contributions at higher-rate tax, but only pay basic-rate tax on withdrawals. By contrast, Isa contributions don't receive tax relief, although withdrawals are fully tax-free.

However, these tax breaks are becoming less generous. Last April the government lowered the caps on how much savers may put into their plans each year and over their lifetimes. And it seems very plausible that the Treasury may limit the level of tax relief in future. So the advantage that pensions have is narrowing and will shrink further if the government launches Lifetime Isas in April 2017 as planned (although these could be delayed see below).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Savers into these new vehicles who must be aged between 18 and 40 when they first open the account will get a cash bonus of up to £1,000 a year when they contribute the maximum £4,000 each year. Money built up in a Lifetime Isa can either be used as a deposit on a first house or withdrawn tax-free at age 60 (earlier withdrawals are permitted, but are subject to penalties).

This means that Lifetime Isas combine some of the flexibility of traditional Isas with the upfront boost that makes pensions so attractive. Add in the increase in the overall Isa allowance from £15,240 per year today to £20,000 in April 2017 and it's easy to see why Isas look like a real threat to the dominance of traditional pension plans for retirement saving.

Investment firms call for Lifetime Isas to be delayed

Ministers are set to unveil the final rules alongside the Autumn Statement, which the new chancellor, Philip Hammond, will deliver before Christmas, but firms including Aegon, Fidelity and Standard Life have complained this will not give them enough time to research, design and deliver products by next April.

Providers are also concerned that the Financial Conduct Authority, the chief City regulator, will need to spend up to three months consulting on how it should police sales of Lifetime Isas.

A further issue is that while providers welcome the proposal for Lifetime Isas to pay taxpayer-funded annual bonuses to reward savings, they believe it would be more effective to pay these top-ups monthly rather than annually. Currently, however, HM Revenue & Customs isn't able to support a monthly bonus scheme.

Other critics of Lifetime Isas have more fundamental concerns. Ros Altmann, the former pensions minister, last month called for the idea to be abandoned. She believes the scheme will end up leaving many people worse off in retirement, with savers missing out on employers' contributions to their pensions as they opt for Lifetime Isas instead, or withdrawing their cash from the schemes well before retirement.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn