UK inflation: summary

- The Office for National Statistics (ONS) has released the latest UK inflation data today (21 January).

- The data shows the Consumer Price Index (CPI) measure of inflation rose by 3.4% in the 12 months to December

- Analysts expected CPI to have risen by this amount; the Bank of England’s latest forecast projected a 3.5% increase.

- In the 12 months to November, CPI rose by 3.2%, below analyst predictions that had been as high as 3.6%.

- The Bank of England projects that CPI will fall to 3.0% in January, and to 2.5% by the fourth quarter of 2026.

| What is inflation? | Upcoming CPI release dates | Your personal inflation rate |

Good afternoon, and welcome to our coverage of the latest UK inflation data.

The Office for National Statistics (ONS) announces the latest Consumer Prices Index (CPI) inflation data, covering the year to December 2025, tomorrow morning.

The previous release, covering November, showed a surprise drop in year-on-year inflation to 3.2%; the Bank of England had forecast a reading of 3.4% while some analysts had forecast as high as 3.6%.

But December’s read could paint a gloomier picture. The Bank of England’s latest available projections (dated 5 November) expect CPI to have risen to 3.5% in the 12 months to December, and other analysts also expect UK inflation to have risen from the previous month.

Follow us here at MoneyWeek for rolling preview analysis ahead of tomorrow’s announcement, plus live coverage of the release and reaction tomorrow morning.

Economists expect UK inflation to have risen in December

The latest Bank of England forecasts point to a jump to 3.5% in CPI inflation tomorrow.

These forecasts are a little dated – they were included in the Monetary Policy Report that accompanied the MPC’s last-but-one meeting, on 5 November. There have been two inflation data releases (covering October and November) since then, and both reads undershot expectations.

But economists still broadly forecast UK inflation to be higher in the year to December than it was in the year to November.

There is some uncertainty over the date on which inflation data will have been gathered; 9 December would be four weeks after the previous data collection, but it is unusually early in the month.

The alternative, 16 December, is a more appropriate date but would make it the fifth five-week gap between collections of 2025, and it is unusual to have that many five-week gaps in a calendar year.

The collection date could materially change the outcome, as prices tend to increase in the run-in to Christmas.

Robert Wood, chief UK economist at Pantheon Macroeconomics, forecasts CPI to have risen 3.3% assuming that data is collected on 9 December, rising to 3.4% if it is collected on 16 December.

Sanjay Raja, chief UK economist at Deutsche Bank, expects a headline CPI inflation figure of 3.4%, though he said this could be higher if (as he expects) data is collected on the later date.

When is UK inflation data announced?

UK inflation data for the 12 months to December will be announced at 7am on 21 January.

We will bring you live analysis and reaction to the ONS data tomorrow morning following the release.

UK inflation's recent history

It has been a turbulent few years for UK inflation.

Following the Covid pandemic, inflation was running at historically low levels – just 0.2% in August 2020. Most economists would argue that inflation rates this low are economically unhealthy; 2% is regarded as the optimal rate, which is why the Bank of England targets this level.

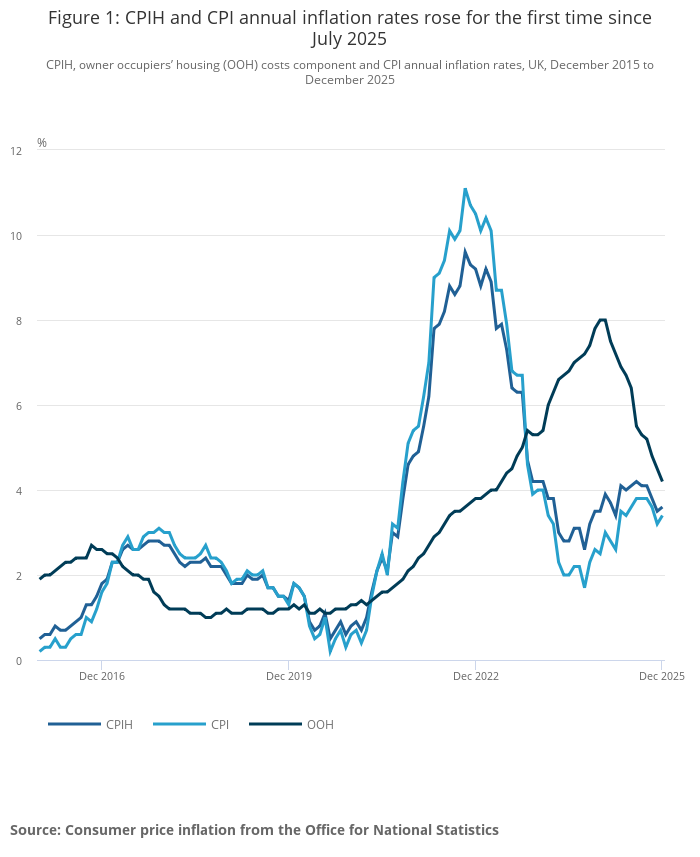

From the second half of 2021, though, the rate of inflation rapidly passed beyond this optimal rate, peaking at 11.1% in October 2022.

Since then, inflation has gradually been trending downwards. The 2024 Autumn Budget caused a temporary bump as inflationary measures like increased employer National Insurance contributions came into effect from April, but following a three-month plateau at 3.8% over the summer, inflation now appears to be coming down.

What is CPI inflation?

You might be asking yourself, what is inflation?

Inflation is a measure of the pace at which prices are increasing within an economy. A higher rate of inflation means that prices rose faster, while a slower rate means they fell slower.

A fall in inflation doesn’t indicate a fall in prices, unless the inflation number turns negative (which is known as deflation). But a fall in inflation from, say, 3% to 2% means that prices still rose, just at a slower rate than in the previous period.

There are various different ways to measure inflation. The Consumer Prices Index (CPI) is viewed as the key metric by economists, but there are others including Consumer Prices Index including owner occupiers’ housing costs (CPIH), which includes the costs of owning, maintaining and living in a home, and the Retail Prices Index which includes costs associated with home ownership.

The longer-term UK inflation outlook

UK inflation looks set to come in somewhere above 3% in the December release.

But what is the longer-term outlook for UK inflation, and when is it likely to return to the 2% level that economists target?

Analysts at the Bank of England expect UK inflation to fall to 3.1% in the first quarter of this year, and to fall below 3% in the second quarter. Inflation is expected to average 2.5% in the final quarter of the year.

In Q1 of 2027, the bank forecasts that inflation will have fallen to close to its target rate of 2%, and that it will fall below it the following quarter.

What does inflation mean for your money?

Inflation erodes the purchasing power of money.

It is related to interest rates, in that policymakers will generally raise rates when inflation is high (in order to reduce the amount of available money within the economy, which lowers demand and thus prices) and reduce them when inflation is low (in order to stimulate more economic activity).

But the relationship isn’t perfect, and other factors – particularly the overall health of the economy – impact interest rates. The UK is currently enduring a period of elevated inflation alongside lacklustre growth, meaning that interest rates are falling despite inflation running well above the 2% target rate.

That is bad news for savers in particular, because the returns on saved cash may not beat inflation, meaning that savings held for the long term are actually losing value in real terms.

Inflation reduces the value of your cash savings over time.

“Falling inflation puts the spotlight firmly on getting the best possible return,” said Harriet Guevara, chief savings officer at Nottingham Building Society. “As expectations grow that interest rates will start to come down, savings rates are likely to follow. That makes now an important moment to shop around, while competition between providers is still delivering strong returns.”

The impact of inflation on long-term cash holdings is also a reason to consider starting to invest some of your disposable income.

Thank you for following our preview of the latest UK inflation data release today. We're going to pause coverage here for this evening, but join us first thing tomorrow morning as we report on the latest UK inflation figures live from 7am.

Good morning and welcome back to our live UK inflation blog.

The Office for National Statistics (ONS) will be announcing December's figures shortly.

Stay with us for live coverage, rolling reaction and analysis.

BREAKING: UK INFLATION ROSE TO 3.4% IN DECEMBER

The UK’s Consumer Price Index (CPI) rate of inflation rose in the 12 months to December in part due to higher tobacco prices, the ONS said.

A rise in the cost of airfares, likely due to higher prices over the Christmas period, also drove the slight uptick on the month before.

The ONS said rises in the price of tobacco and transport were partially cancelled out by falls in the cost of furniture and household goods and recreation and culture activities such as TV subscriptions and trips to the cinema.

Prices across the health and communication sectors also fell.

The Consumer Price Index (CPI) rate of inflation is not the only measure tracked by the ONS.

It also releases Consumer Price Index including owner occupiers' housing costs (CPIH) data which includes the costs of owning, maintaining and living in a home.

It is considered the most comprehensive measure of inflation published by the ONS.

The ONS has published the CPIH measure of inflation for the 12 month to December today (21 January), which shows a rise of 3.6%, up from 3.5% in November.

December uptick 'short-lived'

The latest CPI inflation data is a blow for the Bank of England (BoE) which has a 2% target it is supposed to meet.

However, Alice Haine, personal finance analyst at investment platform Bestinvest by Evelyn Partners, said the December figures were just an uptick and inflation would come down in early 2026.

Haine said: "The combination of tax rises and spending restraints introduced in the Autumn Budget, along with a cooling labour market and slowing wage growth, are likely to act as a drag on prices."

Haine also pointed to core inflation, which strips out more volatile items such as food, alcohol and tobacco, holding at 3.2% in December.

Core inflation is considered important because it provides a clearer picture of long-term price rises.

How has inflation changed over time?

Both the CPI and CPIH measures of inflation, while rising slightly in December, have broadly fallen from peaks of 11.1% and 9.6%, respectively, in October 2022.

The CPI rate of 11.1% in October 2022, driven in part by soaring energy prices, was the highest the measure had been for four decades.

What does the latest inflation data mean for interest rates?

The Bank of England most recently cut interest rates from 4% to 3.75% in December as it looks to kickstart growth in the UK economy.

However, rising inflation could cause the bank's Monetary Policy Committee (MPC), which sets rates, to take a more cautionary approach at its next meeting in February.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales (ICAEW), said the December inflation figures made a February rate cut "look improbable", "particularly as policymakers may want to assess the effect of escalating geopolitical tensions before loosening policy again".

A closer look at the figures

The main drivers of the uptick in inflation in the 12 months to December were alcohol and tobacco, transport and food and non-alcoholic drinks.

Here's a breakdown of exactly how much prices rose across these categories.

Alcohol and tobacco

Alcohol and tobacco prices rose by 5.2% in the 12 months to December. This was a sharp increase from 4% in the 12 months to November.

The ONS said the uplift was mostly caused by a rise to Tobacco duty in November.

Transport

Prices across the transport sector went up by 4% in December, a rise from 3.7% in November.

The spike was mainly caused by an increase in air fares, which rose by 28.6%.

Food and non-alcoholic drinks

Food and non-alcoholic beverages prices rose by 4.5% in the 12 months to December, up from 4.2% in the 12 months to November.

Chancellor reacts to the latest inflation figures

The chancellor Rachel Reeves has responded to this morning’s inflation data, saying that driving down people's bills and everyday costs is her "number one focus".

"At the Budget I announced £150 off energy bills, a freeze to rail fares for the first time in 30 years, a freeze to prescription charges for the second year running, and an increase to the national minimum and living wage.

"Money off bills and into the pockets of working people is my choice. There’s more to do, but this is the year that Britain turns a corner."

The policies announced by the government to drive down people's bills are forecast by the Office for Budget Responsibility (OBR) to lead to a reduction in CPI inflation of 0.4 percentage points in the 2026/27 financial year.

Savers face falling returns despite inflation outlook

Caitlyn Eastell, finance expert at Moneyfacts, said the latest inflation data signalled bad news for savers.

The Moneyfacts Average Savings rate sits at 3.33% as of 21 January, lower than December's rate of inflation.

Anyone with a savings account paying this level of interest is effectively losing money in real-terms and should switch to an account paying a higher rate.

Eastell said: "January is the ideal time for savers to set new financial goals and to check if their savings are working as hard as they can."

According to Moneyfacts, the best-paying easy access account is currently with Chase, which is paying 4.41% interest (including a bonus rate).

The best one-year fixed bond is with Marcus by Goldman Sachs, paying 4.55%. The best easy access ISA is with Plum, paying out 4.28% in interest.

What does higher inflation mean for mortgage rates?

The Bank of England can increase interest rates to curtail rising inflation, but this tends to lead to higher mortgage rates.

That said, the central bank is keen to kick start the economy, so while immediate further rises in interest rates are not likely, mortgage borrowers may have to wait longer for cuts.

David Hollingworth, associate director at broker L&C Mortgages, said: "The rise in the rate of inflation in December was not unexpected but is a larger bump than many anticipated. That could be enough for the Bank of England to pause any thought of another cut when they meet in February."

Hollingworth pointed out a lot of lenders had already priced further cuts to interest rates in 2026 into their fixed-rate mortgages, but today's inflation data could "mean that we’re in for a period where the brakes are applied and mortgage rates flatten out".

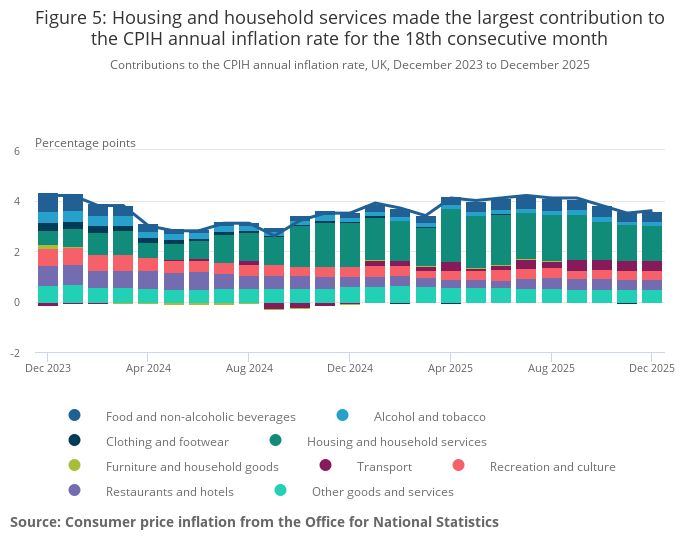

Housing and household services the largest contribution to CPIH annual inflation rate for 18th consecutive month

Households will feel the effects of inflation differently

Because the ONS calculates inflation based on a representative basket of goods and services, which is subject to change, households will experience it differently.

For example, if more of your spending is weighted towards food or travel, any rises in these categories will be felt by you more.

Charlotte Kennedy, chartered financial planner at Rathbones, said: "While headline inflation guides monetary policy, it rarely captures the full picture of how price pressures are felt across the economy."

What items were added to the ONS's basket of goods and services in 2025?

As previously mentioned, the ONS tracks price changes across a range of goods and services when reporting its inflation data. What is included in this basket of goods and services is subject to change each year.

In 2025, virtual reality (VR) headsets were added, as well as men's sliders, cushions and ready-to-eat noodles.

Other items already in the basket were taken out, including fresh diced or minced turkey.

When will January's inflation data be released?

The ONS releases inflation data each month for the preceding month. That's why the data released today covers the month of December.

The ONS will release inflation data for January on 18 February.

You can find out when the ONS is set to release inflation, GDP and wages data on its website.

Inflation rises for first time in five months

The last time the CPI measure of inflation rose was in July 2025, when it ticked up to 3.8% from 3.6% the month before.

It stayed at 3.8% in August and September, fell to 3.6% in October and then slowed to 3.2% in November.

Where is inflation headed next?

It's impossible to say for sure where inflation will head next, but the Bank of England has made predictions.

It projects that CPI will fall to 3% in January and to 2.5% by the fourth quarter of 2026.

Further down the line, it expects CPI will slow to 2% by the end of 2027 and then rise to 2.1% by the close of 2028.

Recap: UK inflation rose to 3.4% in December

Here’s a recap of this morning’s UK inflation headlines:

- UK inflation, as measured by the Consumer Prices Index (CPI), rose to 3.4% in the 12 months to December, up from 3.2% in the year to November.

- Alcohol and tobacco, transport and food and non-alcoholic drinks were the main drivers of the uptick in inflation, particularly a 28.6% increase in air fares.

- The jump is widely expected to be short-lived. Bank of England forecasts expect UK inflation to fall to 3.0% in January.

Could petrol price deceleration lower UK inflation?

One counterweight to the general acceleration in UK price increases in December was a slowdown in the pace at which petrol prices rose.

Petrol prices rose by 1.3 pence per litre between November and December 2025 compared to 1.5 pence per litre in the same period a year before.

“Petrol pump price rises slightly levelled off,” said Scott Gardner, investment strategist at J.P. Morgan Personal Investing. “We could see further weakening in the months ahead with recent falls in global oil markets expected to feed through to prices at petrol station forecourts.”

One to watch for motorists and consumers in general over the coming months.

The pace of petrol price inflation slowed in December, and falling global oil prices could see future reductions at the pump.

We're going to end our inflation coverage here for today. Thank you for following, and visit our homepage for all the latest personal finance and investing news.