Retired banker who gave wife £80m to avoid inheritance tax won’t face equal split in divorce

Family lawyers say the Supreme Court ruling will have significant impact on high net worth divorce cases

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The Supreme Court has ruled a retired banker who gave his wife nearly £80m to avoid paying inheritance tax, will not have to split that money with her equally following a divorce.

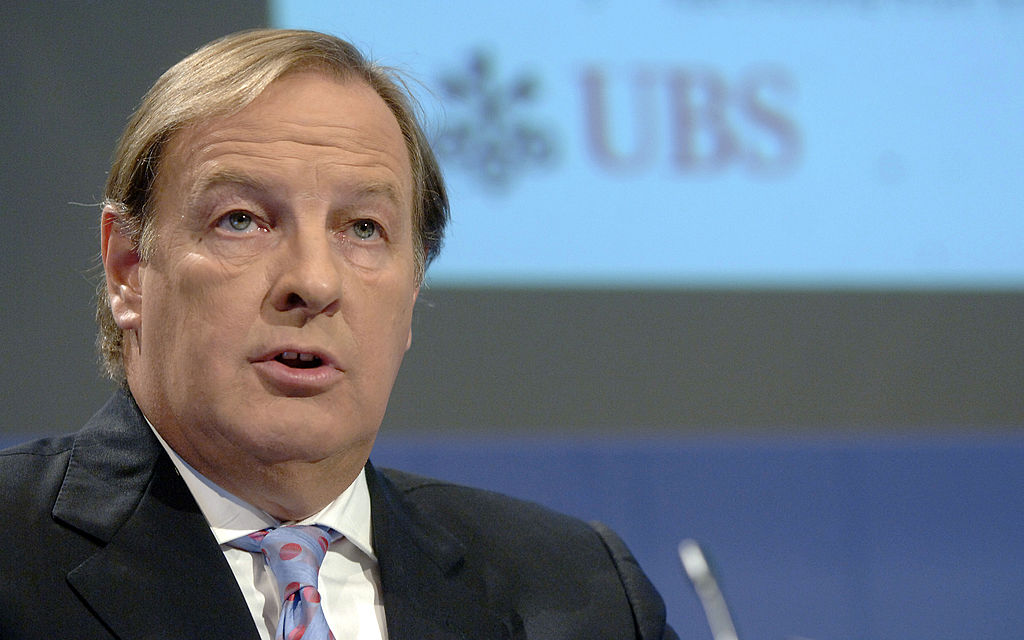

Five judges unanimously agreed that because most of the money had been earned prior to the marriage, Clive Standish was entitled to keep the largest share.

In Standish v Standish, the court ruled that a significant transfer of wealth in 2017 to avoid inheritance tax – amounting to over £77m – was not subject to “matrimonalisation”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If an asset is matrimonial it means it has been built up or acquired during a marriage. Both spouses on divorce usually have a strong claim to share equally in all matrimonial property. Typically, matrimonial assets include the family home, pensions and savings.

Nick Gova, partner and head of family at London law firm Spector Constant & Williams, said: “This landmark ruling by the Supreme Court reinforces the principle that not all wealth transferred between spouses during marriage becomes matrimonial property.

“The court’s emphasis on the intention behind the transfer – in this case, tax efficiency and provision for children – is a critical distinction.”

Gova said the judgment provides valuable clarity for couples – that unless assets are clearly treated as shared during the marriage, they may retain their non-matrimonial character, even if legally held by the other spouse.

“This will have a significant impact on high-net-worth divorce cases, especially where asset protection strategies or estate planning measures are in play,” Gova said.

"Couples and their advisers should be acutely aware of how such transfers may be interpreted by courts in future disputes. Substance and context matter just as much as legal ownership.”

What happened in the Standish v Standish case?

Mr and Mrs Standish began their relationship in 2003, later marrying in 2005. At the beginning of the relationship, Mr Standish was already a successful banker.

As law firm Black Morgan explained in a review of the case, in 2004 his assets were valued at £57m. By comparison at the time Mrs Standish’s assets were considerably less – a property in Melbourne, inheritance and some funds in bank accounts.

In 2017, Mr Standish transferred £77m of investment funds from his sole name to the wife’s sole name. Secondly, the wife was issued shares in the farming business.

The husband’s decision to make these transfers, Blake Morgan pointed out, were for tax planning reasons, to avoid inheritance tax by taking advantage of his wife’s UK non-domicile status.

The husband had received financial advice that by making this transfer, the assets would escape UK inheritance tax.

Ultimately, Blake Morgan explained, the plan was for Mrs Standish to place the assets in a discretionary trust in Jersey, for the benefit of the couple’s children. But this never happened.

So when the couple separated, the money, representing the majority of the couple’s assets, was held in the wife’s sole name.

In 2020 Anna Standish issued divorce proceedings. In 2022 High Court judge Justice Moor split the family’s total wealth of £132m by awarding Mr Standish £87m and Mrs Standish £45m.

Mr Standish appealed against this decision, arguing that the majority of the money, including the £80m of assets that he transferred, was earned before the marriage. Therefore, he said, the case should be dealt with on the basis of meeting the wife’s reasonable needs only, with the remainder of the assets to be held by him.

In 2024 the Court of Appeal judges ruled that Mrs Standish’s share should be reduced to £25m. Mrs Standish appealed to the Supreme Court, arguing the assets were matrimonial from the very outset of the marriage, but the transfer into her sole name in 2017 made those assets hers.

After two months deliberation, the Supreme Court found in favour of the husband.

Are all marriage assets shared?

Not all marriage assets are automatically shared equally upon divorce.

While the "sharing principle" is a starting point, meaning that assets acquired during the marriage are generally considered matrimonial property and subject to division, there are exceptions and considerations beyond a simple 50/50 split.

Non-matrimonial assets are those owned before the marriage or received during the marriage as an inheritance or gift. They may be excluded from sharing, particularly if they have not been mingled with marital assets.

In the Standish case the Court found that the assets in question were transferred for inheritance tax planning purposes and did not acquire the necessary “matrimonial character” merely by virtue of being held in the wife’s name during the marriage.

Stephanie Kyriacou, managing associate in the family law team at Freeths, said “The judgment reinforces the principle that intention, treatment during the marriage, and the source of the wealth remain central to whether assets should be shared on divorce.”

“This ruling puts beyond doubt that not all inter-spousal transfers are automatically caught by the sharing principle,” she added. “Instead, there must be clear evidence that the parties intended the wealth to become part of the economic foundation of the marriage.”

Nick Gova of law firm Spector Constant & Williams, said the Standish decision raises the bar on what wealthier couples should think about in terms of documentation and planning.

“Whether you're a high-net-worth individual or building family wealth, now is the time to: audit and document your asset records, consider putting in place a pre or post nuptial agreement and get your tax-planning documents in order,” he said

“Being proactive isn’t just wise, it could protect your assets and relationships in the years ahead."

Inheritance tax planning and divorce

Lawyers have said the Standish decision has a significant impact on wealthy individuals’ inheritance tax planning.

Where the financially stronger party seeks to undertake IHT planning and reduce their inheritance tax bill, the ruling helps reduce the risk of them being forced to equally split those assets if their marriages break down.

Will MacFarlane, partner in the family and divorce team at Kinglsey Napley, said: “Until now, there has always been a conflict between inheritance tax planning and wealth protection.

“This is a green light for those seeking to transfer assets between spouses for inheritance tax planning as it cannot now be assumed that those assets will be matrimonialised [i.e. shared equally on divorce]”.

A stand-out point from the judgment, said MacFarlane, is that if transfers taking place within an IHT planning exercise are clearly for the benefit of the next generation or someone other than the recipient of the assets, matrimonialisation is unlikely to have occurred.

Another big lesson from this case for family lawyers and wealthy individuals is that if Mr and Mrs Standish had entered into a postnuptial agreement this litigation could have been avoided.

“Had they done so the purpose of the transfer of assets to Mrs Standish would have been clearly set out and agreed so respective interests could have been protected,” said MacFarlane.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Laura Miller is an experienced financial and business journalist. Formerly on staff at the Daily Telegraph, her freelance work now appears in the money pages of all the national newspapers. She endeavours to make money issues easy to understand for everyone, and to do justice to the people who regularly trust her to tell their stories. She lives by the sea in Aberystwyth. You can find her tweeting @thatlaurawrites

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how