Features

Latest

-

Vaccines inject billions into Big Pharma – how to profit

The vaccines subsector received a big fillip from Covid, but its potential extends far beyond combating pandemics. Here's what it means for investors

By Dr Mike Tubbs Published

-

'Investors should keep putting trust in investment trusts'

Interview Peter Walls, manager of the Unicorn Mastertrust fund, analyses investment trusts in a conversation with Andrew Van Sickle

By Andrew Van Sickle Published

-

Monks Investment Trust is worthy of the spotlight

Monks Investment Trust, a global growth trust, sits in the shadow of its stablemate, Scottish Mortgage. But its record warrants attention, says Max King

By Max King Published

-

New year, same market forecasts

Forecasts from banks and brokers are as bullish as ever this year, but there is less conviction about the US, says Cris Sholto Heaton

By Cris Sholto Heaton Published

-

'Expect more policy U-turns from Keir Starmer'

Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

By Matthew Lynn Published

-

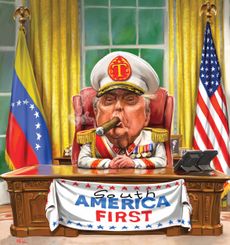

Why does Donald Trump want Venezuela's oil?

The US has seized control of Venezuelan oil. Why and to what end?

By Simon Wilson Published

-

Britain heads for disaster – how can the economy be fixed?

Opinion The answers to Britain's woes are simple, but no one’s listening, says Max King

By Max King Published

-

8 January 1835: US national debt hits $0

By selling land, collecting taxes and cutting public spending, the US national debt was brought down to $0 for the first and only time in the country’s history on this day in 1835

By Ben Judge Last updated

-

MoneyWeek news quiz: which leader did Trump order US troops to capture?

Quiz Donald Trump, soaring copper prices, and the cold weather all made headlines in the first full working week of 2026. How closely were you following the news?

By MoneyWeek Published

-

Cold Weather Payments triggered in hundreds of postcodes as Storm Goretti hits the UK: who can get it and when?

Millions of people could be eligible for Cold Weather Payments during the winter. We explain who qualifies and how to check if a payment is due

By Daniel Hilton Last updated

-

How Virgin Flying Club works as tens of thousands to get bonus points from this month

Tens of thousands of Virgin Atlantic flyers could get a points boost from 2026 as the airline’s new loyalty reward scheme comes into play. Are you eligible?

By Jessica Sheldon Last updated

-

8 of the best properties for sale with mountain views

The best properties for sale with mountain views – from a 1780s house in the Catskill Mountains in New York State, to a 19th-century house near Pitlochry

By Natasha Langan Last updated

-

Review: A cultural tour of North India

Travel Jessica Sheldon explores North India's food and art scene from three luxurious Leela Palace hotels in New Delhi, Jaipur and Udaipur

By Jessica Sheldon Published

-

What do falling interest rates mean for you?

You may think that only businesses and politicians should pay attention to choices made by the Bank of England, but its interest rates decisions also have an impact on your personal finances. We explain how.

By Daniel Hilton Published

-

Should you invest in copper?

A critical metal in electronics and the energy transition, copper is often viewed as a bellwether for the global economy. How can investors gain exposure to changing copper prices?

By Daniel Hilton Last updated

-

Most popular Sipp investments

The investment decisions you make with your Sipp impact how much you end up with in your retirement pot. We look at the most popular Sipp funds to consider when adding to your pension savings.

By Dan McEvoy Last updated

-

In the money: how my trading tips fared in 2025

The success of the open positions offset losses on closed ones, says Matthew Partridge

By Dr Matthew Partridge Published

-

Vietnamese stocks are charging ahead – here's what to buy

Vietnam has been upgraded from a frontier to an emerging market. It remains a promising pick, says David Prosser

By David Prosser Published

-

Child Benefit: how it works, eligibility criteria and how to claim

Child Benefit is worth hundreds of pounds per year and claiming it can help build up your state pension entitlement but there are tax pitfalls. We look at who is eligible and how to get the payment

By Marc Shoffman Last updated

-

13 tax changes in 2026 – which taxes are going up?

As 2026 gets underway, we look at what lies ahead in terms of changes to tax rates and allowances this year and how it will affect you.

By Holly Thomas Published

-

The best credit cards for cashback

The best credit cards for cashback can help you earn rewards on everyday spending. We list some of the top deals on the market

By Oojal Dhanjal Last updated

-

How to protect property in a divorce – and the common mistakes to avoid

The festive period can sadly push some marriages to breaking point, forcing couples to consider what will happen to their property after divorce.

By Samantha Partington Published

-

Tesla is no longer the world’s largest electric car maker. Should you invest?

Investors need to weigh up the potential of Tesla’s autonomous technology drive against struggles in its core carmaking business when deciding whether or not to invest

By Dan McEvoy Last updated

-

European defence funds rise on Venezuela intervention

While US intervention in Venezuela does not directly impact European defence firms, it adds to the incentives for Europe to increase its defence spending

By Dan McEvoy Last updated

-

Where to invest in 2026

2025 provided plenty of twists and turns. What do experts think are the best investments in the year ahead? Here’s where to invest in 2026.

By Dan McEvoy Last updated

-

Investors will reap long-term rewards from UK equities

Opinion Nick Train, portfolio manager, Finsbury Growth & Income Trust, highlights three UK equities where he’d put his money

By Nick Train Published

-

The graphene revolution is progressing slowly but surely

Enthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

By Dr Matthew Partridge Published

-

A strong year for dividend hero Murray International

Murray International has been the best-performing global equity trust over the past 12 months, says Max King

By Max King Published

-

The shape of yields to come

Central banks are likely to buy up short-term bonds to keep debt costs down for governments

By Cris Sholto Heaton Published