Semiconductor shortage: industry heads for “supersize bust”

The semiconductor shortage could soon become a semiconductor glut as demand for electronic gadgets falls while state subsidies could mean a surplus of supply.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“Chipmakers are the coalface of the modern economy,” says Cormac Mullen on Bloomberg. Demand for semiconductors is a good “leading indicator” for stockmarkets and the economy.

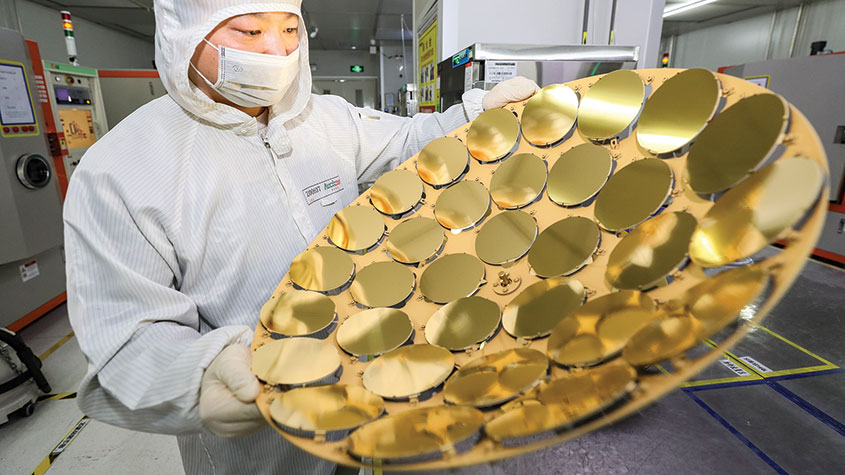

The industry is heading for a slump, say Debby Wu, Jeran Wittenstein and Ian King, also on Bloomberg. The global shortage of chips that started during the pandemic is not over yet – average wait times were 27 weeks in June, up from less than 15 weeks pre-pandemic – but the cycle has clearly started to turn.

The PHLX Semiconductor index, which tracks the industry’s leading lights, gained 43% in 2021, but has fallen 24% since the start of this year. “Disastrous” second-quarter results from Intel and a revenue warning from graphics-card specialist Nvidia show a market that is “rapidly weakening”, says Dan Gallagher in The Wall Street Journal.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Demand for PCs and smartphones has dropped this year: many consumers bought new gadgets during lockdown and don’t feel the need to upgrade. But more worrying is a warning from memory-chip business Micron that demand from big names in the cloud-computing and car industries is also starting to weaken.

Huge state subsidies in the US, Europe and Asia are likely to push the chip industry into long-term overcapacity, says The Economist. Last year’s shortages have convinced leaders that chipmaking is too important to be done overseas in unfriendly countries.

Not that the industry needed government help to overbuild: Intel, Samsung and Taiwanese giant TSMC jointly “invested $92bn…last year”. Some 58 new “fabs” – as semiconductor plants are called – “are scheduled to open between 2022 and 2024”, raising global capacity by about 40%. When that supply comes online, the chipmakers could be heading for “a supersize bust”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.