Kim Woo-choong: the ambiguous legacy of Daewoo's Chairman Kim

Former Daewoo chairman Kim Woo-choong inspired a generation of entrepreneurs. His empire collapsed and his career ended in ignominy, but was he to blame for his downfall? Jane Lewis reports

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The death of former Daewoo chairman Kim Woo-choong, whose catchphrase, “To the world, to the future!”, inspired legions of young South Korean entrepreneurs, has reignited the debate in the country about his legacy. “Chairman Kim”, who died of pneumonia aged 82 in December, strove to be an “automotive Genghis Khan”, says The New York Times. His “mad-rush corporate expansion” in the 1990s came to symbolise South Korea’s rise as an Asian tiger. Yet it all ended in the biggest bankruptcy in the country’s history when his Daewoo “chaebol” collapsed in 1999.

An empire riddled with debt

At the height of his success, “Kim personified South Korea’s unlikely transformation, out of the ashes of brutal civil war, into a manufacturing powerhouse”, says the FT. “But his empire, riddled with fraud and debt, toppled over after the 1997-1998 Asian financial crisis, turning Kim and his reliance on personal ties with politicians and state-backed loans into a symbol of what was wrong with the country.” Although it became known in the West primarily for its cars (Daewoo Motors was eventually sold to General Motors), Kim’s conglomerate straddled ships, oil-rigs, steel-making, home appliances and hotels – at its peak employing more than 300,000 in 110 countries. Yet it all began with a humble one-room textile company, founded in 1967 when Kim was 30, with just five million won (roughly $5,000) in capital, says the Nikkei Asian Review.

Born in Daegu in 1936, Kim’s early life was scarred by the Korean war. When he was a teenager, his father – a school teacher turned provincial governor – was kidnapped by Communists and taken to North Korea, says The New York Times. Kim worked his way through high school and college, selling vegetables and ice tea on the streets, “acquiring the marketing gumption and savvy that would later mark his career”. When he began Daewoo, his family connections, including those with Park Chung-hee, who became the country’s authoritarian ruler in 1963, stood him in good stead, says the FT. Kim then expanded aggressively, first at home through mergers, then abroad. In 1992 he was the first South Korean businessman to visit North Korea, later opening a joint “inter-Korean�� venture.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

An unhappy fate

Kim lived a spartan life: he slept at his factories, never took a day off, never drank and never played golf. He famously said. “If we don’t have technology, we can buy it. If we don’t have money, we can borrow and repay it when we make it.” But therein lay the seeds of both his own, and his country’s, downfall. When the Asian crisis hit, and banks began calling in loans, Kim’s empire crumbled and South Korea sought a $58bn bailout from the IMF. His own “unhappy fate” was to flee overseas to avoid a criminal investigation, says the Nikkei Asian Review. When a Fortune reporter caught up with him in 2003, he found Kim to be a shadow of his former self: “a frail old man in loose trousers and bare feet”, chain-smoking Marlboro Lights.

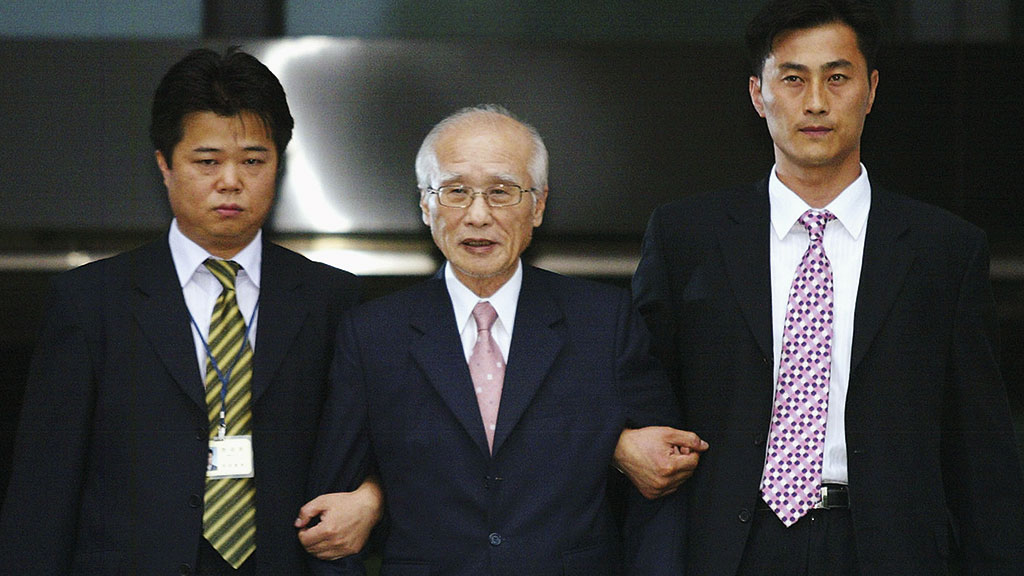

In 2005, Kim returned to Korea to face the music, receiving an eight-year prison sentence for accounting fraud. He was pardoned three years later and never fully accepted responsibility for Daewoo’s collapse, blaming “economic bureaucrats” for its downfall. The Daewoo brand name “has largely disappeared in South Korea”, says The New York Times. Still, Kim lives on in his way. “Dozens of executives” who began their careers with him and who still call themselves “Daewoo men” lead South Korean companies today.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

-

What is Warren Buffett’s net worth?

What is Warren Buffett’s net worth?Warren Buffett, sometimes referred to as the “Oracle of Omaha”, is considered one of the most successful investors of all time. How did he make his billions?

-

Kwasi Kwarteng: the leading light of the Tory right

Kwasi Kwarteng: the leading light of the Tory rightProfiles Kwasi Kwarteng, who studied 17th-century currency policy for his doctoral thesis, has always had a keen interest in economic crises. Now he is in one of his own making

-

Yvon Chouinard: The billionaire “dirtbag” who's giving it all away

Yvon Chouinard: The billionaire “dirtbag” who's giving it all awayProfiles Outdoor-equipment retailer Yvon Chouinard is the latest in a line of rich benefactors to shun personal aggrandisement in favour of worthy causes.

-

Johann Rupert: the Warren Buffett of luxury goods

Johann Rupert: the Warren Buffett of luxury goodsProfiles Johann Rupert, the presiding boss of Swiss luxury group Richemont, has seen off a challenge to his authority by a hedge fund. But his trials are not over yet.

-

Profile: the fall of Alvin Chau, Macau’s junket king

Profile: the fall of Alvin Chau, Macau’s junket kingProfiles Alvin Chau made a fortune catering for Chinese gamblers as the authorities turned a blind eye. Now he’s on trial for illegal cross-border gambling, fraud and money laundering.

-

Ryan Cohen: the “meme king” who sparked a frenzy

Ryan Cohen: the “meme king” who sparked a frenzyProfiles Ryan Cohen was credited with saving a clapped-out videogames retailer with little more than a knack for whipping up a social-media storm. But his latest intervention has backfired.

-

The rise of Gautam Adani, Asia’s richest man

The rise of Gautam Adani, Asia’s richest manProfiles India’s Gautam Adani started working life as an exporter and hit the big time when he moved into infrastructure. Political connections have been useful – but are a double-edged sword.