Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

In this week’s MoneyWeek magazine, we’re concentrating on inflation. Merryn talks to the Bank of England’s outgoing chief economist, Andy Haldane, who explains why price rises might prove rather more stubborn than many people think. We’ve also got a feature on how to buy into emerging markets – notoriously difficult – by using UK stocks as a proxy. If you’re not already a subscriber, sign up now.

This week’s “Too Embarrassed To Ask” looks at “zombie companies” - a term you may well have heard in this low-interest-rate environment. You can watch that here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We’ve another big hitter on the MoneyWeek Podcast this week. Merryn talks to Jim Mellon, one of our favourite investment gurus. Jim explains what he’s buying – a lot of UK stocks – and why, with plenty of tips for you to investigate. They also talk about Big Tech (and why he’s not buying that), Big Oil (and why he is buying that), plus why Jim believes that the future of meat and dairy production lies not on the farm, but in the lab. Find out everything he has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: The central bank race for digital currencies is hotting up

- Tuesday Money Morning: What will pop the UK's house price bubble?

- Merryn’s blog: Private equity isn’t evil, it’s just doing what traditional investors should be doing

Web article: What the FCA’s “ban” on Binance means for cryptocurrencies - Wednesday Money Morning: Inflation? A Covid relapse? Markets are trying to work out what’s coming next

Web article: Cathie Wood’s ARK Invest to launch bitcoin ETF - Thursday Money Morning: The US dollar is in a bull market. That’s bad news for most assets

- Friday Money Morning: Record M&A activity is usually a toppy sign – what does it mean today?

- Cryptocurrency roundup: Binance “ban” and a bitcoin ETF

Now for the charts of the week.

The charts that matter

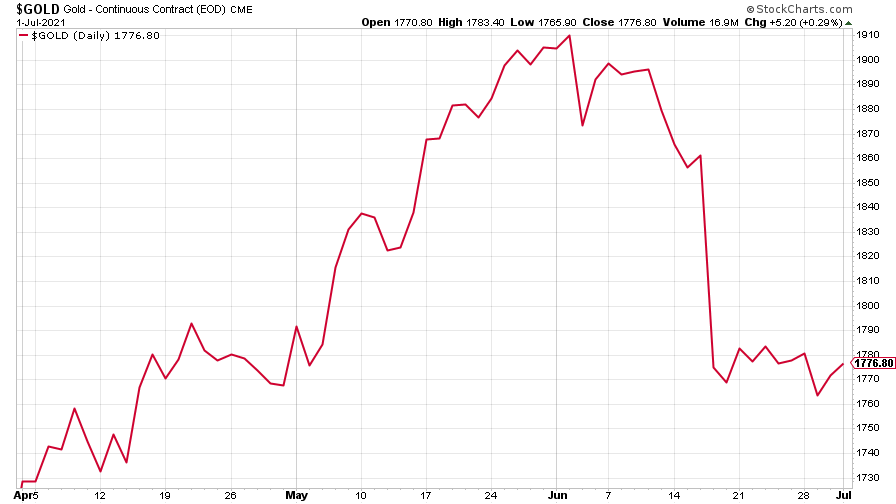

Gold continued to trade in a range.

(Gold: three months)

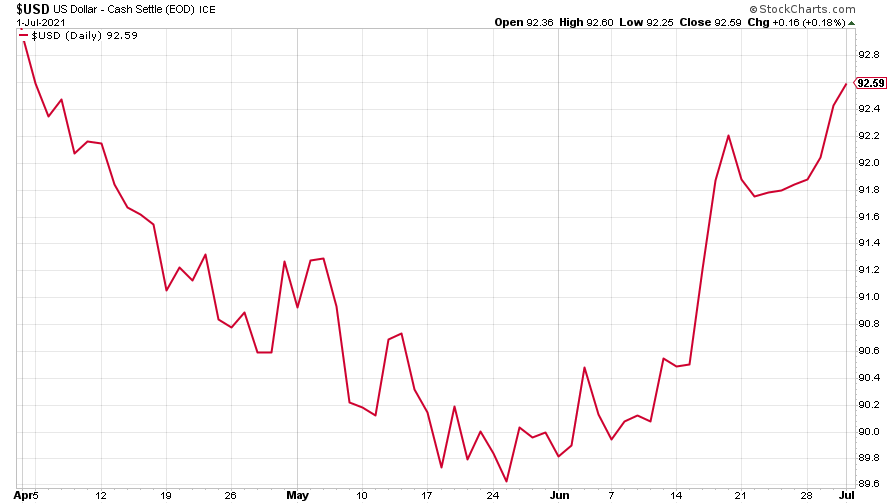

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) perked back up in the latest leg of its bull run. That’s not good for any other assets, says Dominic.

(DXY: three months)

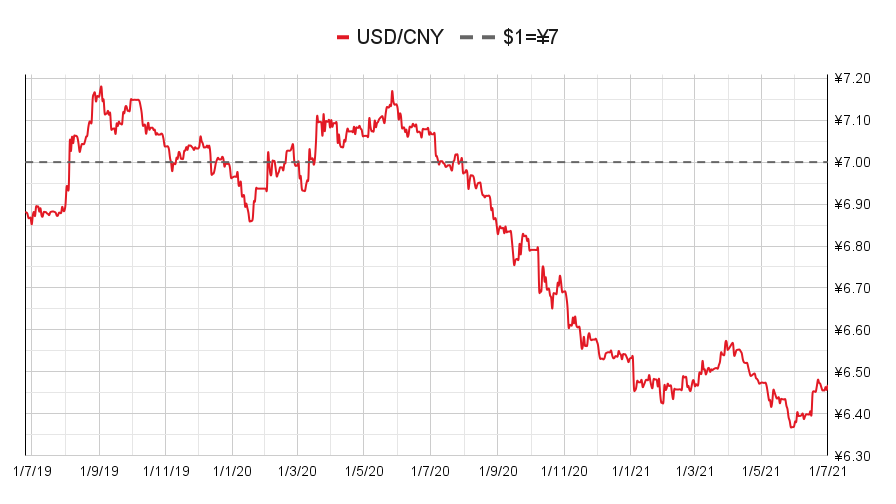

Dollar strength was reflected in the Chinese yuan (or renminbi) – when the red line is rising, the dollar is strengthening while the yuan is weakening.

(Chinese yuan to the US dollar: since 25 Jun 2019)

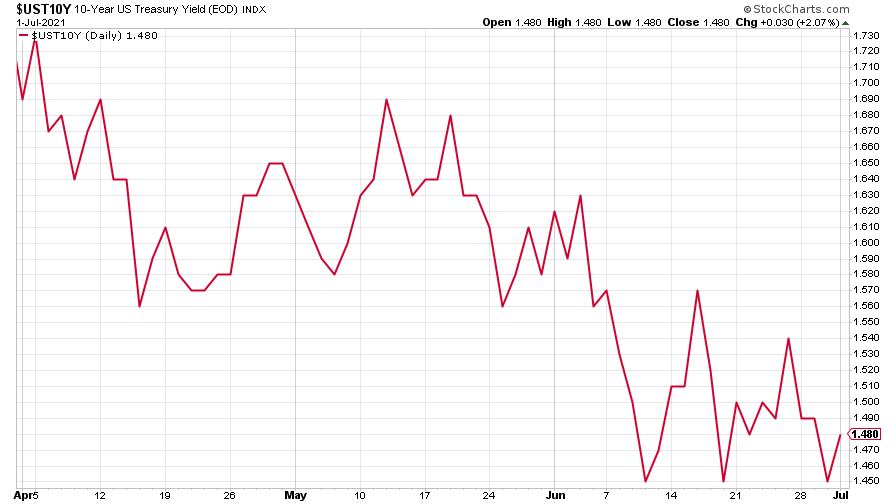

The yield on the ten-year US government bond continued to drift slowly down.

(Ten-year US Treasury yield: three months)

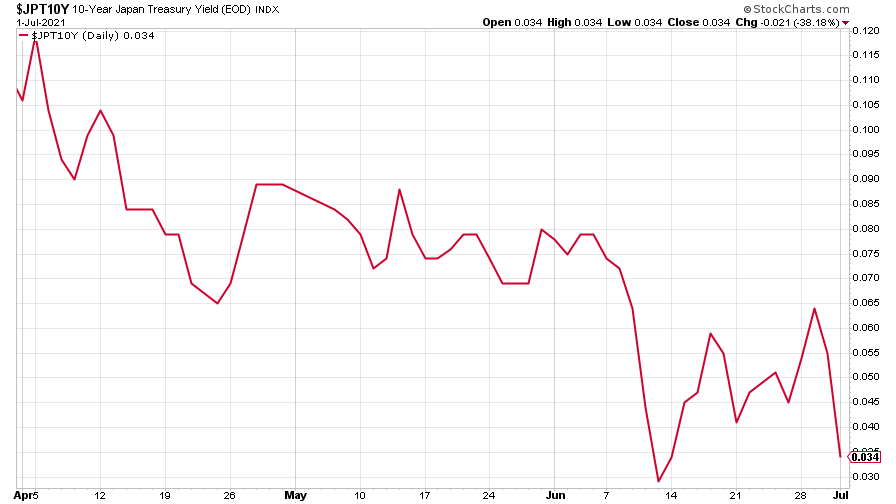

The yield on the Japanese ten-year bond turned sharply down.

(Ten-year Japanese government bond yield: three months)

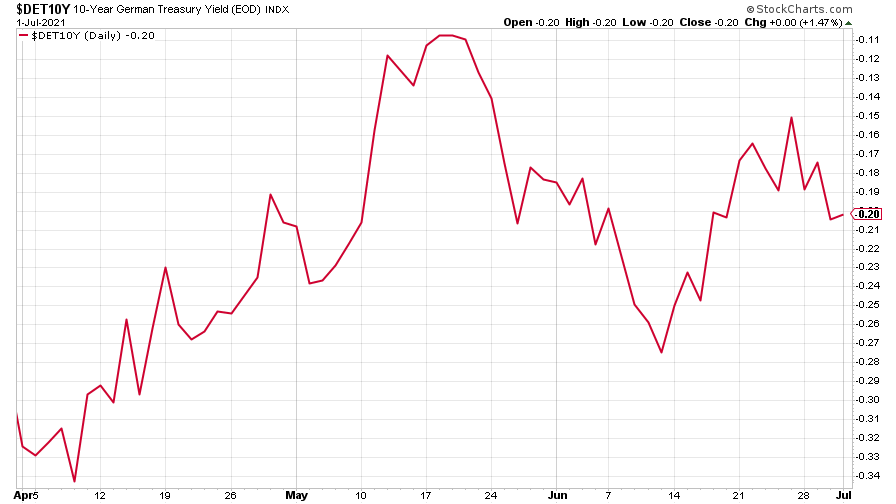

And the yield on the ten-year German Bund slipped, too.

(Ten-year Bund yield: three months)

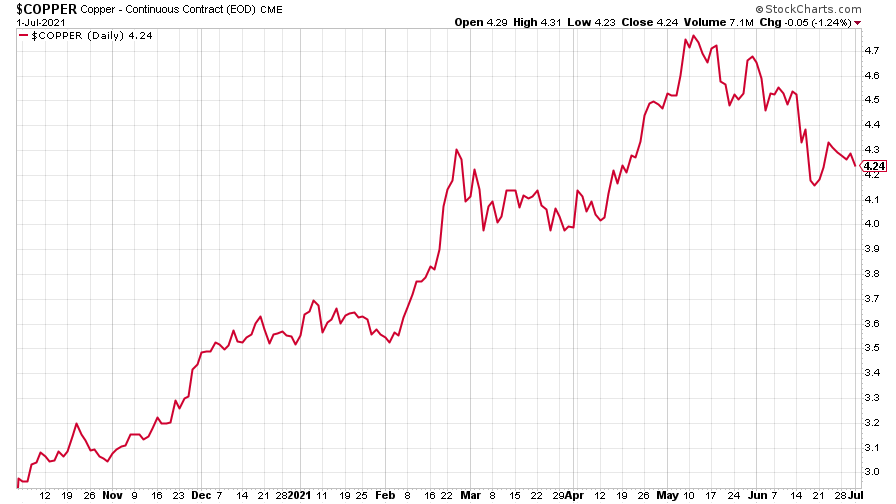

Copper continued to slip, reflecting broader commodity-price weakness (oil excepted).

(Copper: nine months)

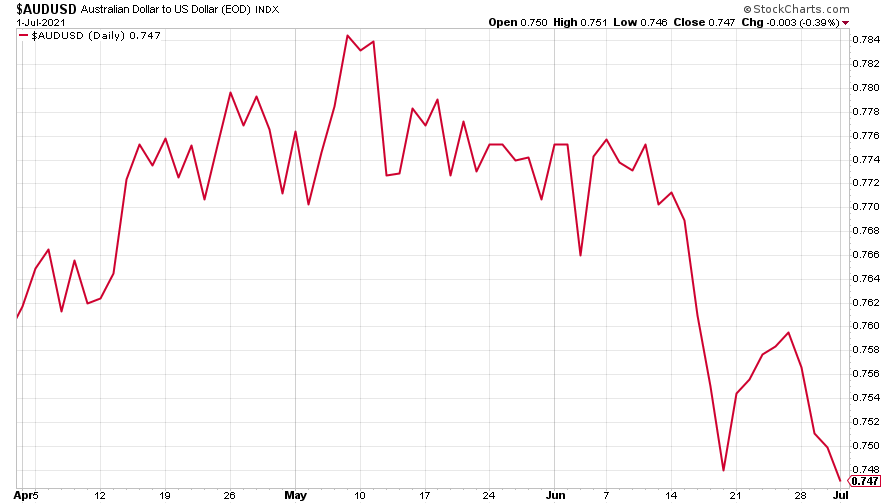

The closely-related Aussie dollar followed copper down.

(Aussie dollar vs US dollar exchange rate: three months)

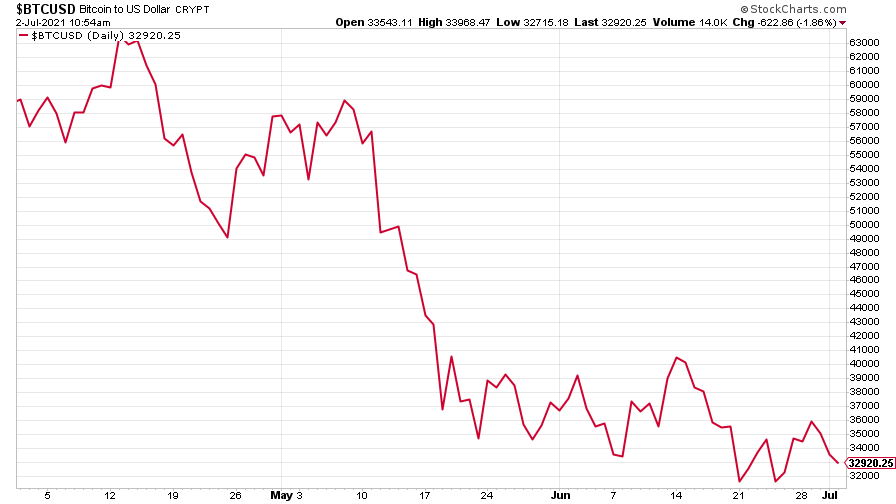

Bitcoin continued to slip lower. Regulators are cracking down, says Saloni, which could dent the price further.

(Bitcoin: three months)

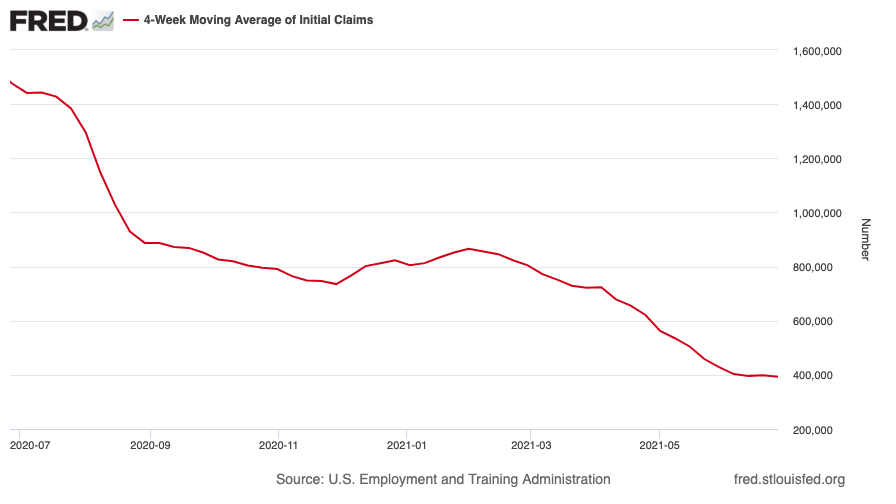

US weekly initial jobless claims fell by 51,000 to 364,000, the lowest since 14 March 2020. The four-week moving average fell by 6,000 to 392,750.

(US initial jobless claims, four-week moving average: since Jan 2020)

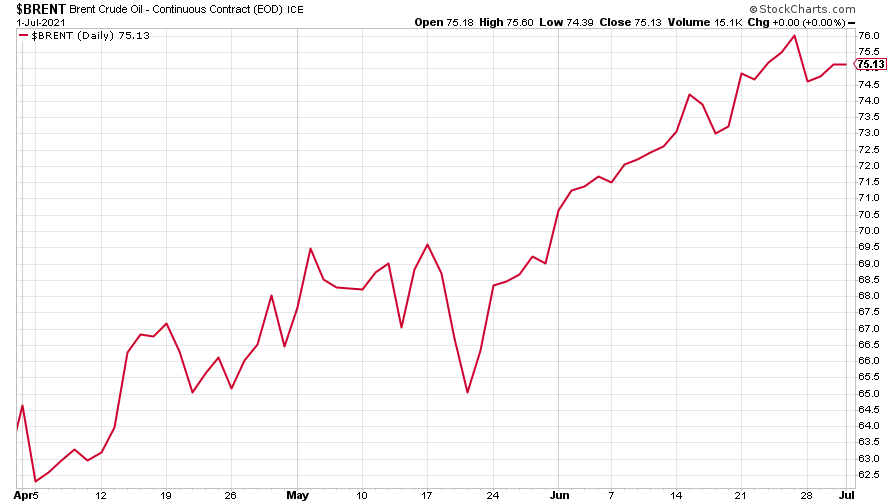

The oil price wavered a little, but its bull run is intact.

(Brent crude oil: three months)

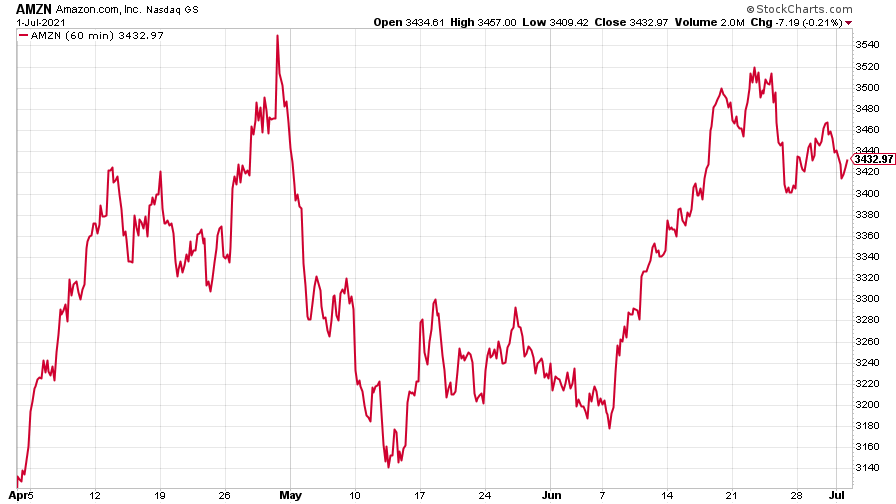

Amazon slipped further.

(Amazon: three months)

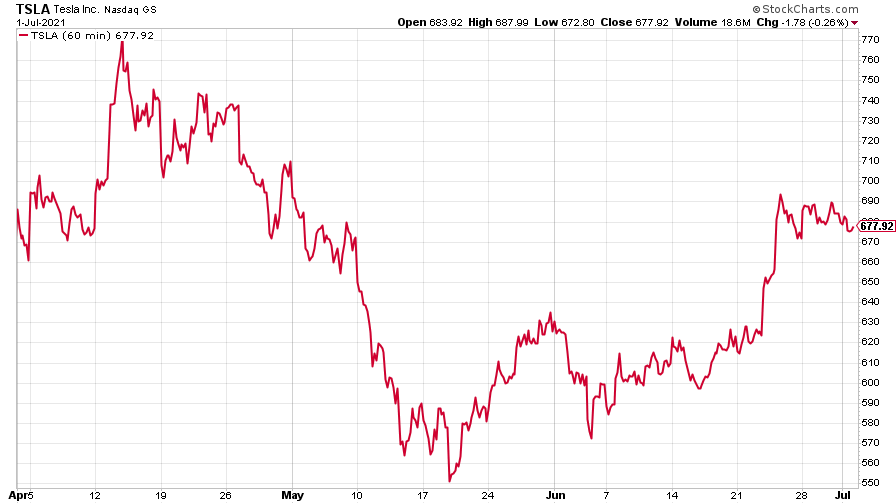

But Tesla held on to its previous week’s gains.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why Scotland's proposed government bonds are a terrible investment

Why Scotland's proposed government bonds are a terrible investmentOpinion Politicians in Scotland pushing for “kilts” think it will strengthen the case for independence and boost financial credibility. It's more likely to backfire

-

How have central banks evolved in the last century – and are they still fit for purpose?

How have central banks evolved in the last century – and are they still fit for purpose?The rise to power and dominance of the central banks has been a key theme in MoneyWeek in its 25 years. Has their rule been benign?

-

UK to have highest inflation among advanced economies this year and next, says IMF

UK to have highest inflation among advanced economies this year and next, says IMFThe International Monetary Fund (IMF) says it expects inflation to remain high in the UK, while lowering economic growth forecasts for 2026.

-

Is Britain heading for a big debt crisis?

Is Britain heading for a big debt crisis?Opinion Things are not yet as bad as some reports have claimed. But they sure aren’t rosy either, says Julian Jessop

-

'Britain is on the road to nowhere under Labour'

'Britain is on the road to nowhere under Labour'Opinion Britain's economy will shake off its torpor and grow robustly, but not under Keir Starmer's leadership, says Max King

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Why investors can no longer trust traditional statistical indicators

Why investors can no longer trust traditional statistical indicatorsOpinion The statistical indicators and data investors have relied on for decades are no longer fit for purpose. It's time to move on, says Helen Thomas

-

Live: Bank of England holds UK interest rates at 4.5%

Live: Bank of England holds UK interest rates at 4.5%The Bank of England voted to hold UK interest rates at their current level of 4.5% in March, as widely anticipated, after inflation rose to 3% in January