A change in leadership: Is US stock market exceptionalism over?

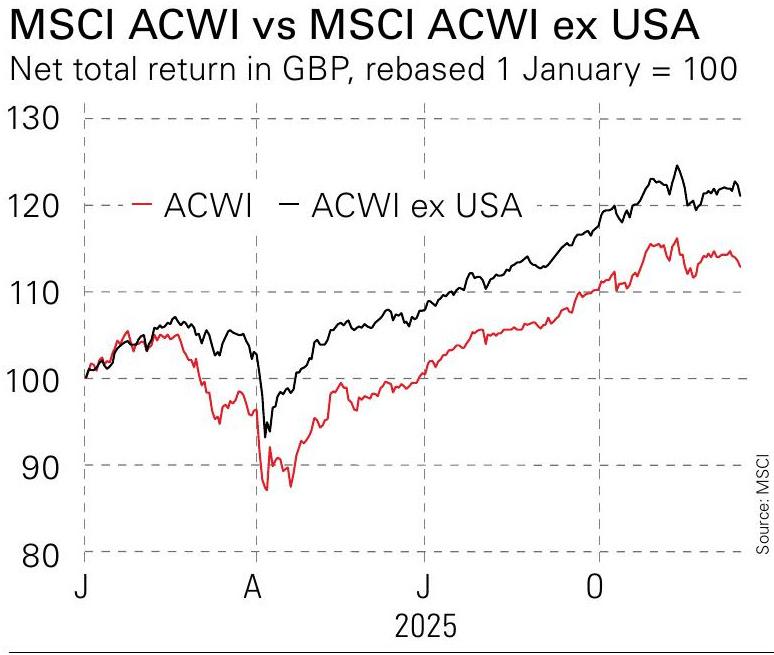

US stocks trailed the rest of the world in 2025. Is this a sign that a long-overdue shift is underway?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If nothing goes awry between now and the new year, 2025 will end up being a much better year for stocks than looked likely eight months ago. The US tariff sell-off in early April was severe at the time, but the slide ended faster than expected and markets rebounded quickly.

For all Donald Trump’s bluster, the reality is that he backtracked on the level of tariffs pretty significantly. Foreign governments signed a bunch of deals to placate him, including many promises around investment and trade that they will do their best not to deliver. Central banks began loosening monetary policy a bit more. So stocks went up again: the MSCI ACWI index – which includes developed and emerging markets – have returned a very strong 18% (including net dividends) in local currency terms.

It is likely that the full effect of the tariffs is yet to show up. It is also plausible that at some point the Trump administration will a) notice that the rest of the world has no intention of actually funnelling hundreds of billions of dollars more into the US and b) start to worry about some early signs of a slowdown in the part of the economy that is not fuelled by AI spending. At that point, it may decide to start a fresh trade war with China and Europe. However, until then, we are where we are: business as usual.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A long-term view on US stocks

Yet something is different. US stocks have returned around 16% this year – an above-average performance. However, that is only just in line with Europe and well below many European countries (including the UK), Japan and emerging markets. Note too this is in local-currency terms: factor in the drop in the US dollar and investors have done better in almost any other market. This runs against American outperformance in recent years and is the opposite of what most strategists were expecting at the start of 2025.

We cannot know whether this will happen again next year. However, on a long-term view we can note that the MSCI USA index trades on a forecast earnings yield (earnings divided by price) of around 4.5%. The MSCI Europe index is on an earnings yield of over 6.5%, the MSCI Japan is around 6% and the MSCI Emerging Markets is a bit under 7.5%.

In theory, the earnings yield is a direct proxy for expected longer-term real returns. You either get earnings back as dividends or reinvested by companies to create growth – either way, a higher yield should mean stronger returns. Reality is never that simple, but it is unarguable that the US will have to keep delivering much better earnings growth than the rest of the world to overcome the drag of starting on a lower yield.

So on a longer-term view, the odds are in favour of an extended spell when the rest of the world outperforms. This is why our asset allocation portfolio – which I will be reviewing shortly – keeps significantly underweighting the US despite its strong past performance. That call may finally be starting to work in our favour.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems