The charts that matter: the dollar flexes its muscles

As the US dollar made significant gains this week, everything else sold off. John Stepek looks at how it's affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Don’t miss this week’s issue of MoneyWeek magazine.

I take a look at the theory that passive investing is distorting the stockmarket to a dangerous extent. We’re fans of passive investing – but I’m starting to think there’s something to this fear – it’s not just active managers talking their book. And it could have genuinely serious ramifications for how the market works – and for your own portfolio. To find out more, get hold of your copy now.

In this week’s podcast Merryn talks to Dale Nicholls, manager of Fidelity’s China Special Situations fund. Is now a good time to invest in the rising superpower? Find out here.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, I joined the team over at The Week Unwrapped to talk about the electric car bubble. We also discussed the problems facing pregnant women during lockdown – and whether our spies really should have a licence to kill. It’s always a stimulating chat with that lot...

And if the buzz term “ESG” has you slightly confused, do check out our new “Too Embarrassed To Ask” video for a quick and painless explanation.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Why investors should take cycle theories with a massive pinch of salt

- Merryn’s blog: Why the FCA should sit back and do nothing for now

- Tuesday: Oil producers are back at their Covid-19 lows – is it time to buy?

- Wednesday: The rising dollar is proving bad news for most other assets – will it last?

- Thursday: The electric-car bubble could get an awful lot bigger from here

- Friday: Can Rishi Sunak’s winter plan save the UK economy?

- Merryn’s blog: How the stamp duty holiday is pushing up house prices

Now for the charts of the week.

The charts that matter

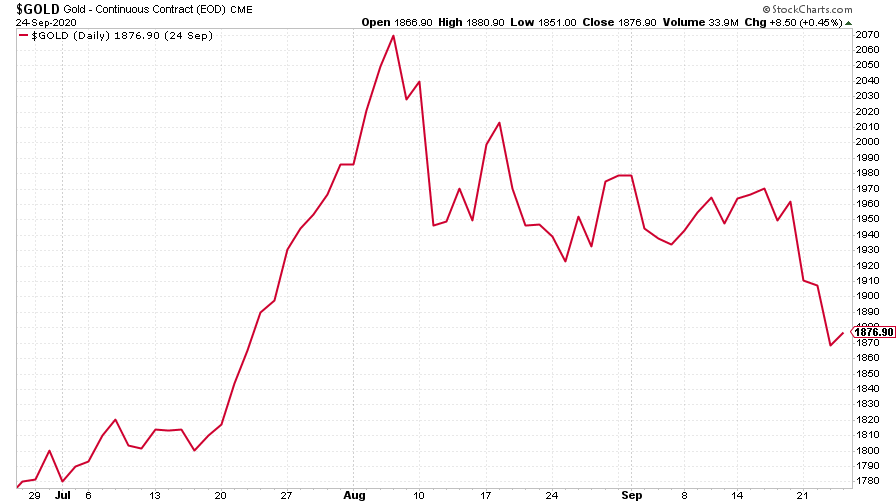

Gold took a tumble this week as the dollar strengthened and investors started to worry that there won’t be any more free money for the stockmarket (and other assets) until the US election is over. As Dominic wrote earlier this week, the short-term trend on most assets is now looking wobbly. That said, we reckon this gold bull market has a long way to go, so unless you’re a leveraged trader (which is your choice, but you really really need to be aware of the risks) then I wouldn’t worry about the current dip.

(Gold: three months)

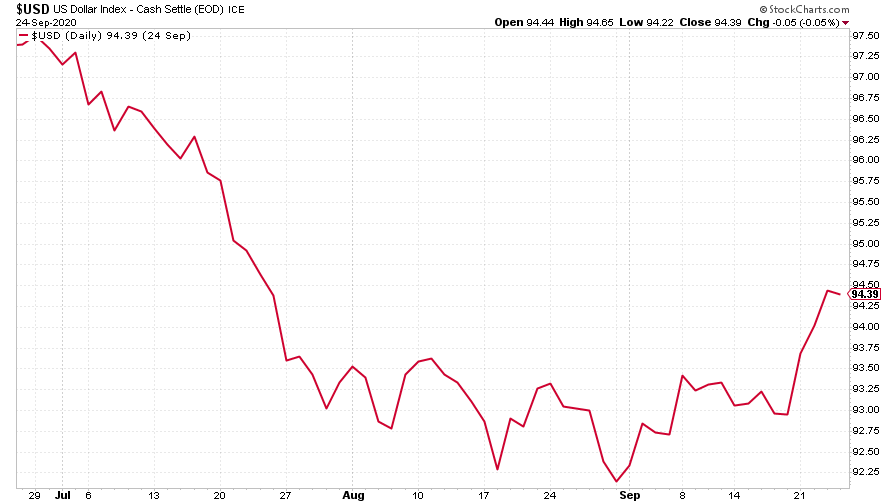

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) made a significant gain this week, which is why everything else sold off.

(DXY: three months)

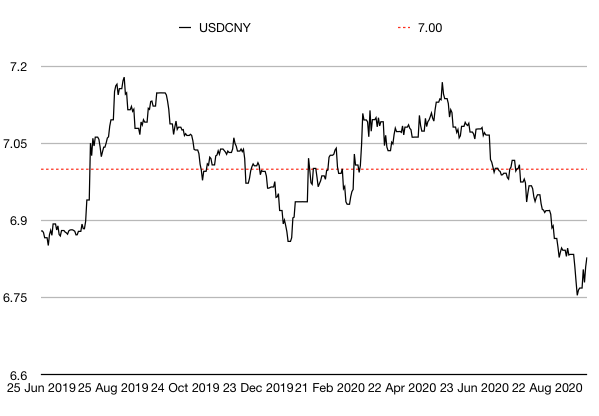

Even the Chinese yuan (or renminbi) has weakened against the dollar this week (when the black line below rises, it means the yuan is getting weaker vs the dollar). It’s ironic and yet entirely in line with the way markets work, that this turnaround has happened just as analysts were starting to get very bullish on the yuan.

(Chinese yuan to the US dollar: since 25 Jun 2019)

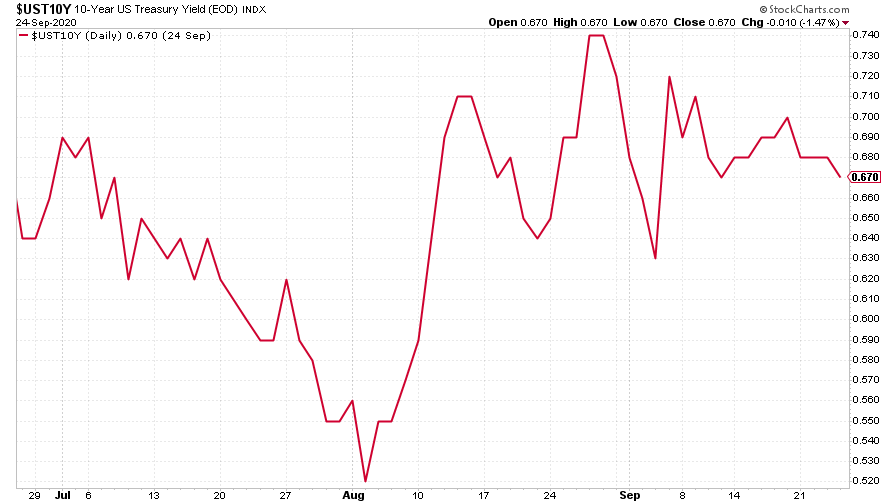

The yield on the ten-year US government bond was once again little changed on the week. As Eoin Treacy of FullerTreacyMoney pointed out earlier in the week, “the price has gone literally nowhere over the past month”, with traders acting as though the Federal Reserve is already engaging in “yield curve control” - capping yields, basically – even although that’s not officially the case as yet.

(Ten-year US Treasury yield: three months)

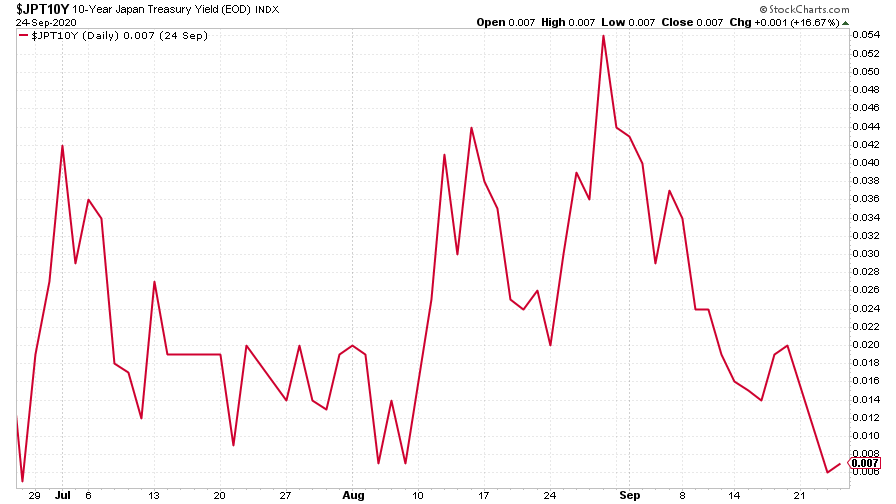

The yield on the Japanese ten-year, where yield curve control is official policy, barely changed.

(Ten-year Japanese government bond yield: three months)

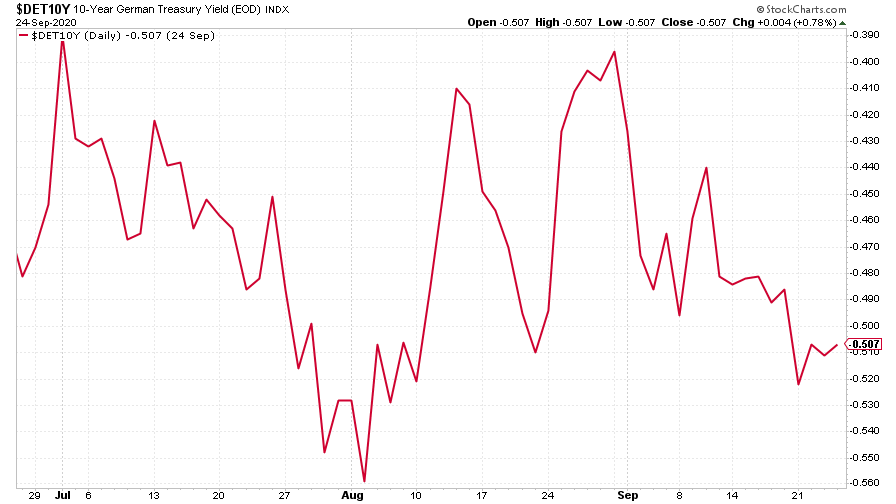

The yield on the ten-year German bund also barely moved.

(Ten-year Bund yield: three months)

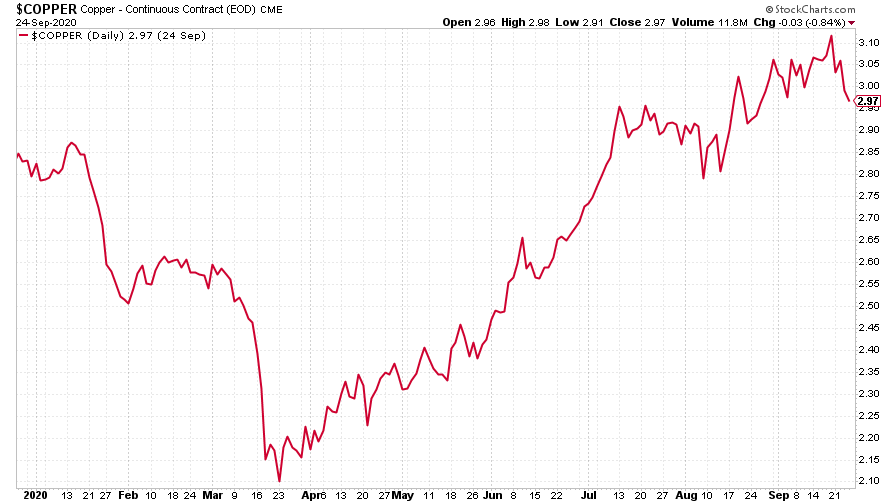

Copper slipped back this week along with everything else as fears over a resurgence of Covid-19, alongside the rising US dollar (which is a “fear trade” anyway), saw the metal drop back.

(Copper: nine months)

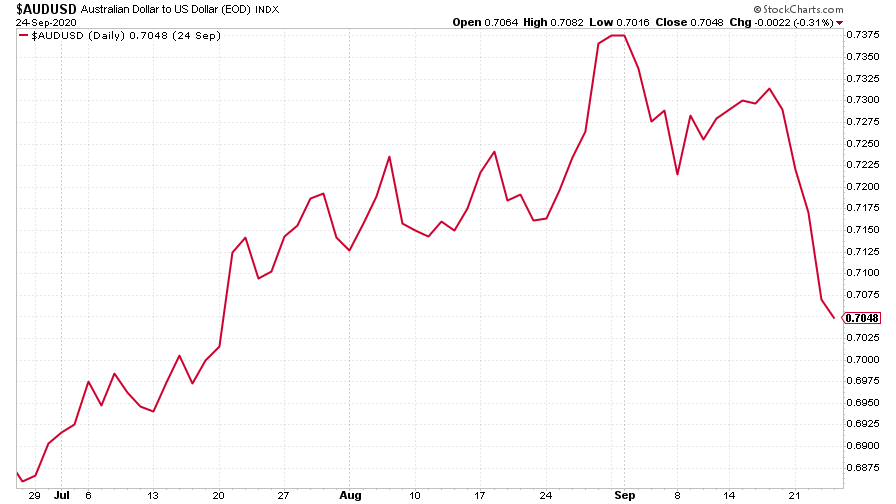

The Aussie dollar slid hard against the US dollar this week.

(Aussie dollar vs US dollar exchange rate: three months)

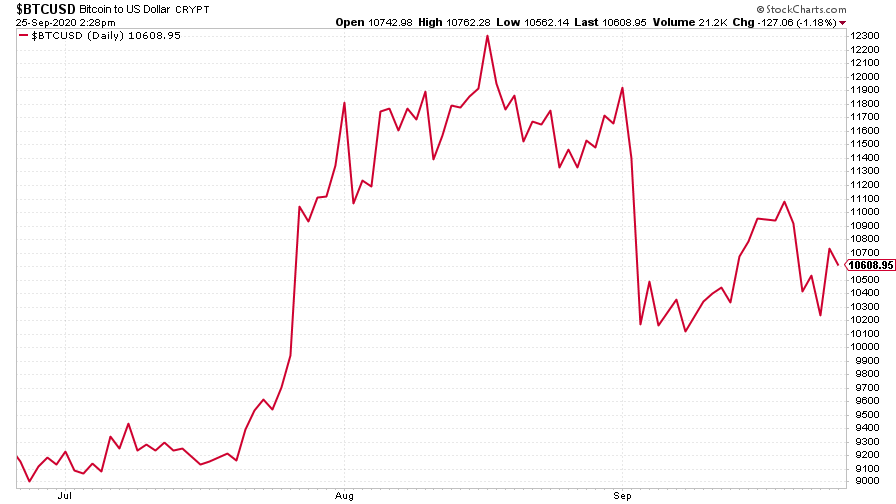

Cryptocurrency bitcoin joined every other risk asset in going lower, though it recovered somewhat quicker than most others.

(Bitcoin: three months)

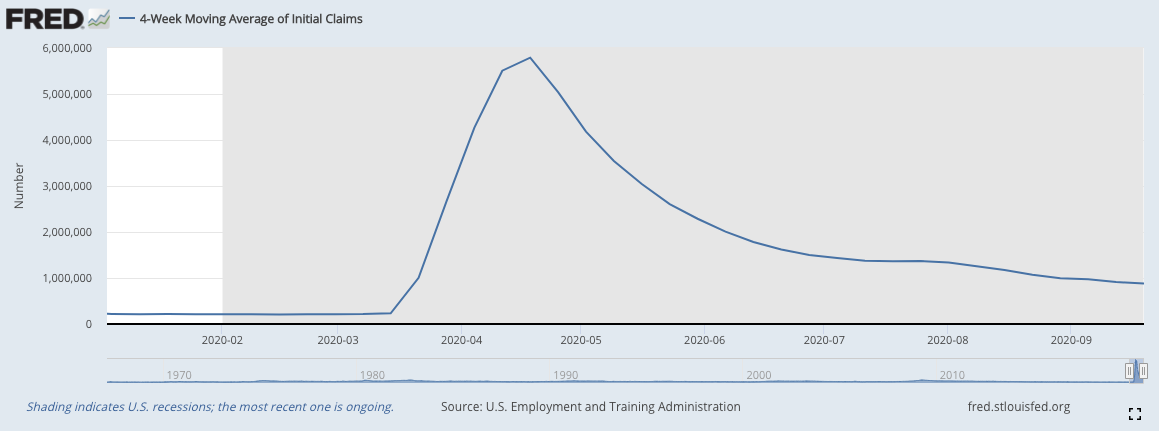

US weekly jobless claims were higher than analysts expected last week. There were 870,000 new claims, up from 866,000 last week (that was revised a little higher from 860,000). The four-week moving average fell to 878,250 from 913,250 (which was revised a little higher) previously.

(US jobless claims, four-week moving average: since Jan 2020)

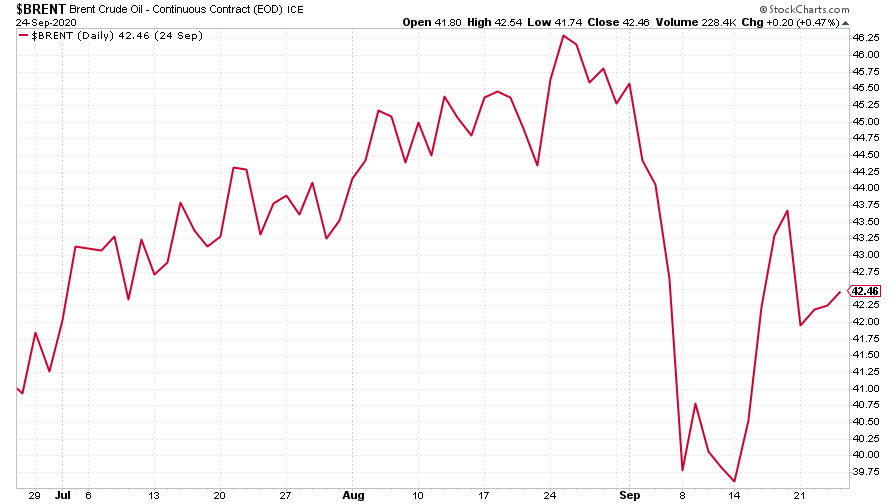

The oil price (as measured by Brent crude) ticked lower this week. The strong dollar didn’t help, and nor did concerns about another Covid-induced slowdown. If anything, the surprise is that oil didn’t fall further.

(Brent crude oil: three months)

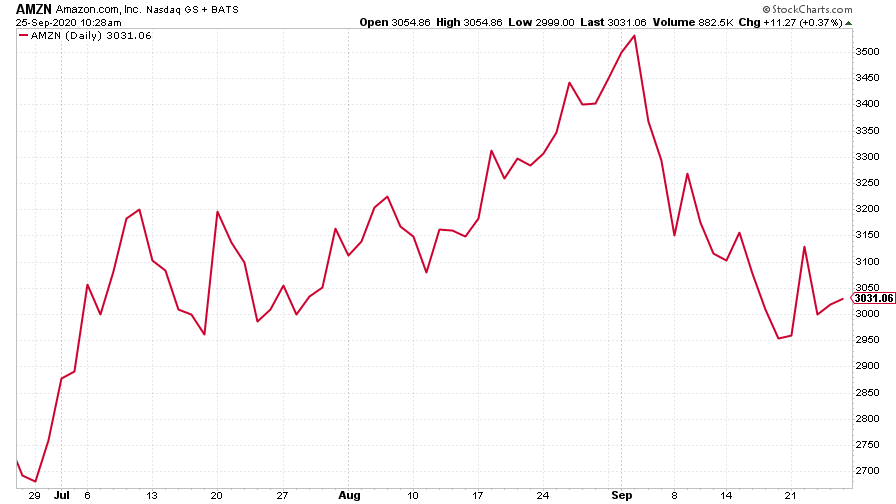

Amazon enjoyed a bit of a rebound this week. That’s partly because it’s a Covid trade and also because your fund manager won’t get fired for owning it. So it’s a safety trade, believe it or not.

(Amazon: three months)

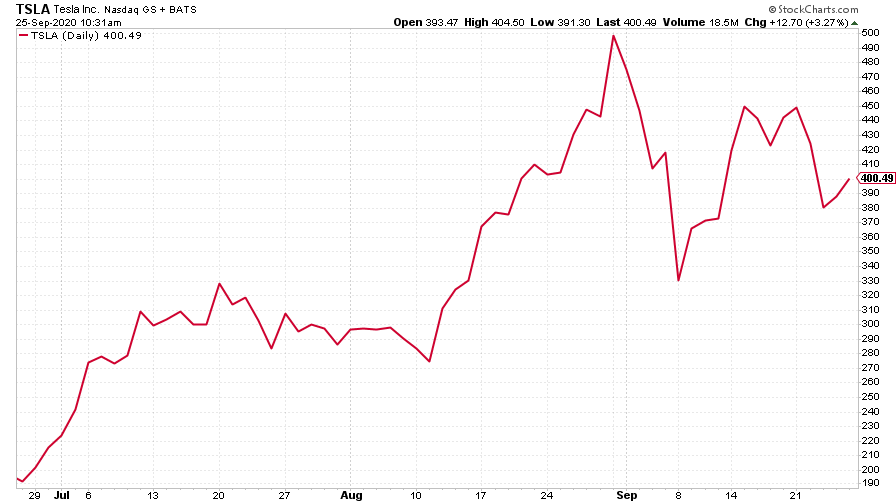

Tesla was little changed this week. “Battery day” was a bit of a damp squib – why investors thought Elon Musk would whip out a “million mile” battery there and then is anyone’s guess, but hope is what a bull market runs on.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?