New year, same market forecasts

Forecasts from banks and brokers are as bullish as ever this year, but there is less conviction about the US, says Cris Sholto Heaton

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I never take the flood of forecasts that investment banks and brokers produce at the start of the year very seriously, but this isn’t because the analysts who produce them are fools. Most people who work in these jobs are smart and knowledgeable. Yet the tendency of the investment industry to reward moderate bullishness at all times means that very few can put out a genuinely unconstrained view.

There are not many analysts who have the freedom to write that they think investors should have zero exposure to the US, as Jeremy Grantham argues. Right or wrong, it is clearly a strong opinion, while simply saying that investors should be “market weight” in US equities does not offer much to chew over.

Still, when you read enough of these reports, you at least get a clear sense of whether the consensus lies. While this is far from scientific, a quick overview of the thinking for 2026 probably runs something like the following.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

AI spending is forecast to rise in 2026 – should investors keep backing it?

Spending on AI will keep rising, but the prospects for a technological revolution are so great that the bigger risk is not being invested. (It’s notable that fund managers seem to be rather more worried about whether there is an AI bubble than brokers are.) Stocks will go up, although there is much less optimism than last year about whether America will outperform the rest of the world after it fell behind in 2025. No region seems to stand out as a consensus pick, although there is quite a bit of interest in Japan. Interest rates will fall, especially in the US, which will be good for bond markets. However, nobody is getting especially excited about traditional credit (eg, corporate bonds) – not because they are forecasting disaster, but because valuations are fairly steep: there’s not much extra yield to pick up from riskier bonds compared to safer ones. Conversely, enthusiasm about private credit (eg, loans made directly by investors to companies) still seems high, despite a couple of high-profile defaults in the past year. Oil will remain under pressure. Gold will keep going up. Industrial metals such as copper and aluminium could do well due to tight supply and rising demand from AI infrastructure.

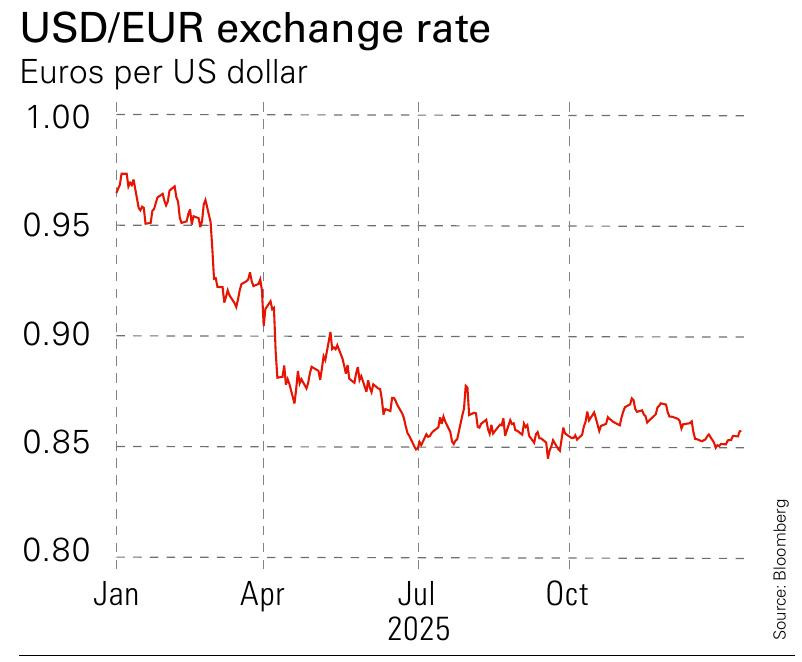

The biggest shift compared with last year seems to lie in the currency markets. Back then, the consensus was that the dollar would keep getting stronger as a result of foreign capital flowing into US markets and Donald Trump’s policies being helpful for the US trade deficit. In the end, the dollar weakened against most major currencies in the first half of the year before stabilising.

This year, most forecasters expect a weaker dollar, on the basis that interest rates will fall faster in the US than elsewhere. The other reason to expect this largely goes unsaid: the tail risks created by the Trump administration’s increasingly unpredictable policies are changing how investors feel about the US and making them – at the margin – more inclined to look for opportunities elsewhere. Based on the events of this week, we should expect that to continue.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton