Summary

- Chancellor Rachel Reeves delivered her Spring Statement to the House of Commons on Wednesday, 26 March.

- Reeves said she was proud of what the government had achieved "in just nine months”, but added that the task now was to “secure Britain’s future in a world that is changing before our eyes”.

- The global economy has become “more uncertain”, the chancellor said, with more “unstable trading patterns”. She added that borrowing costs have risen for most major economies.

- The Office for Budget Responsibility (OBR) published its latest economic forecast alongside Reeves's statement. The growth forecast for 2025 has been slashed in half, but upgraded for the rest of the forecast period.

- Reeves said she has restored her fiscal headroom, and that she is on track to meet the "stability rule" and the "investment rule" (her two fiscal rules) two years early.

- A series of cuts have facilitated this, including a £4.8 billion cut to the welfare budget, and a commitment to reduce Civil Service running costs by 15% by the end of the decade.

Live reporting from the team at MoneyWeek as it happened, starting with preview analysis.

Good afternoon and welcome to our live blog. Chancellor Rachel Reeves will deliver her Spring Statement to Parliament this Wednesday, 26 March. Reeves has said it will not be a “tax and spend” event, but spending cuts are widely expected.

Over the past two weeks, the government has already made several major announcements:

- NHS England: On 13 March, the government announced that NHS England would be abolished to “reduce bureaucracy” and “drive efficiency”. Government sources cited by the BBC believe this will save £500 million per year.

- Health-related benefits: On 18 March, work and pensions secretary Liz Kendall unveiled a series of cuts to health-related benefits, intended to save £5 billion by 2030.

- Civil Service: Over the weekend, Reeves confirmed that Civil Service running costs would be cut by 15% by the end of the decade. She told the BBC that savings would be made from back office and administrative roles.

These followed February’s announcement that the international aid budget would be slashed to fund increased defence spending. Prime minister Keir Starmer said the aid budget would be reduced from 0.5% of gross national income to 0.3% in 2027. Defence spending will increase to 2.5%.

Could further cuts be announced on Wednesday?

One major fiscal event each year

Rachel Reeves has previously committed to just one major fiscal event each year "to give families and businesses stability and certainty on upcoming tax and spending changes". However, a lot has changed since the Autumn Budget last October, when tax hikes of £40 billion and spending policies of £70 billion were announced.

High borrowing costs and low economic growth have already wiped out the government’s £9.9 billion “fiscal headroom”, according to reports from Bloomberg last month.

When MoneyWeek asked the Treasury to comment on whether Reeves's statement would involve major policy announcements, they neither confirmed nor denied, simply stating: “The government’s commitment to fiscal rules and sound public finances is non-negotiable. As previously announced, the OBR's next forecast will be presented to parliament on 26 March alongside a statement from the chancellor”.

Above: The chancellor poses outside 11 Downing Street with the red box, shortly before delivering the Autumn Budget on 30 October 2024. Reeves has previously committed to just one major fiscal event each year, delivered in the autumn. Will she adhere to this on Wednesday when she delivers the Spring Statement?

What are the fiscal rules?

Reeves has been clear that she will stick to her self-imposed fiscal rules, which were voted into law by the House of Commons in January. There are two main parts:

- Stability rule: Day-to-day spending needs to be matched by tax revenues, not funded through borrowing.

- Investment rule: Debt needs to be falling as a share of the economy by 2029/30.

Chancellor left with "few avenues to choose from"

"The government wants to spend more; on defence, and on building the UK’s green infrastructure to power growth for generations to come. But with such geopolitical uncertainty, fiscal rules are important and breaking them would be costly," said Danni Hewson, head of financial analysis at investment platform AJ Bell.

"Not breaking them leaves the chancellor with few avenues to choose from, especially with her fiscal headroom almost certainly evaporated, and probably in deficit," she added.

Figures published last week showed that government borrowing came in higher than forecast in February, at £10.7 billion. Borrowing for the current financial year (ending March 2025) has already exceeded the OBR's full-year forecast, at £132.2 billion versus a forecast of £127.5 billion.

"Promises not to increase taxes will mean even fewer choices, more cuts to public spending and the increased likelihood that the unpopular fiscal drag of frozen tax thresholds will remain with us way beyond 2028," Hewson added.

Cash ISA rumours – have changes been shelved?

In recent months, cash ISAs have been at the heart of a media storm. Reeves was rumoured to be looking at cutting the annual allowance from £20,000 to £4,000 – part of a bid to get Britain investing and boost UK growth.

These plans now appear to have been shelved.

An official told the Financial Times: “We are not looking at any changes to ISAs in the Spring Statement. We recognise the range of views around the current ISA system and want to ensure it strikes the right balance between cash and equities.

“We want to continue to support cash savings whilst earning better returns for savers, boosting the culture of retail investment and supporting the growth mission.”

We share further details in: “Will Rachel Reeves impose a £4,000 cash ISA limit?”

Above: Will Reeves come for the cash ISA allowance?

Spring Statement: Pensions are unlikely to be a target

One of the main ways the government can raise money from pensions is by adjusting the tax rules, but the upcoming Spring Statement is not expected to be a tax-raising event.

There was lots of speculation about changes to the tax-free lump sum and pension tax relief before the Autumn Budget last year, but neither of these changes ultimately materialised.

The main change Reeves announced last October was that pensions would be brought inside the inheritance tax net from April 2027.

That said, pension savers should still listen out for hints about the state of the UK's finances when Reeves speaks in Parliament this Wednesday.

"Reeves may use the Spring Statement to set the ‘mood music’ for the future direction of travel on tax and spending policy against the overriding economic growth agenda," said Steven Cameron, pensions director at financial services company Aegon.

Meanwhile, pension reforms are likely to take centre stage later in the year, rather than during the Spring Statement.

"The Pensions Investment Review is likely to lead to workplace pensions placing more of their members’ funds in investments designed to boost UK economic growth, which could also deliver better returns for pension savers," Cameron said.

"And this summer’s Pension Schemes Bill will include new measures to ensure all pensions are offering good value for money as well as plans to bring together small pension pots individuals may have left behind when changing employers."

We take a closer look in: "Spring Statement: What could Rachel Reeves say about pensions?"

Harsher punishment for submitting your tax return late

Although the chancellor isn't expected to announce tax hikes during the Spring Statement, MoneyWeek understands that the rules around tax collection will be tightened. This is expected to raise an extra £1 billion a year by the end of the decade.

From next tax year onwards (2025/26), the Treasury will increase late payment penalties for VAT and Making Tax Digital for Income Tax Self Assessment (ITSA). The penalty will increase from 2% to 3% at 15 days, 2% to 3% at 30 days, and 4% to 10% from day 31.

To help enforce the new regime, Reeves will earmark £80 million to pay for third-party debt collectors to bring in £1.3 billion in outstanding tax over the next five years. The Treasury says the collectors will return £16 for every £1 spent on their employment.

Reeves will also announce that a further 600 permanent members of staff will be recruited into HMRC’s debt management teams, and a further 500 in the compliance teams.

For more details, read our full report.

Reeves’s focus will be on spending cuts

The government is expected to reduce spending by billions of pounds in the Spring Statement, in what some commentators are calling the biggest cuts since austerity. We already know what some of the targets will be – from health-related benefits to NHS England and the Civil Service.

Tax hikes do not appear to be on the table, although Reeves is expected to spend money on enforcement measures (including harsher punishments for those who submit their tax return late).

“It’s not surprising that Rachel Reeves has come out in recent days to quash speculation that there could be some sort of tax rise in her speech, given the negative reception the Autumn Budget received from businesses and individuals and the drag that those tax-raising announcements seem to have exerted on growth and confidence,” said Jason Hollands, managing director at wealth management firm Evelyn Partners.

“Given that most of those tax rises have yet to take effect, including the significant hike on employer’s National Insurance costs, the last thing this government needs right now is to say it’s inflicting more of the same. Instead, the onus for now will be on spending cuts that have been well-telegraphed,” he added.

Thank you for following our live blog today. We will be back tomorrow with further analysis in the lead-up to Wednesday's announcements. Have a good evening.

Welcome back... plus latest headlines on affordable housing

Good Tuesday morning, and welcome back to our Spring Forecast live blog. There is just one day to go until chancellor Rachel Reeves delivers her statement to Parliament.

The latest headline overnight is that the Treasury has announced £2 billion of new investment to support social and affordable housing. This is intended to deliver up to 18,000 new homes, contributing to the government's wider promise to build 1.5 million new homes before the end of this Parliament.

The £2 billion injection will only support development on sites that will deliver in this Parliament, the government said.

The Treasury is calling the investment a "down payment" ahead of more long-term investment in social and affordable housing planned later this year. Further details will be revealed after the government completes its current spending review process on 11 June.

"This investment will help us to build thousands more affordable homes to buy and rent and get working people and families into secure homes and onto the housing ladder," said deputy prime minister and housing secretary Angela Rayner.

Would the government ever consider a wealth tax?

A wealth tax is not expected tomorrow and would prove deeply unpopular, particularly after last year’s tax-raising Autumn Budget. The headlines are already full of stories of millionaires leaving Britain thanks to high taxes and plans to abolish the non-dom status.

Around 10,000 millionaires left the UK in 2024, a 157% increase on the year before, according to a report from wealth intelligence firm New World Wealth and investment migration consultancy Henley and Partners. Reeves has already had to soften the non-dom changes in a bid to stem the flow.

Despite this, some have called on the government to consider the measure.

A cross-party group of around 30 MPs wrote to Reeves before the Autumn Budget, calling on her to introduce a 2% tax on assets worth more than £10 million. The group claimed the measure could raise £24 billion per year.

Signatories of the letter included representatives from Labour, the Greens, the Liberal Democrats, Plaid Cymru, and more, as well as former Labour leader and current independent MP Jeremy Corbyn.

Reeves has previously distanced herself from any policy like this, saying in 2023: “We have no plans for a wealth tax.”

We take a closer look in: “Could Labour introduce a 2% wealth tax?”

Expect “tweaks” to public finances

Major tax changes are not expected tomorrow. This was never intended to be a Budget, even if weak growth and high borrowing costs ultimately force Labour into announcing more than it would have liked.

Pete Glancy, head of pension policy at Scottish Widows, said the statement is more likely to be used as a platform for “tweaks to the public finances”. That doesn’t mean it won’t be significant, though.

“Anything we do hear on the day could have an impact on things like saving, investing and pensions,” Glancy said. “For example, the relative performance and attractiveness of our economy could influence asset allocations either towards or away from the UK. Indicators of a recession often favour bonds over equities, and vice versa when things have been predicted to boom.

“Short-term interest rates trending down could shift people from cash ISAs towards equity ISAs, and longer-term interest rates remaining high may favour annuities over income drawdown.

“The trick is to translate what is announced on the day into how it might play out into customer behaviours and customer demand.”

“The government must be smarter on investment”

The Organisation for Economic Co-operation and Development (OECD) has forecast that the UK will be the second-fastest growing economy in the G7 this year, behind the US. However, it recently downgraded its growth forecast from 1.7% to 1.4%. All G7 countries saw downgrades against an uncertain global backdrop.

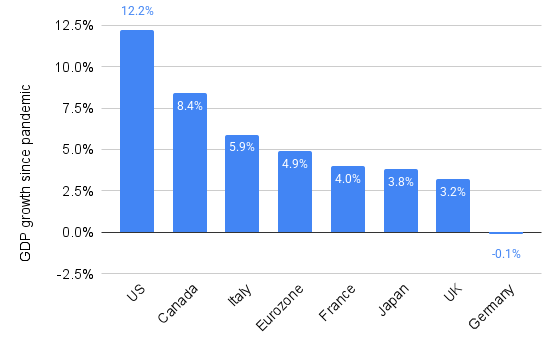

As the below chart shows, the UK has had the second-lowest growth rate of all G7 countries since the pandemic (Q4 2019 versus Q4 2024).

Growth of G7 real GDP since the pandemic (Q4 2019 versus Q4 2024, percentage change)

The Institute of Chartered Accountants in England and Wales (ICAEW) has said the government needs to make “smarter investment decisions”.

“There must be a step change in the way the government invests if it is serious about kickstarting the economic growth needed for the UK to be the fastest-growing economy in the G7,” said Alan Vallance, ICAEW chief executive. “The evidence is clear – our members have told us that investment, when poorly targeted, can crowd out funding from the private sector.”

A poll of ICAEW members found that 72% want better targeting of government investment to lower the cost of capital for difficult infrastructure projects, rather than replacing capital on projects the private sector is likely to invest in anyway.

Eighty-five percent of members said poorly-targeted government investment risked displacing private sector funding without generating additional economic benefits.

“A smarter approach to investment, which focuses on unlocking private funds and prioritises spending on skills, technology and infrastructure, would be a smarter use of taxpayers’ money,” Vallance added.

How will inflation impact the Spring Statement?

The next set of UK inflation figures will land on the same day as the Spring Statement. This has the potential to cause a major headache for the chancellor.

January’s larger-than-expected jump in inflation (from 2.5% to 3%) helped inform the Bank of England’s decision to pause interest rate cuts this month, as the Bank balances inflationary risks against the desire to kick-start a stagnant economy.

One month's inflation reading won’t have any direct bearing on the Spring Statement, but it could set the tone. Should inflation come in higher than expected, it will add more pressure on Reeves, making her goal of growing the economy and easing cost-of-living pressures that much harder.

A lower-than-expected reading could, on the other hand, offer some optimism.

Read more about what to expect in tomorrow’s report in our February inflation live blog.

Why so much fuss for a non-Budget?

The red box is not expected to make an appearance tomorrow, and shadow chancellor Mel Stride will respond to Reeves’s statement rather than opposition leader Kemi Badenoch. In other words, the government is keen to emphasise that this is not a Budget. Reeves herself has insisted that it will not be a “tax and spend” event.

Why all the fuss then?

The truth is that this statement will almost certainly be a bigger event that Labour originally intended. Gilt yields soared at the start of the year on the back of higher inflation expectations, pushing up government borrowing costs and wiping out most (if not all) of Reeves’s £9.9 billion “fiscal headroom”. Meanwhile, economic growth has been weak – almost non-existent. The OBR is expected to halve its forecast for the 2025 financial year from 2% to around 1%, according to reports from the Telegraph.

This essentially leaves the government with three options: raise taxes, cut spending, or change the fiscal rules.

Reeves has pretty much ruled out the first and third options. Spending cuts have been her chosen route so far. Several have been announced in advance of Wednesday’s statement, including a £5 billion cut to health-related benefits, but we could be given further details during Wednesday’s speech.

Another reason Wednesday’s statement is important is that it could set the tone for tax and spending changes further down the line. If the OBR’s economic forecast highlights a big gap in the public finances, Reeves could use her statement to warm households and businesses up to future tax rises – perhaps at the 2025 Autumn Budget.

Reeves is likely to justify any changes by pointing out that the world has changed since Labour first came into power last July. Defence spending in particular has become more of an urgent priority in light of America’s retreat from European security under US president Donald Trump. Inflation is back on the rise, and could be pushed higher by an escalation of Trump’s trade war. Tariffs could also weaken global economic growth by making it more expensive (and more challenging) for businesses to operate.

Will the government tighten inheritance tax rules?

Tax hikes are not on the cards tomorrow, but it could be worth keeping an eye out for any small print that accompanies Reeves's speech.

"We will have our eyes peeled for any announcements of consultations or reviews that accompany the Spring Statement," said Jason Hollands, managing director at wealth management firm Evelyn Partners.

"Often billed as 'simplification' proposals, one such area could be an overhaul of the lifetime gifting regime, as the government has been clear the taxation of inheritances is an area it is prepared to tighten up on," he adds.

Currently, anyone can give up to £3,000 of their assets to loved ones each tax year without that sum becoming liable for inheritance tax (IHT). After that point, your gift may be classified as a "potentially-exempt transfer". If you die within seven years of making the gift, inheritance tax will be payable on a sliding scale known as taper relief.

Hollands says there is an "almost irresistible urge" for the government to clamp down on gifting rules, as some families are now giving more of their money away in response to IHT changes around pensions.

Pensions currently fall outside of the IHT net, but this is set to change from April 2027.

"We are seeing many clients draw money from pensions, which they had originally planned to leave untouched for IHT purposes, and instead make lifetime gifts to their children and grandchildren," he explains.

Thank you for following our live blog today. We will be back again tomorrow with further preview analysis, before reporting on the chancellor's speech as it happens. Reeves is expected to address the House of Commons at around 12.30pm. Join us then.

£2.2 billion funding boost for defence next year

We had signed our blog off for the evening, but we are briefly returning to bring you the latest headline on defence spending.

Tomorrow, the chancellor is expected to announce a £2.2 billion funding boost for defence in 2026. The Treasury is calling the move a “significant step” towards spending 2.5% of GDP on defence by 2027.

The funding will be invested in advanced technologies, including directed energy weapons for royal navy ships. It will also be used to provide better homes for military families.

Reeves will promise to deliver “security for working people” and a “decade of national renewal”. She is also expected to warn that “we have to move quickly in a changing world”.

Join us tomorrow for further coverage on all things Spring Statement.

It's Spring Statement day... expect further welfare cuts

Good morning and welcome back to our live blog. The latest headline is that chancellor Rachel Reeves is expected to unveil further welfare cuts when she delivers her Spring Statement at 12.30pm.

Work and pensions secretary Liz Kendall announced a string of benefit cuts last week, including narrowing the eligibility criteria for personal independence payments. The changes were expected to save £5 billion by 2030. However, the fiscal watchdog has since informed ministers that the cuts will save £1.6 billion less than planned, according to The Times.

Pound weakens against dollar, as traders prepare for growth downgrade

The pound has weakened against the dollar this morning, as traders anticipate bad news when Reeves delivers the OBR's latest UK economic forecast. The OBR is expected to halve its forecast for the 2025 financial year from 2% to around 1%, according to reports from the Telegraph.

"It could be a testing day for markets if chancellor Rachel Reeves delivers more bad news and is seen to be fighting a losing battle. However, the flipside of a weaker pound is that it benefits the army of dollar earners on the FTSE 100," said Dan Coatsworth, investment analyst at platform AJ Bell.

Inflation drop will come as welcome news to Reeves

February’s inflation report was published today and showed that prices rose by 2.8% on an annual basis in February, down from 3% in January. Economists polled by Reuters had expected it to drop to 2.9%, while those cited by Bloomberg were forecasting 3%.

The result will come as good news to Rachel Reeves as she gears up to deliver a painful Spring Statement today – from a PR perspective if nothing else. Indeed, the Bank of England has forecast that inflation will rise further over the course of the year, potentially hitting 3.75% in the third quarter.

“Make no mistake, inflation remains on a one-way journey: up. We see headline CPI rising to just under 4% later this year,” said Sanjay Raja, chief UK economist at Deutsche Bank. “Inflation expectations have already risen on the back of rising headline prices, energy prices, and food prices. The MPC have taken notice – one reason they opened the door to a potential pause in May.”

See our live blog for all the latest on today’s inflation figures.

Poll: Share your thoughts on rumoured welfare cuts

The main headline this morning is that Rachel Reeves looks set to unveil further welfare cuts after the OBR reportedly informed her that last week's benefit cuts will not save £5 billion by 2030, as expected.

Share your thoughts in our poll – is Reeves right to cut welfare spending further?

10-year gilt yields have been rising

10-year gilt yields have been rising in recent days in advance of the Spring Statement, and are currently north of 4.7%, up from around 4.5% at the start of March.

Gilt yields reflect how much the government must pay to borrow money.

Yields have been rising in response to a deteriorating macroeconomic backdrop, with the OBR expected to downgrade its growth forecast today. Investors are pricing a higher level of risk into the market as a result.

Reeves has said she will not announce any tax hikes today, but it is possible she will use her statement as an opportunity to set the ground for future policy changes, depending on the state of the public finances.

Investors will be listening closely to understand how any future changes might impact the economy.

For example, the hike to employers' National Insurance (announced in October's Autumn Budget) was received negatively and caused gilt yields to rise, as businesses warned this could push inflation higher and damage economic growth.

Recap: What is Reeves expected to announce?

With less than an hour to go until Reeves delivers her statement, let’s recap on what she is expected to announce:

- Growth downgrade: Reeves will share details from the fiscal watchdog's latest economic forecast. Expect growth expectations to be downgraded. Reports suggest the growth forecast for this financial year could even be halved from 2% to around 1%.

- Further welfare cuts: The Office for Budget Responsibility (OBR) has reportedly told Reeves that last week’s benefit cuts will not save £5 billion by 2030 as anticipated, but more like £3.4 billion. Expect further welfare cuts as a result.

- Increased defence spending: A £2.2 billion injection into defence spending is expected next year, focused on boosting military technology and funding better homes for families in the armed forces. The government has already committed to raising defence spending to 2.5% of GDP by 2027.

- Investment in affordable housing: The Treasury has already announced £2 billion of new investment to support social and affordable housing, intended to deliver 18,000 new homes. The government has previously committed to 1.5 million new homes by the end of this Parliament.

- Civil Service cuts: Reeves has confirmed that Civil Service running costs will be cut by 15% by the end of the decade.

- NHS England: The government has already announced that NHS England will be abolished. Government sources cited by the BBC have indicated this could save £500 million per year.

- No tax hikes this time – but how long can this last? Reeves has said this is not a “tax and spend” event. No tax hikes are expected today. However, depending on the OBR’s findings, Reeves could lay the ground for hikes at a future date, such as the 2025 Autumn Budget.

Above: Rachel Reeves photographed leaving 11 Downing Street earlier today ahead of her Spring Statement at 12.30pm.

Prime minister’s questions are currently underway. Reeves will deliver her statement once they have concluded, probably at around 12.30pm. Stick with us – we will be reporting live.

OBR Forecast

Increased uncertainty has had two consequences; on public finances, and on the economy, says Reeves.

She reiterates the non-negotiability of her fiscal rules, and harks back to the Liz Truss mini-budget, of which she says ordinary people “are still feeling the effects”.

Turning to the OBR forecast, Reeves says that the current budget would have been in deficit by £4.1 billion by the end of the period.

“As a result of the steps I am taking today, I can confirm that I have restored in full our headroom against the stability rule,” says Reeves.

- Dan McEvoy, senior online writer

Restoring headroom

Reeves claims that the changes she will announce today will create £15.1 billion of headroom by the final year of the forecast.

The OBR, she says, anticipates £4.8 billion of savings from the welfare budget based on today’s changes.

- Dan McEvoy, senior online writer

Reeves aiming at reducing government running costs

“My right honourable friend, the health secretary, is driving forward vital reports that increase NHS productivity, bearing down upon costly agency spend to save money so that we can improve patient care,” says Reeves. “My right honourable friend, the chancellor of the Dutchy of Lancaster, is taking forward work to significantly reduce the costs of running government by 15% worth 2 million pounds by the end of the decade.”

These form part of a package of reforms, including getting the Civil Service making greater use of AI, to reduce the overall costs of running the government.

Day-to-day government running costs could be cut by £3.5 billion by 2029/30, she says.

Chancellor takes credit for falling inflation

Reeves pointed out that the rate of inflation came down in today’s report, coming in at 2.8% in February, down from 3% in January. She said the government must support the MPC in meeting the 2% inflation target, and pointed to the three cuts the MPC has delivered since the summer.

It is worth pointing out that today’s fall in the inflation rate is expected to be short-lived. The Bank of England has forecast that inflation will hit 3.75% later this year.

- Katie Williams, staff writer

Tax evasion crackdown

While there will be no tax cuts, Reeves will cut back on tax evasion. The government will invest in tech that will allow HMRC to crack down on tax avoidance and tax fraud, and increase the number of tax fraudsters charged each year by 20%.

This will raise £1 billion in revenue, bringing the total revenue raised from cracking down on tax evasion to £7.5 billion.

Capital investment will grow by £2 billion a year

A further £2 billion a year will be spent on capital investment by the government, adding to the £100 billion of funding pledged by 2030 in the Autumn Budget.

Reeves says that this extra cash will be used to “drive growth” and “deliver defence commitments” while increasing productivity and improving the quality of front-facing public services.

- Daniel Hilton, junior writer

Reeves: “We have to move quickly in this changing world”

Reeves has committed a £2.2 billion increase to defence in the next financial year. She said this would boost Britain’s economic security as well as its national security.

A minimum of 10% of the equipment budget will be spent on drones, AI technology and advanced manufacturing production, Reeves said, “bringing innovative tech to the front line at speed”.

Reeves said boosting defence spending would create jobs for engineers and scientists and bring business to tech firms and start-ups. She also spoke about giving small businesses better access to Ministry of Defence contracts.

- Katie Williams, staff writer

Reforms to planning regulations to deliver nearly £7 billion in growth

Planning reforms are expected by the OBR to deliver £6.8 billion by 2029/30.

“Our reforms will lead to housebuilding reaching a 40-year high,” says Reeves. 1.3 million homes over the next five years are planned, “taking us to within touching distance of our promise to build one and a half million homes during the course of this government,” she adds.

By 2034, these reforms could boost the economy by 0.4% of GDP – the highest level of any single zero-cost policy that the OBR has ever forecast.

- Dan McEvoy, senior online writer

OBR forecasts a larger economy, says Reeves

“By the end of the forecast, our economy is larger than at the time of the Budget,” says Reeves.

She adds that real household incomes are also expected to grow at more than twice the rate they were expected. “People will be on average over £500 per year better-off under this Labour government,” says Reeves.

- Dan McEvoy, senior online writer

Universal Credit to increase by £8 a week by 2029/30; health elements to be cut

The standard allowance of Universal Credit will be increased from £92 a week in 2025/26 to £106 a week by 2029/30.

The Universal Credit health elements will, however, be cut for new payments by around 50% and then frozen until 2030.

Reeves says this has been done to “provide guaranteed, personalised employment support to help people get back into work”.

This measure was not announced when work and pensions secretary Liz Kendall announced cuts to disability benefits last week.

- Daniel Hilton, junior writer

Mel Stride responds, framing the statement as an “emergency Budget”

Shadow chancellor Mel Stride has responded to Reeves’s statement, and is framing Reeves’s announcements as an “emergency Budget”.

Unsurprisingly, his focus is on the UK’s weak economic growth. Stride is blaming it on the decisions announced by Reeves last autumn, and Labour’s decision to “talk down the economy” after it took office. Remember that famous “£22 billion black hole” that Reeves accused the Conservatives of leaving behind.

The key message from Reeves is that the world has changed since Labour took office, but Stride is trying to push a different narrative: that Reeves is the “architect of her own misfortune”, having “borrowed, spent and taxed like it was the 1970s”.

Stride has asked Reeves to confirm that she won’t raise taxes further at a future date.

- Katie Williams, staff writer

Stride calls for a faster ramp-up in defence spending

On defence spending, Stride says that the 3% target should be brought forward to this target.

“What provision has she made in her plans for increased defence spending in this Parliament if this becomes necessary?” he asks Reeves.

He also asks her to scrap the “absurd Chagos deal” in favour of increased spending on the armed forces.

- Dan McEvoy, senior online writer

Zoopla chief: planning reforms welcome, but work needed on mortgages and social housing

“The housing market needs a strong and growing economy to support housing supply. It’s promising to see the Government focusing on longer-term impact by boosting funding for new homes and avoiding short-term measures like stamp duty holidays that don’t really help with the fundamental challenges in the housing market,” says Richard Donnell, CEO at Zoopla.

“The top priority should be an easing of mortgage regulations, which will support first-time buyers, an important buyer group for homebuilders and the broader market.”

He adds that “increased funding for social housing is essential in the upcoming Spending Review to help support housing delivery and boost the stock of social rented homes, which has been static for 30 years”.

- Dan McEvoy, senior online writer

Proposals to exempt PISCES share transactions from stamp duty

Alongside the Spring Statement, the government has also published a consultation on exempting PISCES transactions from stamp duty.

Private Intermittent Securities and Capital Exchange System (PISCES) is a new type of stock exchange that will allow private companies to have their shares traded intermittently.

The consultation will end on 23 April 2025.

- Ruth Emery, contributing editor

Disability benefit cuts fall short of £5 billion promise

The OBR has said that cuts in disability benefits promised to save £5 billion by 2029/30 will instead save £4.8 billion – £200 million less than anticipated.

The cuts include those outlined by work and pensions secretary Liz Kendall last week as well as the surprise announcement today that Universal Credit health elements will be cut by 50%.

It comes after reports suggested that a spat occurred between the OBR and the Treasury over the costing of the cuts.

The OBR is said to have assessed the changes announced last week and said they would only have produced savings of £3.4 billion in 2029/30. That may be what spurred the changes to the health elements of Universal Credit announced today.

- Daniel Hilton, junior writer

Stride sneaks in a zinger about there being “more last-minute changes to this Statement” than there were to the chancellor’s LinkedIn profile.

He also accuses her of breaking her commitment to only hold one fiscal event per year.

Reeves responds by saying that if this was a Budget, the leader of the opposition would be responding, but that she is probably “looking forward to her lunchtime steak”.

Relief that cash ISA limit isn’t changed

There was no announcement in the Spring Statement about slashing the cash ISA limit. There had been speculation that the £20,000 ISA allowance could be cut to just £4,000.

Carol Knight, chief executive of The Investing and Saving Alliance (TISA), said: "We’re relieved that the chancellor has decided not to announce any immediate changes to the incredibly popular cash ISA in her push for growth.

“Using a stick, by cutting the tax benefits of cash ISAs is not the way to boost the investment culture in the UK. There is a huge amount that the chancellor could and should do to provide a boost to the consumer investment culture in the UK.”

- Ruth Emery, contributing editor

OBR forecast in detail

The OBR’s forecast for growth this year has been halved since the October budget, from 2% to 1%. It has also revised its estimate for borrowing by the end of the Parliament upwards from £70.6 billion to £74.0 billion.

Growth is forecast to stabilise and average at around 1.75% for the rest of the decade.

It forecasts that government policies will offset this by raising £14.0 billion by 2029/30.

“This means that the fiscal rules for a current balance and for net financial liabilities to be falling in 2029-30 are both met by similar small margins to October of £9.9 billion and £15.1 billion respectively,” says the report. “But borrowing is projected to be £3.5 billion higher and debt 0.6 per cent of GDP higher at the end of the decade than in our October forecast.

“The chancellor is just as vulnerable to adverse economic and financial market developments that could wipe out her headroom again and force her to tighten fiscal policy further in the full Budget later this year,” says Paul Dales, chief UK economist at Capital Economics.

“Indeed, the OBR today highlighted that the hit to the economy from widespread 20% import tariffs could cut the headroom by almost £10bn,” he added.

- Dan McEvoy, senior online writer

Could the chancellor have gone further to boost growth?

“Growth is the chancellor’s ‘number one mission’, but other than organisations in the defence sector, many may be disappointed that there was very little in today’s Spring Statement to help them to grow,” said Robert Marchant, partner at tax firm Crowe.

“There are fiscal levers the chancellor could have used such as providing businesses with access to finance for capital investments, making the UK more attractive to the wealthy and boosting the UK’s stock markets, and it will be interesting to see whether there are changes made in these areas in the future,” he added.

Businesses have expressed concern about the impact of upcoming National Insurance changes, with employers’ contributions set to rise from April. Several have warned that the changes could result in price hikes – an attempt to offset the effects of a higher wage bill. Some businesses have said they will look to cut working hours, or even carry out redundancies.

- Katie Williams, staff writer

Lib Dems challenge Reeves not to reduce Digital Services Tax

Daisy Cooper, Liberal Democrat Treasury spokesperson and deputy leader, challenges Reeves to rule out rumoured adjustments to the Digital Services Tax (DST).

The DST raises around £800 million annually by taxing the revenue of big tech companies like Meta that are earned in the UK. It is rumoured that Reeves could be about to reduce the tax in order to secure a more favourable trade deal with the US.

“We are a small, open trading economy,” Reeves responds. “We benefit with trade links around the world, including with our single biggest trading partner, the United States of America, and it is right that we work with our allies in the United States to ensure that that free and open trade continues.”

- Dan McEvoy, senior online writer

Relief - or disappointment? - about pension silence in Spring Statement

Some experts have expressed relief that pensions did not feature in Reeves’s speech, and a quick flick through the Spring Statement document doesn’t reveal any mention of tinkering with pensions policy.

This can be seen as a positive, following the government’s decision in the Autumn Budget to subject pensions to inheritance tax from 2027.

However, there is disappointment that there was no mention of the second phase of the Pension Review, which is supposed to examine the issue of savings adequacy and whether the pension system is on track to deliver the outcomes people want and expect. There had been speculation that it has been postponed, but Mike Ambery at Standard Life says he’s hopeful there will be an update in the coming months.

Lisa Picardo at PensionBee said she was disappointed pensions had been “sidelined” today, and called for new legislation to implement a 10-day pension transfer switch guarantee, and to expand auto-enrolment.

- Ruth Emery, contributing editor

Markets respond to “game of two halves” statement

Reeves’ speech initially dampened investor confidence in UK stocks, but this reversed as the statement went on.

“The Chancellor’s statement was a game of two halves, and it’s been reflected in sharp market movements,” says Susannah Streeter, head of money and markets, Hargreaves Lansdown.

“Rachel Reeves appeared to be on the losing side of investor sentiment with downgrades to growth this year, but scoring goals of optimism with upgrades to GDP further ahead, and forecasts for real disposable income to rise in the months to come.

“The FTSE 100 and FTSE 250 lost ground and then made handbrake turns as hope rebounded about flickers of growth.”

- Dan McEvoy, senior online writer

Allocations for £2 billion extra a year in capital investment yet to be announced

Reeves was asked where the extra £2 billion a year in capital investment will be allocated by chair of the Treasury Select Committee, Dame Meg Hillier MP.

The Chancellor said that details of the allocations will be published in the upcoming spending review, but noted that £2.2 billion has been pledged to defence, and £2 billion will be put towards building affordable and social housing.

- Daniel Hilton, junior writer

Inheritance tax take set to soar even further

Inheritance tax will now raise £66.89 billion between 2024/25 and 2029/30, according to the OBR’s projections released today alongside the Spring Statement forecast.

Compared to the estimates made at the Autumn Budget, the Treasury is set to benefit from a further £2.44 billion boost from IHT in this Parliament.

“Frozen thresholds and rising asset prices have long been increasing the inheritance tax haul and from next month the reforms announced at the Autumn Budget will be accelerating this trend," Stephen Lowe, director at retirement specialist Just Group, said.

Approximately one in 10 (9.7%) deaths are forecast to incur IHT on the estate by 2029/30. The most recent figures show 4.39% of UK deaths led to an IHT charge in the 2021/22 tax year.

Lowe said the predicted increase shows it is "clear that the tax is no longer restricted to the very wealthy and is beginning to take a bigger bite of Middle Britain’s wealth".

He added: “We encourage people to make sure they have an up-to-date valuation of their estate, including a recent assessment of their property wealth, to help them understand if they are likely to incur IHT.

"Estate planning is complex and professional financial advice can be immensely helpful for people who want to manage their estate efficiently and pass on the maximum inheritance to loved ones.”

- Jessica Sheldon, deputy digital editor

Rachel Reeves sets the scene for ISA reforms

While the chancellor didn’t mention ISAs in her speech, the tax-free savings accounts did get a mention in the Spring Statement policy paper.

It said: “The government is looking at options for reforms to Individual Savings Accounts that get the balance right between cash and equities to earn better returns for savers, boost the culture of retail investment, and support the growth mission.”

This could be a hint towards cutting the cash ISA limit in future. Currently, savers and investors can split their £20,000 ISA allowance across different types of accounts like cash ISAs and stocks and shares ISAs as they see fit.

Rachael Griffin at the wealth manager Quilter says modernising ISAs is “long overdue”. She adds: “Making stocks and shares ISAs more attractive than their cash counterpart could help more people grow their wealth over the long term and direct more capital toward productive investment, which is clearly a goal for this government.”

However, Michael Summersgill, chief executive of AJ Bell, says a separate cash ISA limit would “run counter to Labour’s stated aim to simplify the ISA landscape. Rather than having a simple-to-understand £20,000 overall limit, people would have a limit within that limit and there would need to be complex restrictions on transfers from stocks and shares ISAs to cash ISAs to prevent people gaming the system.”

- Ruth Emery, contributing editor

Rightmove: “Government should have extended the impending stamp duty deadline for home buyers”

Stamp duty thresholds will revert to their original levels next Tuesday (1 April), meaning home buyers will potentially have to fork out thousands of extra pounds in tax. To recap, since October 2022, stamp duty has only been due on homes worth more than £250,000, or £425,000 for first-time buyers. However, these thresholds will drop back to their original levels from 1 April – £125,000 for regular buyers and £300,000 for first-time buyers.

Estate agents, mortgage lenders and conveyancers have reported a huge rush in buyers trying to complete before next week’s deadline.

Rightmove’s property expert Colleen Babcock says: “It’s extremely disappointing that the government has not used the Spring Statement as an opportunity to extend the impending stamp duty deadline for those currently going through the home-moving process. We estimate over 70,000 buyers are going to miss the deadline and complete in April instead, and a third of those are first-time buyers.”

- Ruth Emery, contributing editor

Summary: Key announcements from Reeves’s Spring Statement

- OBR forecasts: The growth forecast for 2025 has been halved to 1%, but revised up for the rest of the forecast period.

- Fiscal rules: The chancellor says the measures she has announced have restored her fiscal headroom “in full”.

- Welfare reforms: Reeves announced some further details following on from last week’s reforms. The standard allowance of Universal Credit will increase above inflation from 2026-27, but by less than previously thought. Meanwhile, the health element of Universal Credit will be frozen for existing claimants until 2029/30, and for new claimants it will be reduced by £50 a week in 2026/27 before being frozen until 2029/30. In total, the entire package of reforms (measures announced last week and today) will save £4.8 billion by 2029/30, the government said.

- Defence spending: Labour reiterated its commitment to increasing defence spending to 2.5% of GDP by 2027, and announced an additional £2.2 billion funding boost for 2026.

- Capital infrastructure: The chancellor committed £13 billion to capital infrastructure over the next five years.

- Social and affordable housing: Reeves committed an additional £2 billion to social and affordable housing in 2026/27.

- Clamping down on tax evasion: The government said measures would raise over £1 billion in additional gross tax revenue per year by 2029-30.

- Public sector reform: Steps include abolishing NHS England to “reduce bureaucratic inefficiencies”, and providing £150 million for government employee exit schemes – part of a drive to reduce Civil Service costs by 15% by the end of the decade.

- Katie Williams, staff writer

Reeves’s statement was better than expected – but are tax hikes on the horizon?

In his response to Reeves’s statement, shadow chancellor Mel Stride asked her how the markets would respond. But the answer so far today is that they seem relatively non-plussed – a good outcome for the chancellor.

The FTSE 100 and the FTSE 250 are both in the green, at the time of writing. Ten-year government bond yields haven’t risen significantly either. They are still at around 4.7%, roughly where they were this morning.

A better-than-expected growth outlook from the OBR could be partly to thank. Although the 2025 growth forecast has been slashed in half to 1%, the outlook for the remainder of the forecast period has been upgraded.

Despite this, James Smith, developed markets economist at ING, points out that the UK’s public finances are “operating on increasingly fine margins”. What’s more, he adds that defence won’t be the only department that requires “fresh cash injections over the coming years”.

“At the Autumn Budget, that may leave the Treasury with little choice but to boost government spending plans even further,” he says. “In the absence of further upgrades to GDP growth, or a fall in gilt yields (not our base case), we think this is likely to necessitate further tax hikes.”

- Katie Williams, staff writer

Calls for wealth tax in post-Spring Statement debate

During the post-Spring Statement debate, Andy McDonald, Labour MP for Middlesbrough East and Thornaby, made the case for capital gains tax (CGT) equalisation with income tax or a 2% wealth tax on assets worth over £10 million.

The latter suggestion was supported by Nadia Whittome, Labour MP for Nottingham East.

Both suggested this as an alternative to cuts to disability benefits.

While the chancellor said last September that Labour would not bring in a wealth tax, she did not mention it today - and experts predict we could hear more about this 2% tax on the wealthy in future.

Sarah Coles, head of personal finance at Hargreaves Lansdown, comments: “With the public finances still so tight, the government hasn’t ruled out more tax rises in the autumn Budget, and as the post-Statement debate showed, we can expect the debate on the wealth tax to rumble on.”

According to Coles, there are wealth taxes in countries including Spain, France, Switzerland and Norway. “They all work differently, so there’s no one single structure to follow. In effect, the UK already has taxes on wealth – including CGT and dividend tax when you invest outside an ISA or a pension.

- Ruth Emery, contributing editor

State pension forecast to rise by 4.6% in 2026 - but ‘bizarre tax cliff edge’ looms

The full new state pension of £11,975 a year – that will come into effect next month – will be just under the tax-free personal allowance (£12,570).

The latest forecasts from the Office for Budget Responsibility, released alongside the Spring Statement, suggest the state pension will rise by 4.6% next year under the triple lock, taking it to £12,569.85 a year – just 15 pence below the tax-free allowance.

Jon Greer at the wealth manager Quilter, comments: “The OBR’s latest forecasts confirm we are fast approaching a bizarre tax cliff edge for pensioners.

“What was intended as a mechanism to protect pensioners from poverty is now colliding with fiscal drag. This situation is the result of the triple lock producing some significant increases in the state pension due to high inflation and earning figures while the government has failed to uprate tax thresholds in tandem.”

The OBR predicts the state pension will then rise by 2.5% in 2027/28, taking the full new state pension to £12,885.50 a year – busting the personal allowance by £315.50.

- Ruth Emery, contributing editor