The charts that matter: is Tesla’s share price “too high”?

With Tesla's earnings surprising to the upside, John Stepek looks at the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

I got a really nice email from a satisfied MoneyWeek reader the other day. “Your magazine has been a game changer for me since I subscribed last year. Keep up the awesome work.”

That made my morning. I’m sharing it with you for two reasons. The first is pretty obvious. If you don’t subscribe, I’d like you to, and I’m hoping that some social proof will get you off the fence if you’re still sitting on it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I’d add that we do have an excellent offer running right now. Not only do you get your first six issues free (so plenty of time to cancel if you decide it’s not for you!), but you also get a free copy of my new ebook, The Little Book of Big Crashes.

So that’s reason one – I want you to buy our magazine.

What’s the second reason? Well, I also just like to hear from our readers. And now we’re just a few weeks away from putting our 1,000th issue out. So whether you’ve been with us for a week, or from way back at the start in November 2000, it’d be great to hear any MoneyWeek-related recollections, investment tales, or observations from your time as a subscriber.

Send me an email to editor@moneyweek.com, with “Issue 1,000” in the subject line. I can’t promise to get back to them all individually (I’m still going through the house-price emails you flooded us with last week) but Merryn and I may well pull together some of the most interesting stories for issue 1,000 or a related Money Morning.

And if you’re not already a subscriber – well, you know what to do next!

The podcasts keep on coming

More new podcasts for you this week – I rejoined Merryn to talk about central bankers’ self-esteem issues, while Alasdair McKinnon of the Scottish Investment Trust told us how he’s adapting to the Covid-19 crisis. Check it out here.

Merryn also had a more upbeat conversation with Pictet’s Luciano Diana about ESG investing in the post-coronavirus era.

And if you’ve missed any over the past month or so, make sure you catch up – Merryn has had a full roster of fascinating interviewees. Here’s a list of just a few of them:

- Professor Steve Keen on debt jubilees;

- Ruffer’s Alexander Chartres on the dawning of a new era for investors;

- Gillian Tett of the FT on lockdown and the US election;

- Intertemporal Economics founder Brian Pellegrini looked on the bright side;

- And financial historian Russell Napier on financial repression.

If you’re new to podcasts, they’re very simple to use. You can click on the links above and the player will just play through your computer speaker; alternatively, if you have an app on your phone, you can download them onto your phone and listen to them while you’re going for your daily state-mandated walk, or doing the gardening.

Money Morning and our new Quiz of the Week

I’m very excited about this one – don’t miss our new Quiz of the Week feature. See how much you can remember about the economic and political events of the past seven days – give it a go here.

And here are the links for this week’s editions of Money Morning plus other stories you might have missed on the website this week.

- Monday: Here’s why cutting interest rates hurts more than it helps

- Merryn’s blog: How new technology can bring retail investors back to the party

- Tuesday:Negative oil prices are just one result of banning bankruptcy

- Merryn’s blog: Dividends, directors and the holes in the government’s coronavirus furlough scheme

- Wednesday: The FTSE 100 is nearly back in a bull market – does that make sense?

- Thursday: Comedy and Covid 19: the lessons for investors

- Friday: Royal Dutch Shell slashes its dividend: what now for income investors?

And if you view yourself as a contrarian investor – or you’d like to know how to become one – then pick up a copy of my first book, The Sceptical Investor. It’s also available in audio – you can even get it for free if you’re signing up to Audible for the first time.

The charts that matter

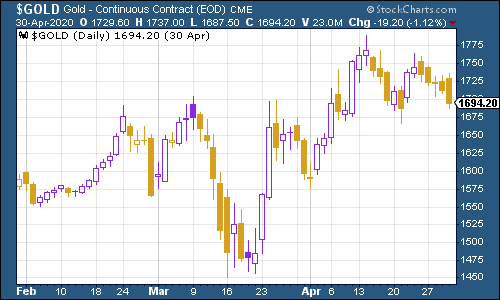

Gold (measured in dollar terms) fell back this week as investors sentiment improved. When investors feel that things might get better, they favour equities over gold.

(Gold: three months)

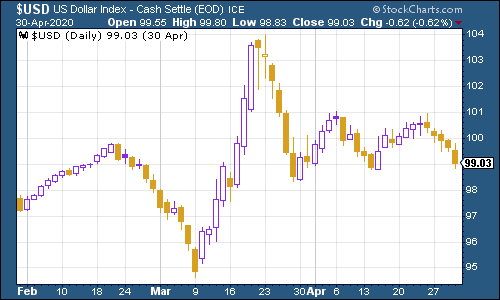

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – fell back right up until the end of the week as a mild “risk-on” mood gripped investors.

(DXY: three months)

The Chinese yuan (or renminbi) remains above the $1/¥7 mark, but currently shows no signs of weakening drastically (which would be deflationary and thus worrying).

(Chinese yuan to the US dollar: since 25 Jun 2019)

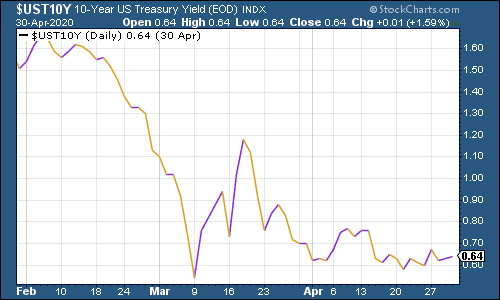

The yield on the ten-year US government bond remains extremely low, with investors still clinging to their “risk-free” assets. But it hasn’t made a new low since the March panic moment.

(Ten-year US Treasury yield: three months)

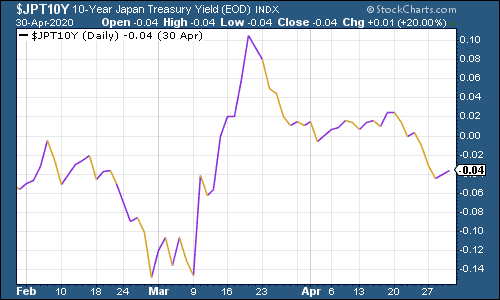

The yield on the Japanese ten-year was little changed, even though the Bank of Japan is steadily increasing the quantity and type of assets that it’s prepared to buy.

(Ten-year Japanese government bond yield: three months)

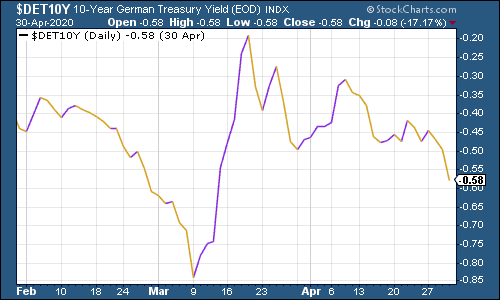

The yield on the ten-year German Bund fell back this week. The European Central Bank didn’t decide to increase its current bond-buying scheme, but it will be feeding more money to commercial banks via the back door and clearly remains very open to doing a lot more. That said, markets weren’t necessarily relieved – the gap between German and Italian bond yields rose, suggesting that investors are increasingly concerned about Italy’s prospects in the absence of a concrete commitment from the rest of the eurozone to underwrite its borrowing costs.

(Ten-year Bund yield: three months)

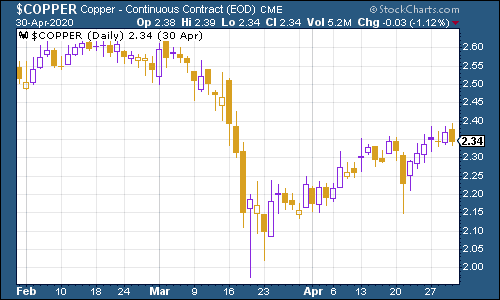

Copper continues to edge higher – this is one reason to cling to hope that the global economy might fare better in the medium-term than we might believe.

(Copper: three months)

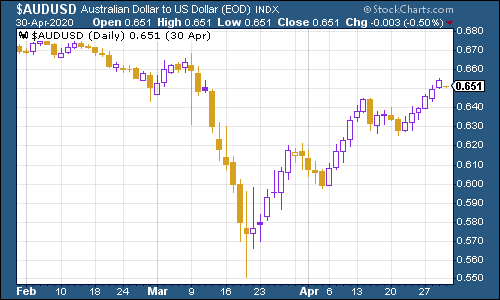

The Aussie dollar has continued to rally this week, helped by China’s economy continuing to come back online, as well as Australia’s so-far relatively mild brush with coronavirus.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin had a solid run higher this week, making it back above the $9,000 mark for a little while before easing lower towards the end of the week.

(Bitcoin: ten days)

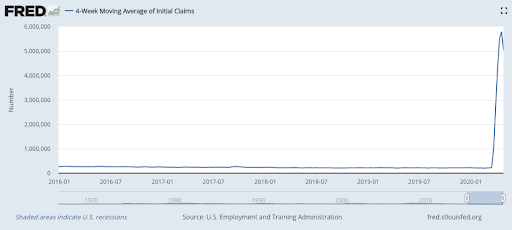

US weekly jobless claims were again awful – this week’s claim of 3.8 million was lower than last week’s (4.43 million), but the figure was still worse than expected. That means about 30 million people have joined America’s dole queues in the last six weeks. The four-week moving average now sits at 5.03 million, which is at least an improvement on last week’s 5.8 million.

The one saving grace – as far as I can see – is that reportedly, in many cases, the combination of state unemployment benefits and emergency federal top ups means that a significant proportion of workers, particularly the lowest paid, are actually getting more money now than when they were working.

On the one hand, that might make it harder to get people back to work (although I’m not convinced of that). But on the other hand, it’s good because the US is a consumer-dependent economy, and if people still have a decent overall level of income, then that should make any “return to normal” a bit quicker than if this was a standard recession.

We’ll see before long. I’m trying to find a bright side to what is otherwise a starkly grim statistic here.

(US jobless claims, four-week moving average: since January 2016)

The oil price began to recover somewhat this week after the extraordinary events of the previous week. The market was given a lift by news that US crude oil inventories aren’t filling up as quickly as some had feared.

(Brent crude oil: three months)

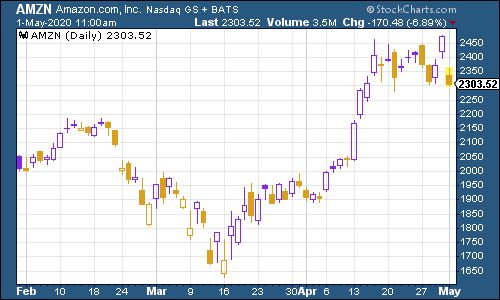

Amazon shares slipped back as the company warned that even though it’s done good business during the coronavirus outbreak, the rise in costs related to deliveries and keeping staff safe could more than offset the boost to sales.

(Amazon: three months)

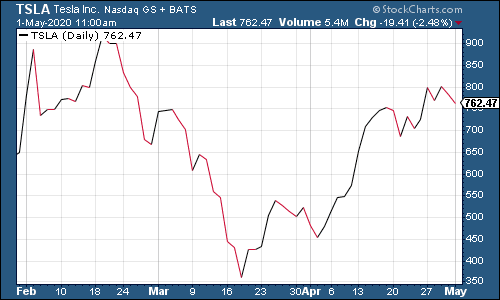

Electric car group Tesla meanwhile was higher after first-quarter earnings surprised on the upside. Elon Musk, the shall-we-say, mercurial, chief executive and founder, then on Friday said that the share price was too high, and it fell somewhat.

For what it’s worth, I agree with Musk on this one, though I suspect that we might disagree as to where the point of fair value actually lies. Its valuation is still credulity-straining if you exclude all the blue-sky hope baked into the price but that’s been the story of Tesla so far, and it’s not changing now it appears.

Indeed, the persistence of Tesla’s “long duration, jam tomorrow” popularity is another reason why I don’t think the coronavirus really marks the definitive end of the post-2009 bull market – I think that will only truly come when inflation takes off.

(Tesla: three months)

Have a good weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Ayatollah Ali Khamenei: Iran’s underestimated chief cleric

Ayatollah Ali Khamenei: Iran’s underestimated chief clericAyatollah Ali Khamenei is the Iranian regime’s great survivor portraying himself as a humble religious man while presiding over an international business empire

-

'AI will change our world in more ways than we can imagine'

'AI will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.