The Brussels effect – how the EU is raising standards around the world

EU standards and consumer protection regulations have a habit of being enforced globally. Why is that? And is it such a bad thing?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

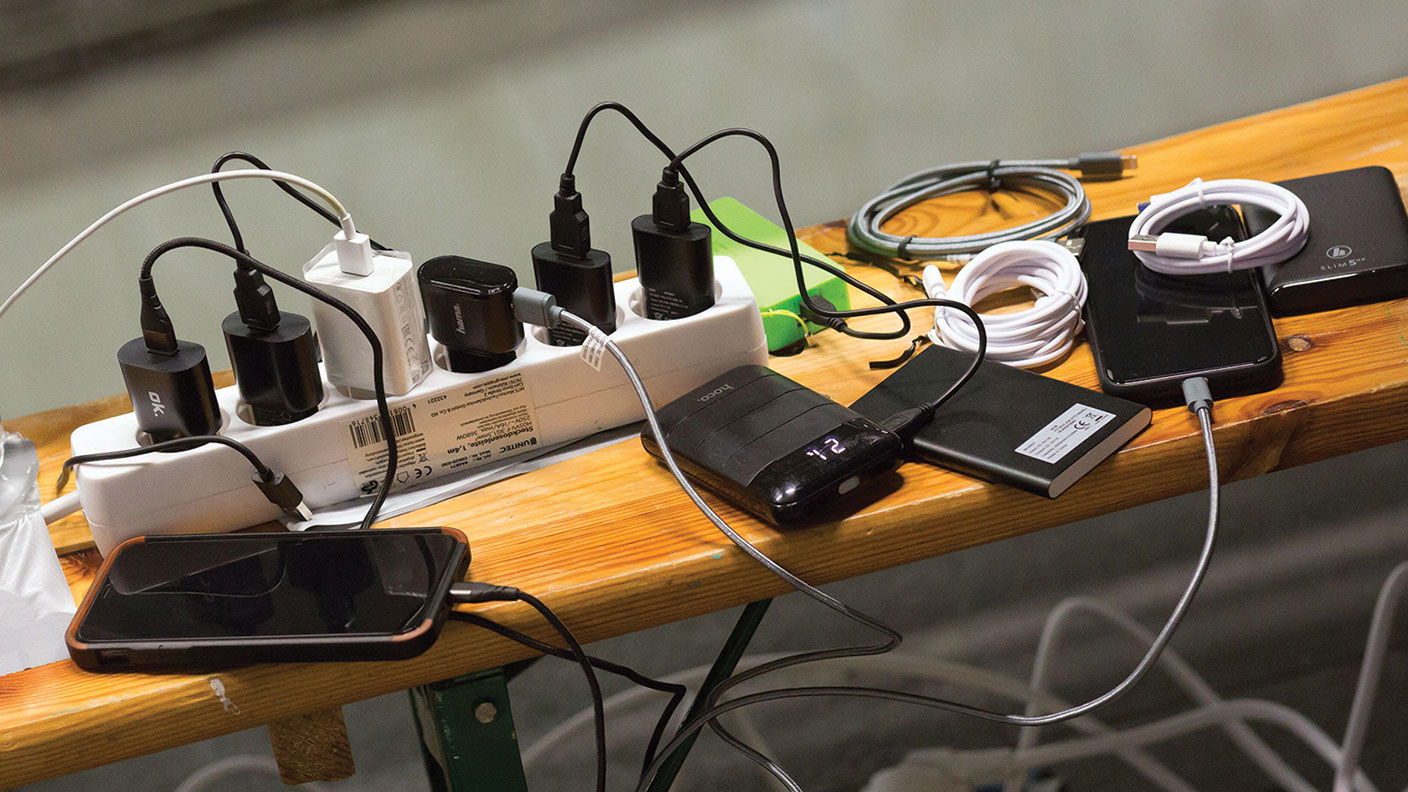

The European Commission has announced new rules covering mobile phones and several other kinds of consumer electronics goods that mean products sold in the EU will have to be fitted with a standard USB type-C charging port.

The new rule (assuming it is signed off by the European Parliament and European Council) will take effect from the autumn of 2024 and will initially apply to “small and medium-sized portable electronics”, including tablets, headphones and headsets, handheld videogame consoles, e-readers and portable speakers, as well as mobile phones.

Laptop computers will also be included, but manufacturers are being given longer to make the necessary changes: 40 months from when the changes get approved, which is expected to be this autumn.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What’s the idea?

The changes mean that in future consumers will only need a single, separately sold charger to power all kinds of products from all the different manufacturers – saving them money and hassle and cutting waste.

The idea, according to the EU, is to “make products in the EU more sustainable, to reduce electronic waste, and make consumers’ lives easier”. The EU calculates that the measure will save consumers “up to €250m a year on unnecessary charger purchases” and eliminate 11,000 tonnes of waste per year.

The biggest loser is Apple; the US giant already uses USB-C charging on its laptops and a handful of iPad models, but its iPhones and less expensive tablets use its proprietary Lightning ports and chargers, which will no longer be acceptable in the EU.

What will Apple do?

When the plan was first floated last September, Apple claimed that regulation mandating just one type of connector would “stifle innovation” and harm consumers. In practice, though, it will have to comply – and work out whether it’s worth making separate models for the EU and non-EU markets.

“I think the most likely outcome here is that Apple will shift the iPhone to USB-C globally rather than manufacture two slightly different designs,” Aaron Perzanowski, law professor at Case Western Reserve University, told The Washington Post. “If that’s right, it’s another powerful illustration of the Brussels effect, and one that has broader implications,” he said.

What is the “Brussels effect”?

It’s the term coined by Anu Bradford, an American professor of international trade law, to describe the way in which the EU has quietly become a global regulatory superpower – with rules governing everything from timber production in Indonesia to internet privacy in Latin America.

The EU manages to wield disproportionate global influence by making access to its market of roughly 450 million consumers conditional on compliance with its standards – which are typically more stringent than other jurisdictions, and aimed at facilitating interoperability and free trade across the 27-nation bloc.

Companies adopt the standards as the price of selling into the huge EU market, and then often choose to impose them across their global businesses to save on the costs of running two or more compliance regimes. Sometimes, though not always, these rules are then codified by non-EU governments or international organisations.

For example?

Bradford’s 2020 book, The Brussels Effect, traces the phenomenon back to the early 2000s and the chemicals regulation regime known as Reach. Other major areas are food safety and environmental stewardship. But the biggest recent example was in the field of data privacy and regulation, where the EU’s GDPR rules have been widely adopted around the world.

Tech giants such as Facebook and Google have adapted their business models to suit the new standards stemming from the EU Digital Market Act, drastically cutting their options for monetising consumer data, says economist Renaud Foucart on The Conversation. “Companies are not obliged to apply EU law globally, they often simply find it easier to do so.”

What sectors are next?

In the field of technology, the EU’s explicit mission is to “protect EU values and counter external dependencies and threats from artificial intelligence and hacking” by dominating standards. But the Brussels effect also extends to more mundane and tangible fields such as clothes and furniture.

Last month, for example, EU regulators announced proposals for new textiles regulations that would have a massive impact on the global industry by, in effect, declaring war on the “fast fashion” culture of cheap, throwaway garments. The EU Strategy for Sustainable and Circular Textiles would force companies selling in the EU to comply with rules governing everything from how long a garment lasts, to how much recycled yarn it contains.

Will this “effect” last?

The EU’s regulatory dominance is a relatively recent affair, says The Economist, and there are reasons to doubt its permanence.

First, its share of the global economy is likely to fall in the coming decades, cutting the world’s incentive to follow Europe’s rules. Second, in some contexts, technological innovations – such as 3D printing – could cut the costs of abiding by both European and other standards. Moreover, in some areas, “high standards may become a curse, rather than a virtue”. For example, in the AI field, companies under sketchier regulatory regimes “may build an insurmountable lead via unethical experimentation”.

One day the Brussels effect may be replaced by the Beijing effect, but the shift looks some way off. “Countries are increasingly forced to pick a sphere of influence. When the other choices are an erratic America and an undemocratic China, the EU has something to offer.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?

-

No peace dividend in Trump's Ukraine plan

No peace dividend in Trump's Ukraine planOpinion An end to fighting in Ukraine will hurt defence shares in the short term, but the boom is likely to continue given US isolationism, says Matthew Lynn

-

Europe’s new single stock market is no panacea

Europe’s new single stock market is no panaceaOpinion It is hard to see how a single European stock exchange will fix anything. Friedrich Merz is trying his hand at a failed strategy, says Matthew Lynn

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon