The charts that matter: precious metals, longevity and a cure for baldness

As the gold price presses on to new highs, John Stepek looks at he charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

We have a fantastic new podcast this week. Merryn interviews Andrew J Scott about The New Long Life, the new book he has just written with fellow London Business School professor Lynda Gratton. It’s a fascinating discussion of how we have the potential to live much longer than we have really yet got to grips with. As well as health and wealth tips, this podcast is maybe a bit unusual for us in that – for all that longer lifespans will present their own formidable social challenges – it’s really rather optimistic. I highly recommend you listen to this one.

We also have a new “Too Embarrassed To Ask” video. This week we explain: what’s a “real return” and why is it so important? You can view it here – and if you have five minutes, let me know what you think, at editor@moneyweek.com.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the topic of ageing and health, by complete coincidence, in this week’s issue of MoneyWeek, we had a look at the investment opportunities in the ever-expanding world of male grooming, including the small biotech companies who are hunting for the Holy Grail of the barber shop – a cure for male pattern baldness. If you’re not already a subscriber, get your copy here now.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: Can the recent rally in sterling continue?

- Merryn’s blog: Listed companies are dying out, and that could have serious consequences

- Tuesday: BP has slashed its dividend – and markets love it

- Wednesday: Gold hits the big $2,000 level – are Aim miners about to play catch up?

- Thursday: Don’t despair on dividends – these companies could be set to bring them back

- Friday: Platinum: the precious metal that looks set to play catch-up with silver and gold

And whether you’re off on holiday or staying at home, if you’re looking for summer reading (or an audiobook to speed the time on a long car or train journey), then may I suggest my book, The Sceptical Investor, for the budding contrarian in your life?

Now for the charts of the week.

The charts that matter

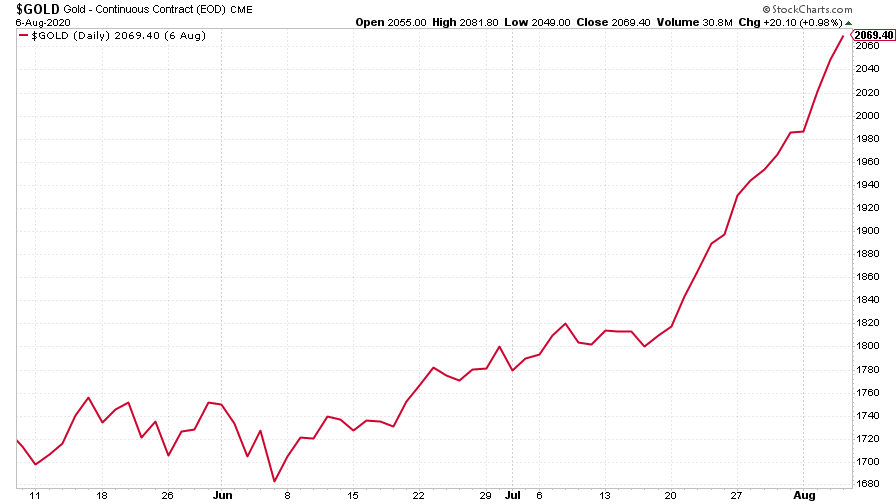

Gold kept going after last week’s record-breaking excitement to set higher and higher new records. It surged above the $2,000 an ounce mark. Silver – its more volatile sister metal – came within a whisker of $30 an ounce as it played catch-up with gold. Dominic looked at where it could go next, and also at the impact of the gold surge on mining shares, here.

(Gold: three months)

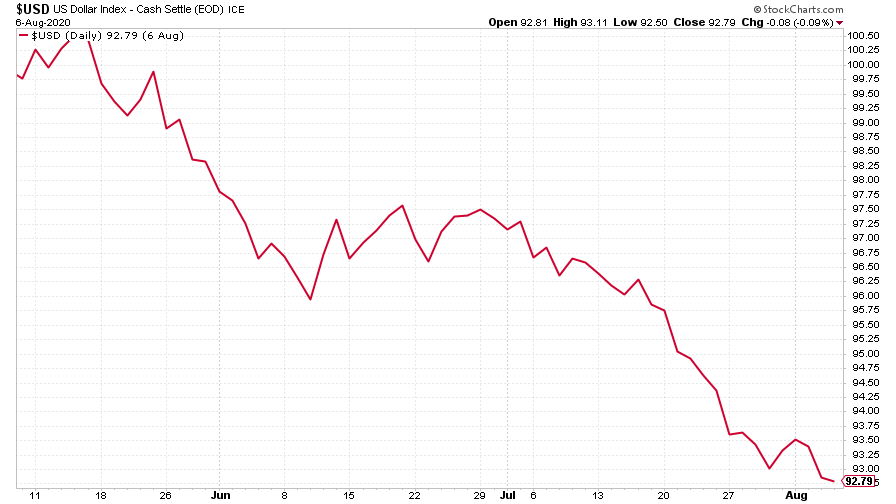

While gold surged, the US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) continued to head lower. That’s good news for “risk assets” in general – everyone needs dollars, so in effect, if the dollar is weaker, money around the world is cheaper.

(DXY: three months)

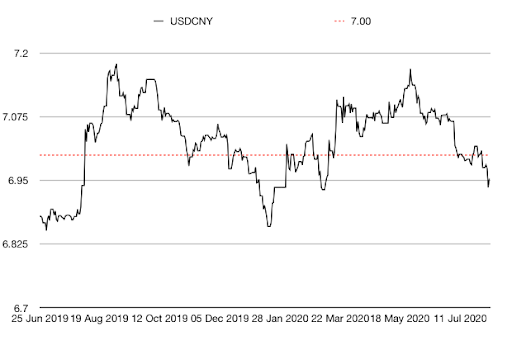

Meanwhile the Chinese yuan (or renminbi) strengthened as the dollar fell (when the black line below falls, it means the yuan is getting stronger). The exchange rate has proved to be a reasonable barometer of tensions between the two countries (the weaker the yuan, the greater the tension) but the US-China relationship has deteriorated to the point where that may no longer be the case.

There’s no doubting that the Chinese government would like the yuan to challenge the dollar for reserve currency status. While devaluing the currency would solve some of its problems, it may not be inclined to do so while it wants to position the yuan as a more reliable store of value than the US currency. This is all long-term stuff but it’s intriguing to think about (Charles Gave has written some interesting theories on the topic).

(Chinese yuan to the US dollar: since 25 Jun 2019)

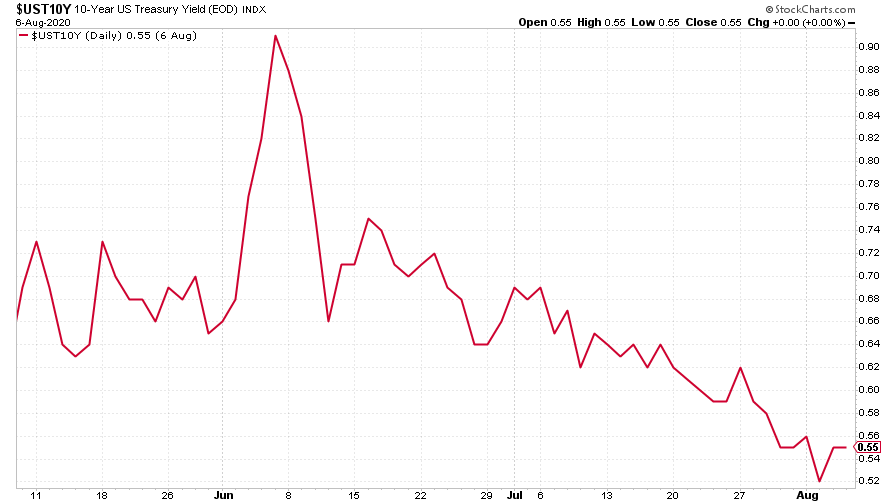

The yield on the ten-year US government bond was little changed on the week.

(Ten-year US Treasury yield: three months)

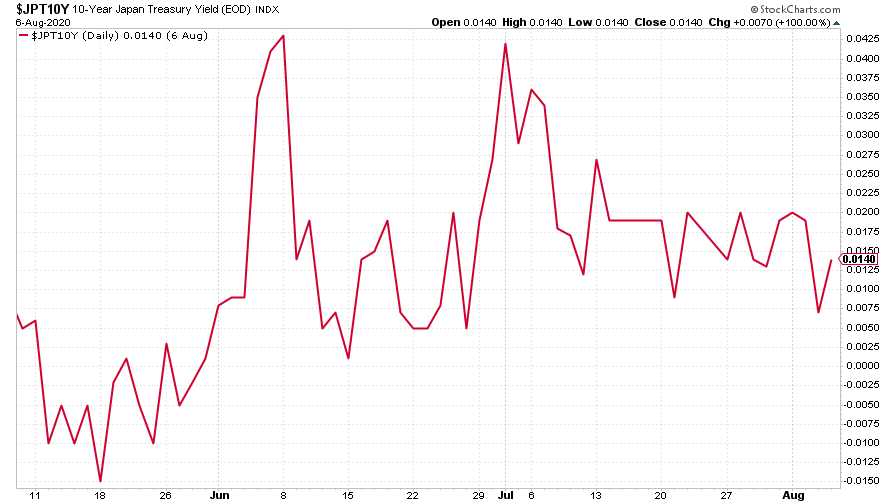

The same goes for the now-virtually-static yield on the Japanese ten-year bond.

(Ten-year Japanese government bond yield: three months)

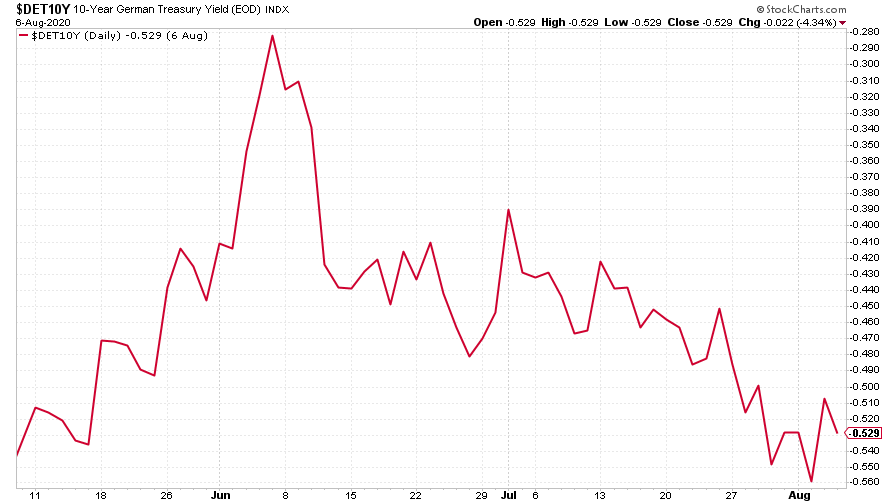

The yield on the ten-year German Bund edged a little higher.

(Ten-year Bund yield: three months)

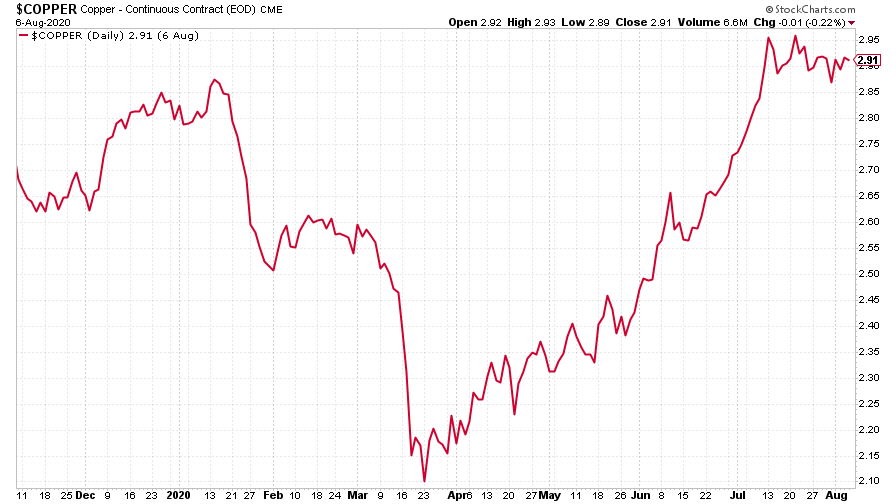

Copper also didn’t move much on the week – it seems to be consolidating its recent rampant surge higher.

(Copper: nine months)

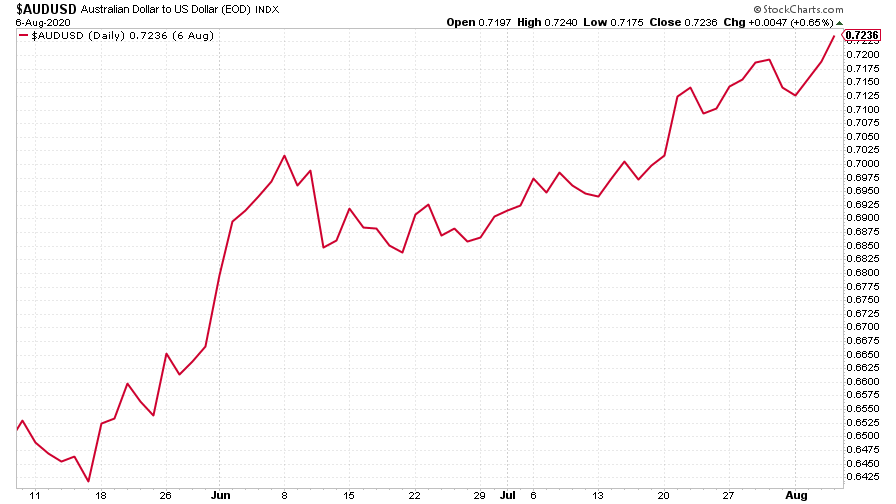

The Aussie dollar continued to climb against the weakening US dollar, helped by the fact that the Australian central bank was fairly upbeat about the economy this week. The Aussie is also a commodity currency play. With gold and silver taking off, and other metals either doing the same or thinking about it, that’s supportive of the Aussie.

(Aussie dollar vs US dollar exchange rate: three months)

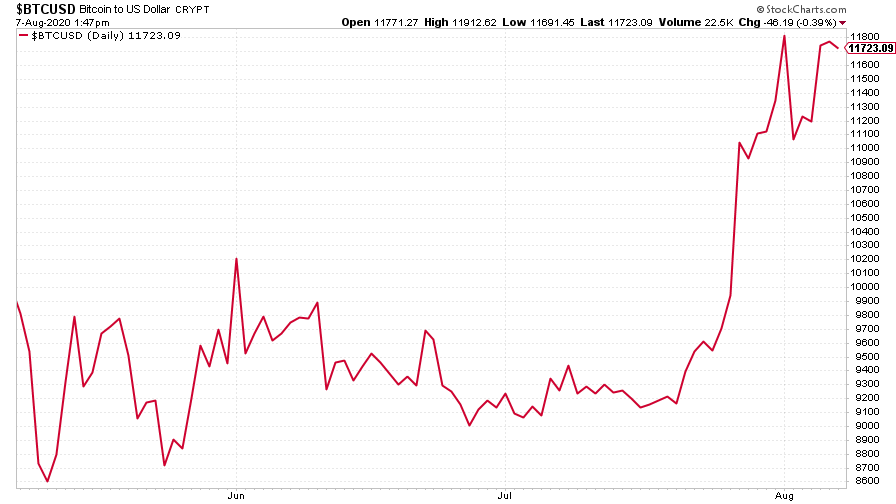

Cryptocurrency bitcoin rose sharply this week and demonstrated some of its more traditional volatility in doing so. Having spent a long time gathering itself below the $10,000 mark, it’ll be fascinating to see how far it can go on this particular run.

(Bitcoin: three months)

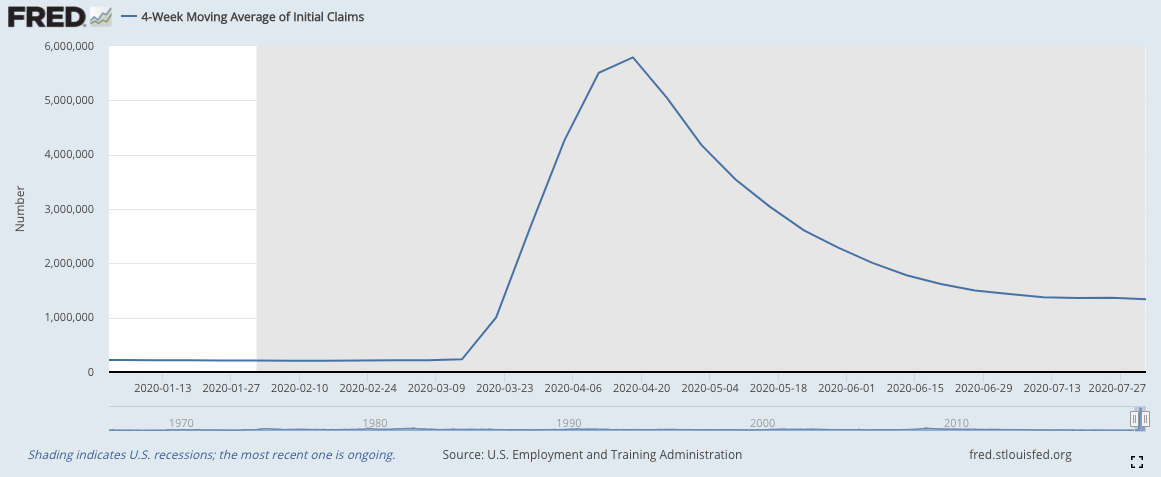

US weekly jobless claims fell this week, a good sign. The number of new claims came in at 1.19 million (from 1.43 million last time), well below expectations for 1.4 million. The four-week moving average fell back to 1.34 million from last week’s 1.37 million. US politicians are still trying to hammer out a deal to extend unemployment benefits although they were getting closer it seems than at this point last week.

More important for the market this week was Friday’s non-farm payrolls report. This showed that the US economy added more jobs than expected last month. Payrolls grew by around 1.76 million employees, beating expectations for 1.65 million. Meanwhile, the unemployment rate fell to 10.2% from 11.1%.

As Andrew Hunter put it for analysts Capital Economics, “employment remains nearly 13 million below its pre-pandemic February level but, overall, the employment report does at least suggest the recovery will continue.”

Overall, the market didn’t react particularly strongly one way or the other. The reading was neither so weak that it encouraged expectations of more government intervention and fears of collapse, nor so strong that it raised concerns about support being withdrawn.

(US jobless claims, four-week moving average: since Jan 2020)

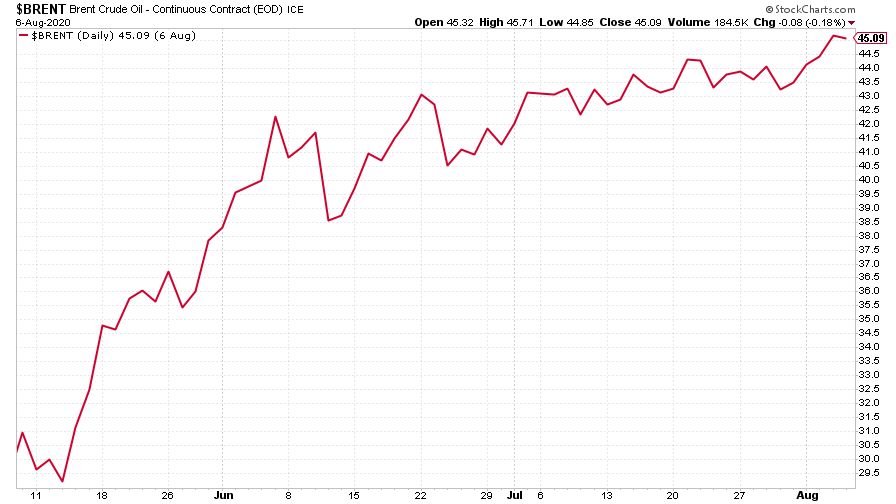

The oil price (as measured by Brent crude) had a stronger week. Cuts in Iraqi production helped to boost the price, and oil also appreciates a weaker dollar (oil is priced in dollars, so it makes it cheaper for other nations). Yet there are still concerns that there's just too much of the stuff out there.

We’ve seen this story many times before. Ongoing fears of a glut mean that producers produce less, and eventually you have fears of a drought. We’ve had “peak glut” fear already so in the longer run I’d expect oil prices to go up. But it might take a while to get investors betting on significantly higher prices again.

(Brent crude oil: three months)

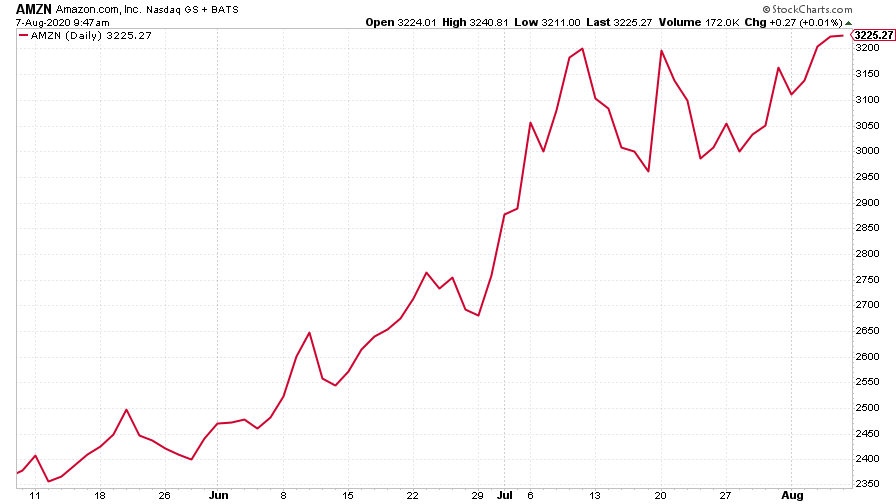

Amazon hit a fresh record high as the Nasdaq index continues to set new records. Amazon founder Jeff Bezos sold $3.1bn-worth of the stock this week. That sounds like a lot, until you realise that he still owns about $170bn-worth, so this isn’t a director’s dealing to take any notice of.

(Amazon: three months)

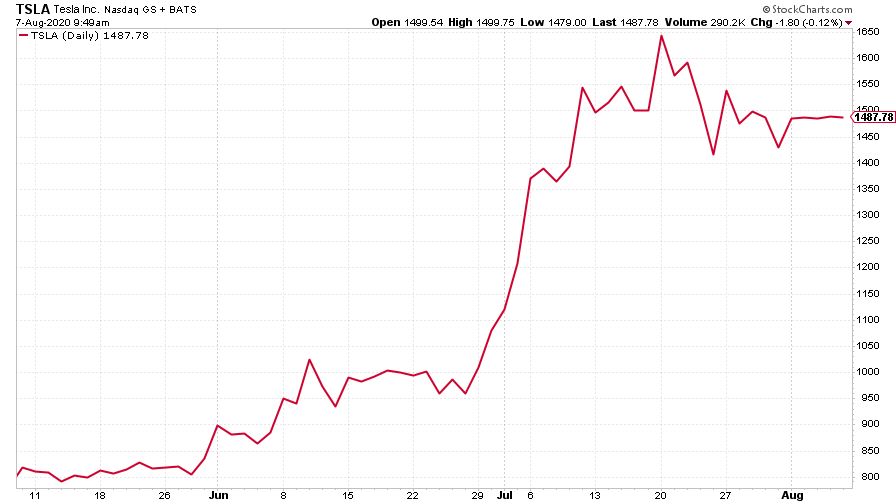

Electric car group Tesla on the other hand, ended the week little changed on the last.

(Tesla: three months)

Enjoy the weekend hot weather – see you next week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?