Interest rates summary

- The Bank of England has voted to keep interest rates on hold at 4.75%.

- The result is in line with expectations. Analysts had pretty much ruled a cut out after measures announced in the Autumn Budget were deemed inflationary.

- Inflation also ticked up in November to 2.6%, and wage growth accelerated to 5.2% in the latest report.

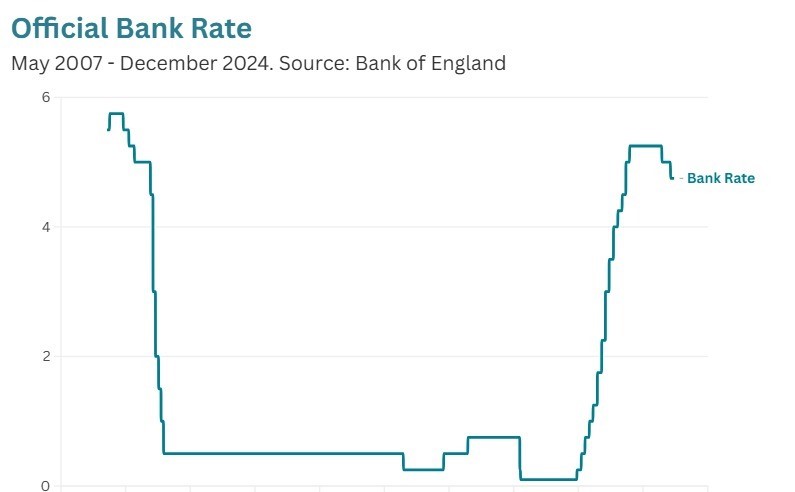

- So far this year, the Bank of England has cut interest rates twice from a peak of 5.25%.

- The TUC called for an interest rate cut ahead of the announcement, saying "the economy is still fragile".

- The US Federal Reserve cut interest rates overnight, but markets have fallen since in response to hawkish rhetoric.

Scroll for full coverage and analysis from the team at MoneyWeek.

Latest Bank of England predictions | MPC meeting dates | Live inflation updates

Good afternoon, and welcome to MoneyWeek’s interest rates live blog. We’ll be covering everything you need to know about Thursday’s Bank of England policy meeting, before and after the headline announcement.

If you haven’t already, make sure you visit MoneyWeek’s inflation report live blog for the key economic background to Thursday’s meeting. The headline: UK inflation rose to 2.6% in November, its highest level since March.

Interest rate expectations

Given the increase in inflation, alongside stronger-than-expected wage growth and the anticipated inflationary effects of the Autumn Budget kicking in next year, experts think it is unlikely that the Bank will lower interest rates at its December meeting.

“We don’t expect a cut this week,” says James Smith, developed markets economist at ING, “but better underlying inflation data could unlock faster easing in the spring.”

Similarly, Morningstar’s survey of FactSet analyst expectations suggests that the Bank is likely to hold rates steady at 4.75%.

More bad news for house buyers

Assuming interest rates do remain where they are, Sarah Coles, head of personal finance at Hargreaves Lansdown, says it’s “more bad news for [house] buyers” who are “faced with record-high prices and relatively high mortgage rates that show no sign of significant easing”.

It also complicates the picture for anyone in the market for a remortgage. “With some uncertainties remaining about the trajectory of rates and inflation, it may be worth locking in a rate as soon as you can,” says Coles. “That way if rates fall, you can shop around, and if they’re higher when your remortgage rolls around, you’ll have secured a better rate.”

Could the UK fall behind?

Interest rates in the UK are already higher than in other major economies. While the UK is currently in line with the US, the Federal Reserve is expected to lower interest rates by 25 basis points when it meets today.

Meanwhile, the European Central Bank lowered interest rates to 3.15% last week. Assuming the Bank of England keeps rates at 4.75% tomorrow, it could start to look like an outlier.

“The UK appears to be falling behind other central banks as they continue to lower the cost of borrowing,” says Tom Stevenson, investment director at Fidelity International.

While politicians will be desperate for interest rates to fall in order to stimulate economic activity, “the Bank of England will feel less inclined to add to its rate cuts” in light of today’s inflation reading.

How significant is November’s inflation reading?

Much is being made of the uptick in the CPI reading between October and November, and while it is one more reason why the Bank may hold rates as they stand tomorrow, one economist thinks it’s a relatively minor point.

George Lagarias, chief economist at Forvis Mazars, points out that prices only increased 0.1% month-over-month in November. The 2.6% figure is, he suggests, “slightly misleading” – prices rose six times as fast during October, month-over-month.

“The Bank of England should not worry about this month's inflation number,” he suggests. “Instead, it should look forward into 2025, to trade wars, the Chinese economy and US pro-cyclical policy to gauge how inflation might develop in the new year and adjust monetary policy accordingly.”

Why might the BoE be hesitant to cut rates?

There have already been two rates cuts from the Bank of England this year, and while borrowers, politicians and, to some extent, investors will be keen to see further falls, the Bank is likely to be cautious ahead of the New Year given the extent of economic uncertainty.

“The stubbornness of key elements of inflation and the heightened uncertainty surrounding the outlook will prevent the BoE from acting hurriedly around cutting interest rates further,” says Rob Morgan, chief investment analyst at Charles Stanley.

“With wage inflation remaining high, feeding into services costs, and a reacceleration of energy prices, the Bank will be wary of loosening too much too soon.”

Measures included in the Autumn Budget, such as elevated costs to employers through higher National Insurance costs and minimum wage increases, could continue to raise costs in the services sector, says Morgan.

“With two cuts so far this year, in August and at last month’s meeting, the BoE will no doubt feel it’s time to press the pause button again at its final meeting of the year.”

Elsewhere in interest rates

While we’ll have to wait until Thursday for the Bank of England’s interest rates decision, there will be a big announcement across the pond in the meantime.

The Federal Reserve is due to announce its interest rates policy today at 2pm Eastern time – 7pm in the UK.

Markets are anticipating a 25 basis point reduction in the Fed’s headline rate.

“The Fed is widely expected to cut the federal funds rate a quarter-point today, continuing their rate normalization plans in keeping with progress in reducing inflation,” says David Payne, chief economist at Kiplinger, MoneyWeek’s US sister site.

“However, the main story of the 2:30 pm EST press conference will be whether the Fed plans to continue cutting next year, or whether they will hold off given the new Administration's plans for further fiscal easing from tax cuts and possible upward pressure on inflation from tariffs.”

Payne adds that while Fed chair Jerome Powell is unlikely to comment directly on hypotheticals like these, sentiment in the wake of the announcement is likely to be driven by his perceived commitment to heading off inflationary trends.

‘’Investors are eyeing up another expected interest rate cut from the Federal Reserve later but may have to get used to the idea of interest rates descending in more spaced-out steps given the stubbornness of inflation,” says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

To follow events in the US as they unfold, head to Kiplinger’s live Federal Reserve meeting blog.

TUC calls for interest rates cut

While most economists and market experts expect rates to remain unchanged, the Trades Union Congress (TUC) has called on the Bank of England to cut rates tomorrow, following today’s inflation reading.

Despite inflation returning to near target levels faster than many had expected over the past year, “the latest GDP and employment figures show the economy is still fragile and the priority must be turning this around,” says TUC general secretary Paul Nowak.

“So, it’s vital the Bank of England keeps moving and makes another interest rate cut tomorrow."

Thanks for joining us today. That’s all from us this evening, though as above, follow Kiplinger’s blog for live updates from the Federal Reserve’s meeting.

We’ll see you tomorrow morning for further analysis and commentary, ahead of the publication of the MPC’s summary and meeting minutes at midday.

Good morning, and welcome back to MoneyWeek's live interest rates blog. Dan here, ready to take you through this morning's analysis and build-up to the Bank of England's interest rates announcement. As a reminder, that's expected at 12pm today.

The big news overnight: the Federal Reserve cut US interest rates by 25 basis points yesterday, bringing the Fed Funds rate to 4.5%.

However, markets slumped as Fed chair Jerome Powell signalled a slowdown in the Fed's cutting cycle from here. The S&P 500 fell 2.9%, as Powell even hinted the Fed could raise rates next year if it deems it necessary.

There is still a "considerable amount of uncertainty" around the US economy, so the Fed is adopting a cautious stance, says Salman Ahmed, global head of macro and strategic asset allocation at Fidelity International.

FTSE 100 falls ahead of interest rates decision

US market uncertainty has spread to the UK; the FTSE 100 opened below Wednesday’s close this morning, with hopes for a rate cut announcement today fading.

“European markets posted sharp losses in early trading, with the FTSE 100 down 1.1%, tracking a global selloff sparked by the US Federal Reserve’s hawkish shift,” says Matt Britzman, senior equity analyst at Hargreaves Lansdown.

“Closer to home, attention turns to the Bank of England, where rates are widely expected to remain on hold, offering little reprieve to jittery markets.”

What interest rates mean for your finances

As a reminder of why today’s interest rates decision matters, Moneyfactscompare.co.uk have today shared data on how changes to UK interest rates this year have impacted people’s finances.

In brief, the two rates cuts so far this year have been good news for borrowers. The average standard variable rate (SVR) has fallen to 7.85% this month, down from 8.18% at the start of the year. The average 10-year fixed rate mortgage stands at 5.69% this month, up month-over-month but down since the start of the year.

“Cuts to the base rate may also delight borrowers who are stuck on a variable rate deal or are soon to come off their low-rate fixed deal, indeed there are estimated to be millions of borrowers due to refinance in 2025,” says Rachel Springall, finance expert at Moneyfactscompare.co.uk.

Savers, however, have seen their returns fall. The average easy access rate has fallen from 3.15% in January to 2.96% now, while the average notice account rate has fallen from 4.39% to 4.10% over the same period.

“It will be interesting to see how hard savers are hit next year, as several base rate cuts are anticipated if inflation is kept under control,” says Springall.

Is the Bank one step ahead?

Assuming there is no cut to interest rates today, it could be argued that, rather than falling behind, the BoE is in fact out in front of its US counterpart in ending a rates cutting cycle in order to manage persistent inflation.

“The Bank of England seems to be one step ahead of the Fed for once,” says Russ Mould, investment director at AJ Bell. “It’s not expected to cut rates at the meeting today as sticky inflation and rising wages mean it has no reason to loosen monetary policy.”

With expectations of a rates hold fairly baked in at this stage, the focus in the aftermath of its announcement at midday will likely be on the details, specifically the minutes of the Bank’s Monetary Policy Committee meeting and the longer term outlook for inflation and interest rates.

“Like the Fed’s latest announcement, of more importance is any commentary from the Bank of England on where it sees rates going next year,” says Mould.

Breaking: Bank of England holds rates at 4.75%

As expected, the Bank of England has decided against a rate cut today. The devil will, of course, be in the detail. Here’s Katie Williams signing on to bring you all the afternoon’s reaction and analysis.

The decision to hold rates was based on a 6-3 voting split, with three members preferring to cut rates. They included Swati Dhingra, known for her dovish stance, Dave Ramsden and Alan Taylor.

Reeves responds to Bank decision

Chancellor Rachel Reeves has issued the following statement in response to the Bank of England’s interest rate decision:

"I know families are still struggling with high costs. We want to put more money in the pockets of working people, but that is only possible if inflation is stable and I fully back the Bank of England to achieve that.

"Improving living standards across the country is our number one focus, and is why I chose to protect working people’s pay slips from tax rises, froze fuel duty and increased the National Living Wage for three million people."

Bank reiterates its gradual stance

In its summary statement, the Bank of England reiterated a message it has delivered before – one of gradual rate cuts.

"Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further," it said. "The Committee will decide the appropriate degree of monetary policy restrictiveness at each meeting."

"Bank of England risks backing itself into a corner"

Responding to the announcement, one expert said the 6-3 voting split and some "dovish" language in the minutes suggests a February cut is still in play when the Bank holds its first meeting in 2025. But he added that the MPC risks "backing itself into a corner" with stagflation risks on the horizon.

"With inflation likely to drift higher, the timing of future interest rate cuts could become increasingly complex, especially if stagflation fears become reality," said Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales.

"Against this backdrop, rate setters are likely to take baby steps in cutting interest rates over the next year, particularly in the face of growing domestic and international inflation risks," he added.

Where will interest rates go in 2025?

The Bank of England is now in a rate-cutting cycle, after holding rates at a 16-year high of 5.25% for over a year until August. The question now is how fast (and to what extent) rates will fall further in 2025.

Experts have dialled back their expectations in the wake of the Autumn Budget. Services inflation also remains high. This is a key area of focus for the Bank of England, as the services sector accounts for around 80% of the UK economy. The MPC wants to see further evidence that domestic inflationary pressures are abating.

"The outlook for rates has changed meaningfully over the past few weeks with markets pricing in roughly one fewer rate cuts over the next 12 months than had been the case a month ago," said Ed Monk, associate director at Fidelity International.

"Inflation has proved more difficult to shift, with the official rate creeping back to 2.6% and ending the year higher than the Bank had been forecasting. Further increases are expected in the first half of 2025," he added.

What does it mean for mortgage rates?

Prospective first-time buyers and those about to refix their mortgage may be disappointed that rates were kept on hold today. However, it's worth pointing out that the decision was widely expected and priced into markets in advance.

Indeed, the real movement was in the aftermath of the Budget at the end of October and start of November, as the market priced in a "higher for longer" inflation and interest rates scenario. Mortgage rates have since fallen back somewhat.

"Today’s decision to hold is no surprise but borrowers hoping to see more positive movement next year will be buoyed by the three votes for a cut this month," says David Hollingworth, associate director at L&C Mortgages. "Markets are anticipating that stubborn inflation may hold back the pace of those cuts, which has knocked on into fixed-rate pricing."

He adds: "I expect mortgage lenders to be quick out of the blocks in January and to continue to price as sharply as possible, but the Bank has been consistent in its tone, suggesting the likely pace of rate cutting will be gradual."

What is stagflation – and are we heading towards it?

With inflation inching up and growth slowing down, commentators have started to utter the dreaded s-word – stagflation. This can be defined as an environment of high inflation, stagnant growth and high unemployment.

"It must be said there is currently a high degree of uncertainty over the future course of inflation, in part driven by a question mark over how much of Donald Trump’s rhetoric is going to find its way into policy, especially in terms of trade tariffs," said Laith Khalaf, head of investment analysis at AJ Bell.

"No-one is expecting inflation to rise to double digits again, but sticky inflation still limits the capacity of the Bank of England to cut rates, even if it is only modestly above target. That’s going to keep borrowing costs elevated for companies, dampening the prospects for economic growth," he added.

How have markets reacted to the base rate decision?

Although the decision was widely expected, markets have reacted negatively. "The FTSE 100 stayed deep in the red, while the pound started to slide again against the dollar, trading at $1.26," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Cuts in February?

One of the key lines from the Monetary Policy Committee’s meeting notes is the guidance that “a gradual approach to removing monetary policy restraint remains appropriate”.

In itself, this is slightly unusual.

“Cutting cycles are usually quick and meaningful,” says James Lynch, investment manager at Aegon Asset Management. “When central banks need to cut interest rates, it’s usually because there is a real problem somewhere in the economy (or in financial markets that might spill over to the economy).”

Absent such a problem, the Bank is taking its time cutting rates.

However, as indicated by the three MPC members who voted for a rates cut, ”there is still a sense that they see policy rates as a bit too high, and in the meantime 25 basis points every three meetings seems to be enough.”

As such, says Lynch, “we would expect the next move to 4.50% in February”.

On the other hand...

Markets are pricing in just two price cuts next year, according to Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“The Bank of England is ringing in the same discordant notes of caution as the Federal Reserve,” she says, adding that central banks “remain cautious about inflationary risks ahead - fresh tariffs from Trump are looming and in the UK the effects of the Budget changes on prices are still hard to calculate."

Even if the Bank remains on a cutting trajectory, it will proceed at a reduced speed.

This could be good news for anyone in the market for an annuity, according to Streeter.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, says that a gradual cutting cycle would be “good news for the annuity market as this will help incomes remain steady.

“The latest data from HL’s annuity search engine shows a 65-year-old with a £100,000 pension can get up to £7,281 per year from a single life level annuity with a five-year guarantee,” she adds. “This is not much lower than the £7,586 top rate available in the aftermath of the mini-Budget, so annuities are still offering great value for money and will prove a tempting prospect for people on the hunt for a guaranteed income in retirement.”

That's all from us today. Thanks for following our live blog, and we look forward to joining you again for the next Bank of England interest rates meeting.