Fund in focus: emerging markets coming out of earnings recession

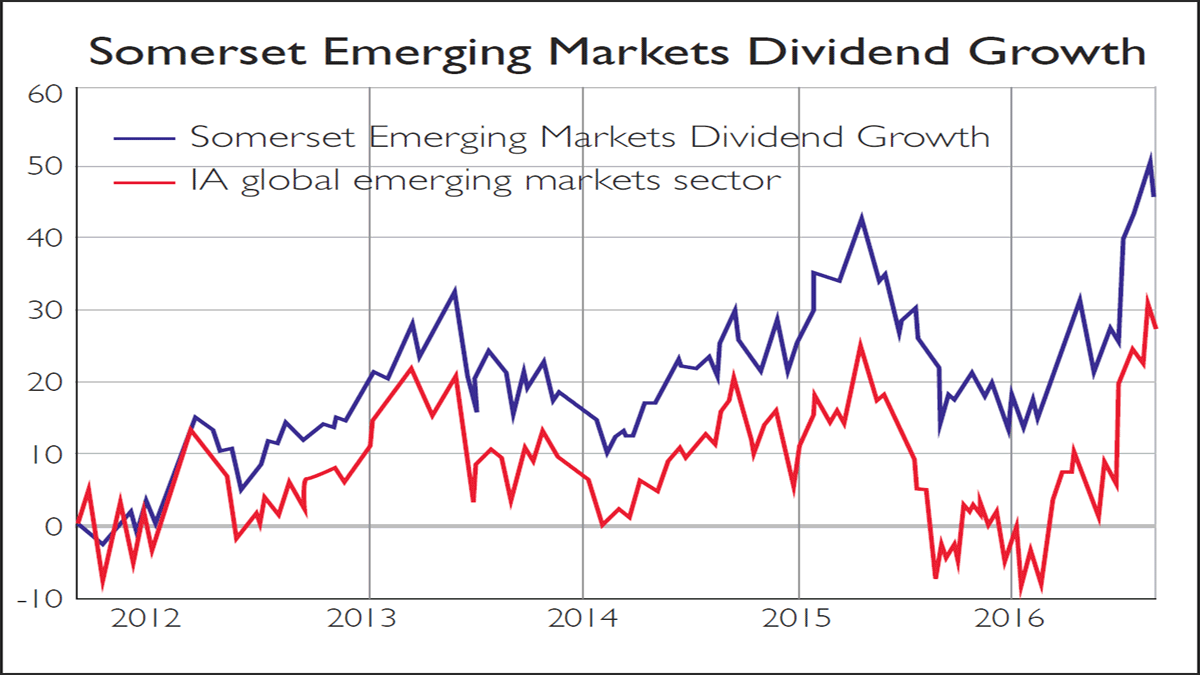

Emerging markets may finally be coming out of a multi-year period of earnings recession, says Edward Lam, Manager of Somerset Emerging Markets Dividend Growth Fund.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For example, while Lam previously considered the emerging-markets consumer goods story overrated and popular stocks in this sector to be overvalued, he now thinks there are some areas, such as in China, where they look more promising.

The fund follows a defensive strategy and aims to find income and grow capital over the long term, rather than focusing purely on short-term dividend yield; indeed, at 2.7%, the fund's yield is relatively low compared to most dividend-focused funds.

Although Lam says his team's stock-picking process is probably "the same as 90% of emerging market funds", he believes that where they stand out is in asking difficult questions in order to track down quality companies and in questioning the assumptions that go into many financial models.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

For example, he recalls meeting with an oil company in mid-2014, when oil was at the $90-$100 mark. When asked how the firm would react if oil went as low as $50 per barrel, the representative replied that they had never been asked that before.

South Korea is the fund's largest country allocation, at 21.2%. Lam believes recent shifts in South Korean corporate governance are finally starting to benefit investors. For example, Samsung Electronics has substantially increased its dividend in three of the last four years.

Sector-wise, he likes telecommunication stocks, which make up 8.6% of the portfolio. While regulation is one of the most influential factors for returns in telecoms, Lam also sees room for growth in countries such as Indonesia.

The fund has ongoing charges of 1.3% and an initial dilution levy of 0.4% when bought through major fund supermarkets. See SomersetCM.com for details.

| Holding | % of assets |

| Otp Bank | 5.1% |

| SK Hynix | 4.9% |

| Samsung Fire & Marine | 4.2% |

| Samsung Electronics | 4.1% |

| Metro Bank | 4.0% |

| HCL Technologies | 3.5% |

| Sanlam | 3.4% |

| Porto Seguro | 3.4% |

| Turk Telecom | 3.3% |

| Pou Chen | 3.3% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.