Summary

- The Bank of England cut interest rates at the first Monetary Policy Committee (MPC) meeting of the year, bringing the base rate from 4.75% to 4.5%.

- All nine members of the MPC voted to cut the base rate. Seven members voted to cut by 25 basis points, while two members voted for a larger cut of 50 basis points.

- The move was widely expected. Economists polled by Reuters unanimously said they expected the base rate to fall by 25 basis points.

- It came after December’s inflation reading (published in January) was lower than expected.

- The annual inflation rate slowed from 2.6% to 2.5%, surprising analysts who had expected the headline figure to hold steady or inch up slightly to 2.7%.

Scroll for full analysis from the team at MoneyWeek, who reported live as it happened with coverage starting the day before.

| When will interest rates fall further | MPC meeting dates | What is inflation? |

It's almost interest rates day

Good Wednesday morning, and welcome to MoneyWeek’s live blog. The sun is shining in London today, but will interest rates thaw tomorrow?

The Bank of England will announce its next decision at midday on Thursday, 6 February.

All eyes have been on US president Donald Trump’s tariffs so far this week, which begs the question: will events across the pond influence the MPC’s thinking?

Markets and economists think the answer to that question is: no.

While events in the US could well appear in the MPC’s meeting minutes, experts are fairly confident that the Bank of England will vote to reduce the base rate by 25 basis points. This would bring it from 4.75% to 4.5%.

Stick with us for the latest forecasts, plus what it means for investment markets and your personal finances.

MPC voting split: an overwhelming majority?

When the MPC last met in December, three members of the committee voted for an interest rate cut: Swati Dhingra, Dave Ramsden and Alan Taylor.

Dhingra has become known for her dovish stance, voting to reduce rates at the past eight meetings.

Similarly, Taylor (who joined the MPC in September) has warned that a weakening economy calls for a “more accelerated pace of rate cuts”.

It seems reasonable to assume that these three will stick to their previous voting pattern this time around. Some additional committee members will probably come on board too, given December’s surprise inflation drop and the slowdown in UK growth.

“Fears of stagflation will override any immediate desire to drive down inflation, meaning we are likely to see a cut of 25bps this Thursday, lowering the base rate to 4.5%,” said Steve Matthews, investment director at financial services company Canada Life.

Matthews expects to see an 8-1 split on Thursday.

Can we expect quarterly rate cuts in 2025?

So far this year, there has been a divergence between the number of rate cuts economists are expecting versus the number of cuts markets are pricing in.

Markets turned bearish in the wake of the Autumn Budget, when chancellor Rachel Reeves announced a hike to employers’ National Insurance contributions. The fear is that this policy (which will come into effect in April) could keep inflation higher for longer by increasing costs for businesses.

Donald Trump’s return to the White House hasn’t helped. The tariffs he has threatened to impose – and has already started imposing in the case of China – could add to inflationary pressure.

Despite this, analysts at Goldman Sachs are forecasting quarterly cuts of 25 basis points from the Bank of England, bringing the base rate to 3.25% by the second quarter of 2026.

The economists at ING are forecasting something similar – and they recently argued that markets are “slowly but surely” starting to come around to their way of thinking. “Markets are now pricing 78bp of easing by year-end, up from just 29bp in mid-January,” they wrote on Friday.

Slowly does it: BoE likely to maintain a cautious tone

Although experts are fairly confident that rates will fall tomorrow, the Bank of England is likely to maintain a cautious tone during its press conference and in summary documents. For a while now, the party line has focused on a “gradual approach” to rate cuts, with the MPC assessing things on a meeting-by-meeting basis.

The following paragraph has appeared in several summary reports: “Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further. The Committee will decide the appropriate degree of monetary policy restrictiveness at each meeting.”

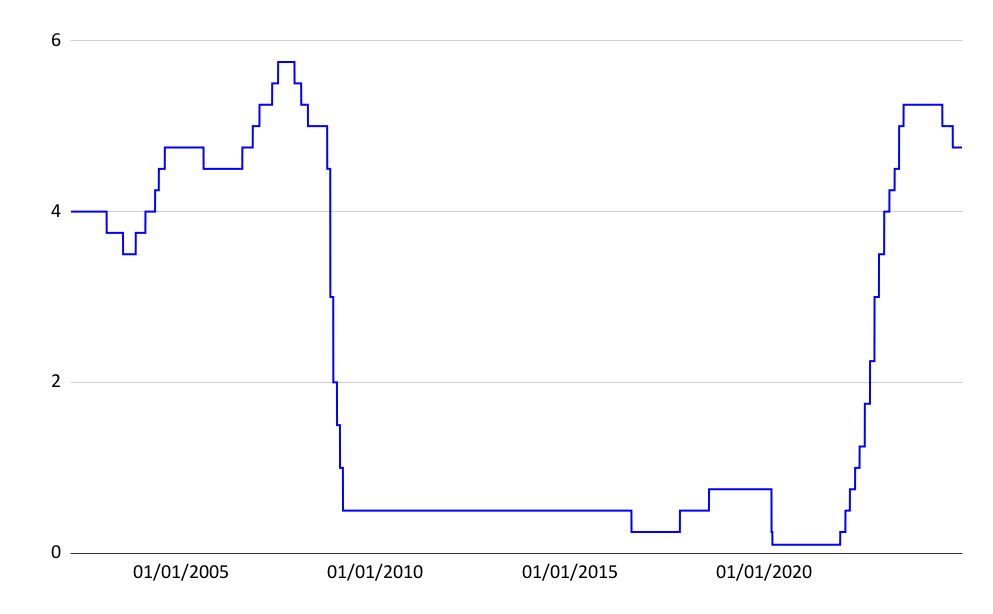

Quick recap: when did the base rate peak?

The base rate peaked at 5.25% – a 16-year high – in August 2023. It was held at this level for almost a year. The Bank of England finally began cutting rates in August 2024 after inflation showed significant signs of coming under control. This cycle has seen two cuts so far, one in August and another in November.

Interest rates are still high compared to their recent history. In the aftermath of the Global Financial Crisis, we lived through a period of ultra-low rates. Experts warn we are unlikely to return to this sort of environment – at least not any time soon.

What would a base rate cut mean for your personal finances?

Let’s turn our attention to what a base rate cut could mean for the pound in your pocket. How will mortgage rates, savings rates and annuities be impacted? Stick with us as we run through the implications for each in our next few posts.

What would a lower base rate mean for your mortgage?

If interest rates are cut tomorrow, prospective homeowners and those looking to refinance will be hoping for a drop in mortgage rates.

Those on variable-rate mortgages could see the effects almost immediately with their payments falling in line with the base rate cut, putting more money in their pockets.

Borrowers on fixed-rate mortgages will not experience immediate respite, though. They will have fixed their repayments for a set time period, and therefore will remain on their agreed-upon rate until it is time to renegotiate.

Despite this, Myron Jobson, senior personal finance analyst at Interactive Investor, says that while “fixed-rate mortgage holders won’t see an immediate impact, if expectations of lower rates persist, we could see better deals emerge for new borrowers and those looking to remortgage.”

Commenting on whether prospective homebuyers should choose a fixed or variable-rate mortgage, Jobson added: “With the BoE cutting the base rate and another reduction potentially on the horizon, homebuyers face a tricky decision between fixed and variable mortgages. A variable rate could mean savings if rates fall further, but it’s a gamble.

“A fixed-rate deal, meanwhile, offers certainty in an uncertain climate. The choice ultimately boils down to risk appetite – those comfortable with fluctuations may benefit from a variable rate, while risk-averse buyers might prefer to lock in a deal for peace of mind.”

Mortgage rates: avoid the standard variable rate

While a tracker rate might appeal to some borrowers, avoid falling onto your lender’s standard variable rate. You will automatically be put onto this once you come to the end of a fixed deal, if you don’t refinance in time.

These are the average mortgage rates today, according to financial information company Moneyfacts:

- Two-year fixed-rate mortgage: 5.51%

- Five-year fixed-rate mortgage: 5.31%

- Two-year tracker rate: 5.46%

- Standard variable rate: 7.78%

Savings rates usually tumble in tandem with the base rate

Generally speaking, lenders are far quicker to cut rates than to boost them – so while savings rates took some time to start rising a few years ago, they will be quick to fall now that the BoE is in a rate-cutting cycle.

Rates have already fallen considerably from their peak, and savers should expect them to fall further if the MPC cuts the base rate tomorrow. With this in mind, now could be a good time to lock in a fixed-rate deal if you don’t need immediate access to a portion of your savings.

These are the best rates currently on the market, according to Moneyfacts:

- Easy-access: Chase 5% saver (note that this includes a temporary six-month bonus, plus the underlying rate is linked to the BoE base rate, meaning it will quickly drop if the MPC cuts rates tomorrow)

- One-year fixed: Charter Savings Bank 4.75% saver (available via Hargreaves Lansdown)

- Two-year fixed: Hampshire Trust Bank 4.41% saver

Are annuities an attractive option for retirees?

Retirees thinking about purchasing an annuity might be wondering whether they should act sooner rather than later, with interest rates likely to fall further in the months to come. But they should take some time to consider whether this irreversible decision is definitely right for them. It could be sensible to speak to a financial advisor.

The good news is that annuity rates are likely to remain attractive for some time yet.

Helen Morrissey, head of retirement analysis at investment platform Hargreaves Lansdown, said: “Interest rates are one factor affecting annuity incomes, but with gilt yields remaining robust, any interest rate cut should only have a relatively limited effect.

“Annuities are offering great value right now with the latest data from HL’s annuity search engine showing that a 65-year-old with a £100,000 pension can get up to £7,492 per year from a single-life level annuity with a five-year guarantee. This is just a whisper below the highs experienced in the aftermath of the mini-Budget.

“With any further interest rate cuts expected to happen only gradually, we can expect incomes to remain robust and interest to stay high among retirees looking to secure a guaranteed income.”

Longer term, Trump’s tariffs could actually speed rate cuts up

Let's move away from personal finances briefly and return to economics.

Tariffs have been a major talking point this week, trumping interest rate speculation as the main story and dominating the financial headlines. But they are unlikely to influence the BoE’s decision tomorrow – and longer term it is still unclear whether they will exert upward or downward pressure on rates.

Paul Dales, chief UK economist at consultancy Capital Economics, told MoneyWeek: “Concerns about tariffs aren’t the main driving force behind what we think will be a decision by the Bank of England to cut interest rates from 4.75% to 4.5% on Thursday. And it’s not clear whether tariffs would make the Bank more inclined to cut rates faster and further later this year or slower and not as far.

“That’s because tariffs could weigh on UK economic growth as well as boost UK inflation. My hunch, though, is that the Bank would be more concerned by the dampening influence on activity. As a result, tariffs would support our existing forecast that the Bank will eventually cut interest rates to 3.5% by early next year.”

What do falling interest rates mean for investors?

In theory, a falling interest rate environment is good news for equity investors. When interest rates go down, it is less expensive for companies to borrow money to fund growth projects. In turn, these projects can help companies boost their earnings.

Furthermore, the main reason the BoE is able to cut rates is that inflation has fallen significantly from its peak. Generally speaking, slowing inflation is good news for businesses as it helps them keep their cost base under control.

In reality, it isn’t quite that straightforward though. Central banks also cut rates when growth becomes a concern – and the UK economy has started to stagnate in recent months. The latest UK GDP report showed zero growth in the three months to November (versus the three months before).

There are also concerns about upcoming tax changes this April, when employers’ National Insurance contributions will go up. More analysis on the NI changes to follow.

NI changes: a headwind for UK equity investors?

As we have established, a falling interest rate environment can be good news for equity investors. But if you are looking at the outlook for UK stocks, there are other factors to consider too. This includes the upcoming changes to employers’ National Insurance contributions.

Jason Hollands, managing director at investment platform Bestinvest, recently told MoneyWeek: “The decision to raise National Insurance costs, alongside hiking the minimum wage and incoming workers’ rights legislation, places a significant cost burden on businesses.

“This is a disincentive to hire (and a reason to cut staff), and an incentive to pass those costs on to consumers. All of this takes more money out of the real economy through rising unemployment and inflation, as well as creating a headwind for earnings.”

UK funds are still seeing significant outflows, despite an improving rates environment

Data from funds network Calastone, published this week, shows that UK-focused funds shed £1.07 billion in January, the sixth-worth month on record. It is perhaps surprising in a month where the FTSE 100 hit a new high, but UK equities have been unloved for some time now. Negative sentiment in the aftermath of the Budget hasn’t helped, although the initial catalyst came several years ago in the form of Brexit.

Despite this, UK equity markets could offer valuation opportunities for stock pickers looking to bag a bargain, as they are far cheaper than their US and global counterparts.

Recent research from Rathbones, which uses regression analysis to compare UK and US markets on a like-for-like basis, showed that the average UK stock's forward PE ratio is 32% lower than the average US stock's. In other words, you can access the same earnings for less by shopping in the UK.

“The UK market contains global businesses that – on a level playing field, after adjusting for sector and quality and growth characteristics – appear significantly undervalued relative to international peers,” writes Oliver Jones, head of asset allocation at the firm.

What’s next for inflation?

The Bank of England pays close attention to the inflation outlook when weighing up how far and how fast to cut interest rates. So where exactly are prices expected to go over the longer term?

In October, the Office for Budget Responsibility (OBR) published a report on the economic and fiscal outlook for the next five years in response to changes in economic policy made by Rachel Reeves’s first Budget.

The OBR expects inflation to average out at 2.6% in 2025. It should then fall to 2.3% in 2026, 2.1% in 2027, 2.1% in 2028 and 2% in 2029.

It is worth noting that there is still room for error in these figures as external shocks to the market cannot be fully anticipated – nor can changes in government policy. The OBR will produce a similar report in March alongside the chancellor’s spring statement.

Energy prices could add to inflationary pressure

Although energy prices have fallen from their peak, they remain higher than pre-crisis levels. Furthermore, they are on the rise again. The energy price cap rose by 1.2% at the start of this year, and the latest forecasts from consultancy Cornwall Insight suggest it could rise by a further 2.7% in April.

The price of gas and electricity has a strong impact on inflation – and not just because of household bills. As energy is used in all parts of the supply chain, higher energy costs can push up the price of goods and services too.

It is unlikely to be enough to prevent the BoE from cutting rates tomorrow, though, particularly in light of the barely-growing economy.

Commenting on the likely outcome of the February meeting, Hetal Mehta, head of economic research at St James’s Place, said: “At the December meeting, the BoE made a dovish pivot that signalled a willingness to support growth despite the inflation risks. It would come as a major surprise to economists and markets alike if the BoE did not vote to cut rates.”

That concludes our interest rates coverage for today. We will be back tomorrow, ahead of the Bank of England's decision at midday. Thank you for joining us.

Good Thursday morning, and welcome back to our interest rates blog. This is Katie Williams and Daniel Hilton reporting live. There's less than two and a half hours to go until the Bank of England announces its next interest rates decision – and a cut is looking very likely. We will be sharing analysis in the lead-up and aftermath. Stick with us.

FTSE 100 hits another record high

The sun is shining and it is a positive start for markets today, with confidence about a rate cut buoying investor optimism. Tariff-related volatility has also quietened down – at least for now. It has been enough to push the FTSE 100 to another record high this morning.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, says a dying-down of the volatility has allowed investors to “zero in on a wave of big earnings reports,” as well as hopes of a rate cut.

“This positive vibe is spreading across Europe, giving global markets a much-needed boost,” he adds. “Seems like investors may be ready to dance to the tune of good news again.”

An economist’s bogeyman: what is stagflation?

While there is optimism in markets this morning, one of the things commentators have been talking about in recent months is the risk of stagflation. This is something the Bank of England will want to avoid at all costs. But what exactly is stagflation?

The term refers to a state of affairs in which the economy suffers from stagnant growth, high inflation, and high unemployment. The 1970s are often referred to as years where the UK, along with many other advanced economies, suffered from prolonged stagflation.

But why are commentators starting to talk about it again now?

Growth was decent in the first half of 2024, when the economy rebounded from the brief recession experienced at the end of 2023, but it flatlined in the second half of the year. There was zero growth at all in the third quarter. Fourth quarter figures have not yet been published, but the latest report (covering November) also showed zero growth on a three-month basis. Inflation is also expected to pick up later this year.

Labour's “number one mission” to boost growth

Since winning the election, Labour has been at pains to paint itself as the “party of growth”. Stimulating the economy and putting more money into the pockets of both individuals and businesses is one way to avoid stagnation, but will the government be successful?

In her growth speech last week, Rachel Reeves announced a number of infrastructure projects and reforms, including building a third runway at Heathrow and improving links between Oxford and Cambridge.

However, critics have countered that these projects will do little to undo the damage of a tax-raising Budget – in particular the decision to raise employers' National Insurance contributions.

Fixed mortgage rates have risen, despite base rate cuts

Five-year fixed mortgage rates are now at a six-month high, as borrowers fork out an average of 5.32%, up from 5.09% last November, according to new data from financial information company Moneyfacts.

Over the same time period, average two-year mortgages fell slightly from 5.56% to 5.52%. Conversely, the average ten-year mortgage rate rose from 5.58% to 5.65%.

Standard variable rates remain expensive, but have fallen over the past year from a high of 8.17% to 7.87% today.

The rises might come as a surprise given there have been two cuts to the base rate since the summer, with a third expected today, however recent volatility in swap rates is to blame.

Commenting on the findings, Rachel Springall, finance expert at Moneyfacts, said: “Borrowers will be disappointed to see a rise to fixed mortgage rates over the past month, with the average five-year fixed rate hitting a six-month high.”

“The Bank of England base rate dropped by 0.25% in November 2024 to 4.75%, so it would not be surprising to see borrowers frustrated that fixed mortgage rates are going up”, she continued.

Pound weakens against the dollar in anticipation of rate cut

The pound has weakened against the dollar in anticipation of a rate cut at midday today. Generally speaking, the domestic currency strengthens when interest rates go up and weakens when they go down.

Commenting on what the latest moves mean for UK companies, Russ Mould, investment director at AJ Bell, said: “A weaker pound against the US dollar benefits companies which earn some or all of their money in the American currency, hence why we saw miners, gambling group Entain, construction rental firm Ashtead and ratcatcher Rentokil get a boost.”

What's happening in the savings market?

Savings rates fell in the last year as the average easy-access account tumbled from 3.17% to 2.92%. Notice accounts also fell from 4.3% to 4%, according to data from Moneyfacts.

The same can be seen in the average interest rate for ISAs. Easy-access ISAs fell from 3.3% to 3.06% and notice ISAs fell from 4.16% to 3.92%.

With another reduction in the base rate anticipated from the Bank of England today, savings rates will likely tumble further.

Capital Economics: Inflation could rise to 3% this year

New insight from consultancy Capital Economics suggests CPI inflation could increase to around 3% later this year, before falling back below 2% in 2026.

Their economists anticipate that falling inflation in the medium-term will prompt the Bank of England to cut interest rates to 3.5% by early 2026, rather than to 3.75-4.00% as investors anticipate.

BREAKING: BoE cuts interest rates

The Bank of England has voted to reduce the base rate by 25 basis points, bringing it from 4.75% to 4.5%.

MPC voted decisively in favour of the cut

All nine members of the committee voted to reduce rates. Two members (Swati Dhingra and Catherine Mann) wanted to go further, voting to cut rates by 50 basis points. This resulted in the 7-2 split.

This is the third time rates have been cut since the start of the Covid-19 pandemic.

MPC: "Substantial progress on disinflation"

In its summary statement, the MPC said: "There has been substantial progress on disinflation over the past two years, as previous external shocks have receded, and as the restrictive stance of monetary policy has curbed second-round effects and stabilised longer-term inflation expectations.

"That progress has allowed the MPC to withdraw gradually some degree of policy restraint, while maintaining Bank Rate in restrictive territory so as to continue to squeeze out persistent inflationary pressures."

Reeves welcomes rate cut but "dissatisfied" with growth

Responding to the latest news, chancellor Rachel Reeves said: “This interest rate cut is welcome news, helping ease the cost-of-living pressures felt by families across the country and making it easier for businesses to borrow to grow.

“However, I am still not satisfied with the growth rate. Our promise in our Plan for Change is to go further and faster to kickstart economic growth to put more money in working people’s pockets. That’s why we are taking on the blockers to get Britain building again, ripping up unnecessary regulatory barriers and investing in our country to rebuild roads, rail and vital infrastructure.”

MPC will be monitoring tariffs "closely"

In the MPC's meeting minutes, they touched on the latest developments with US president Donald Trump's tariffs and tariff threats. They said the ultimate economic impact would "depend on the final composition of policies", but that they would be monitoring the situation closely. "Nevertheless, there [has] already been an increase in economic uncertainty globally and a pickup in financial market volatility," they added.

Markets pricing in two or three more rate cuts this year

In its meeting minutes, the MPC noted that inflation is expected to pick up again later this year, potentially rising as high as 3.7% in the third quarter. Higher global energy prices will be largely to blame. These are likely to push the headline figure up, even while domestic pressures wane.

Despite this, markets are still pricing in two or three further cuts over the course of the year. Several experts have said they expect one cut per quarter.

"For now, even at 4.5%, the bank rate is well above what might be considered the neutral level, and we expect the committee to stay its course of gradually removing monetary policy restraint," said Brad Holland, director of investment strategy at the digital wealth manager Nutmeg.

Which MPC members voted for a larger rate cut?

Two members of the MPC wanted to go further today, voting to reduce rates to 4.25% rather than 4.5% – Swati Dhingra and Catherine Mann.

Dhingra was appointed to the MPC in May 2022 and has attended 20 meetings. She has voted two times to increase, nine times to maintain, and nine times to reduce the rate. She is Associate Professor of Economics at the London School of Economics.

Mann has been on the MPC since September 2021 and has attended 28 meetings. This is the first time she has voted to reduce the rate. She voted 18 times to increase and nine times to maintain. Mann is a Professor of the Practice at Brandeis University.

Reeves's plan for growth

The MPC is currently answering questions in its interest rates press conference. Sky News asked the committee to comment on Reeves's plan for growth.

Committee members including Andrew Bailey and Claire Lombardelli were positive on the structural reforms announced by Reeves overall, calling them the "right thing to do" for the long term. However, they added that these projects would not show up in the MPC's shorter-term forecast period given the projects will take some time to come to life.

Bailey: Economy is not in a state of stagflation

The central bank’s governor, Andrew Bailey, has said that he will not use the term ‘stagflation’ to refer to Britain’s economy. He explained that indicators show a trend of disinflation, although he conceded that economic growth has been flat.

GDP growth will remain weak until 2027, says BoE governor

Growth in GDP has been weaker than the BoE expected since its report in November as business and consumer confidence have declined.

At the MPC press conference, BoE governor Andrew Bailey said that the central bank does not expect there to be strong GDP growth for the next two years, instead anticipating growth will remain at similar levels to now.

GDP is assumed to have fallen by 0.1% in Q4 2024, and is expected to grow by 0.1% in the first quarter of this year.

Bailey: Path of disinflation remains in place

Commenting on the outlook from here, BoE governor Andrew Bailey said: "We think the path of disinflation remains in place. There will be a bump in the road, but we don't think that bump is going to have a long-lasting effect."

The "bump" Bailey is referring to here is probably the spike in the headline CPI rate that is expected later this year, largely driven by higher energy prices. The BoE said the headline figure could hit 3.7% in the third quarter, before falling back to around the 2% target "thereafter".

Downgrade to growth forecast is "not a judgement on the Budget"

The BoE has slashed its growth forecast for 2025 in half from 1.5% to 0.75%. When asked if this was in response to recent political developments, Bailey said it was "not a judgement on the Budget".

He added that the MPC is currently faced with an economic puzzle. Output has remained the same and growth is flat, despite a larger population and labour force. The only conclusion from this is that productivity is lower.

Bailey said he would be surprised if this persisted, though.

Having covered the latest interest rates news, let's turn our attention back to your personal finances. What does today's decision mean for you?

Consumers should remain cautious

While a cut to interest rates sounds like good news, households should remember that one of the reasons the BoE has cut rates today is that the economy is in a fragile position. The MPC has halved the UK's growth forecast for 2025.

Separately, businesses have warned that they may need to raise prices this year in response to National Insurance changes announced in the Autumn Budget. They have also warned that the tax changes could result in redundancies.

Against this backdrop, caution is the order of the day when it comes to spending and saving.

"Consumers should not consider a third interest rate cut as a green light to splash out on big-ticket purchases that may have been put on the backburner for some time," says Alice Haine, personal finance analyst at Bestinvest.

"Uncertainty about the wider economic outlook and the future of interest rates still reigns, so running down emergency funds or borrowing to fund a major lifestyle cost should always be assessed very carefully to ensure repayments are fully affordable over the long term," she adds.

Rate cut was already baked into the savings market

Savings rates will fall further in response to the latest cuts, but Sarah Coles, head of personal finance at Hargreaves Lansdown, says the impact on the fixed-rate market might not be as dramatic as you would expect.

She explains: "This rate cut was all but nailed on. The savings market hadn’t just counted its chickens, it had roasted and sold them, pricing the rate cut firmly into fixed-rate deals [in advance]. It means the fixed-term market is unlikely to move far for now."

Rate cut could offer a welcome boost to the housing market

The decision to cut interest rates by 25 basis points is a “welcome shot in the arm for the UK housing market and the country’s stagnating economy”, according to specialist property lender Together.

The lender says that mortgage costs should fall as a result of the latest cut, allowing more first-time buyers to enter the market. However, as we pointed out earlier, the effect isn't always immediate and volatility in swap rates has actually pushed some mortgage rates up in recent months.

Affordability challenges also remain a hurdle for many prospective homeowners. Although wage growth outpaced house price inflation last year, recent data from Nationwide shows that the average first-time buyer is still paying five times their annual salary. This is significantly higher than the long-term average of 3.9 time earnings.

Those coming to the end of a fixed-rate mortgage deal could also face challenges, particularly if they are coming off a five-year deal that was agreed in 2020 when interest rates were still low.

What a rate cut means for pensioners

If you are on the brink of retirement, one of the main ways interest rates can affect you is by influencing how much you can get from an annuity. As we explored in a previous blog post, annuity rates currently look attractive and the latest rate cut is unlikely to result in much of a dent.

This means you can take your time when weighing up whether an annuity is the right strategy for you. This is generally a good idea, as buying an annuity is an irreversible decision. Data from Hargreaves Lansdown today shows that a 65-year-old with a £100,000 pension can get up to £7,492 per year from a single-life level annuity with a five-year guarantee.

There could be some clouds on the horizon in other areas, though. The summary statement that the BoE published today shows that inflation is expected to pick up to 3.7% in the third quarter of 2025. Nobody likes rising costs, but they can be particularly harmful to retirees on a fixed income. The state pension rises each year in line with the triple lock, but most other sources of pension income do not enjoy the same protections.

Furthermore, the uptick in inflation later this year will largely be driven by higher energy costs. Pensioners tend to be more energy-dependent than younger households, meaning they could feel the pinch more keenly.

Currency tailwinds could send the FTSE 100 higher

Some experts have argued that the Bank of England is now displaying a more dovish tone than the US Federal Reserve. If the two central banks diverge and the BoE cuts rates further and faster, it could cause the pound to weaken against the dollar. In turn, this could send the FTSE 100 higher.

The reason is that many FTSE 100 companies are global in nature and generate their revenue in dollars, before converting this to sterling. Their earnings are therefore flattered by a weaker pound, relative to the dollar.

Explaining the difference between the US and the UK outlook, Garry White, chief investment commentator at Charles Stanley, says: "Fewer interest rate cuts are expected across the Atlantic in 2025, as many of Donald Trump’s policies appear to be inflationary.

"These include tariffs, which are likely to be paid for by consumers, the deportation of undocumented migrants, which will increase the scarcity of low-skilled workers, and the extension of tax cuts for businesses and individuals."

Other things to look out for this month

The MPC will next meet in March. The big things to watch between now and then will be the upcoming inflation, GDP and labour market reports. These will be released on the following dates:

- Next GDP report (covering December and the fourth quarter of 2024): 13 February

- Next labour market report: 18 February

- Next inflation report (covering January): 19 February

That concludes our live coverage on interest rates. Thank you for joining us today! There are still seven meetings to go this year, which we will be covering in detail over the months to come. Check out our calendar of upcoming MPC meeting dates.