Summary

- UK inflation slowed to 2.6% in March, down from 2.8% in February.

- The reading came in lower than analysts had forecast. Estimates pointed to a reading of 2.7%.

- A drop in the inflation rate does not indicate that prices fell in March, but that they rose at a slower rate.

- The slowdown could be short-lived though. Inflation is expected to jump to 3.6% in April, according to Bank of England forecasts.

- This could create a short window of opportunity for the Monetary Policy Committee (MPC) to cut interest rates when it next meets on 8 May.

- Earlier this month, markets started forecasting a faster pace of interest rate cuts as Donald Trump’s trade war heated up.

MoneyWeek is reporting live on today's inflation report. Scroll for the latest updates.

| What is inflation? | CPI versus RPI inflation | UK inflation forecast | CPI release dates |

Hello and welcome. Tomorrow is inflation day.

A lot has happened since we last reported on consumer prices. The Spring Statement, April price hikes, a new tax year, and the small matter of a US trade war and stock market crash.

Hang onto your hats, as more volatility almost certainly lies ahead. Trump doesn’t appear to be done with tariffs, and here in the UK, we are yet to see the full effects of recent tax changes on economic growth.

In the world of inflation, prices are expected to hit 3.75% later this year, but the good news is that a drop in the headline rate is expected tomorrow. This could strengthen the case for an interest rate cut when the Bank of England next meets in May.

Stick with us today for the latest forecasts and analysis, before rejoining us tomorrow for live reporting when the inflation data is published at 7am.

Inflation expected to slow to 2.7%

The Bank of England expects inflation to slow to 2.7% tomorrow, according to forecasts published in its latest quarterly monetary policy report.

The economists at Pantheon Macroeconomics agree. They said a drop in motor fuel prices should contribute to the slowdown, as well as “distortions from last year’s early Easter”, which are expected to reduce services inflation by 10 basis points.

Pantheon expects services inflation to come in at 4.9% in March, down from 5% in February. It expects core inflation to hold steady at 3.5%.

The calm before the storm?

Tomorrow’s slowdown is likely to be short-lived, if it materialises. After slowing to around 2.7% in March, the Bank of England expects inflation to pick up to 3.6% in April. It said price rises could ultimately hit 3.75% in the third quarter, driven by higher energy prices.

“Although global energy prices have fallen back recently, they remain higher than last year and CPI inflation is still projected to rise to around 3¾% in 2025 Q3,” the Bank wrote in a summary statement after the March MPC meeting.

How will Trump’s tariffs impact inflation?

The Bank of England’s inflation forecasts (summarised in our previous post) were published before Donald Trump’s latest round of tariffs. It is too early to know exactly what impact tariffs will have on UK inflation and interest rates, but they could change things.

While tariffs make goods and services more expensive (by adding a tax which is ultimately passed on to consumers), they also tend to slow economic growth. A slowdown in growth can be disinflationary.

When managing the impact of tariffs, the Bank of England will need to weigh growth considerations against inflation considerations. Cutting interest rates would help support economic growth, but could allow prices to rise further.

A lot will depend on the scale of the tariffs that are ultimately imposed and how countries around the world retaliate. For now, Trump has paused most of the harshest measures.

More to follow.

Capital Economics: “The US trade war may prove disinflationary for the UK”

Consultancy Capital Economics points out that a trade war could result in weaker global demand. This “raises the chances that inflation will be lower in the medium term,” said Ruth Gregory, deputy chief UK economist at the consultancy.

Currency dynamics could also play a role. Until recently, Capital Economics thought US tariffs would cause the pound to weaken against the dollar but, so far, it has remained stable. A stable pound should “limit the upward effects” of higher import prices on UK inflation.

On top of this, the dumping of goods originally intended for other economies could push UK prices down.

“With China currently facing much higher tariffs than we had anticipated, products originally intended for the US market may end up in the UK at lower prices than similar products already available,” Gregory said.

If the UK government decides to retaliate against the US with harsh tariffs of its own, that could prove inflationary – but it seems unlikely. Prime minister Keir Starmer has been clear that “a trade war is in nobody’s interest”.

UK labour market is weakening

Let’s turn our attention to the latest labour market data, published by the Office for National Statistics (ONS) today. The report showed some signs that the labour market is continuing to weaken.

On the one hand, regular wage growth and the unemployment rate both held steady in this month’s report, at 5.9% and 4.4% respectively.

On the other hand, job vacancies fell to 781,000, down from 816,000 previously, suggesting businesses are putting a pause on hiring. The number of payrolled employees also decreased by 78,000 in March, based on early estimates.

Going forward, the unemployment rate is likely to rise. Deutsche Bank expects it to pick up to 4.5% in next month’s report.

“Importantly, updated DWP advanced redundancy notifications data has spiked in recent weeks suggesting more job losses in the coming weeks and months,” said Sanjay Raja, chief UK economist at the investment bank.

Evidence of a weaker labour market could open the door to a rate cut from the Bank of England in May.

Rising cost of employment is a “major challenge” for businesses – will it translate into higher prices?

Businesses are being hit with higher costs from every angle. The recent increases to National Insurance and the minimum wage have added to their wage bills considerably, with the British Chambers of Commerce (BCC) calling it a “major challenge”.

Jane Gratton, the BCC’s deputy director of public policy, said it will be “some time” before we fully understand the true impact of these increases on jobs and investment. But some businesses have warned that it could translate into price rises and layoffs.

A survey of 52 leading retailers, conducted by the British Retail Consortium (BRC) earlier this year, suggested as many as two-thirds of businesses could look to raise prices to help offset the cost of the NI increase.

Around half of businesses said they would look to reduce hours and overtime or staff headcount.

How many times will the Bank of England cut interest rates this year?

Most economists expect at least two more rate cuts from the Bank of England before the end of 2025.

- Capital Economics thinks rates will be trimmed by 25 basis points in May, followed by a further 25 basis-point cut in November. This would take the base rate to 4% by the end of the year.

- Financial institution ING is forecasting quarterly cuts. This would mean three more cuts in 2025 (we already had one in February), bringing the base rate to 3.75%.

- Deutsche Bank on the other hand is expecting four, taking the base rate to 3.5%.

The Bank of England has been clear that it will assess things on a meeting-by-meeting basis, taking a “gradual and careful approach”.

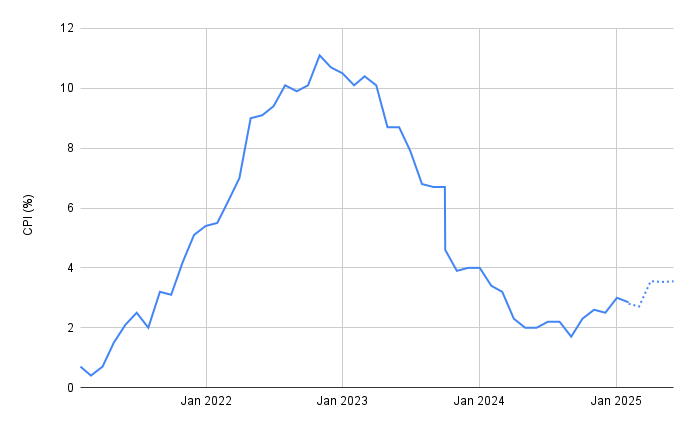

The path of UK inflation

The below chart shows the path of UK inflation over the past four years, and includes Bank of England projections for the next few months (March 2025 to June 2025). Projections are illustrated with the dotted line.

As you can see, inflation peaked at 11.1% in October 2022. The rate of price increases is not expected to hit that level again any time soon – at least not unless the economy faces another serious shock event like Covid.

However, prices are expected to creep up at a faster pace over the coming months. The inflation rate is expected to hit 3.6% when April's figures are published next month. By the third quarter of the year, the Bank of England said the headline rate could even hit 3.75%.

Tell us what you think

We want to know what you think will happen in tomorrow's report. Will the headline rate of inflation rise, hold steady, or fall?

That concludes our live coverage for today but we will be back tomorrow, bright and early. Join us when the inflation report drops at 7.00am.

Good morning and welcome to our live blog. In just over an hour, the latest inflation figures will be published. To recap, analysts are expecting a reading of 2.7% today, a slight slowdown compared to February's report (2.8%).

It could be the calm before the storm with inflation likely to face a big jump the following month, potentially coming in at 3.6% in April, based on Bank of England forecasts.

A lower reading today could strengthen the case for an interest rate cut from the Bank of England at its next meeting.

The Bank is having to balance a complex range of considerations currently. Some indicators like wage growth remain high, but growth concerns are ramping up – particularly in light of Donald Trump's tariffs.

Pantheon Macroeconomics says "pay growth needs to be rising just 2-to-3% year-over-year, rather than 5%-plus, to deliver inflation sustainably at 2%". Yesterday's report came in at 5.9%. However, other parts of the labour market seem to be weakening, with job vacancies falling, for example.

Overall, Pantheon thinks the latest labour market report was weak enough to facilitate a rate cut in May. It is expecting three further rate reductions this year, taking the base rate to 3.75% by the end of 2025.

March's inflation report will be published in around five minutes. Stick with us for live reaction and what it means for your finances.

BREAKING: UK inflation slowed to 2.6% in March

The latest data from the Office for National Statistics shows UK inflation slowed to 2.6% in March, down from 2.8% in February. The result was below analysts' expectations of 2.7%.

Just as a reminder: a lower rate of inflation doesn't mean prices are falling overall, just rising at a slower rate.

What drove the inflation drop?

The largest downward contributions to the drop in the CPI rate came from recreation and culture, and motor fuels. The largest upward contribution came from clothing.

Core and services inflation both lower

The rates of core and services inflation both slowed in March too.

Core inflation, which excludes volatile categories like food and energy, came in at 3.4%, down from 3.5% in February. Services inflation came in at 4.7%, down from 5% in February.

Again, these figures are lower than some analysts were expecting. Pantheon Macroeconomics expected core inflation to hold steady at 3.5%, and services inflation to come in at 4.9%.

These figures should strengthen the case for a rate cut from the Bank of England on 8 May.

"A temporary reprieve"

While today's lower-than-expected reading is good news, particularly for those hoping for an interest rate cut in May, households shouldn't get carried away.

Prices are expected to jump when April's data is released next month, potentially hitting 3.6%, based on Bank of England forecasts.

Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales (ICAEW), makes this very point. He thinks inflation could hit 3.5% in April.

"March’s inflation drop is only a temporary reprieve as a hefty increase is nailed on for April, with rising energy bills and surging business costs, including higher National Insurance, likely to lift inflation to around 3.5%," he said.

What does today's inflation reading mean for mortgage rates?

A lower-than-expected inflation reading strengthens the case for an interest rate cut in May, which could be good news for those looking to take out a mortgage or refinance. Mortgage rates typically fall as interest rates come down.

That said, inflation data and interest rate decisions are typically priced into markets in advance based on expectations – and a spike in inflation is expected next month, with price rises potentially hitting 3.75% by the third quarter of the year. Mortgage rates are unlikely to come down too dramatically with this news on the horizon.

"This might be the last good reading for a few months, so let’s enjoy it while we can. It’s likely we have a few bumps in the road ahead of us – especially before it feels like we’re seeing inflation back under control and where it needs to be," said Ben Thompson, deputy chief executive at the Mortgage Advice Bureau.

"Navigating the balance between inflation and low UK economic growth has been made a lot harder by the wholly unpredictable nature of activity over the pond. Unfortunately, it’s likely there will be some sort of impact to UK numbers as a knock-on later this year and beyond, and right now, trying to work out where that all may or may not go is like fumbling through a thick fog blindfolded," he added.

On the one hand, tariffs could push inflation up as the costs associated with the taxes add costs for businesses, which are passed on to consumers. On the other hand, tariffs are expected to slow global economic growth, which could be disinflationary.

In recent weeks, the market has started pricing in more interest rate cuts this year, suggesting investors expect the Bank of England to prioritise growth concerns over inflation. This has fed into swap rates (which underpin mortgage pricing) and brought mortgage rates down.

But Trump has now paused most of the harshest tariffs announced on 2 April. If he sticks to this route, expectations for rate cuts could ease back, moving closer to where they were before.

Whatever happens with interest rates, it is worth shopping around for a new mortgage a few months before your current deal expires to lock in the best market rates as they appear. If a better rate appears in the meantime, you can usually change it right up until the start date.

What does a drop in the inflation rate mean for savers?

Today's inflation news will be less welcome to savers, who "may soon find returns edging lower," according to Paul Went, head of savings at Shawbrook Bank.

Despite this, many of the best savings accounts are still offering rates north of 4.5%. This means those with significant cash balances could quickly exceed their personal savings allowance and fall into the savings tax trap.

Most basic-rate taxpayers are allowed to earn up to £1,000 in savings interest outside of an ISA each year before tax is due. This falls to £500 for higher-rate taxpayers, while the allowance disappears entirely for additional-rate taxpayers.

"With the 2025/26 tax year now underway, savers should take advantage of their full ISA allowance, shielding up to £20,000 from tax," said Went.

"Our analysis of CACI data reveals that more than 6 million savers risk breaching their personal savings allowance, making it more important than ever to review savings strategies."

In a falling-rate environment, fixed-rate savings accounts and ISAs could be worth a look. These allow you to lock in a higher rate for longer, if you have a pot of cash you are willing to put away for a year or so.

Inflation: big drops to pizza, quiches and musical instruments

The main items which drove the rate of inflation down this month were weaker transport price rises, accommodation prices, and recreational and personal services.

However, digging deeper into the data, Deutsche Bank points out that there were also "big drops in things like communication equipment, sea fares, leisure goods (games), smart watches, pizza and quiches, as well as musical instruments".

Where to next? Deutsche Bank thinks inflation will push above 3.25% in April. The Bank of England has forecast 3.6%.

"Inflation will take a big step up in April, pushing above 3.25% as energy and water bills lead inflation higher," said Sanjay Raja, chief UK economist at the investment bank.

"The good news? We still see inflation running below the MPC’s forecast through Q2-25 – giving the MPC enough runway to cut rates through the year.

"The peak in CPI will likely sit lower than we thought – closer to 3.5% as opposed to 3.75%. And we expect inflation to return to target by the middle of next year."

Deutsche Bank thinks the MPC now has enough room to continue to dial down its restrictive policy, both on the back of weaker labour market data yesterday and softer inflation data today.

"In fact, we think the chances of a dovish pivot have increased heading into the May forecast round," Raja said. This refers to the Bank's quarterly monetary policy report, which includes forecasts for the months ahead. The last report was published in February.

Annual house price inflation 5.4% in February

The price of the average UK property rose by 5.4% on an annual basis in February, up from a revised figure of 4.8% in January, according to official figures from HM Land Registry. Prices were unchanged on a monthly basis. The average property now costs £268,000.

House price inflation data is released each month on the same day as the ONS inflation report, but at the later time of 9.30am.

Will stamp duty changes dampen the housing market?

The increase in the annual rate of house price inflation from 4.8% in January to 5.4% in February paints a resilient picture of the housing market.

Emma Cox, managing director of real estate at Shawbrook, attributes it to "the emergence from the usual winter slowdown" and "a flurry of activity as buyers looked to complete purchases ahead of the removal of stamp duty relief".

We could see a slowdown going forward, though.

On 1 April, the stamp duty threshold for first-time buyers dropped from £425,000 to £300,000. Meanwhile, home movers saw the tax-free threshold drop from £250,000 to £125,000, pushing up purchasing costs.

While the data from HM Land Registry still looks quite strong, separate data from two major lenders paints a weaker picture of slowing growth as the stamp duty window narrowed.

Figures from Halifax suggest house prices rose by 2.8% on an annual basis in March, marking no change compared to February. On a monthly basis, prices fell by 0.5%. Nationwide also reported no change in the annual figure between February and March (3.8%). The monthly figure was flat at 0%.

Although stamp duty thresholds didn't drop until the end of March, those who weren't already a good way through the conveyancing process early on in the month probably failed to complete in time.

Back to inflation... households grapple with higher bills

Although the rate of inflation slowed in March, households are unlikely to be breathing a sigh of relief with a string of bill hikes having taken effect at the start of April. These are likely to contribute to a spike in inflation in next month's report, when the Bank of England thinks the headline rate could hit 3.6%.

The Resolution Foundation, an independent think-tank, commented today: "Bill increases are particularly concerning to low-to-middle income households, for whom energy spending took up nearly twice as much of their total consumption in 2022-23 as it did for high-income households (11% compared to 6%).

"These persistent pressures on core costs are hitting household budgets that are already stretched, with food insecurity recently reaching rates of 11% (in 2023-24)."

Going forward, a lot could depend on Donald Trump's trade policies.

"Global trade uncertainty could drive down our prices, with oil already down more than 10% since the start of April – but a global trade war would create renewed inflation, increasing pressure on British families already struggling with the cost of living," added James Smith, the think-tank's research director.

So far, economists are divided on whether tariffs will push inflation higher or bring it down as the trade war drags on economic growth. Households are unlikely to win in either situation, as a weaker economy could result in slower wage growth and even redundancies.

UK continues to face "stickier inflationary pressures"

Despite a larger-than-expected drop in March, the UK continues to face "stickier inflationary pressures" than other advanced economies, according to Nathaniel Casey, investment strategist at wealth manager Evelyn Partners.

"This has been reflected in the bond market, with gilt yields remaining significantly higher than their European counterparts such as German bunds, even as both markets face a similarly weak growth profile," he said.

10-year gilt yields are currently just shy of 4.6%, while 10-year bund yields are closer to 2.5%.

Thank you for following our live coverage of inflation today. The next CPI figures will be released on 21 May. We will be live blogging again then. In the meantime, look out for our live coverage of the Bank of England's next interest rate meeting on 8 May.