Quiz of the week 23-29 May

Test your recollection of the last seven days' events with MoneyWeek's quiz of the week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

1. Which country defaulted on its debt for the third time this century after missing a scheduled payment to bond holders of $500m?

a. Argentina

b. Chile

c. Ecuador

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

d. Brazil

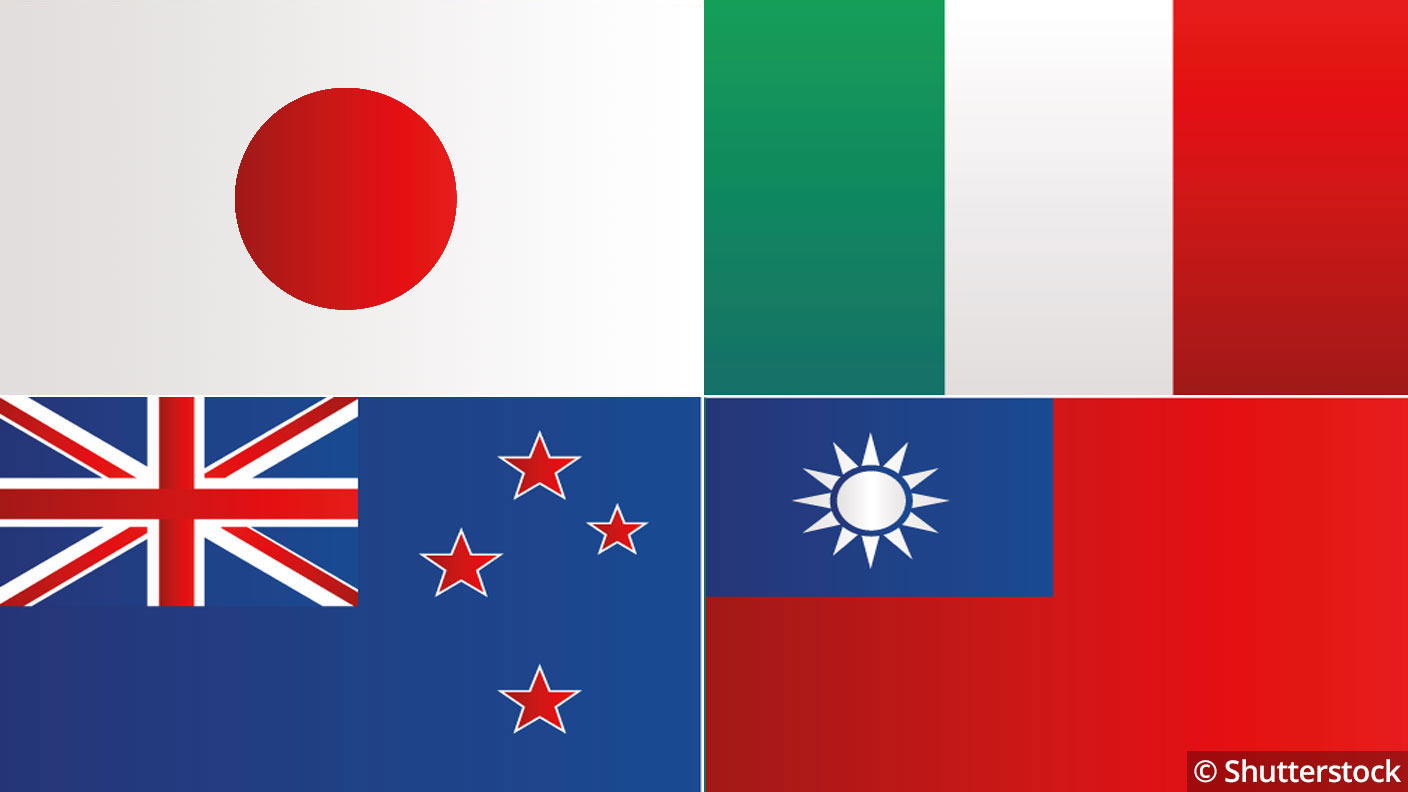

2. Which country hasn’t recorded a case of Covid-19 in over a week?

a. Japan

b. Italy

c. New Zealand

d. Taiwan

3. European Commission president Ursula von Der Leyen pitched her crisis fund proposal this week. How much money is she proposing Brussels borrow on the capital markets?

a. €800bn

b. €750bn

c. €500bn

d. €1trn

4. By how much did Italy’s GDP contract in the first quarter of 2020?

a. 4.7%

b. 5.9%

c. 4.2%

d. 5.3%

5. How many Americans have sought unemployment benefits since the start of the pandemic?

a. 52 million

b. 47 million

c. 40 million

d. 49 million

6. Which stock exchange reopened its famed trading floor this week?

b. New York Stock Exchange

c. Hong Kong Stock Exchange

d. Shanghai Stock Exchange

7. How much did the Dow Jones index rise this week despite political turmoil between the US and China?

a. 3.52%

b. 3.92%

c. 3.82%

d. 3.42%

8. What major airline refused to approve a €9bn bailout package this week?

a. Lufthansa

b. LatAm

c. American Airlines

d. KLM

9. Which airline was found to be the worst for refunds by Which?

a. easyJet

b. British Airways

c. Ryanair

d. Jet2

10. How many cars were made in Britain last month as factory shutdowns pushed production to its lowest level since World War II?

a. 197

b. 263

c. 554

d. 53

Answers

1. a) Argentina. Argentina defaulted for the ninth time in its history this week and is seeking to rearrange $65bn in international debt.

2. c) New Zealand. Only one known active case remains across New Zealand, keeping the total number of cases at 1,504.

3. b) €750bn

4. d) 5.3%. Italy’s economy shrank at the fastest pace on record from January to March. It’s the largest contraction since records began in 1996.

5. c) 40 million.

6. b) New York Stock Exchange. The floor reopened to a quarter of NYSE’s usual population of traders after a two month closure prompted by the pandemic.

7. 3.82%. The Dow Jones is set to close the week with decent gains, up more than 3.82% this week.

8. a) Lufthansa. Lufthansa’s board refused the €9bn lifeline proposed by the German government after the European Commission sought to force the airline to give up coveted slots at Frankfurt and Munich airports.

9. c) Ryanair. A survey found 84% of Ryanair’s customers had not received a refund as requested, compared with 23% at BA, 19% at Jet2.

10. a) 197. The number of cars made was 99.7% down from April last year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.