The shape of yields to come

Central banks are likely to buy up short-term bonds to keep debt costs down for governments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

At the start of 2025, I said that investors should “beware the long bond”. The good news is that yields on the longest-dated bonds did not run wild during the year. The 30-year Treasury and the 30-year gilt are ending where they began. Yes, the 30-year bund has gone from 2.6% to 3.5%, while the 30-year Japanese Government Bond (JGB) is up from 2.3% to 3.4%. However, this is healthy: a world in which investors were willing to lend money for three decades at incredibly low rates (well under 1% at times in Japan) is very damaged, and higher long-term rates are a step towards normality.

At the same time, we are seeing early hints of an important shift. While longer-term rates are not coming down, the short end of the yield curve is. With the exception of the Bank of Japan, central banks mostly reduced rates in 2025, including cuts by the Bank of England and the US Federal Reserve in December. This is likely to accelerate in 2026 in the US: markets are underestimating how aggressively Donald Trump and whatever thrall he appoints as Fed chair will try to cut rates to juice the economy.

Time for governments to issue more short-term debt

Rate cuts alone do not solve today’s big problem for governments. Central banks directly set the rate at which they lend very short-term money to commercial banks. Expectations for this largely set the path of short-term bond yields, but longer-term yields are determined more independently by markets. So even if short-term rates come down, higher long-term yields will still push up the cost of interest on public debt.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Whenever a bond issued at miniscule rates a few years ago has to be refinanced, the new rate shoots up. Thus the amount of interest that government pay is steadily rising. They can try to cut spending to bring down debt, but we constantly see that this isn’t politically possible.

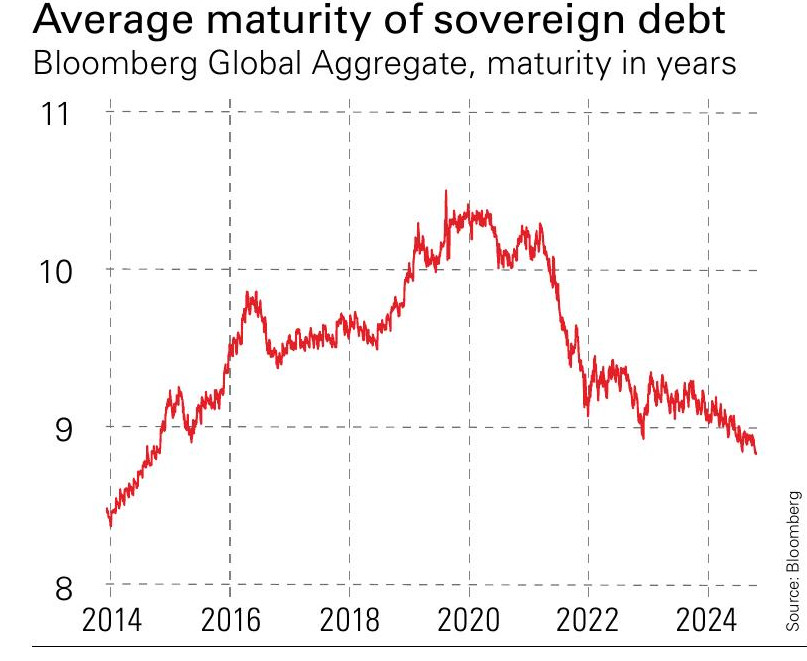

The obvious way out is to inflate away debt – but when markets expect higher inflation, they will demand higher yields to compensate, negating the gains from inflation. Central banks could hold down yields by buying up long-term bonds, but a decade of quantitative easing has shown us how much distortion this causes. The best option for now is to cut long-term debt issuance in favour of short-term debt, which pays lower yields. That is what we are seeing in countries including the US, the UK and Japan (that’s why average maturities of outstanding debt are dropping – see chart). However, a flood of short-term debt could unsettle markets and cause yields to rise. Note that earlier this month, the Fed launched a $40 billion programme of buying short-term bonds. It describes this as a technical move to manage market liquidity, but don’t be surprised if this is just the first step in central banks systematically buying short-term bonds.

So here’s a scenario. Governments issue more short-term debt. Central banks a) cut rates below inflation and b) buy more and more short-term bonds to keep yields down. Longer-term yields tick up, and the yield curve gets steeper. How will this affect markets? Is it inflationary? We should start to find out in 2026.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?