Thinking of buying a home? Here’s what you need to know about house prices

Contrary to many people’s expectations, Britain is firmly in the grip of another house-price boom. John Stepek looks at the reasons behind it, and where prices might go next.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

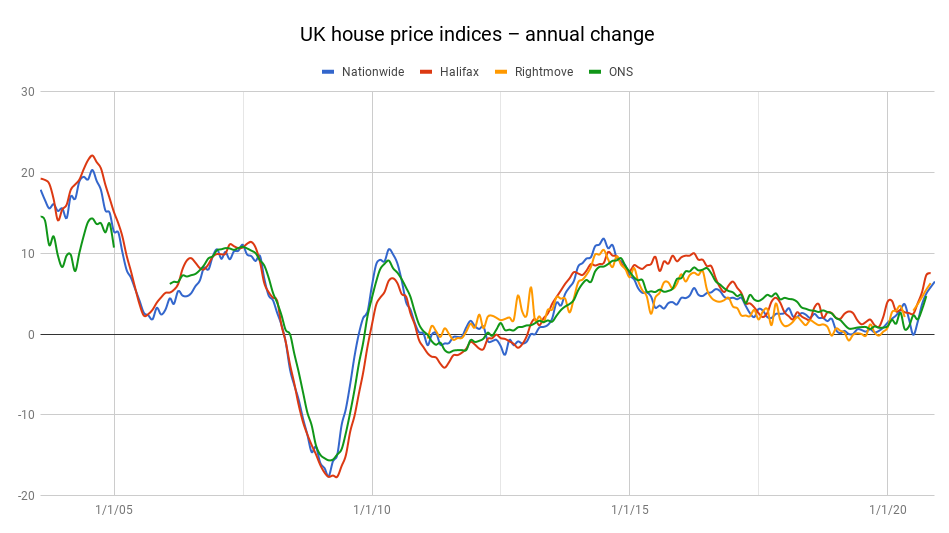

Britain’s house price boom continues unabated. The average UK house is now worth 6.5% more than it was last November, according to the latest figures from Nationwide.

That’s the strongest pace of annual growth recorded by the building society’s house price index since the start of 2015. But what happens when the pent-up demand and stamp duty holiday are over? Let’s have a think.

This isn’t a statistical illusion – we really are in the midst of a property market boom

A house price boom is a far cry from what everyone expected when the lockdown was in full swing. In May, high street bank Lloyds – Britain’s biggest mortgage lender – warned that it expected house prices to fall by 5% this year as its central scenario, or drop by 10% if things got really bad. The best-case scenario was for a drop of 2.2%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now, it’s worth noting that the banks had a good incentive to “kitchen sink” the coronavirus damage. Painting as grim a picture as possible means that it’s easier to surprise on the upside in the future. By the way, this is also how we know that the banks are in much better shape now than they were in 2008.

Banks can only afford to “kitchen sink” like this when their balance sheets are in good condition. When they’re being optimistic in the face of all evidence to the contrary – that’s when you have to worry. That’s not where we are today. (That in turn is one reason why the banks represented a good “buy” earlier this year, and almost certainly still do – indeed, Jim Mellon highlighted Lloyds in his recent interview with Merryn, right before the vaccine news ignited the recent rally.)

Anyway – it’s not as if Lloyds was the only gloomy one out there. As recently as July, the Office for Budget Responsibility (Britain’s fiscal watchdog) said that the best-case scenario for house prices this year was a gain of 0.2%. The worst-case was a drop of 2.4% this year, followed by a 12% slide next. I have to admit that I felt the OBR’s spread of potential outcomes was reasonable – although I also noted that the result would probably be closer to the best-case scenario. But clearly, that scenario has already been comfortably thrashed.

Also, it’s worth noting that this is not a “narrow” market. It’s easy to assume that this is just about a small number of expensive homes swapping hands. (House price indices do attempt to factor that sort of thing in, by the way, but there’s only so much they can do.) But this is a widespread boom. It’s not just prices that are going up, it’s transactions too. In October, mortgage approvals hit their highest level since September 2007. In other words, the number of mortgages being approved has returned to levels we haven’t seen since before the big crash in 2008.

That’s pretty noteworthy. After 2008, transactions plunged and then recovered to a post-crash “new normal” that seemed to be permanently lower than the previous norm (knocking around below the 70,000 a month mark, compared to regular 100,000-plus months in the boom era). Don’t get me wrong. A lot of that is purely home loans being knocked forward from months when the market was genuinely shut. But it’s still an interesting data point.

The question is: what happens next?

If you’re buying a house to live in, don’t spend any time worrying about “the big picture"

Clearly, the stamp duty holiday has helped to bring forward demand (people buying now to beat the deadline). And clearly, the housing market freeze at the start of this year delayed demand. So right now, two big factors are driving the present surge in demand. On top of that, the underlying economy is being artificially propped up by an extended furlough scheme. That has to end at some point – although the overall impact on employment might not be as bad as many expect if the vaccine does lead to a faster recovery than might otherwise have happened.

What does that all mean? Well, Andrew Wishart at Capital Economics argues that when all this pent-up demand is exhausted and the stamp-duty holiday ends, we’ll see a mild slump in 2021. We saw something similar in 2009, when there was a stamp-duty holiday designed to prop up the market post-crash. That said though, even if house prices were to fall by 5% next year – which is what Capital Economics currently expects – that “would leave house prices marginally higher at the end of 2021 than they started 2020.”

What does all of this mean for you as an individual? Let’s park property investment for now; that’s a specialist business. If you are looking to me to tell you what to do on that front, then the one thing I can tell you is that you don’t know enough about being a landlord to pursue that particular course.

So – talking purely about a house to live in – there are really only three positions that you can be in, relative to the housing market. One – you don't own a house. Two – you own a house and want to sell it and buy a different one. Three – you own a house, and you want to sell up and rent.

In all three of those circumstances, trying to time the market is a stressful waste of energy and it should be the bottom of your list of things to care about. It’s particularly irrelevant for the last two (if you are just moving home, then what you lose on the swings you gain on the roundabouts. And if you’re stepping off the “ladder” then you’ve got your money – the worst-case scenario is merely that prices keep going up). But even if you’re a first-time buyer, it’s just not worth worrying about.

Here’s what you should be worrying about: can you afford the mortgage payments? Have you built in a reasonable margin of safety for things going wrong? Have you considered what happens if interest rates go up? Have you considered what happens if your income goes down? Is owning more practical than renting? Perhaps even more importantly: do you like the house? Can you bear to live there for the next few years? Few things can make you more miserable than living somewhere that you don’t like. And owning is a lot less flexible than renting on that front.

I know this doesn’t feel helpful. This isn’t why you read Money Morning. You want a crystal ball. But here’s the alternative: you keep saving. You keep those savings in cash, because you can’t afford the risk of a market crash demolishing your capital when you need it. And you hope for a housing market crash that somehow leaves your job and savings unscathed, so that you can take your huge deposit, top it up with a cheap home loan, and buy from a distressed seller.

You could be waiting for years. You could get there and find that you have no job. You could get there and find that your savings pile is still not big enough to secure credit during a credit crunch.

My point is this: if you’re looking for a home to live in, don’t try to second-guess house prices. You might get lucky on prices. You might not. But in the grand scheme of things, that aspect of the transaction just isn’t worth the energy. Better to spend that time focusing on how to get the best price for the house that suits you best, and making sure that an unexpected event won’t leave you regretting the decision.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The UK cities where it’s cheaper to buy a house than rent

The UK cities where it’s cheaper to buy a house than rentFor people in some areas of the country, home ownership is a distant dream. But for others it can be surprisingly affordable.

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.

-

North outperforming the South for property investors

North outperforming the South for property investorsThe property market in the North of England is outperforming the South for both capital appreciation and rental yields.

-

UK house prices: half of sellers cut asking prices to secure a sale

UK house prices: half of sellers cut asking prices to secure a saleProperty price reductions have reached their highest level in at least nine years.