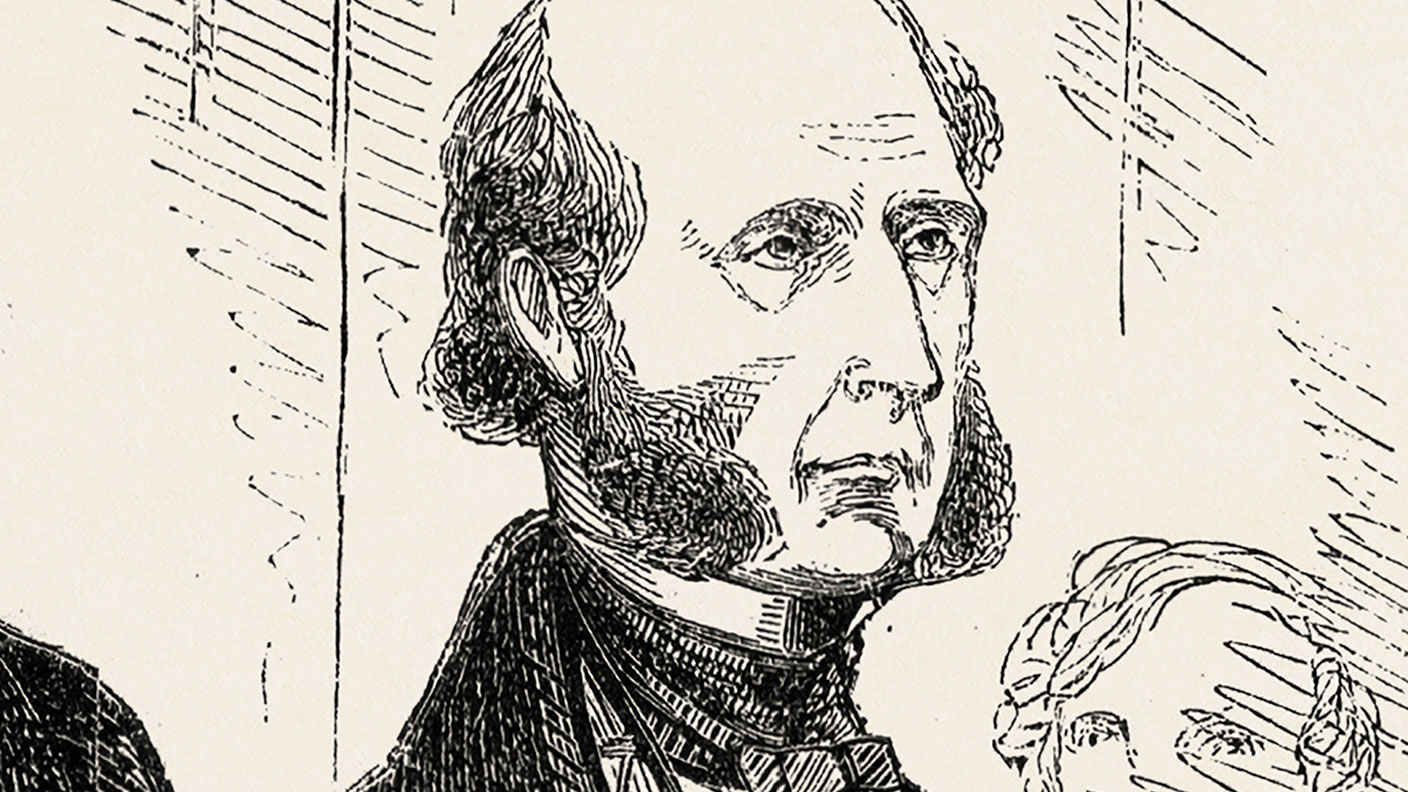

Great Frauds in History: Robert Schuyler’s illicit share issue

Robert Schuyler was known as “America’s first railroad king” issued millions of dollars' worth of fraudulent shares in his company, and kept the money, fleeing to France when his scam was exposed.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Robert Schuyler was born in Rhinebeck, New York in 1798, the grandson of American general Phillip Schuyler and nephew of the treasury secretary, Alexander Hamilton. After graduating from Harvard he moved into steamboats, becoming president of the New York and Boston Transportation Company in 1838. In 1846 he founded R. & G. L. Schuyler, which invested in railroads. His career progressed rapidly and he soon became a major figure in the American rail industry: he was president of several railroads and involved with many others. As a result he became known as “America’s first railroad king”.

How did the scam work?

In 1848 he was appointed president of the New York and New Haven Railroad, as well at its sole transfer agent, which meant that he was in charge of keeping the shareholders’ register up to date to reflect share transactions. He took advantage of this to issue 19,540 shares in the group without informing shareholders or the directors. Schuyler then diverted the $2m ($56.9m today) raised in this way from the company’s treasury, instead using it as collateral for loans intended to shore up other parts of his business empire. He then falsified the accounts to conceal his activities.

What happened next?

In 1853 one of the New York and New Haven railroad’s trains crashed into Norwalk Harbour, killing 50 people. Complaints that Schuyler had spread himself too thinly meant that he had to resign several of his presidencies. However, it was not until the summer of 1854 that a sudden plunge in the value of New York and New Haven’s shares finally prompted the board to investigate, prompting Schuyler to flee, eventually to France, and confess his guilt. Schuyler would die in November 1855 from the combined effects of illness and guilt about his own behaviour.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Lessons for investors

After a long legal battle, the US Supreme Court ruled that the company had to honour the shares, costing the company around $1.8m. The wider impact of the scandal resulted in the bankruptcy of several small brokerages, as well as a fall in the share price of other railroads Schuyler had been involved with. These days most major stock exchanges require share transfers to take place through a centralised system, making sales of unauthorised shares practically impossible, although the practice can still occur with shares in small private companies.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

Great frauds in history: Wang Fengyou’s ant-breeding scam

Great frauds in history: Wang Fengyou’s ant-breeding scamProfiles “Model entrepreneur” Wang Fengyou's ant-farming Ponzi scheme pulled in $1.2bn, with investors losing all.

-

Great frauds in history: Jeff Carpoff’s green Ponzi scheme

Great frauds in history: Jeff Carpoff’s green Ponzi schemeProfiles Jeff Carpoff's plan to make money from renting out solar-powered generators quickly turned into a Ponzi scheme.

-

Great frauds in history: Helmut Kiener, Germany’s mini-Madoff

Great frauds in history: Helmut Kiener, Germany’s mini-MadoffProfiles The performance of Helmut Kiener’s fund of funds, which invested money from institutions and private investors into hedge funds, seemed too good to be true. It was.

-

Great frauds in history: Manfred Schmider, the Sheikh of Karlsruhe

Great frauds in history: Manfred Schmider, the Sheikh of KarlsruheProfiles Manfred Schmider massaged the sales figures at FlowTex, his utility technology company, and used investors’ money to buy villas around the world, a fleet of luxury cars, and even a helicopter.

-

Great frauds in history: how Elizabeth Bigley, AKA “Madame DeVere”, spirited away cash

Great frauds in history: how Elizabeth Bigley, AKA “Madame DeVere”, spirited away cashProfiles Serial fraudster Elizabeth Bigley AKA, the “psychic” Madame Lydia DeVere, conned people into believing she was the long lost daughter of fabulously wealthy industrialist Andrew Carnegie.

-

Great Frauds in History: Michael Meehan’s market manipulation

Great Frauds in History: Michael Meehan’s market manipulationProfiles Stockbroker Michael Meehan manipulated the markets, driving stock prices up and making a mint.

-

Great frauds in history: Meyer Blinder's Blind ’em & Rob ’em

Great frauds in history: Meyer Blinder's Blind ’em & Rob ’emProfiles Meyer Blinder’s brokerage firm cold-called unsuspecting punters and pumped shares in fraudulent shell companies while stiffing them with huge commissions.

-

Great frauds in history… William Strahan’s stolen bonds

Great frauds in history… William Strahan’s stolen bondsProfiles Eton-educated William Snow, AKA William Strahan, inherited a huge fortune and joined the family bank. On the face of it he was a pillar of respectable society. But he and his partners sold investors' assets to bail themselves out when they went broke.