UK inflation: Summary

- The Office for National Statistics (ONS) releases the latest UK inflation data today (17 December).

- The Consumer Prices Index (CPI) rose 3.2% in the 12 months to November, below the Bank of England's expected 3.4%. Some analysts had forecast a reading as high as 3.6%.

- CPI fell by 0.2% between October and November.

- A slowdown in food, alcohol and tobacco prices was the biggest disinflationary driver.

- Last month, data showed that CPI rose 3.6% in the 12 months to October, down from 3.8% in the previous three months.

- The UK’s current inflationary cycle is expected to have already peaked for 2025.

- The Office for Budget Responsibility (OBR) expects inflation to fall to 2.5% in 2026, and to the Bank of England’s target 2% rate the following year..

| What is inflation? | CPI versus RPI inflation | Upcoming CPI release dates |

Good afternoon, and welcome to our live coverage ahead of tomorrow’s UK inflation data release.

The final week before Christmas is a big one for UK macroeconomic news. Today saw the release of labour market figures showing that UK unemployment rose to 5.1% in the three months to October, while tomorrow we have the ONS’s inflation data release.

Both those releases will be front and centre when the Bank of England’s Monetary Policy Committee (MPC) meets on Thursday. A weakening economy will strengthen calls for an interest rate cut, but tomorrow’s inflation data could pose a head-scratcher for the committee if the CPI figure remains elevated.

Follow our preview and reaction coverage of the latest UK inflation data release in this live report. MoneyWeek will also be reporting on the MPC meeting later in the week.

When is UK inflation data announced?

The ONS will release the latest UK inflation data tomorrow (17 December) at 7am.

We’ll bring you live coverage of the release as it happens as well as reaction and analysis afterwards.

What is CPI?

The Consumer Prices Index (CPI) is the headline measure of inflation that is used by the ONS and policymakers to measure the pace of price increases.

CPI is calculated based on annual changes in prices of a basket of goods that reflect broad consumption patterns in the economy. The MPC targets an annual rate of CPI inflation of 2%, which is viewed by most economists as a healthy level of inflation.

CPI reflects a basket of goods that are representative of general consumer patterns.

While too much inflation is bad, as it can make goods unaffordable for much of the population, too little is also viewed as economically unhealthy. If inflation turns negative (so prices are falling across the economy), it is called deflation, and it can be very damaging economically.

Most countries use CPI as the headline measure of inflation, but there are other means of measuring it.

For example, the Retail Prices Index (RPI) includes measures that are related to home ownership.

We explain the difference between CPI versus RPI inflation in a separate piece.

What are the expectations for UK inflation?

According to last month’s Monetary Policy Committee report, the Bank of England expects inflation to have fallen by 0.2 percentage points to 3.4% in the 12 months to November.

Not all economists agree. Andrew Goodwin, chief UK economist at economic advisory firm Oxford Economics, predicts an inflation read of 3.6%. Robert Wood, chief UK economist at research firm Pantheon Macroeconomics, expects the read to come in at 3.5%.

“We expect year-over-year airfares inflation to surge to 12.3% in November from 0.9% in October, as a large fall in ticket prices last November drops out of the annual comparison,” said Wood.

Bank of England projections see CPI inflation averaging 3.5% in the fourth quarter of 2025, before falling to 3.1% in the first quarter of 2026.

Charting UK inflation

UK inflation was trending downwards following a peak in October 2022.

That trend has reversed this year, largely thanks to the impact of last year’s Autumn Budget which contained several inflationary measures like an increase to the minimum wage.

September was expected to mark the high point of the latest bout of inflation, at 4%. As it happened, the month marked the end of a three month plateau at 3.8%, before inflation fell to 3.6% in October.

Will we see another dip when the ONS figures are released tomorrow, or is UK inflation set to plateau again?

Inflation data unlikely to comfort households at Christmas

Expectations for tomorrow’s inflation read range between 3.4-3.6%. But households are likely still feeling the squeeze, according to Tamsin Powell, consumer finance expert at Creditspring.

“While prices may not be rising as quickly as they have done previously, they are still rising faster than wages for many,” she said. “The prolonged period at this level continues to squeeze already stretched budgets.”

Powell added that the timing of the final read of the year is “particularly difficult as families head into the festive period, when spending on food, travel and socialising typically rises”.

However, the longer term picture is more upbeat.

“Inflation is widely expected to move onto a clearer downward path in 2026, supported by easing energy costs and continued government measures such as the fuel duty freeze,” said Powell.

Thanks for following live coverage ahead of tomorrow's UK inflation data. That concludes coverage for today, but join us first thing tomorrow morning for live coverage of the release as it happens.

Good morning, and welcome back to live coverage of today's UK inflation data release. We're just a few minutes away from the ONS announcing November's inflation figures. Stay with us for live coverage and rolling reaction and analysis.

BREAKING: UK INFLATION FELL TO 3.2% IN NOVEMBER

Food and alcohol bring UK inflation below expectations

A slowdown in alcohol and food inflation seems to have been the main driver behind this unexpectedly low inflation reading.

More analysis and reaction to follow.

UK Inflation at its lowest level since March

That reading of 3.2% is the lowest CPI reading since March (2.6%), which preceded a jump to 3.5% in April as some of the more inflationary measures from chancellor Rachel Reeves’s first Autumn Budget took effect.

Lower food, alcohol and tobacco inflation seem to have driven the drop.

“Lower food prices, which traditionally rise at this time of the year, were the main driver of the fall with decreases seen, particularly for cakes, biscuits, and breakfast cereals,” said Grant Fitzner, chief economist at the ONS.

“Tobacco prices also helped pull the rate down, with prices easing slightly this month after a large rise a year ago. The fall in the price of women’s clothing was another downward driver.”

While the cost of raw materials for businesses rose, there was a slowdown in the increase of the cost of goods leaving factories.

Services remain the main driver of inflation

Looking more closely at today’s UK inflation figures, services inflation, which has remained sticky throughout the current inflationary cycle, is still the biggest driver of inflation.

In the 12 months to November, services CPI rose 4.4%. Goods CPI ran at 2.1% in that period – only fractionally above the Bank of England’s target rate for all CPI.

On a monthly basis, CPI fell by 0.2% in November.

The cost of goods in the UK rose almost in line with the Bank of England's target in the 12 months to November.

Reeves responds to inflation report

Chancellor Rachel Reeves has responded to this morning’s inflation report, saying that families across the country that are concerned about their bills will welcome the fall.

“Getting bills down is my top priority. That is why I froze rail fares and prescription fees and cut £150 off average energy bills at the Budget this year,” said Reeves. “The Bank of England agree this will help cut prices and expect inflation to fall faster next year as a result.”

Chancellor Rachel Reeves's cuts to energy and fuel bills are expected to reduce inflation by 0.4-0.5% from the second quarter of 2026.

Lower-than-expected inflation increases the chance of an interest rate cut

The Bank of England’s Monetary Policy Committee (MPC) meets tomorrow, and today’s unexpectedly low inflation read combined with recent weak economic data ramps up the likelihood that the Bank will deliver an interest rate cut at its final meeting of the year.

“Today’s news is a bright spot for the Bank of England, government and consumers alike,” said Isaac Stell, investment manager at Wealth Club – though he cautioned that there is still a way to go before headline inflation rates return to the Bank’s 2% target.

“Looking ahead, barring any surprise change of heart, markets expect the Bank of England to press ahead with one final cut for the year to the base rate,” said Scott Gardner, investment strategist at J.P. Morgan Personal Investing.

Beyond CPI: more November inflation metrics

As we have mentioned earlier, CPI – while the headline rate that is most closely-watched by policymakers – is not the only measure of inflation.

Nor is it the most comprehensive: that mantle goes to the Consumer Prices Index including owner occupiers' housing costs (CPIH). UK CPIH rose 3.5% in the 12 months to November, down from 3.8% in the 12 months to October.

Core CPI and core CPIH are versions of each of these indices that remove more volatile categories such as food, alcohol, energy and tobacco.

Core CPI rose 3.2% in the 12 months to November, down from 3.4% the previous month, while core CPIH rose by 3.5% – down from 3.7% in October.

| Header Cell - Column 0 | CPI 12-month % change | CPIH 12 month % change | Core CPI 12-month % change | Core CPIH 12-month % change |

|---|---|---|---|---|

October 2025 | 3.6 | 3.8 | 3.4 | 3.7 |

November 2025 | 3.2 | 3.5 | 3.2 | 3.5 |

Source: Office for National Statistics

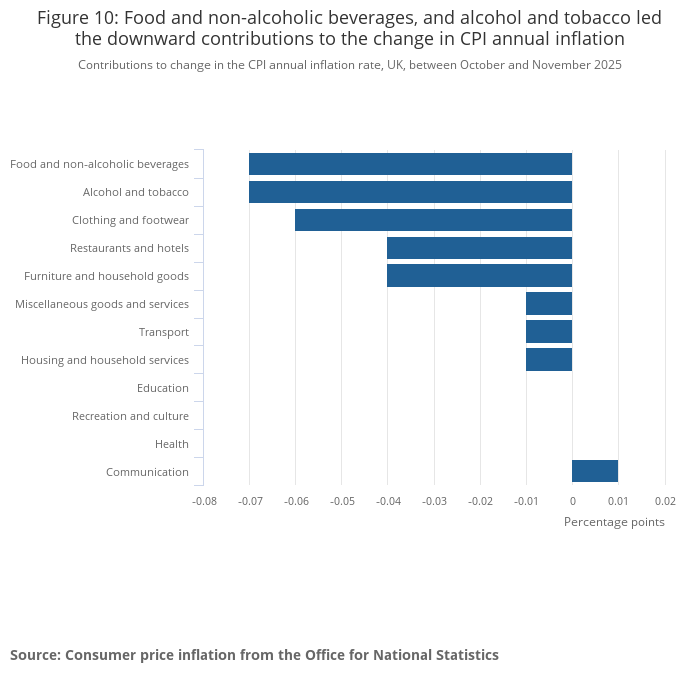

Food and drink dragged UK inflation downwards

Here’s a closer look at how the different categories impacted CPI in the 12 months to November:

Food and non-alcoholic beverages as well as alcohol and tobacco were the two most disinflationary categories, both taking 0.07% off annual CPI inflation.

Clothing and footwear followed with an annual impact of -0.06%.

Communication added 0.01% to annual CPI inflation.

Recap: UK CPI inflation fell to 3.2% in November

Here’s a recap on the UK inflation headlines today:

- Headline UK inflation as measured CPI rose by 3.2% in the 12 months to November.

- The Bank of England had forecast a rise of 3.4%, while some economists expected an inflation rate of 3.6%.

- Food and non-alcoholic beverages as well as alcohol and tobacco were the two most disinflationary categories.

- CPI fell by 0.2% on a monthly basis.

- CPIH rose 3.5% in the 12 months to November, down from 3.8% in the 12 months to October. Core CPI rose 3.2%, down from 3.4%, while core CPIH rose 3.5%, down from 3.7%.

Services inflation still a concern

Looking at goods alone, CPI ran barely above the Bank of England’s target rate in the 12 months to November.

It is the services sector that is keeping UK inflation elevated.

“Service sector inflation will certainly be an area of concern, with the cost of eating and staying out elevated as businesses attempt to deal with last year’s Budget measures which increased labour costs,” said Danni Hewson, head of financial analysis at AJ Bell.

Inflation is still running at more double the target rate in the services sector, largely thanks to increased labour costs from last year's Budget.

Hewson cautions that falling inflation doesn’t mean the cost of living is getting cheaper – inflation measures the pace of price increases, and 3.2% is still well above the target level.

“But the bigger than expected fall in headline CPI is good news and will help boost people’s spending power and confidence,” she added. “With so much of the UK economy reliant on household spend, it could also signal better news for the UK’s flatlining growth.”

UK inflation is trending down

November’s headline inflation figure, with CPI rising 3.2% annually, is the lowest the measure has stood since March this year.

It continues a welcome trend of falling inflation, with the period from July to September when CPI rose 3.8% for three consecutive months marking the peak of the current inflationary cycle.

Based on data from the MPC’s last meeting in November, Bank of England staff expect UK inflation to average 3.5% in Q4 before falling to 3.1% in Q1 2026 and 2.9% in Q2.

Moneyfacts: savings are being hit by inflation

We’ve had a slightly unusual combination of falling interest rates alongside elevated inflation this year.

That’s bad news for savers, who see their returns squeezed in nominal terms by falling rates, and in real terms by inflation eroding their buying power.

“This year inflation has averaged 4.01% and the Moneyfacts Average Savings Rate at 3.50%, meaning cash savings have failed to keep pace,” said Caitlyn Eastell, spokesperson at Moneyfacts.

“For someone with £10,000, this equates to being around £50 worse off in real terms.”

Eastell recommends that savers shop around for the best deals to ensure that their money is working as hard as possible for them.

Alternatively, savers could consider starting to invest some of their money in a stocks and shares ISA. Historically, stock market trackers have tended to outperform cash savings and generate inflation-beating returns.

Research from Fidelity International found that £20,000 saved into a cash ISA on 6 April 2017 would have been worth £23,549 by October 2025. But to keep up with inflation over that period, it would have needed to grow to £27,000.

The same amount invested into a global tracker fund in a stocks and shares ISA would have grown to £50,700, according to the analysis.

Are we nearing an end to the inflationary cycle?

Aside from September 2024, when annual CPI inflation briefly dipped to 1.7%, inflation has been running above the Bank of England’s 2% target rate ever since July 2021.

But with inflation having fallen by more than expected in the year to November, is the end of the current inflationary cycle now in sight?

“After a prolonged period of elevated inflation, the latest figures suggest the economy is entering the final stretch towards more normal levels,” said Charlotte Kennedy, chartered financial planner at Rathbones. “Measures announced at the Budget – such as freezing rail fares until 2027, cutting fuel duty, and reducing energy bill costs – are expected to shave around 0.5 percentage points off headline inflation by the middle of next year.”

However, Kennedy cautioned that we are not out of the woods yet.

“It remains important to recognise that each of us experiences a personal inflation rate based on our individual spending habits. Making the necessary adjustments is key to maintaining financial resilience - especially during the festive period, which is often characterised by excessive spending.”

What the latest UK inflation data means for interest rates

A 25 basis point cut to interest rates had been widely expected for the Monetary Policy Committee’s (MPC) meeting tomorrow, even before the surprisingly large drop in CPI inflation.

The inflation surprise “de facto locks in” the cut, according to Kallum Pickering, chief economist at investment bank Peel Hunt.

Pickering also observed that the likelihood of a successive rate cut in the first quarter of next year has increased off the back of today’s data.

“The danger now is that the BoE keeps its policy too tight for too long,” he said. “No growth since summer, a rapid cooling of the labour market, elevated household saving and a sluggish housing market are all obvious signs of tight money.

“These data are hard to square with the lingering hawkishness at the BoE,” he added.

Tell us your thoughts – where is UK inflation going?

Today’s UK inflation read marked a surprisingly large drop in UK inflation. Where do you think inflation will go between now and the end of next year?

UK inflation recap

As a reminder, the headline CPI inflation figure fell from 3.6% in the year to October to 3.2% in the year to November. That’s a much steeper drop than had been expected, though it still leaves UK inflation well above the Bank of England’s target 2% rate.

The big question now is whether this will prompt the MPC to cut interest rates when it meets tomorrow.

We're going to end our inflation coverage here in the meantime. Thank you for following, and visit our interest rates report for more analysis of how today's inflation data could impact UK interest rates.