Trump eyes private foundations to raise tax. Will philanthropy decline?

The picture is mixed, but philanthropy on the whole is alive and well, says Simon Wilson

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What’s happened?

The world’s largest charitable organisation, the Gates Foundation – which has already spent $100 billion fighting disease and poverty worldwide – announced last month that it will spend another $200 billion in the next 20 years, before shutting up shop and dissolving itself. Bill Gates is part of a mini-trend of mega-wealthy donors setting deadlines to give away all their money – speeding up the spending and prioritising immediate action over an ongoing legacy. Billionaire Chuck Feeney used his charitable vehicle Atlantic Philanthropies to give away everything (about $8 billion) before he died in 2023. Laurene Powell Jobs, the founder of Emerson Collective, started her climate-focused non-profit Waverley Street Foundation with $3.5 billion and a deadline of a decade to give it all away.

What exactly is a “foundation”?

For more than a century, the main model of billionaire philanthropy in the US has been the private foundation – from John D. Rockefeller and Andrew Carnegie to Bill Gates. In return for exemption from federal income taxes, charitable foundations must spend an average of 5% of their assets each year for charitable purposes – including donations to colleges and religious institutions that are already wealthy, as well as to people or communities suffering hardship or disadvantage. That foundation model is under growing strain, however: the Trump administration sees this pool of money – currently an estimated $1.6 trillion – as a tax-raising opportunity, and a chance to put supposedly “liberal” billionaires such as Bill Gates and George Soros in their place.

What’s Donald Trump got planned?

As part of the US president’s “big, beautiful” $4 trillion budget bill, the federal government plans to impose a 10% levy on the investment income of foundations with more than $5 billion in assets, up from 1.39% now (and 5% on those with assets of more than $250 million). That poses a big threat to the US philanthropy industry, “even as it is playing an increasingly vital role in filling the void left by the state’s retreat”, says Sun Yu in the Financial Times. If passed (as expected), the bill is set to accelerate the shift from the foundation model towards limited liability companies and “donor-advised funds”, offering fewer tax breaks, but potentially more flexibility to donors. For example, the Gates Foundation had $7.3 billion of investment income in 2023, and the new tax rate would see its liability jump from about $101 million to $726 million. Meanwhile, the Trump administration’s hostility towards the sector has “put pressure on donors to make big gifts now, both to beat any new rules and to advertise the benefits of philanthropy”, says The Economist. In the meantime, donors and charities in some sectors are bracing for politically motivated executive orders – blocking grants to projects abroad, for example, or new rules directing that environmental causes don’t count as charitable giving for tax purposes.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Is philanthropy a force for good?

Not everyone thinks so. There’s a longstanding strain of academic thought which holds that “institutional philanthropy” – big giving by corporations and foundations – is worryingly unbalanced, favouring sectors of society that are already well-off and thereby perpetuating inequality. Big givers typically donate to established colleges, hospitals and cultural organisations, rather than, say, vulnerable children, the poor, minorities and the disabled. Moreover, the very wealthiest individuals have the most unbalanced pattern of giving of all (Bill Gates being a notable counter-example).

Are philanthropic donations going down?

Broadly speaking, philanthropic giving has grown strongly since the turn of the century. But it has slowed down – and may have gone into reverse – since the pandemic, the post-pandemic inflation shock and the cost of living crisis.

In the US, overall giving has grown by about 42% since 2003, according to the annual Giving USA report. However, the $557 billion Americans gave to charity in 2023 marked a 2.1% decline from the previous year in inflation-adjusted terms (although it’s still higher than in 2019, pre-pandemic). Moreover, the share of Americans who give to charitable causes has fallen sharply from 66.2% of all adults in 2000 to 45.8% in 2020. Fewer people can afford to give, but those who do give considerably more than they used to.

Here in the UK, overall donations to charity from FTSE-100 firms have declined 34% in real terms over the past decade. Outside the FTSE 100, three-quarters of UK businesses did not support charities at all in 2023.

What about personal giving?

Personal donations from the public are holding up well (around £14 billion was given to charities in 2023, up 10% on the year before), but – as in the US – the number of donors is falling steadily (from 69% of people in 2016 to 58% in 2023).

The list of top donors, as assessed by The Sunday Times, is dominated by hedge-funders. Suneil Setiya and his business partner Greg Skinner, the famously private founders of Quadrature Capital, are worth an estimated £980 million each, and last year they gave away almost 14% of their joint wealth – more than £5 million a week – to causes including the Arctic Basecamp, the African Climate Foundation, and the World Wide Fund for Nature. In terms of donations as a proportion of their wealth, that puts them at the top of The Sunday Times’ “Giving List”.

Who else gives a lot?

Veteran hedge-fund philanthropist Chris Hohn remains Britain’s most charitable person, giving away £983 million, or 12% of his wealth in the past year.

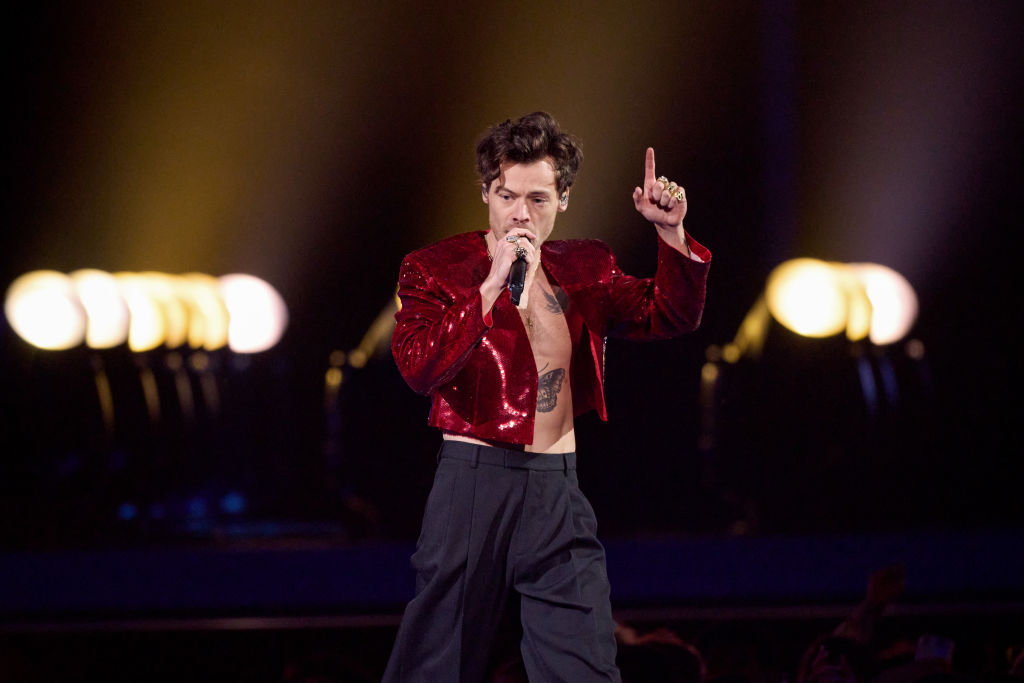

Famous names on the newspaper’s list include Elton John, who gave away £26.5 million, and Harry Styles, who donated £5.2 million to causes including Save The Children. As a proportion of his overall wealth – 2.3% – this makes the ex- One Direction star the 15th most-generous donor in the country.

Overall, for the first time in three years, donations by the top 100 have risen, by £498 million, with total donations rising to £3.731 billion. Reports of the death of philanthropy may have been exaggerated.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

"Botched" Brexit: should Britain rejoin the EU?

"Botched" Brexit: should Britain rejoin the EU?Brexit did not go perfectly nor disastrously. It’s not worth continuing the fight over the issue, says Julian Jessop

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Tony Blair's terrible legacy sees Britain still suffering

Tony Blair's terrible legacy sees Britain still sufferingOpinion Max King highlights ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

How Canada's Mark Carney is taking on Donald Trump

How Canada's Mark Carney is taking on Donald TrumpCanada has been in Donald Trump’s crosshairs ever since he took power and, under PM Mark Carney, is seeking strategies to cope and thrive. How’s he doing?

-

Long live Dollyism! Why Dolly Parton is an example to us all

Long live Dollyism! Why Dolly Parton is an example to us allDolly Parton has a good brain for business and a talent for avoiding politics and navigating the culture wars. We could do worse than follow her example