Quiz of the week 23-29 May

Test your recollection of the last seven days' events with MoneyWeek's quiz of the week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

1. Which country defaulted on its debt for the third time this century after missing a scheduled payment to bond holders of $500m?

a. Argentina

b. Chile

c. Ecuador

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

d. Brazil

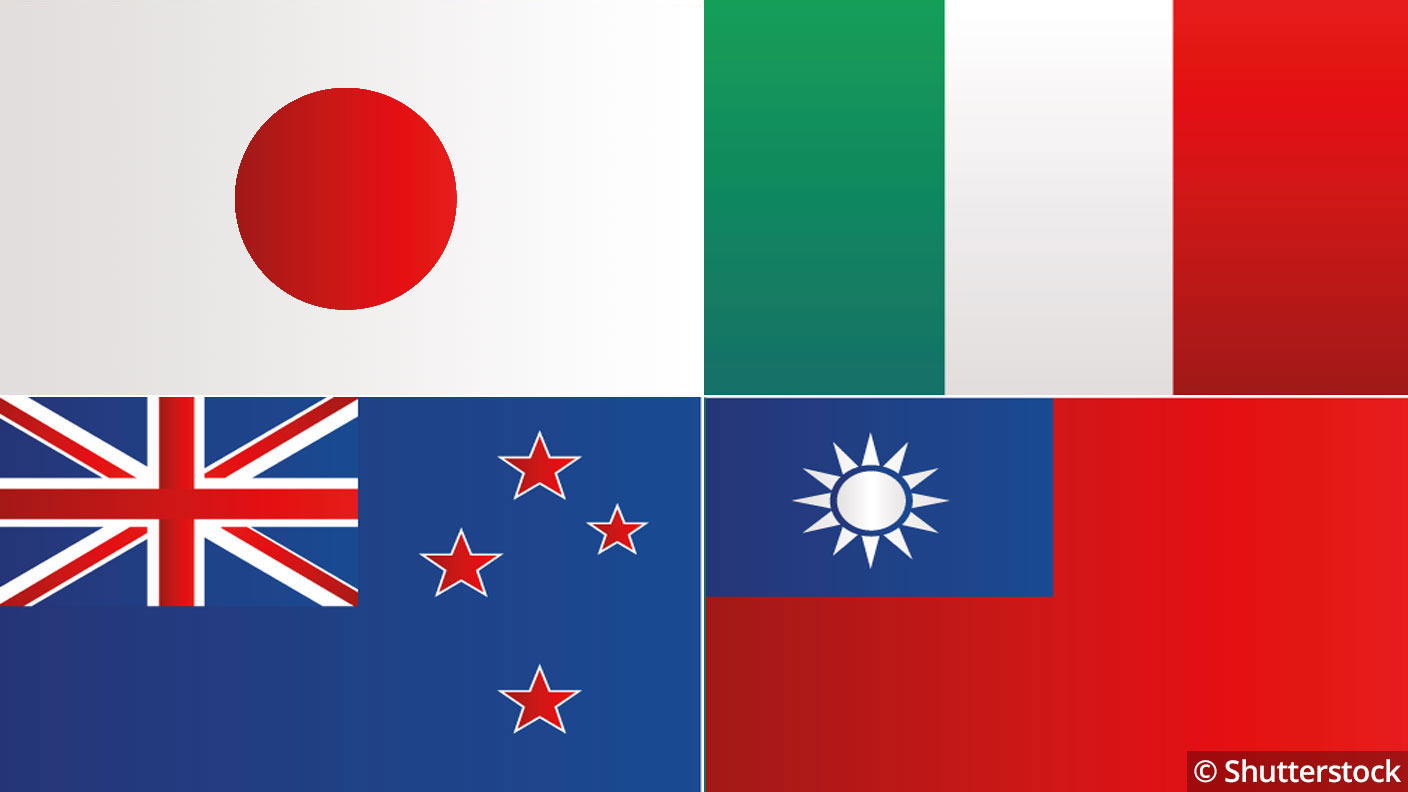

2. Which country hasn’t recorded a case of Covid-19 in over a week?

a. Japan

b. Italy

c. New Zealand

d. Taiwan

3. European Commission president Ursula von Der Leyen pitched her crisis fund proposal this week. How much money is she proposing Brussels borrow on the capital markets?

a. €800bn

b. €750bn

c. €500bn

d. €1trn

4. By how much did Italy’s GDP contract in the first quarter of 2020?

a. 4.7%

b. 5.9%

c. 4.2%

d. 5.3%

5. How many Americans have sought unemployment benefits since the start of the pandemic?

a. 52 million

b. 47 million

c. 40 million

d. 49 million

6. Which stock exchange reopened its famed trading floor this week?

b. New York Stock Exchange

c. Hong Kong Stock Exchange

d. Shanghai Stock Exchange

7. How much did the Dow Jones index rise this week despite political turmoil between the US and China?

a. 3.52%

b. 3.92%

c. 3.82%

d. 3.42%

8. What major airline refused to approve a €9bn bailout package this week?

a. Lufthansa

b. LatAm

c. American Airlines

d. KLM

9. Which airline was found to be the worst for refunds by Which?

a. easyJet

b. British Airways

c. Ryanair

d. Jet2

10. How many cars were made in Britain last month as factory shutdowns pushed production to its lowest level since World War II?

a. 197

b. 263

c. 554

d. 53

Answers

1. a) Argentina. Argentina defaulted for the ninth time in its history this week and is seeking to rearrange $65bn in international debt.

2. c) New Zealand. Only one known active case remains across New Zealand, keeping the total number of cases at 1,504.

3. b) €750bn

4. d) 5.3%. Italy’s economy shrank at the fastest pace on record from January to March. It’s the largest contraction since records began in 1996.

5. c) 40 million.

6. b) New York Stock Exchange. The floor reopened to a quarter of NYSE’s usual population of traders after a two month closure prompted by the pandemic.

7. 3.82%. The Dow Jones is set to close the week with decent gains, up more than 3.82% this week.

8. a) Lufthansa. Lufthansa’s board refused the €9bn lifeline proposed by the German government after the European Commission sought to force the airline to give up coveted slots at Frankfurt and Munich airports.

9. c) Ryanair. A survey found 84% of Ryanair’s customers had not received a refund as requested, compared with 23% at BA, 19% at Jet2.

10. a) 197. The number of cars made was 99.7% down from April last year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.