Why do house prices just keep marching higher?

Other asset prices may be dropping off as the second wave of Covid hits. But house prices just keep on climbing. John Stepek looks at what’s behind their unstoppable rise.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before I get started this morning – don’t forget to answer our 20th anniversary questions! Best answers will be published in next week’s mag – check out the questions here.

The second wave of Covid is clearly here. The pressure for a full-on lockdown is building. Markets around the world are rattled. The oil price has collapsed (again). Stocks are jittery. Gold has been on the slide too. Even bitcoin’s recent hot run has stopped in its tracks.

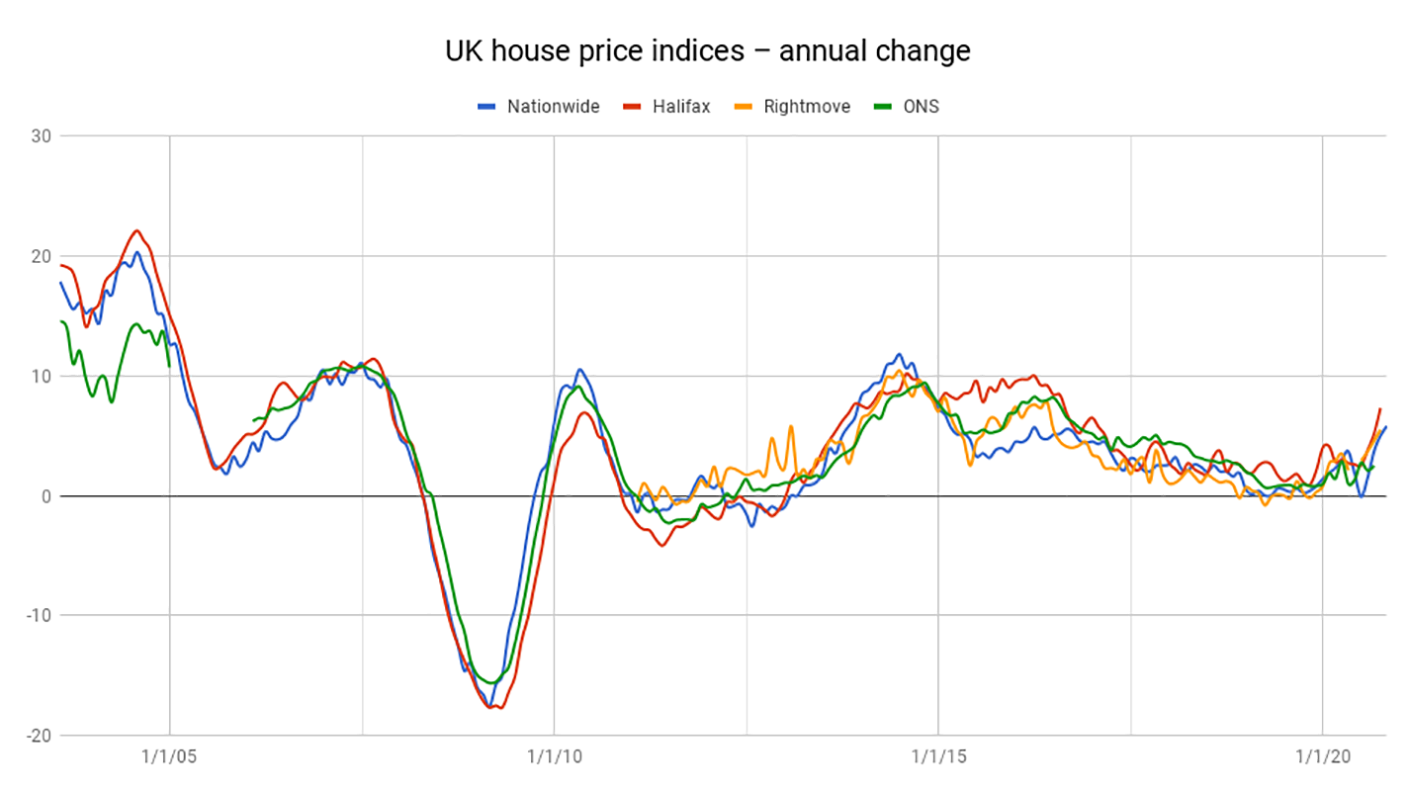

And yet, through it all, the UK housing market sales on. The latest figures from Nationwide, which issues one of the longest-running and most widely-reported house price indices in the UK, show that annual house price growth hit 5.8% in October. That’s the highest rate seen since January 2015.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This isn’t some glitch caused by a small number of sales. It comes off the back of a big increase in activity. Mortgage approvals for house purchase came in at 91,500 in September, which is the kind of level we haven’t seen since 2007. Believe it or not, it looks as though 2020 will end up being one of the strongest years for house price growth we’ve seen in at least five years. Yes, 2020, the plague year. What’s going on?

What’s driving house prices in the UK?

Let’s start with the obvious. Everyone who wanted to move earlier in the year had to call a halt during lockdown, so that created a backlog of sales that are going through now. Given the pandemic, right enough, you could have been forgiven for expecting a lot of those sales to have collapsed. But that doesn’t appear to have happened – or, at least, new activity has compensated for previously planned sales falling through.

The next obvious factor is the stamp duty holiday. If you’d been on the fence about moving, then the idea of saving money on tax is probably enough to sway you in the direction of deciding to go through with it (yes, it’s not at all clear who benefits most from the stamp duty cut but let’s park that for now). The stamp duty holiday runs until March (which of course, does not mean that it won’t be extended). So that’s an impetus to get on with moving.

What about longer-term factors? Well, interest rates are still low and they won’t be going up any time soon. I’d just caveat that with a point – they aren’t going down either. In September, the average rate on a new mortgage was 1.74% (up by 0.02 percentage points on the month before) while the rate on existing mortgages slipped by 0.01 percentage point to 2.13%.

And it’s worth remembering that at least two of the big factors that had kept house-price growth more modest in recent years – unusually extreme political uncertainty, plus the impact of George Osborne’s landlord tax reforms – are now pretty much in the past.

OK – so we can see several factors why house price growth might be rallying. The next obvious question is this: that’s all very well, but what about the flipping great pandemic and the government reaction which has upturned our economy, our way of life, and threatens to create massive swathes of unemployment? How on earth can this be good for house prices?

The K-shaped recovery explains UK house price growth

Well, let’s think this through. Economists have run through lots of different alphabetical letters to try to describe the shape of the recovery (or lack of one) that we’re likely to have from Covid.

One such letter is the “K” shaped recovery. That’s when different sections of the economy recover at different rates. Long story short, the better off come back a lot faster than the worse off. I also think it’s fair to surmise that many of the people who are relocating because they are confident of being able to work from home for good are also probably in the upper leg of the “K” shape. And now they’re keen to exploit that newfound freedom.

“Behavioural shifts appear to be boosting housing market activity as people reassess their housing needs and preferences,” as Nationwide chief economist Robert Gardner puts it.

This urban exodus is in turn being driven by the relatively well-off selling properties in expensive urban areas, and then feeling able to splash the cash when they go shopping beyond the daily commuter zone. That’s going to push up prices in areas that previously haven’t enjoyed the benefit of “quality of life” movers.

On top of that, a lot of people have saved a lot of money during lockdown. It’s been clear that much of the cash that wasn’t spent on holidays, eating out, or all of those other things, has been redirected to home improvements. And what is moving house, other than a massive home improvement project?

So overall, as mad as it seems, there are clear reasons for the burst higher in prices, even in the face of the pandemic. Will it continue? The end of the stamp duty holiday might demonstrate that lots of house moves were simply brought forward. The urban exodus will also diminish over time, particularly if working from home is less feasible than believed.

But will either of those things then lead to a crash in prices? I can’t see it. And believe me, I say that as someone who feels strongly that high house prices are a bad thing, and one of the most potent destabilising forces in both our economy and our society.

We’ll see what happens. But it looks like it will take more than a global pandemic to put a dent in our dysfunctional property market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Halifax: House price slump continues as prices slide for the sixth consecutive month

Halifax: House price slump continues as prices slide for the sixth consecutive monthUK house prices fell again in September as buyers returned, but the slowdown was not as fast as anticipated, latest Halifax data shows. Where are house prices falling the most?

-

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?

Rents hit a record high - but is the opportunity for buy-to-let investors still strong?UK rent prices have hit a record high with the average hitting over £1,200 a month says Rightmove. Are there still opportunities in buy-to-let?

-

Pension savers turn to gold investments

Pension savers turn to gold investmentsInvestors are racing to buy gold to protect their pensions from a stock market correction and high inflation, experts say

-

Where to find the best returns from student accommodation

Where to find the best returns from student accommodationStudent accommodation can be a lucrative investment if you know where to look.

-

The world’s best bargain stocks

The world’s best bargain stocksSearching for bargain stocks with Alec Cutler of the Orbis Global Balanced Fund, who tells Andrew Van Sickle which sectors are being overlooked.

-

Revealed: the cheapest cities to own a home in Britain

Revealed: the cheapest cities to own a home in BritainNew research reveals the cheapest cities to own a home, taking account of mortgage payments, utility bills and council tax

-

UK recession: How to protect your portfolio

UK recession: How to protect your portfolioAs the UK recession is confirmed, we look at ways to protect your wealth.

-

Buy-to-let returns fall 59% amid higher mortgage rates

Buy-to-let returns fall 59% amid higher mortgage ratesBuy-to-let returns are slumping as the cost of borrowing spirals.