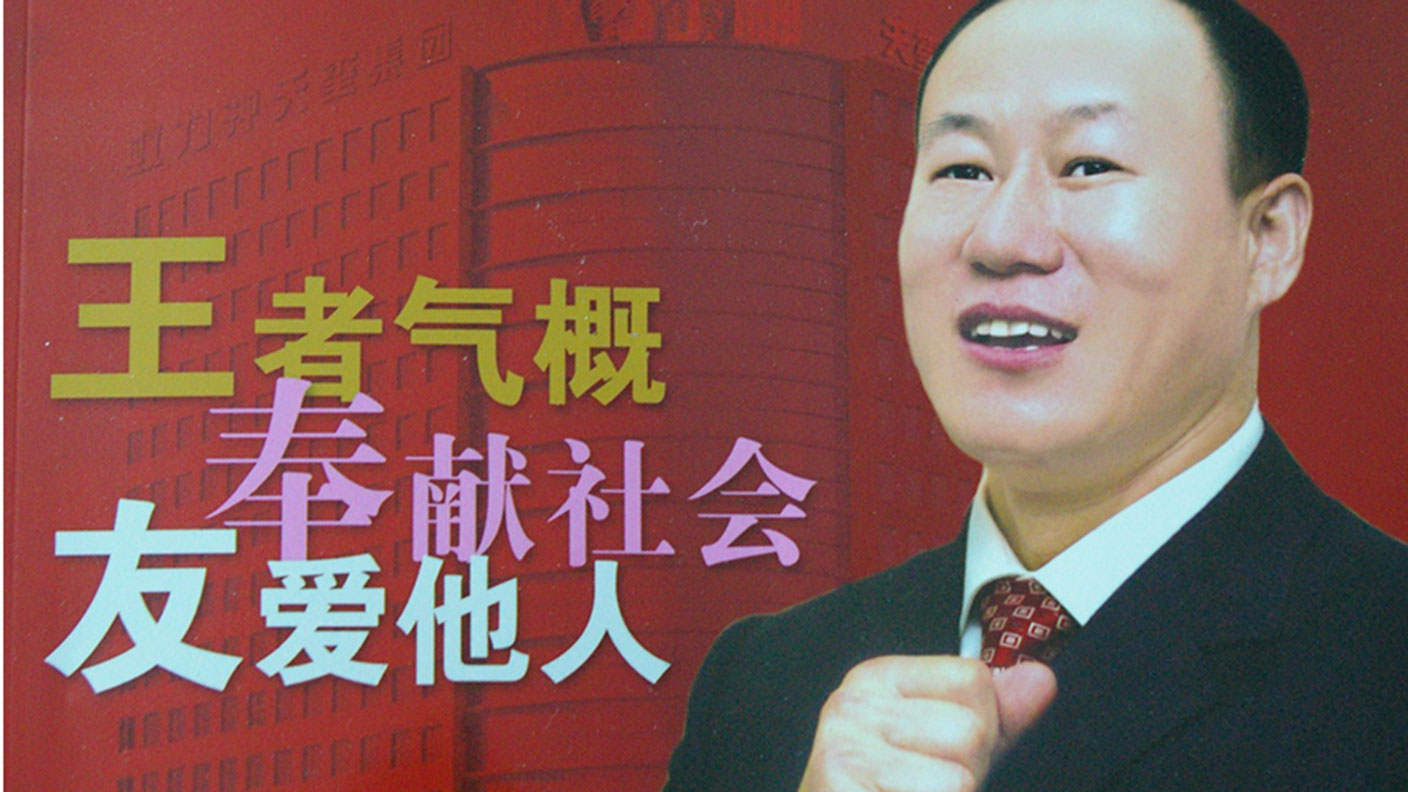

Great frauds in history: Wang Fengyou’s ant-breeding scam

“Model entrepreneur” Wang Fengyou's ant-farming Ponzi scheme pulled in $1.2bn, with investors losing all.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Wang Fengyou was born into poverty in China, but developed an entrepreneurial streak selling potatoes before turning to running a bottling plant, a slaughter-house and a taxi business. In 1999 he founded Yilishen Tianxi Group, which manufactured traditional Chinese remedies, including an aphrodisiac, made from ants. These products were heavily advertised on Chinese television with endorsements from Chinese comedian Zhao Benshan, and Bao Xishun, China’s tallest man. The apparent success of the company won him a stream of awards, including a “model entrepreneur” award from the government, and he was photographed with many prominent officials, including the now disgraced Bo Xilai.

What was the scam?

From 2001 Wang offered “investors”, mainly peasants who had received compensation for losing their land to development, the chance to earn large returns from ant farming. Investors got three boxes of “special” ants from his company for ¥10,000 ($1,600) and, for feeding them until they died, the firm would buy them back for a return of around 32.5% over 14 months. In reality, the firm was never legitimately profitable – it was a Ponzi scheme, with new investors’ money going to pay those who had invested previously. Large amounts were spent on gifts to officials.

What happened next?

In 2004 the US Food and Drug Administration banned Yilishen’s products from America on the basis that they contained active ingredients found in Viagra. This forced the company to abandon plans to float on the Hong Kong stock exchange and sales fell. In response, Wang stepped up recruitment for his scheme, but by 2007 investors’ money had run out, leading to protests involving 200,000 people. The authorities stepped in and arrested Wang. He was made to confess to organising counter-protests and sentenced to death; many of his managers were given prison sentences.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lessons for investors

Estimates of the numbers of those conned vary, but the scheme may have collected as much as $1.2bn. Despite official promises of compensation, investors got little or no money back and the police harassed and arrested those who complained. Endorsements from local politicians are never a guarantee of a scheme’s trustworthiness, especially in emerging markets where transparency and the rule of law may be limited.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

Pensions vs savings accounts: which is better for building wealth?

Pensions vs savings accounts: which is better for building wealth?Savings accounts with inflation-beating interest rates are a safe place to grow your money, but could you get bigger gains by putting your cash into a pension?

-

Great frauds in history: Jeff Carpoff’s green Ponzi scheme

Great frauds in history: Jeff Carpoff’s green Ponzi schemeProfiles Jeff Carpoff's plan to make money from renting out solar-powered generators quickly turned into a Ponzi scheme.

-

Great frauds in history: Helmut Kiener, Germany’s mini-Madoff

Great frauds in history: Helmut Kiener, Germany’s mini-MadoffProfiles The performance of Helmut Kiener’s fund of funds, which invested money from institutions and private investors into hedge funds, seemed too good to be true. It was.

-

Great frauds in history: Manfred Schmider, the Sheikh of Karlsruhe

Great frauds in history: Manfred Schmider, the Sheikh of KarlsruheProfiles Manfred Schmider massaged the sales figures at FlowTex, his utility technology company, and used investors’ money to buy villas around the world, a fleet of luxury cars, and even a helicopter.

-

Great frauds in history: how Elizabeth Bigley, AKA “Madame DeVere”, spirited away cash

Great frauds in history: how Elizabeth Bigley, AKA “Madame DeVere”, spirited away cashProfiles Serial fraudster Elizabeth Bigley AKA, the “psychic” Madame Lydia DeVere, conned people into believing she was the long lost daughter of fabulously wealthy industrialist Andrew Carnegie.

-

Great Frauds in History: Robert Schuyler’s illicit share issue

Profiles Robert Schuyler was known as “America’s first railroad king” issued millions of dollars' worth of fraudulent shares in his company, and kept the money, fleeing to France when his scam was exposed.

-

Great Frauds in History: Michael Meehan’s market manipulation

Great Frauds in History: Michael Meehan’s market manipulationProfiles Stockbroker Michael Meehan manipulated the markets, driving stock prices up and making a mint.

-

Great frauds in history: Meyer Blinder's Blind ’em & Rob ’em

Great frauds in history: Meyer Blinder's Blind ’em & Rob ’emProfiles Meyer Blinder’s brokerage firm cold-called unsuspecting punters and pumped shares in fraudulent shell companies while stiffing them with huge commissions.

-

Great frauds in history… William Strahan’s stolen bonds

Great frauds in history… William Strahan’s stolen bondsProfiles Eton-educated William Snow, AKA William Strahan, inherited a huge fortune and joined the family bank. On the face of it he was a pillar of respectable society. But he and his partners sold investors' assets to bail themselves out when they went broke.