Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

In this week’s issue of MoneyWeek, Jonathan Compton looks at how farming currently works (hint: its business model is unsustainable) and how it might look in the future as the global population gets richer and diets change; farmers respond to an increasing number of environmental challenges; and the “eye-watering” level of subsidies inevitably fall. He picks the best ways to invest in the farms of the future. It’s well worth a read – so if you’re not already a subscriber, get your first six issues free here now.

In the latest podcast, John talks to Helen Thomas of BlondeMoney, one of the most astute political analysts I know, about V-shaped disappointments and the “velocity of people”, and why Donald Trump could spring a surprise come November’s presidential elections. Don’t miss this one – you can listen here (or wherever you get your podcasts).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We also have a new “Too Embarrassed To Ask” video. This week, we discuss what “liquidity” is, and why it matters. Check it out here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Two “crosses” to help you decide when to buy and sell the markets

- Tuesday: Warren Buffett, hater of pet rocks, buys his first gold mine

- Wednesday: Why Warren Buffett’s purchase of Barrick shares is such a big deal for gold-mining stocks

- Thursday: Investors are assuming a near-perfect future – that seems unwise

- Friday: Career risk – the private investor’s secret weapon

Now a swift rundown of this week’s main charts.

The charts that matter

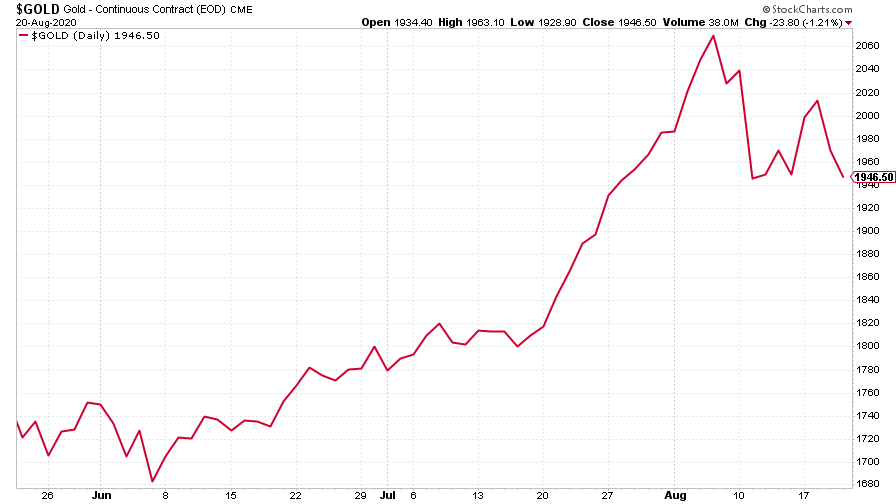

Gold slipped back after Warren Buffett’s purchase of half a billion dollars’ worth of shares in mining giant Barrick. It’s now over $100 below the fresh peak it hit at the start of the month – but the show’s by no means over yet.

(Gold: three months)

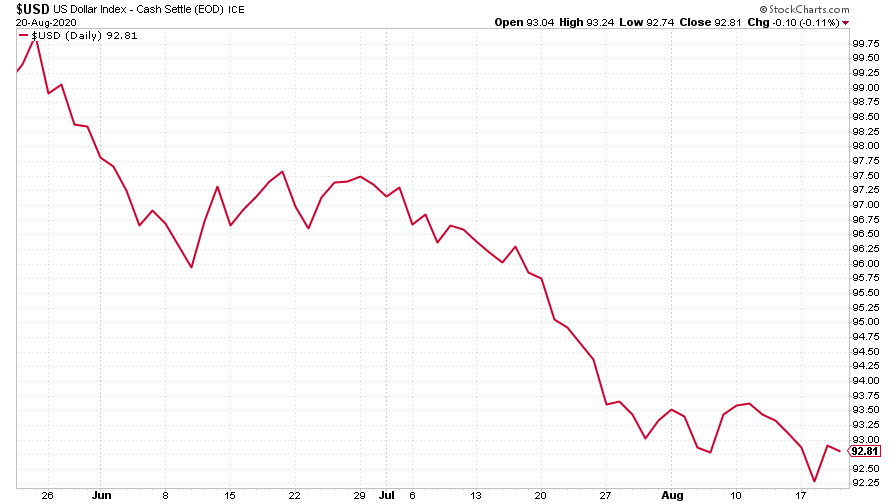

US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners):

(DXY: three months)

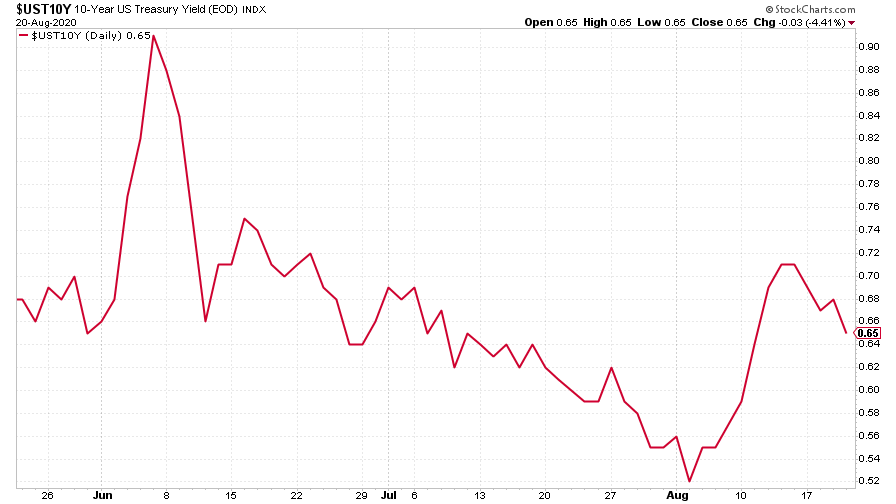

Ten-year US government bond yield:

(Ten-year US Treasury yield: three months)

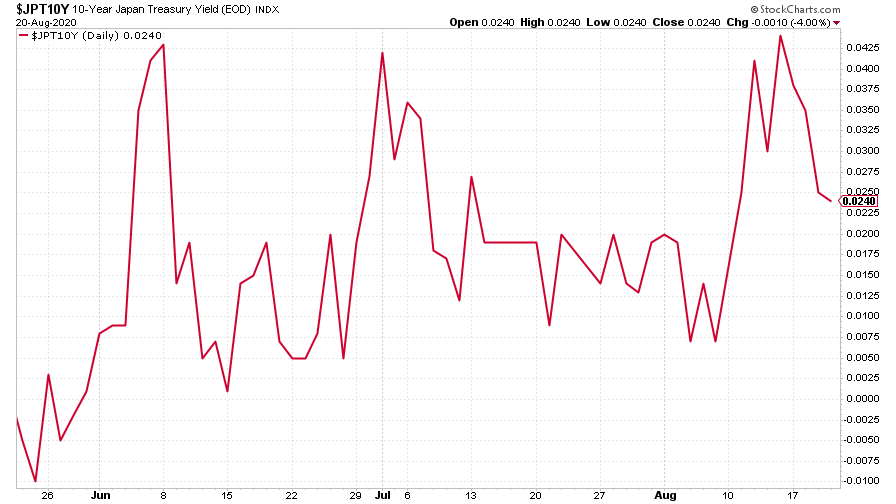

Ten-year Japanese government bond yield:

(Ten-year Japanese government bond yield: three months)

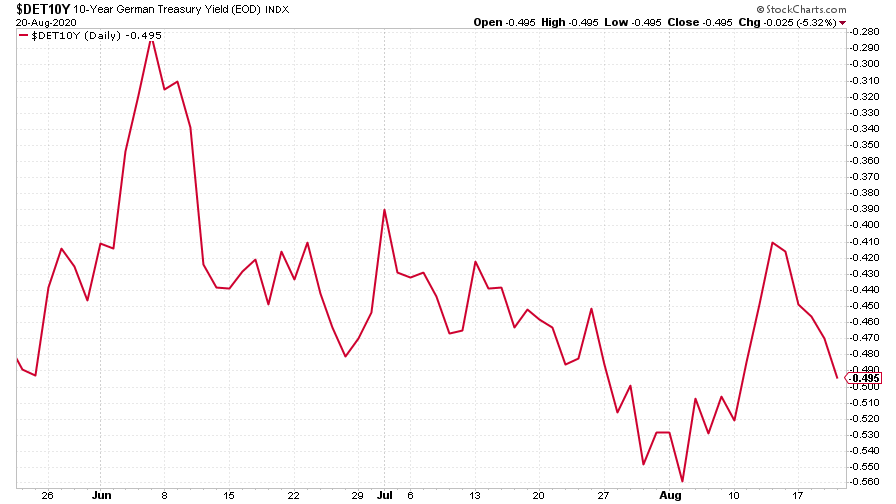

Ten-year German bund yield:

(Ten-year Bund yield: three months)

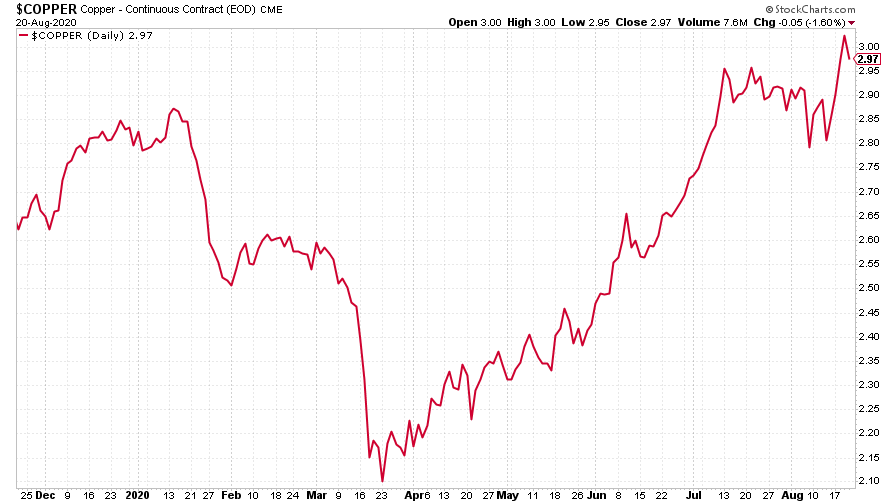

Copper:

(Copper: nine months)

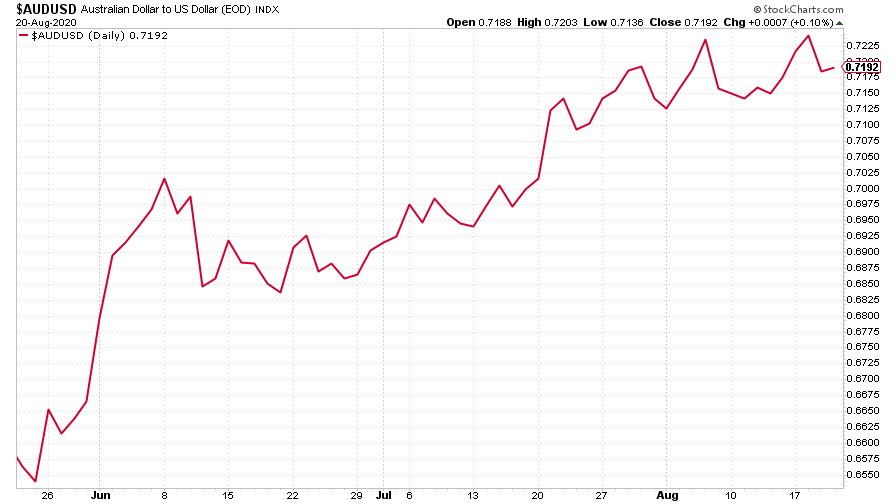

Aussie dollar:

(Aussie dollar vs US dollar exchange rate: three months)

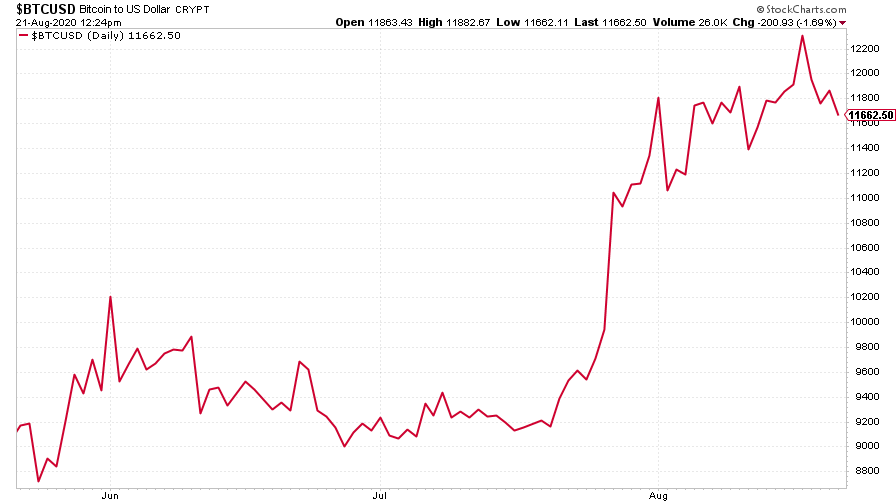

Bitcoin:

(Bitcoin: three months)

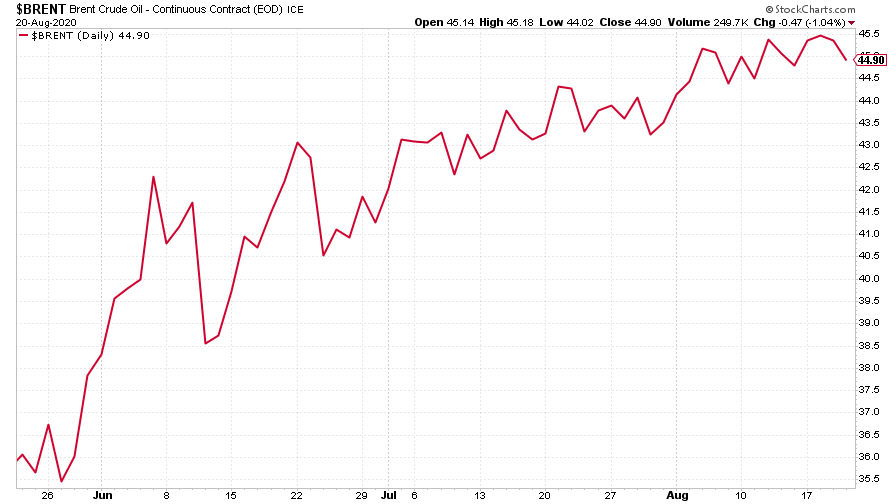

Oil price (Brent crude):

(Brent crude oil: three months)

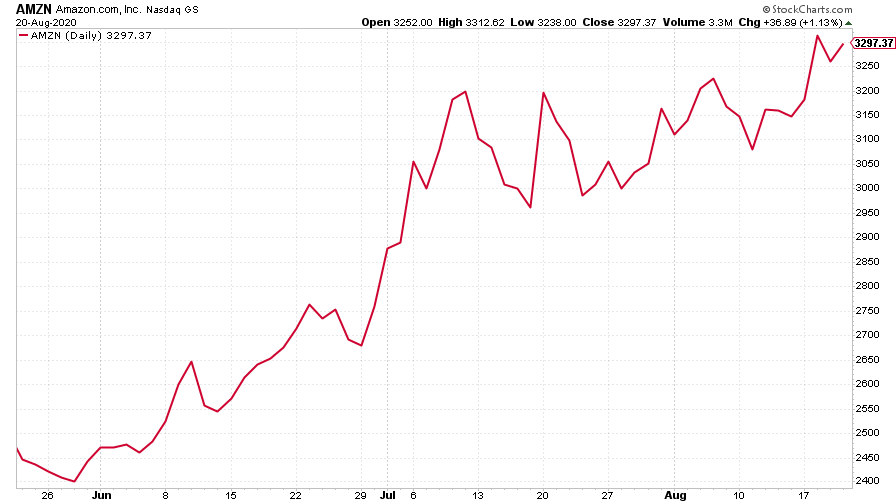

(Amazon: three months)

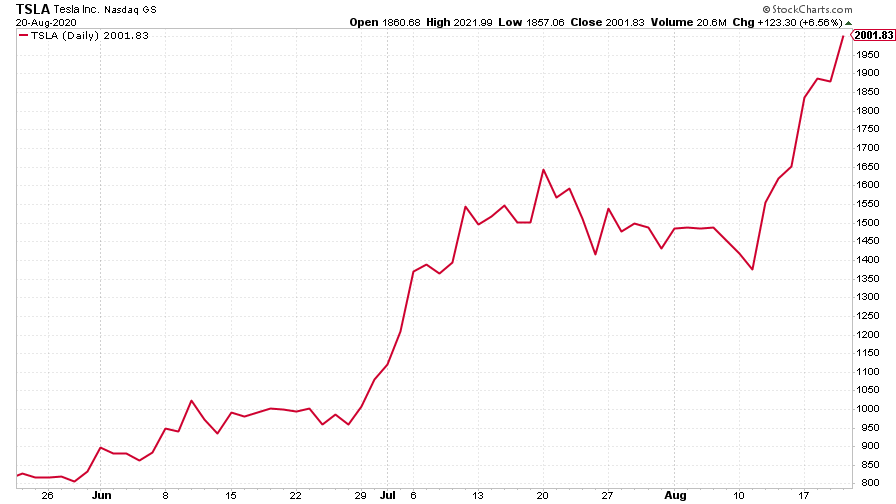

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?