Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Equities

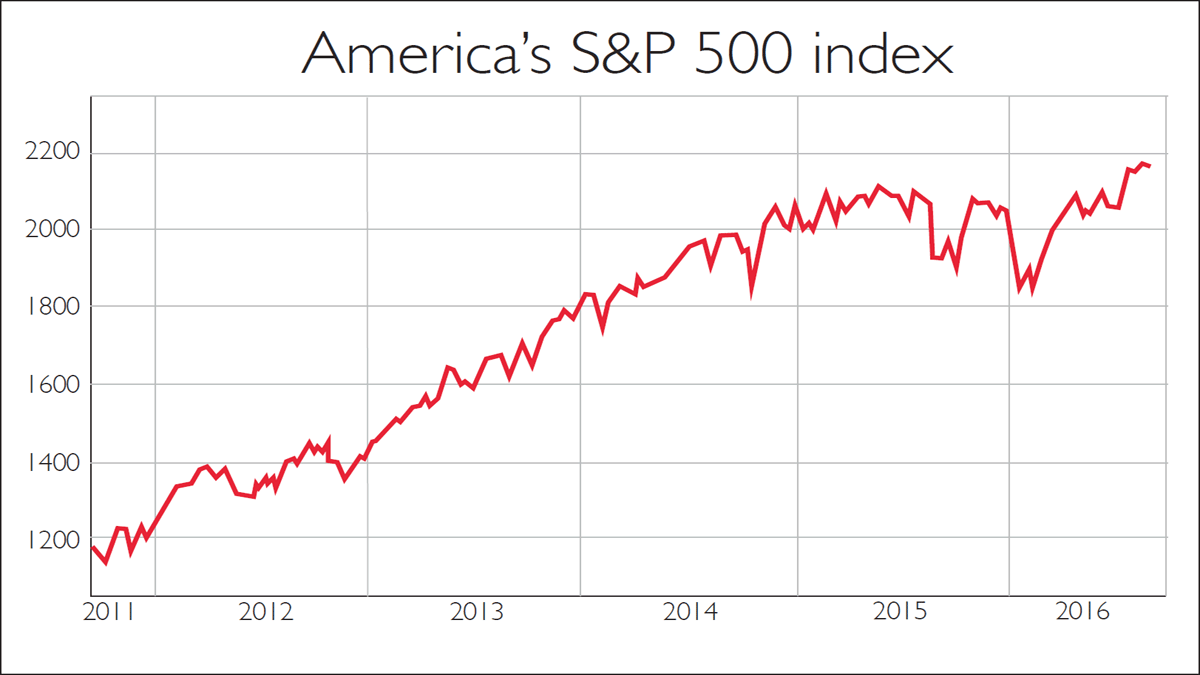

Most developed-world stockmarkets continued to recover from their Brexit-induced swoon last month. Britain's FTSE 100 index climbed to a 14-month high around 6,800 and America's S&P 500, which sets the tone for world markets, hit a new record. Japan's market trod water, weighed down by concern over the strong yen's impact on heavyweight exporters' earnings. But despite the market's lacklustre recent performance, we still like it. Abenomics has unleashed a corporate governance revolution, with higher dividend payouts now the norm: earlier this year, the yield on the Topix index eclipsed that on the S&P 500. The prospect of further central-bank action is another reason to like Japan and continental Europe, where there is also more scope for profits to rise than in the overpriced US market.

The MSCI Emerging Markets index has jumped by almost 30% from its January low, and is at a 13-month high. Emerging markets appear to be over the worst after a torrid few years. Growth is ticking up, helped by a gradual rebound in commodities prices and the Chinese economy. Valuations also look attractive. The most appealing emerging markets are ones with large domestic economies where government policy is moving in a pro-market direction, as in India and Vietnam.

Bonds

"It's surreal," as Gregory Peters of Prudential Fixed Income puts it. The value of government bonds with a negative yield rose above $13trn last month. This universe consists largely of European and Japanese paper: the two economies' quantitative easing (QE) programmes have hoovered up vast amounts of debt and driven prices sky-high (yields move in the opposite direction to prices). German debt's yield is negative up to a maturity of ten years; in Switzerland's case, the 50-year yield has gone negative. Bonds are hideously overpriced, and thus acutely vulnerable to a return of inflation. Consider only top-quality credits with positive yields.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Gold

Golddipped in August, its first month of losses since May, but remains close to two-year highs. It now looks as though the US Federal Reserve could raise interest rates again sooner than expected, as recent data have been strong. Because gold has no yield, higher rates lessen its relative appeal. However, rates are unlikely to rise anywhere else for some time, and with jitters over Chinese growth or the eurozone's viability prone to flare up again at some stage, the ultimate safe haven and store of value is worth holding as a form of portfolio insurance.

Cash

Early this year, savers were looking forward to the Bank of England's first interest-rate rise in almost a decade. Instead, they got Brexit and the first cut in seven years. As a result, almost 300 savings accounts trimmed their rates too, and the average easy-access account offered just 0.5% last week, compared with 0.66% a year ago.

Commercial property

There were mixed signals in the UK commercial property market in July. The leasing of central London offices was more resilient than expected, up 25% month-on-month, and lending to commercial property companies rose by £123m, according to Capital Economics. However, the total value of commercial property deals fell, with July's reading down by 42% from its mid-2015 peak.

The Lifetime Wealth portfolio

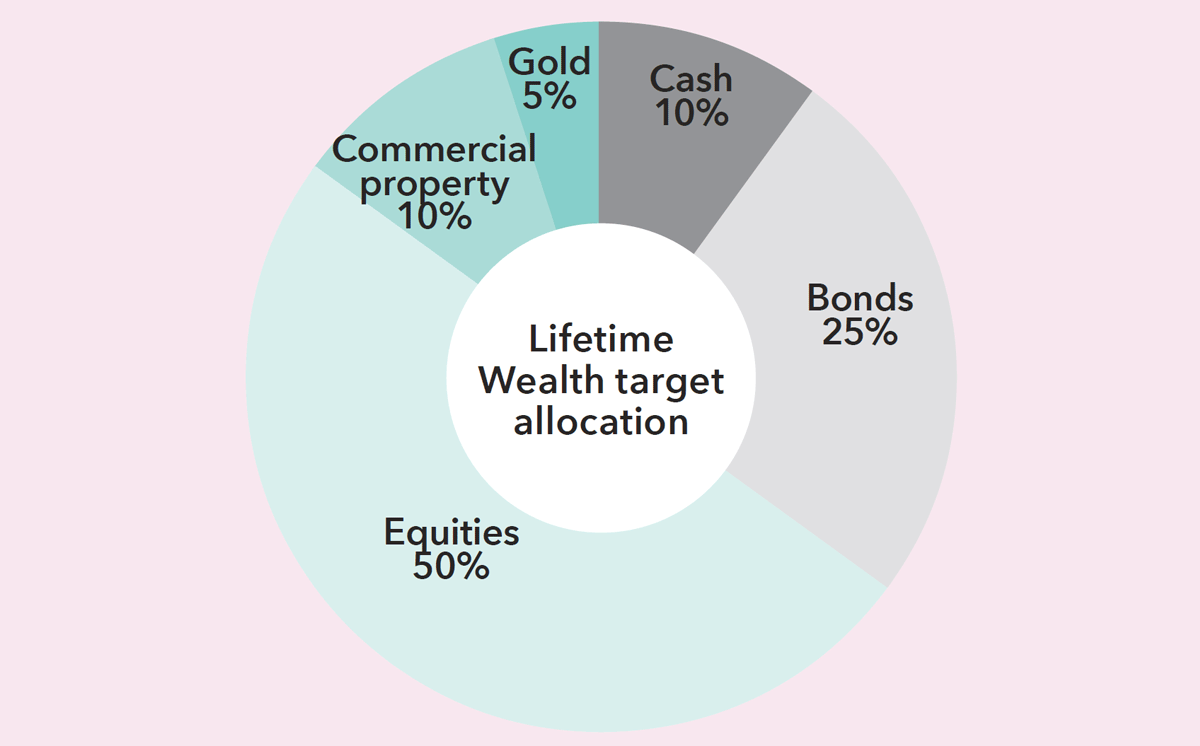

MoneyWeek's Lifetime Wealth portfolio is built around a simple asset-allocation strategy based on the five main asset classes: stocks (both UK and international), bonds (conventional and inflation-linked), cash, property and gold. We allocate a certain percentage of the overall portfolio to each asset class. You can see our current target asset allocation in the chart on the right.

The portfolio is implemented through exchange-traded funds (ETFs) and index funds. Within each asset class we choose these funds to weight the portfolio to the markets we consider most attractive on a long-term view. For example, we can favour Japanese equities over American ones, or UK government bonds over US ones. We aim to minimise unnecessary trading and to keep costs as low as possible.

Lifetime Wealth is designed to be a sensible way to grow and manage your wealth over the long term with minimum hassle. For more details, seemoneyweek.com/lifetime-wealth

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how