A change in leadership: Is US stock market exceptionalism over?

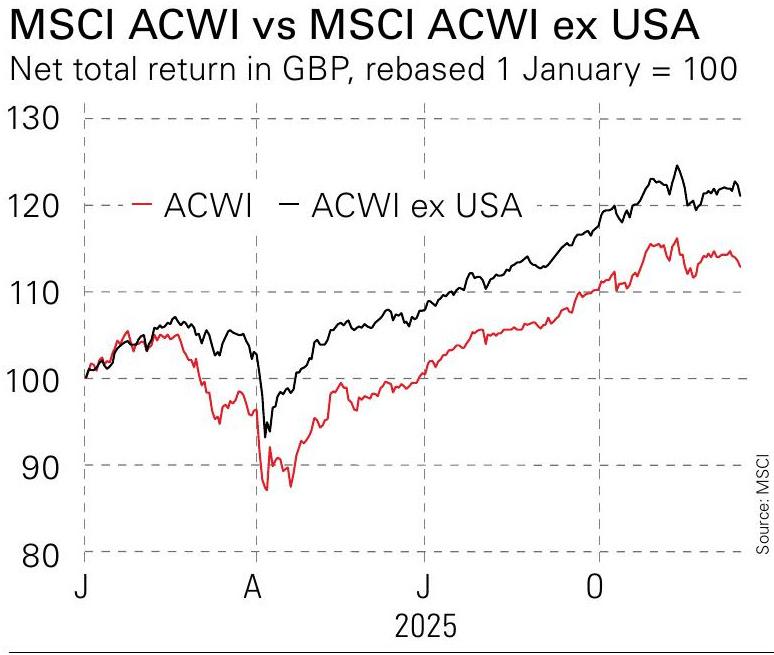

US stocks trailed the rest of the world in 2025. Is this a sign that a long-overdue shift is underway?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If nothing goes awry between now and the new year, 2025 will end up being a much better year for stocks than looked likely eight months ago. The US tariff sell-off in early April was severe at the time, but the slide ended faster than expected and markets rebounded quickly.

For all Donald Trump’s bluster, the reality is that he backtracked on the level of tariffs pretty significantly. Foreign governments signed a bunch of deals to placate him, including many promises around investment and trade that they will do their best not to deliver. Central banks began loosening monetary policy a bit more. So stocks went up again: the MSCI ACWI index – which includes developed and emerging markets – have returned a very strong 18% (including net dividends) in local currency terms.

It is likely that the full effect of the tariffs is yet to show up. It is also plausible that at some point the Trump administration will a) notice that the rest of the world has no intention of actually funnelling hundreds of billions of dollars more into the US and b) start to worry about some early signs of a slowdown in the part of the economy that is not fuelled by AI spending. At that point, it may decide to start a fresh trade war with China and Europe. However, until then, we are where we are: business as usual.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A long-term view on US stocks

Yet something is different. US stocks have returned around 16% this year – an above-average performance. However, that is only just in line with Europe and well below many European countries (including the UK), Japan and emerging markets. Note too this is in local-currency terms: factor in the drop in the US dollar and investors have done better in almost any other market. This runs against American outperformance in recent years and is the opposite of what most strategists were expecting at the start of 2025.

We cannot know whether this will happen again next year. However, on a long-term view we can note that the MSCI USA index trades on a forecast earnings yield (earnings divided by price) of around 4.5%. The MSCI Europe index is on an earnings yield of over 6.5%, the MSCI Japan is around 6% and the MSCI Emerging Markets is a bit under 7.5%.

In theory, the earnings yield is a direct proxy for expected longer-term real returns. You either get earnings back as dividends or reinvested by companies to create growth – either way, a higher yield should mean stronger returns. Reality is never that simple, but it is unarguable that the US will have to keep delivering much better earnings growth than the rest of the world to overcome the drag of starting on a lower yield.

So on a longer-term view, the odds are in favour of an extended spell when the rest of the world outperforms. This is why our asset allocation portfolio – which I will be reviewing shortly – keeps significantly underweighting the US despite its strong past performance. That call may finally be starting to work in our favour.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

The scourge of youth unemployment in Britain

The scourge of youth unemployment in BritainYouth unemployment in Britain is the worst it’s been for more than a decade. Something dramatic seems to have changed in the labour markets. What is it?