What will pop the UK's house price bubble?

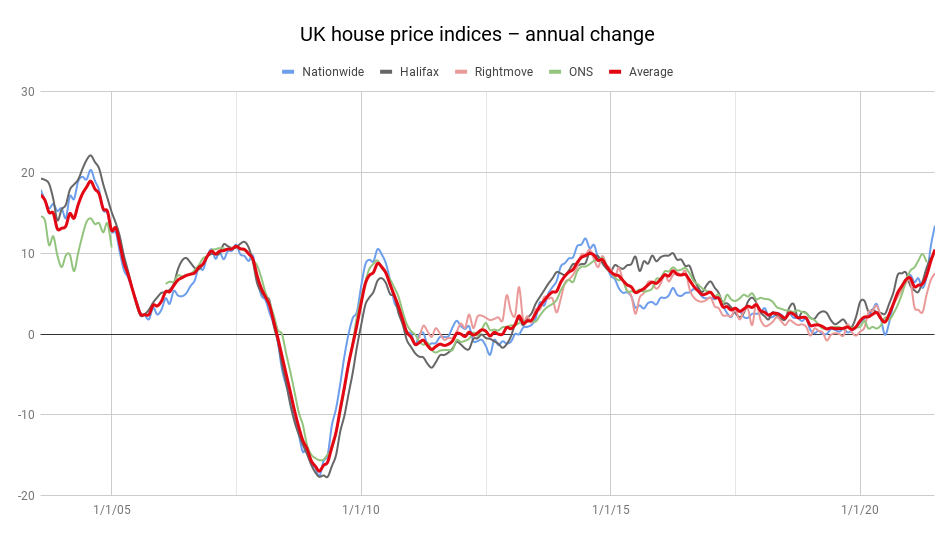

UK house prices are rising at their fastest rate since 2004. And there’s just one thing that can burst the bubble. John Stepek explains what it is.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Annual house price growth hit 13.4% last month, according to Nationwide figures.

That’s a horrible statistic for any would-be first-time buyer to read, and if you’re in that position, I sympathise.

I’d like to be able to tell you that relief is on the horizon.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Unfortunately, I don’t think it is.

The end of the stamp duty holiday isn’t going to bring any relief

The latest surge in annual house price growth – to the highest level since November 2004, slap bang in the middle of the last house price bubble – is admittedly not quite as wild as it looks.

June last year was, as Nationwide’s chief economist Robert Gardner puts it, “unusually weak”. House prices actually dipped that month, because we were all in ultra-lockdown as opposed to the rolling pseudo-lockdown we’re stuck in to various extents right now.

There were no vaccines then. Lots of people thought there wouldn’t be vaccines for at least five years. And back then, some of us even imagined that house prices might drop because of the pandemic.

Needless to say, that’s not what happened. Prices have risen every month in the past five, according to Nationwide.

So while the 13.4% rise in prices has been a little exaggerated due to the “base” effect of being by comparison to a very weak month last year, that’s really very little consolation for anyone who doesn’t think that it’s healthy economically or socially for the cost of a basic human need to be rising at such a rapid rate.

Is anything going to change this any time soon? The most obvious crumb of comfort on the horizon is the end of the stamp duty holiday (though it’s already ended in Scotland), which many blame for pouring fuel on the fire.

It’s almost certainly true that the stamp duty holiday has pulled forward transactions that would otherwise have happened later in the year. That in turn means an artificial surge in demand without a corresponding artificial surge in supply.

Also sellers aren’t daft. They know a stamp duty holiday means they can bump their own sale price up at least a little. If the buyer doesn’t have to pay a big cash lump sum in stamp duty, it means they can afford to borrow more to buy the actual house. Hence at least some if not all of the stamp duty savings accrue to the sellers and their agents, not to the buyer.

So there’s no doubt that a stamp duty holiday is going to boost house prices, all else being equal.

So you might be hoping that as it ends or becomes less generous (depending on which part of the UK you are in), that prices might calm down a little.

What will end the house price bubble – inflation

Unfortunately, the end of the stamp duty holiday is not going to put an end to all this. As Andrew Wishart of Capital Economics points out: “The tax break is just one of a laundry list of factors behind the surge in house prices over the past year.”

What do those include? We’ve been through it before but the list includes low interest rates; rising mortgage availability; a pent-up desire to move after the lockdown; and an added desire to move as people adjust to new working patterns.

Now the last two things are possibly temporary factors. But I can see it taking a while to settle down. And in any case, they’re not really the fundamental driving force behind the rising prices.

Yes, you’ve arguably got an outflow of money from expensive (ie commuter belt) areas to less expensive (ie previously non-commuter belt) ones which probably means you have a wave of slightly less price sensitive buyers than before.

But the real issue – as always with houses – is the supply of credit to the market. And that shows no sign of seizing up.

Wishart argues that house prices will likely “moderate” rather than crash, and on an annualised basis that’s probably reasonable, given that for the rest of the year, the comparators will be tougher. (In other words, the year-on-year figure won’t be compared with weak months).

Also it’s worth noting that affordability – as measured by the Nationwide – is now very close to where it was at the peak of the last bubble in 2007. Does that mean the bubble will pop?

As far as I can see, there’s only one way it happens. I don’t think we’re going to get a repeat of 2008 anytime soon.

So until inflation takes off and the Bank of England and credit markets respond by tightening the cost of borrowing (Andy Haldane had a bit to say about this in the latest MoneyWeek podcast), it’s hard to see house prices coming down.

However, it does mean that until then, we’re going to be stuck with this social and economic problem which is a lack of affordable housing.

How will that resolve itself? I’d expect to see more pressure to build more homes. That might help at the margins in some areas, but it doesn’t address the credit issue.

It might also increase the pressure on wages to go up, which is inflationary in itself.

The government might even throw more fuel on the fire at some point by coming up with more first-time buyer schemes that are just taxpayer-backed subsidies for house builders or home sellers.

In the meantime, if you’re looking to buy a house, I can only refer you to this article in which I explained that worrying about the big picture outlook is usually a waste of time. If you want to buy a house to live in, it’s your personal circumstances that really matter.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.