The graphene revolution is progressing slowly but surely – how to invest

Enthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might have been early, not wrong, says Matthew Partridge

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In 1874, the Scottish-American industrialist Andrew Carnegie completed the mile-long Eads Bridge, made of steel and crossing the River Mississippi into St. Louis. At the time, nobody believed that steel was strong enough to be suitable for such a project. Carnegie made an elephant walk along it to show that it was strong enough, as Vivek Koncherry, the CEO of Graphene Innovations Manchester, recounts. Carnegie thus ensured that mass-produced steel would become the backbone of the later industrial revolution, “leading to the rise of the skyscrapers”.

Graphene, a sheet of which is strong enough to bear an elephant standing on a pencil, is set to transform the world today in the same way that steel did then, says Koncherry. As well as being an example of groundbreaking British science, it may also prove to be lucrative for investors. Koncherry predicts that graphene and similar nanomaterials will enable the rise of “some of the biggest companies of the future”.

Where did graphene come from?

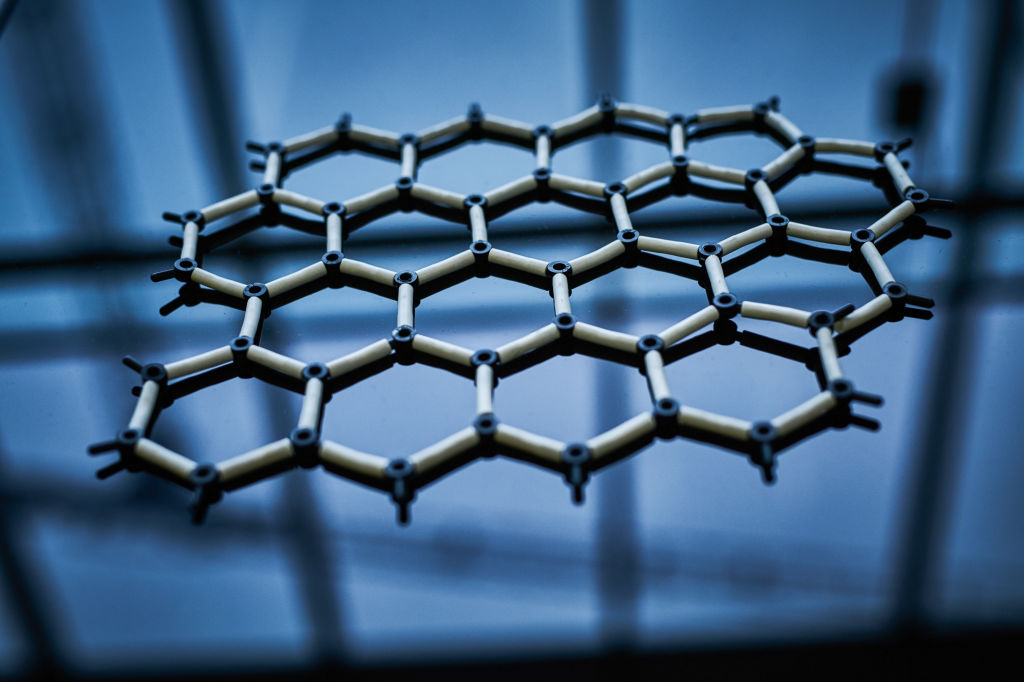

The story of graphene began more than two decades ago in 2004, with two scientists, Professors Andre Geim and Konstantin Novoselov of the University of Manchester, some graphite and some sticky tape, says James Baker, the CEO of Graphene@Manchester. They found that it was possible to use a modified version of the sticky tape to isolate a single two-dimensional atomic layer of carbon from the graphite. This material, a crystallised single layer of carbon atoms arranged in a flat honeycomb or hexagonal lattice pattern, occurs naturally, if very rarely, and is called graphene. It has some “unique properties”: it is stronger than steel, more conductive than copper, and can act as a membrane that allows some molecules through but blocks others.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The most interesting uses of the material occur when you “add it to things to complement them” and improve their functioning, says Baker. Scientists have already established that it can usefully complement materials used in batteries, energy storage, water filtration, the storing of hydrogen, in coatings for metals to prevent corrosion, for membranes and water desalination, and even inks used in wearable technologies. Baker notes that researchers at Manchester have already built graphene sensors that have been inserted into patients’ brains, opening up the possibility that the material could even be used to treat conditions such as Parkinson’s and strokes.

Graphene’s “exceptional qualities” are that it is “lightweight, while having high tensile strength and electrical conductivity” and “enhances the performance and durability of products”, says Asad Farid, portfolio manager of JSS Sustainable Equity – Strategic Materials at J. Safra Sarasin Sustainable Asset Management. Another factor which makes it different is its “simplicity” – graphene “is not a new compound and doesn’t use any exotic materials in its manufacturing” and can be extracted from graphite, an everyday substance.

The trouble with meeting expectations

Predictions that the discovery of graphene was about to change the world proved to be overly optimistic. But this was, argues Baker, the fault of unrealistic expectations, not with any thing to do with the material itself. Indeed, the gap between Geim and Novoselov’s discovery in 2004, their being awarded the Nobel Prize in 2010, and not finding commercial applications until around the present day, is not that unusual. After all, it was 25 years between discovery and the first carbon-fibre products hitting the marketplace, and that was for upscale, high-quality products such as Formula One cars, tennis rackets and golf clubs. In fact, it is usual for new materials to take ten years to get to market and even longer to reach a mass market. So graphene is still a “relatively young material”.

The biggest barriers standing in the way of mass adoption are a lack of standardisation, production costs and problems with scalability, says Aneeka Gupta, director of macroeconomic research at WisdomTree. Industry wants materials to be cheap, consistent and scalable, and that isn’t yet the case with graphene. Indeed, until very recently “there weren’t even any widely adopted standards” for the material. This matters to large industrial companies as they won’t want to redesign a process around a material unless they can be sure that other suppliers are going to be able to produce equivalent materials.

The good news is that, despite these “headwinds”, there has been progress in addressing all three issues, says Gupta, even if in a “very quiet incremental way”. Graphene hasn’t yet quite reached the point where it is being widely used across industry, but it is starting to gain a foothold in “niche, high-value components”. Terrance Barkan of the Advanced Carbons Council trade association is more bullish, noting that a lot of companies have been spending the last five years doing experiments with incorporating graphene into their product and are now ready to start rolling them out.

Setting global standards

The Advanced Carbons Council has been at the forefront of trying to get product quality standards in place, and has produced the graphene classification framework, which has now become an ISO standard – a universal benchmark for consistency across industries globally. The council also carries out work to help companies inspect and audit the supplies of graphene that they use. This is important, emphasises Barkan. “If a company uses a material that they’re told is graphene and it’s not, and it doesn’t work as they expect, then that damages the credibility of the entire market.”

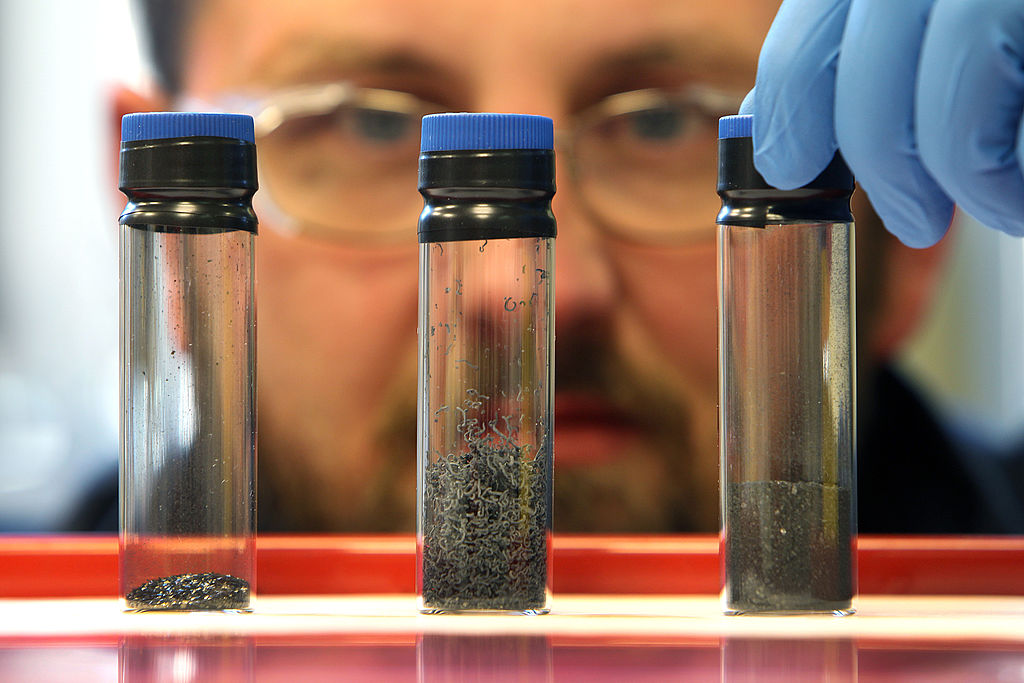

There has also been progress on the key problem of manufacturing graphene cheaply at scale. Traditionally, the approach has been to make it by “exfoliating graphite”, essentially the same approach Geim and Novoselov used back in 2004, says Kjirstin Breure, CEO of HydroGraph. Her company has developed an alternative process, based on research carried out at Kansas State University, which involves exploding hydrocarbon gases.

This approach may not necessarily be the cheapest by weight, but because the result is of such high quality compared with other methods, “it works out as much cheaper for our customers as they have to use much less of it”. Costs are set to come down further as HydroGraph starts to move its operations to a large-scale production facility in Houston, Texas, which Breure predicts will be capable of producing hundreds of metric tonnes of graphene annually. She expects the amount produced to rise even further as demand explodes.

HydroGraph isn’t the only company leading a revolution in the way that graphene is produced. Mike Harrison, CEO of Concretene, points to the work of Levidian Nanosystems, a spinout from the University of Cambridge, which has devised its own process for manufacturing high-quality graphene from methane. Like Breure, Harrison thinks we have reached the point where reductions in cost and increases in quality will make more companies interested in using the material, which in turn is enabling those making graphene to benefit from economies of scale, further reducing the price.

Graphene in construction

One industry that is starting to enthusiastically embrace graphene is construction. By putting the material graphene into concrete (sometimes called “graphene doping”), for example, Concretene claims a 10% to 20% improvement in the material’s performance. This, in turn, means construction companies can reduce the amount of cement they need to put in the concrete, which reduces the environmental impact of their construction projects. Every 50g of graphene added can lead to a saving in terms of cement used of 7kg-9kg.

At the moment, most of Concretene’s customers – United Utilities, for example – are firms that are interested in the product for the boost it will give to their green credentials. There has also been interest from the Middle East. But Harrison reckons that, in a few years, graphene in concrete will be the best solution on economic as well as environmental grounds.

Graphene is set to play an important role in other parts of the building industry, too. Nathan Feddy and Liam Britnell of Vector Labs, for example, are already working with a range of partners, including large builders, to roll out a range of products that use graphene to improve home insulation. They are also particularly impressed with graphene’s potential for reducing the risk of fires, noting that graphene-enhanced materials “can reduce the spread of flames in the event of fire by up to 80%, without impacting on the performance of the original material, which is one of the weaknesses of existing materials”.

A growing market for graphene

Construction may be at the forefront of the graphene revolution, but other sectors are not far behind. There is currently no “single killer application”, but Barkan identifies no fewer than 45 separate vertical markets where graphene is set to play a major role. The paints and coatings industries, for example, are already using graphene to protect against corrosion. The textile industry is embracing the material, too – “more than a dozen companies now make graphene-enhanced clothes”. Koncherry highlights the fact that graphene is starting to be used “to make smaller and more efficient semiconductors, for use in a wide range of electronics and batteries”. Recent reports suggest that photonic chips produced with graphene by Cambridge Graphics can “deliver not only much higher data throughput, but also 80% lower energy use than equivalent silicon chips”, says Gupta. This could have big implications for AI data centres and telecoms firms, as “they are exactly the kind of niche, high-value market where graphene’s speed and optical properties matter more than its lack of scale”.

In short, we’re now seeing the emergence of hundreds of graphene-related companies worldwide. So although “the hype that we saw a few years ago has died down, a slightly slower, but more realistic, revolution has taken its place”, says Gupta, with graphene being used to improve concrete, plastics, coatings, filters and batteries. Research from IDTechEx suggests that the global market for graphene is “estimated to grow by around 27% a year over the next decade to 2036”, as Ivan Buckley, director of business development at Graphene@Manchester, points out.

An exciting times for materials

Perhaps the clearest sign of change in the world of materials is that, encouraged by the success of graphene, researchers and companies are also “developing a whole family of other 2D materials”, says Baker. One group of materials he thinks people will be hearing a lot more about in the future is the MXenes, a metal-based family of 2D materials. They have a “potentially huge” range of applications for energy storage and for aircraft, and are sometimes used in combination with graphene.

MXenes also outperform all other materials in certain properties that make them ideal for use in insulation and wearable electronics, says Yury Gogotsi of Drexel University. MXenes have tended to live “in the shadow of graphene”, but interest in them is taking off, especially in Asia. Companies such as Murata and Samsung hold “dozens of patents” in the area, and there are now “more than a dozen” Chinese companies that produce and sell MXenes, as well as in the US, Korea and Europe, too.

Another graphene-like material that has potential is Gii. Discovered in 2014, and coming out of research into graphene, Gii has a lot of similar properties to graphene. But while the former takes the form of a single 2D layer, Gii “can be grown in three dimensions, without losing performance”, says Marco Caffio, co-founder and chief scientific officer of iGii (formerly Integrated Graphene). It can also be manufactured at scale, at low cost and “anywhere where there’s electricity”, says iGii’s CEO Jean-Christophe Granier. Both Granier and Caffio emphasise that they have already received a huge amount of interest from industry, especially in terms of developing “faster, more accessible ways to detect disease or water contaminants, as well as the creation of flexible printed batteries the size of a fingernail”. Given such developments, it’s no surprise that Granier and Caffio consider it to be an “exciting” time for the materials industry.

How to invest in graphene

No safe way into graphene

There is no exchange-traded fund (ETF) or other collective investment that gives diversified exposure to the graphene theme. And the individual companies operating in the area must be considered high risk. Some of the very early public companies have struggled to get to commercial sales, and their stock prices have suffered because investors have lost patience with them, having gone through “year after year of fundraising”, says Terrance Barkan of the Advanced Carbons Council. Still, those companies able to achieve both profitability and critical mass could see investor interest return as “sales cure all ills”.

A catalyst for wider adoption

One company that is currently starting to see its revenue go up in leaps and bounds is HydroGraph Clean Power (Vancouver: HG). The company has developed a method of extracting graphene from gases. CEO Kjirstin Breure says the firm is now building a major production plant in Texas, which could cut costs and expand production so much that “we alone could serve as a sort of catalyst for wider adoption of graphene by industry”. Indeed, HydroGraph is so confident about the future that it is planning to move its share listing Stateside to the Nasdaq.

Better batteries and cement

Aneeka Gupta, director of macroeconomic research at WisdomTree, is optimistic about the prospects for the Graphene Manufacturing Group (Toronto: GMG), a Canadian company that makes graphene-based batteries. Two years ago, the company agreed a partnership with mining company Rio Tinto to develop a battery that uses graphene to improve the safety of batteries and reduce the need for cooling. This is useful in rugged environments where batteries may need to be charged and discharged quickly. Gupta is particularly positive about GMG’s graphene spray products, which can be applied to improve the conductivity of metals while maintaining performance.

Australian firm First Graphene (Sydney: FGR) is starting to bring products to market, and its graphene-enhanced cement has moved from the trial phase to mass production, says Gupta. The company is now beginning to receive contracts from major construction firms such as Breeden and Morgan Sindall. Indeed, earlier this month First Graphene announced the production of 600 tonnes of graphene-enhanced cement at Breedon Group’s works in Derbyshire for use in new projects that are expected to be rolled out in the UK.

Two alternative plays

A slightly different way to play the graphene revolution, as well as the development of similar materials, is through companies that supply equipment to manufacturers. CVD Equipment Corporation (Nasdaq: CVV), for example, makes systems used to grow graphene and other 2D materials. Its revenue is growing by roughly 7% a year, yet it still trades at a discount of around 18% to its net assets.

Those who are especially adventurous when it comes to risk might want to consider London-listed micro-cap Directa Plus (Aim: DCTA). The company is a producer and supplier of graphene nanoplatelet-based products. These are being used in textiles (including trainers) and filters. Like all of the above companies, it is not currently making any profit, but revenue is expected to rise by more than 50% this year from 2024 and then quadruple again in 2026.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton