Polar Capital: a cheap, leveraged play on technology

Polar Capital has carved out a niche in fund management and is reaping the benefits

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Last year was a horrible year for the active fund-management industry. Investors have consistently been pulling money from active investment funds over the past decade, but outflows accelerated in 2025. According to data compiled by Bloomberg Intelligence, more than $1trillion flowed out of US active mutual funds last year, up from around $600billion in 2024. Investors moved into passive exchange-traded funds (ETFs), adding more than $600billion last year. The trend is much the same in the UK, albeit with smaller numbers.

This might appear to suggest the end is nigh for the UK’s listed fund-management sector, but that’s not entirely the case. Figures available indicate that only two of the listed managers are on track to report a decline in assets under management (AUM), according to analysis from Peel Hunt. Those managers are Liontrust and Impax Asset Management, which lost two key mandates from St James’s Place. That will drag group AUM down by as much as 23.3% for the year.

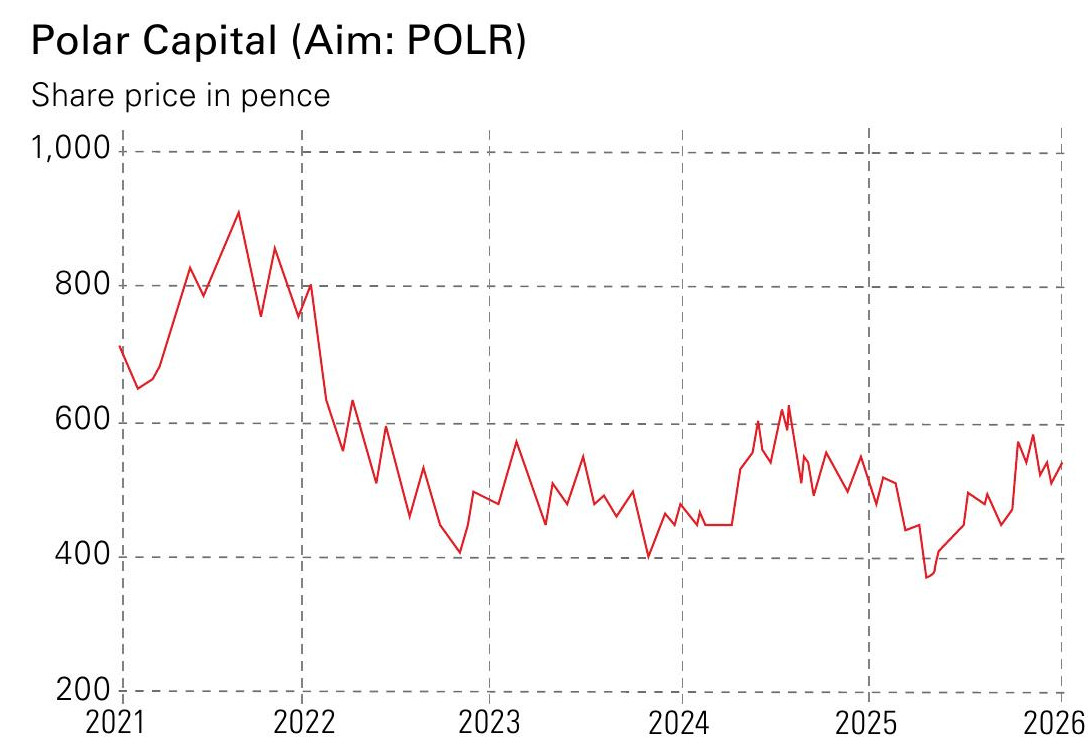

Polar Capital (Aim: POLR) is the standout performer. At the end of September, group AUM sat at a record £26.7billion, up from £23.2billion at the end of June. Net outflows for the quarter totalled just £58million, compared with £632million in the prior quarter. The company’s success can be attributed to its position as a specialist manager that’s focused on a handful of key sector mandates. At the end of September, the firm’s open-ended funds accounted for 75% of assets, with investment trusts making up 23% and segregated mandates the remainder. Tech and healthcare strategies accounted for 51% and 14% of AUM, respectively. This does mean the firm is overexposed to these sectors as a manager, but over the past decade, it’s been on the right side of the fence.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Polar Capital's deep roots in technology

It’s hard to argue that technology and healthcare won’t continue to attract investors’ interest over the next decade. These sectors might encounter some turbulence along the way, but tech and healthcare will remain two of the most exciting and promising thematic trends. Under the new CEO’s stewardship, Polar plans to double down on the markets that have helped it become one of the UK’s top boutique fund managers.

The group’s roots are in technology. It was created by Brian Ashford-Russell and Tim Woolley, who left their positions at the Henderson Technology Trust, managed by Henderson Investors, to set up the new boutique in 2001. Backed by Caledonia Investments, the self-managed investment trust Polar grew quickly despite the dotcom bubble, reaching $2billion in AUM by 2005. Henderson Technology Trust, launched in 1996, became the Polar Capital Technology Trust, a core of the group’s fund range. Since launch, the tech trust has returned 14.7% per annum (to 30 April 2025) by correctly timing key turning points in the tech world, such as the rise of Big Data in 2010 and AI as early as 2017.

The firm’s flagship open-ended tech fund, the Global Technology Fund, was launched at Polar’s inception. Today, it’s far bigger than the trust, although they’re both managed by the same team. The key difference is concentration. The trust has 91 positions, compared with 65 for the open-ended vehicle. But the trust is more concentrated, with 53% of the portfolio in the top-ten holdings, compared with 47% for the open-ended fund.

Iain Evans is a promising new boss

In September, Iain Evans was appointed CEO after 21 years with the company. Evans is planning on doubling down on what’s worked for Polar – specialism in a few key sectors with select acquisitions. This desire to focus on what works is refreshing in a sector that often appears to be struggling for direction. Many managers have panicked at the rise of passive funds, often wasting money on bolt-on acquisitions in the hopes of achieving growth or expanding into new markets.

Polar is doing the opposite. While that may leave the company at the mercy of the performance of technology, it stands out in a struggling sector. However, the market is not taking its edge into account. Instead, investors are lumping Polar in with struggling managers such as Liontrust and Impax as its valuation sits near the bottom of the range for its fund-management peers.

At the time of writing, shares in Polar Capital are trading at a forward price-to-earnings ratio (p/e) of ten, according to Panmure Liberum, and nine according to Peel Hunt. That’s a deep discount to the fund-manager sector average of 16 (including wealth managers). Fund-managers’ earnings are cyclical compared with the more stable earnings from wealth management, so the shares deserve a discount to the sector average, but a gap of more than 43% seems excessive. Panmure Liberum believes 20% would be more appropriate.

There’s also the company’s dividend. Polar earns its money in both regular fund-management and performance fees. On its asset base of £23.2billion, Polar Capital booked management fees of £86.8million in the first six months of fiscal 2025. For the year ended March 2025, it booked a management fee yield of 78 basis points (0.78%), generating net management fees of £178.3million. It also earned performance fees of £16million for the year, up several million compared with 2024. These could hit £28 million in 2026, Panmure estimates. Although regular management fees already cover Polar’s dividend, the additional performance fees mean the company’s 8.7% yield is more than covered by earnings per share, and should remain so for the foreseeable future.

All in all, Polar offers a cheap, leveraged way to play the global demand for tech stocks, with a market-beating dividend yield on offer as well.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton