The charts that matter: everyone’s got pre-election jitters

With the US election fast approaching, it's been a tricky week for most assets. John Stepek looks at how the charts that matter most to the global economy have been affected.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It can’t have escaped your notice that there’s an absolutely huge event happening next week. MoneyWeek’s 20th anniversary issue is out on Friday!

In it, we’ll be reporting on the outcome of a local election across the Atlantic (on which we may or may not have any real clarity by that point).

But more importantly, we’ll be looking at what might prove to be the biggest investment trends for the next 20 years. Everything from cryptocurrencies to quantum computing to hypersonic travel to the return of inflation, and much much more, along with some of the best ways to play those trends.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We’ll also be releasing Merryn’s latest video interview with one of our favourite long-time contributors, a man who really understands how to spot promising investment trends. Keep an eye out for that – I’ll let you know when it’s out in Money Morning next week.

And finally, if you haven’t taken your chance to appear in the mag, this is your last opportunity – email us your answers to our five questions for 2040 and you could see your name in print. Check them out here. And if you don’t already subscribe - get your first six issues free here.

Some podcasts and videos for the weekend

In Merryn’s latest podcast, she speaks to Dennis Jackson and James Henderson of the Law Debenture Corporation about how the investment trust’s unusual structure works in its favour – and finds out what they’re buying now.

Meanwhile I joined The Week Unwrapped team for a very money-focused podcast – we discussed the “Attenborough effect” on green investing, TikTok’s move into e-commerce, and whether cryptocurrencies are finally coming of age. I really enjoyed doing this one, hopefully you’ll enjoy listening to it here.

On the video side, in our “too embarrassed to ask” series this week we went right back to basics – if you still don’t entirely understand what a share is, now’s the time to put that right. Get the answer in less than two and a half minutes here.

Also, if you’ve wondered what any of the following actually mean, we’ve got videos for the lot of them: negative interest rates, bonds, tracker funds, p/e ratios – that’s just a selection.

Here are the links for this week’s editions of Money Morning, in case you missed any.

- Monday: Why would you pay anyone for the privilege of lending them money?

- Tuesday: Being unpopular can make life easier for companies – just ask BP and HSBC

- Wednesday: The stars are lining up for bitcoin – make sure you own some

- Thursday: Companies are doing better than expected – but for how long?

- Friday: Why do house prices just keep marching higher?

- The weekly quiz: What do you recall of what went on in the money world last week?

Now for the charts of the week.

The charts that matter

It’s been a tricky week for most assets. Covid has clearly made a comeback and governments are reacting in a very similar way to last time – by locking down. We’re also in the home straight for the US election, which means there’s no chance of seeing any more “stimulus” packages from that direction until the election is over. The worry, of course, is that maybe this election won’t be over next week, because the result may not be clear, and it may well be disputed.

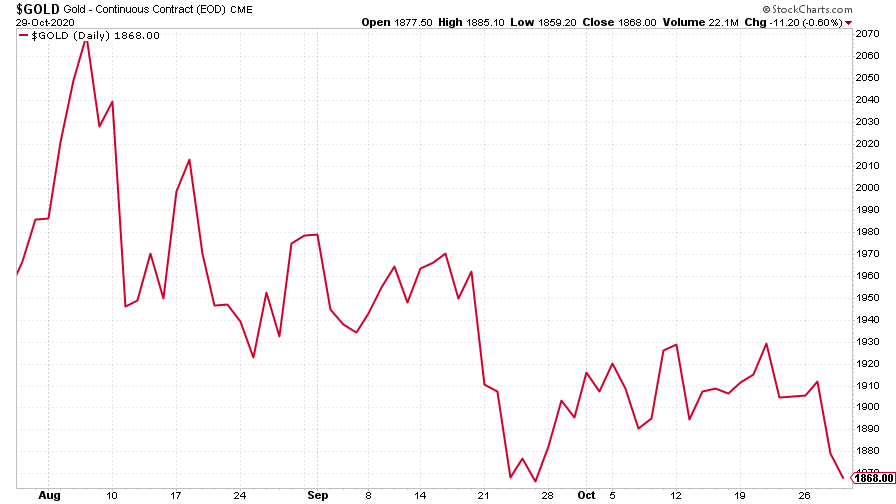

All of that made markets jittery and just about everything fell. Gold was no exception. It ended the week lower again. Why? Gold’s been driven by the same thing as most other assets in recent months – the hope for a lot more money printing. That said, gold also needed a break after its earlier strong run this year – so this is probably overdue as much as anything else.

(Gold: three months)

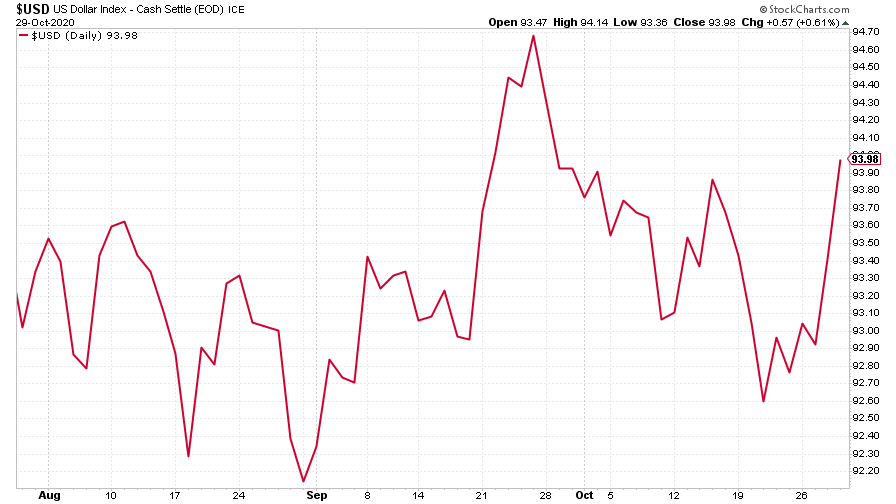

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) moved sharply higher. This is partly because the euro weakened against the US currency this week, as the European Central Bank paved the way for more money printing later in the year, as it lowered its forecasts for future growth.

(DXY: three months)

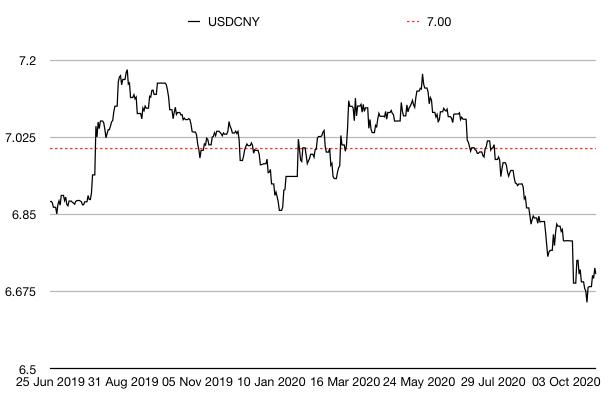

Even the Chinese yuan (or renminbi) weakened against the dollar this week (when the black line below rises, it means the yuan is getting weaker vs the dollar).

(Chinese yuan to the US dollar: since 25 Jun 2019)

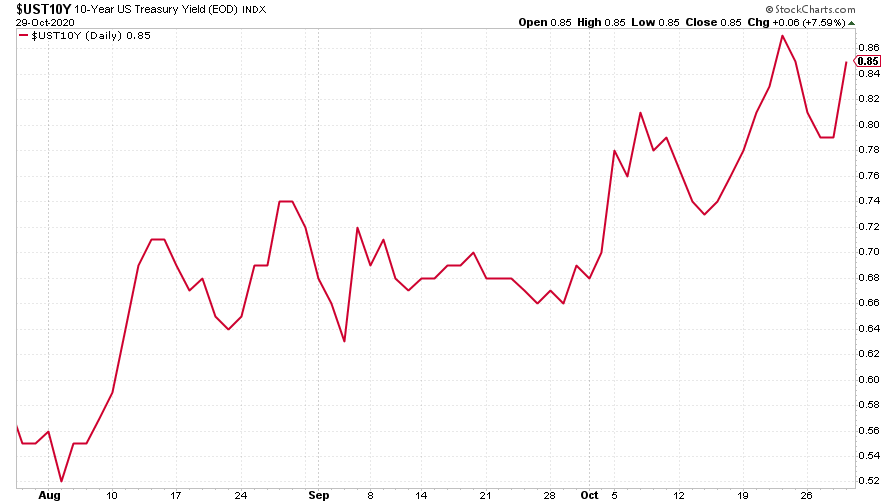

The yield on the ten-year US government bond was little changed on last week, though still trending higher.

(Ten-year US Treasury yield: three months)

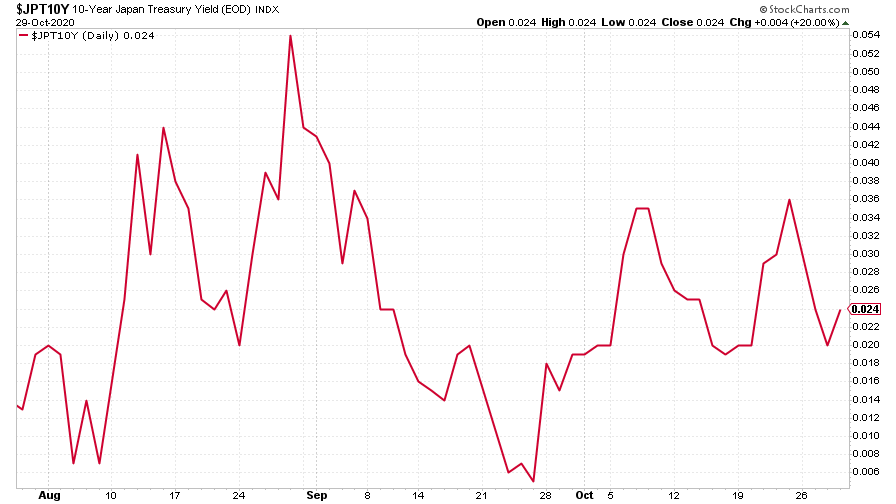

The yield on the Japanese ten-year stayed near 0% as is the Bank of Japan’s policy.

(Ten-year Japanese government bond yield: three months)

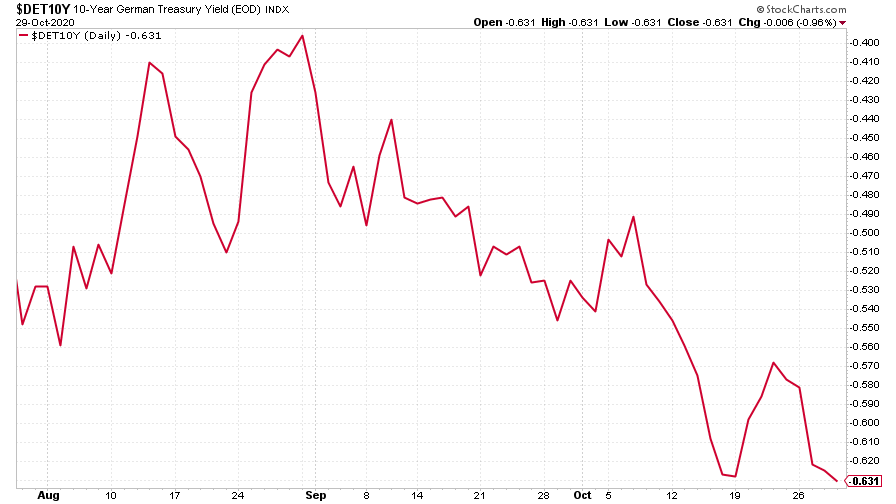

Meanwhile, the yield on the ten-year German bund slipped back again.

(Ten-year Bund yield: three months)

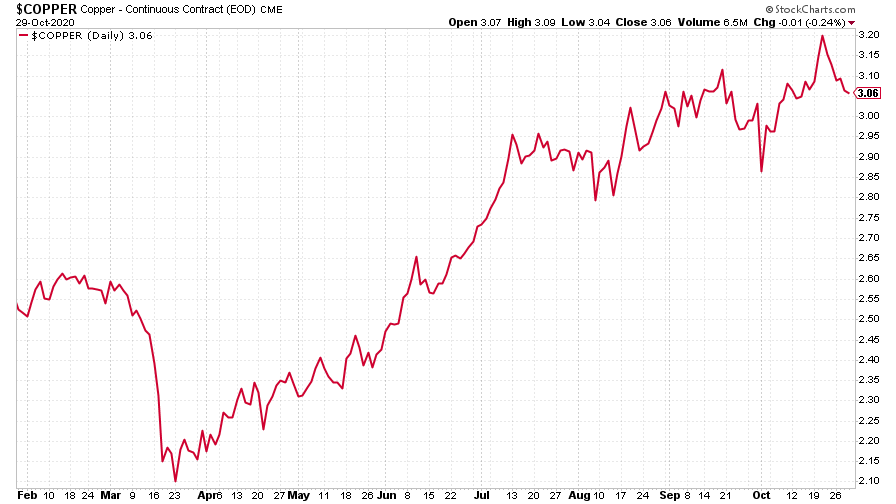

Copper fell a bit this week but remains very resilient compared to many other assets.

(Copper: nine months)

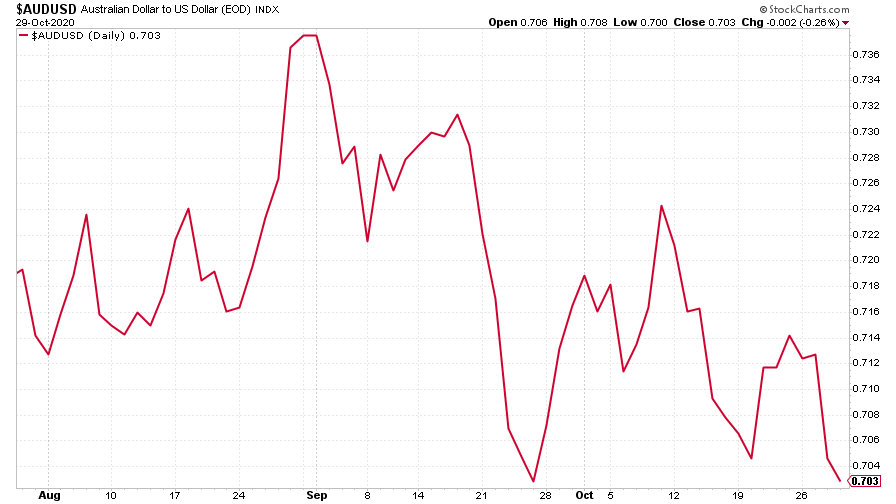

The Aussie dollar fell back as the US dollar strengthened.

(Aussie dollar vs US dollar exchange rate: three months)

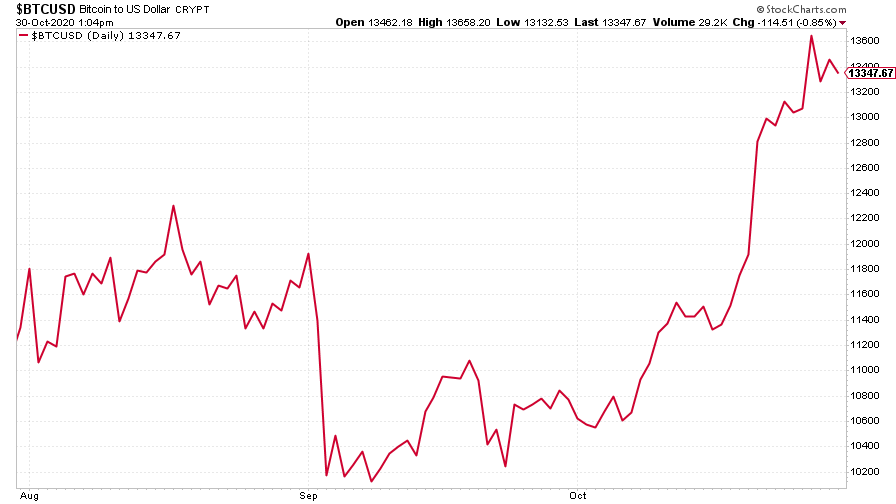

Cryptocurrency bitcoin made further gains, as Dominic discussed in his piece earlier this week.

(Bitcoin: three months)

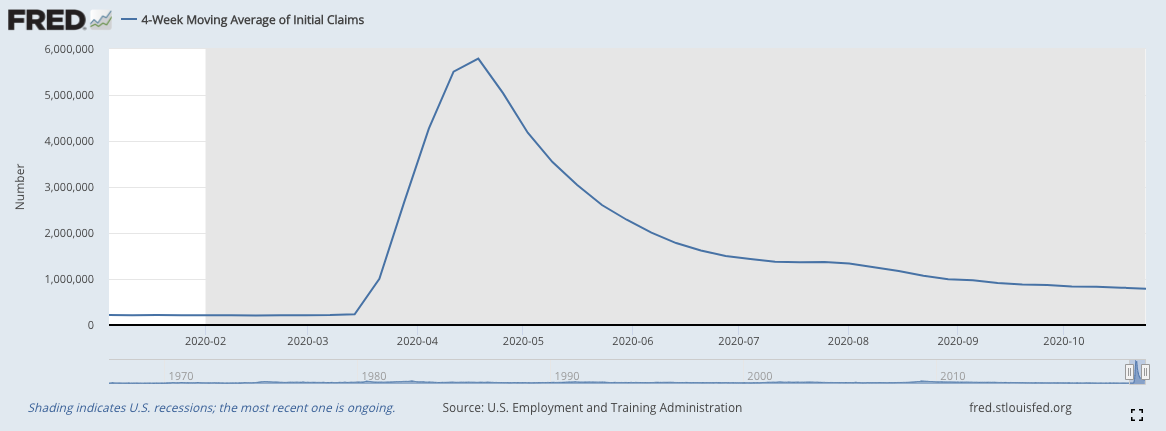

US weekly jobless claims fell again this week to 751,000, which was better than expected, and down from the 791,000 seen last week (which was revised slightly higher). The four-week moving average fell to 787,750, from 812,250 previously.

(US jobless claims, four-week moving average: since Jan 2020)

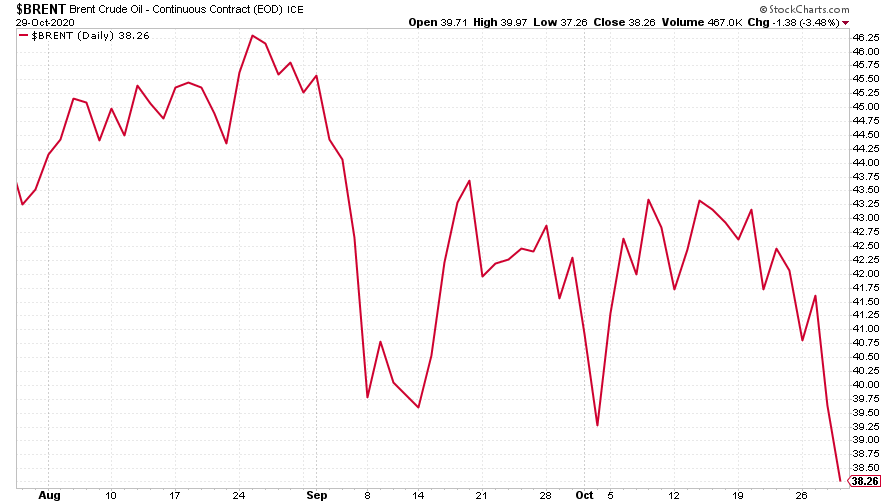

The oil price (as measured by Brent crude) tanked this week. The simple reality is that if we have a second lockdown, people don’t need as much oil. Hence the slide.

(Brent crude oil: three months)

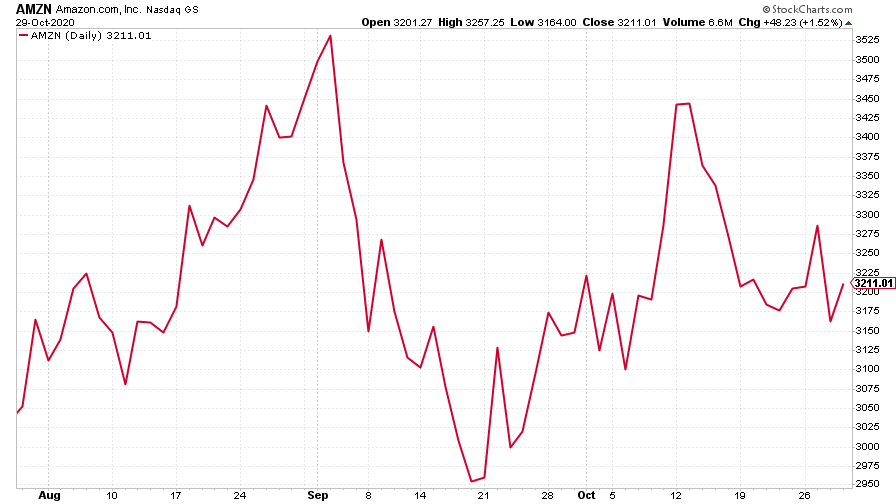

Amazon fell alongside the wider market.

(Amazon: three months)

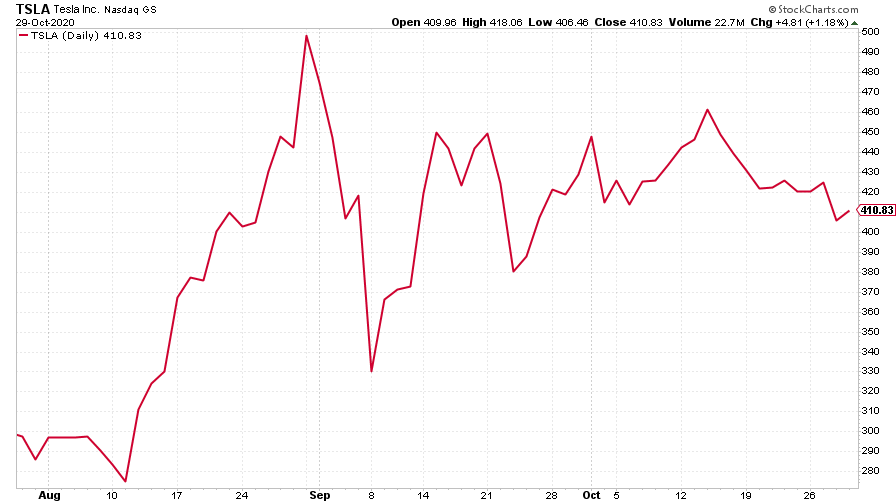

Electric car manufacturer Tesla fell sharply too.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.