The charts that matter: that was a week for the history books

John Stepek looks at how the events of a remarkable week in the markets have affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What can I say? I thought the week before last was a bit of a rollercoaster ride, but this week just past – that was something else altogether.

Frankly, what we’d expected to be the big event of the week just a few months ago – the UK Budget – got rather lost in all the pandemonium.

The worry is that I don’t think we’re through the worst yet. Maybe I’m wrong but even though governments and central banks seem to be gearing up to go all-out to tackle this with the sort of spending splurges we expected, markets look fragile.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Until there’s some view of just how bad this is going to get, expect volatility. I’m particularly concerned as we haven’t seen anything blow up properly yet. It feels like that should have happened by now, or that it’s happened and we just haven’t heard about it yet.

That said, a part of me is also itching to buy something.

Anyway, Merryn and I finally managed to record a new podcast (!). We talk about exactly what you’d expect, although we recorded it on Monday so even now it might feel a bit out of date. You can listen to it here.

And if you want a slightly lighter tone, I joined The Week Unwrapped team this week to discuss oil price wars, the burgeoning low-alcohol beer industry, and Arctic chlamydia (no, really).

Here are the links for this week’s editions of Money Morning plus other stories you might have missed on the website this week.

- Monday: Black Monday: what the oil price crash means for your money

- Afternoon update: Is this the last hurrah for the government bond bubble?

- Tuesday:Don’t try to time the market – here's how to get rich slowly with investment trusts

- Merryn’s Blog: If you think now is a good time to buy, look at these investment trusts

- Wednesday: Silver has almost never been this cheap – but should you buy?

- Budget roundup: Rish Sunak’s bumper giveaway Budget

- Central bank alert: Here’s what the Bank of England is doing to tackle coronavirus

- Thursday: Buckle up – there’s a lot more financial market turbulence to come

- Post-carnage update: The FTSE is down more than 10% today. So what now?

- Friday: What can we learn from the market crash? And what can we buy now?

- Subscribe: Get your first 12 issues of MoneyWeek for £12

Merryn also wrote about ESG and ethical investing, and where to start – check it out here.

Oh, and now might be a good time to get more acquainted with contrarian investing. May I suggest my book, The Sceptical Investor, as just the place to start – you can pick it up here.

The charts that matter

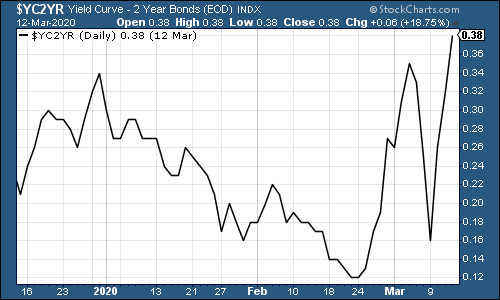

The US yield curve – as measured by the gap between the yield on the ten-year US Treasury (government bond) and the two-year – kept steepening this week. Markets expect the Federal Reserve to cut interest rates even further.

The main point of monitoring the yield curve is because it’s a good recession indicator. However, it inverted last year and that was the signal we needed. It looks like it’s going to turn out to be accurate (the odds of avoiding a recession now seem slim to non-existent). So I’m probably going to drop this indicator from future editions for now.

(The gap between the yield on the ten-year US Treasury and that on the two-year: three months)

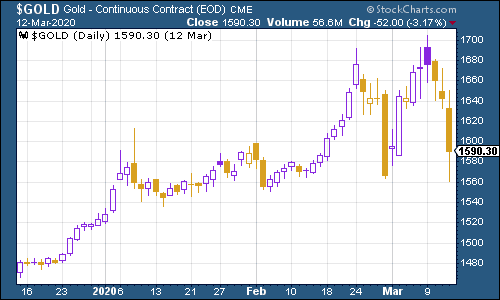

Gold (measured in dollar terms) had a bad week. Why, when everything looks so grim? A couple of things. One, the dollar rocketed towards the end of the week as people craved cash. Two, when people crave cash, they sell the stuff that they can actually sell as opposed to the stuff that simply won’t shift in an illiquid market.

To be clear, I am still very comfortable holding gold. Just understand that the price goes up and down and that just because equities fall it doesn’t mean gold will go up in a perfect negative correlation.

(Gold: three months)

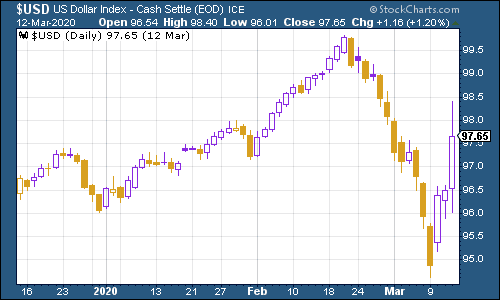

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – surged. It’s partly because action by other global central banks and governments has left the US looking behind the curve, but it’s likely mostly because of pure fear.

(DXY: three months)

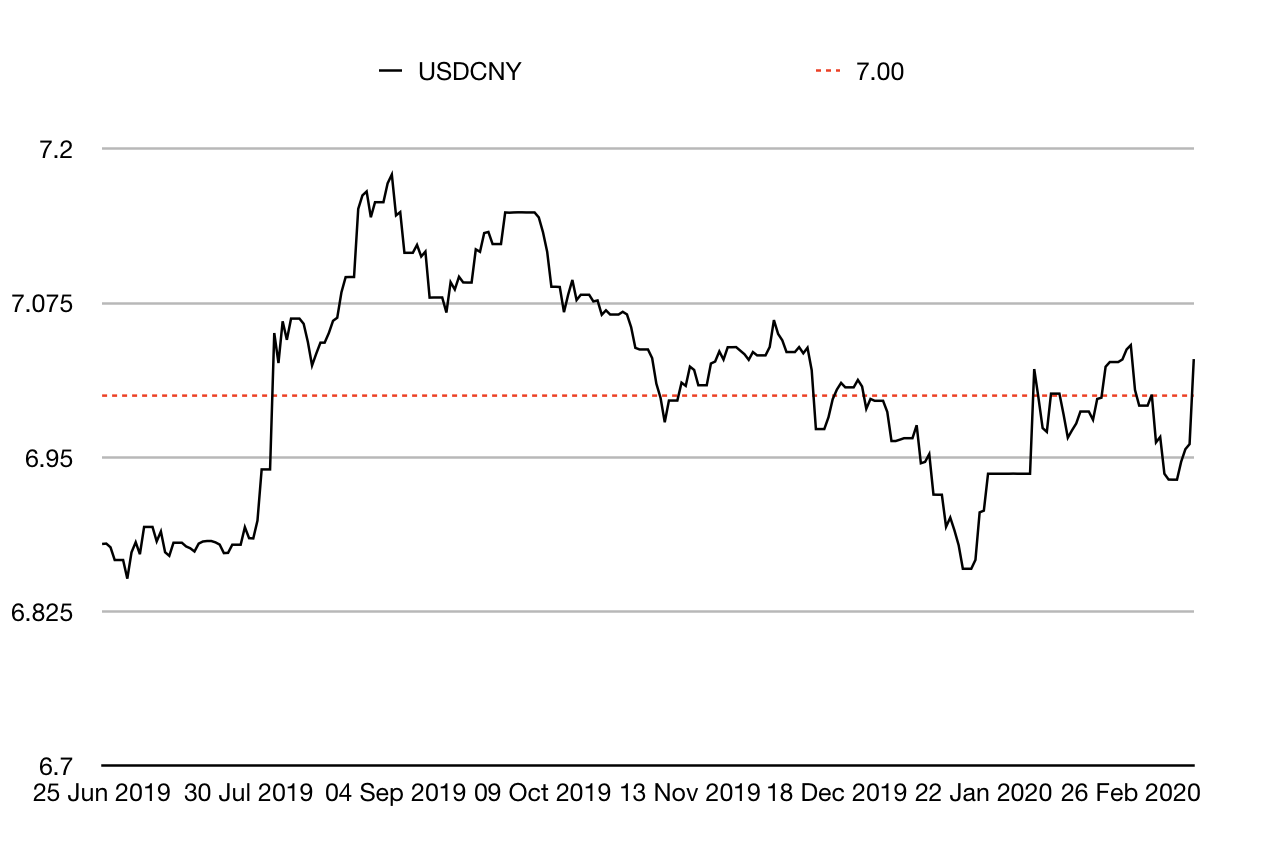

The strengthening US dollar also meant that the Chinese yuan (or renminbi) weakened enough to breach the $1/¥7 mark that gets markets worried (although at the moment that’s the last of their worries).

(Chinese yuan to the US dollar: since 25 Jun 2019)

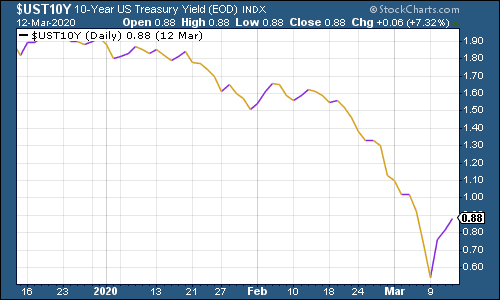

The yield on the ten-year US government bond rebounded at the end of the week after collapsing in horror midweek. Let’s see if this was the bottom or if it ends up going even lower (I fear it might, and I’ve long been calling the end of the bond bubble – maybe that’s a contrarian indicator).

(Ten-year US Treasury yield: three months)

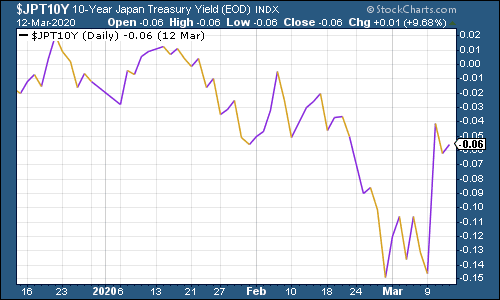

The yield on the Japanese ten-year followed a similar path (strange and grimly ironic to see the Japanese and US ten-year yields converging after all this time).

(Ten-year Japanese government bond yield: three months)

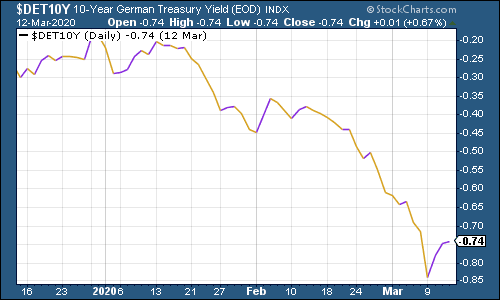

And the yield on the ten-year German bund followed suit.

(Ten-year Bund yield: three months)

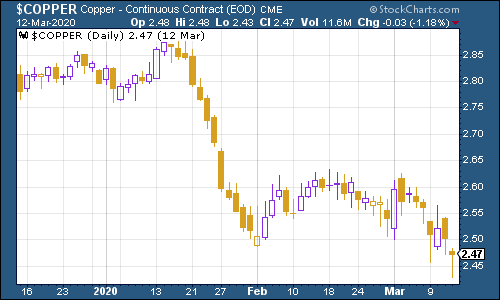

Copper headed lower but I must admit it still seems like an interesting outlier. Given everything that’s going on I’d have expected a more significant collapse here. Maybe it’s still coming.

(Copper: six months)

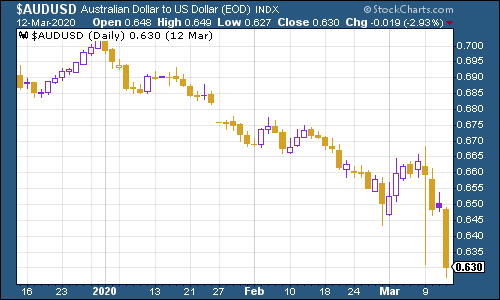

The Aussie dollar simply gave up in the face of a stronger US dollar and a more proactive Aussie central bank.

(Aussie dollar vs US dollar exchange rate: three months)

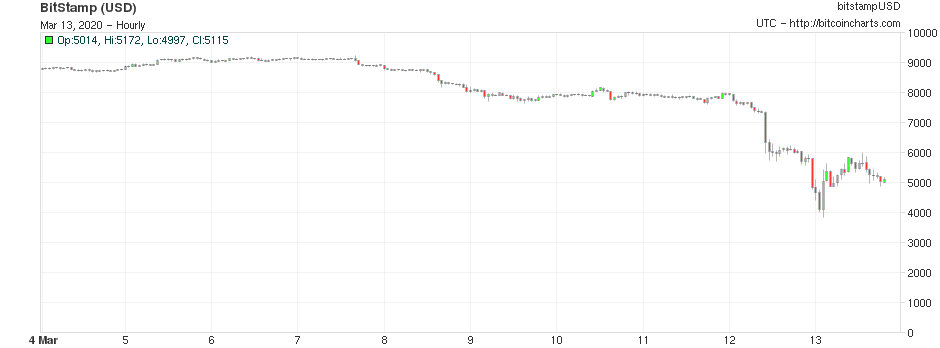

Whatever else it is, cryptocurrency bitcoin is not a safe haven. But I do wonder if it’s getting cheap. Apparently it costs more to mine a new bitcoin now than the selling price. That’s often a good sign with commodities. And I suppose bitcoin is something akin to a digital commodity.

(Bitcoin: ten days)

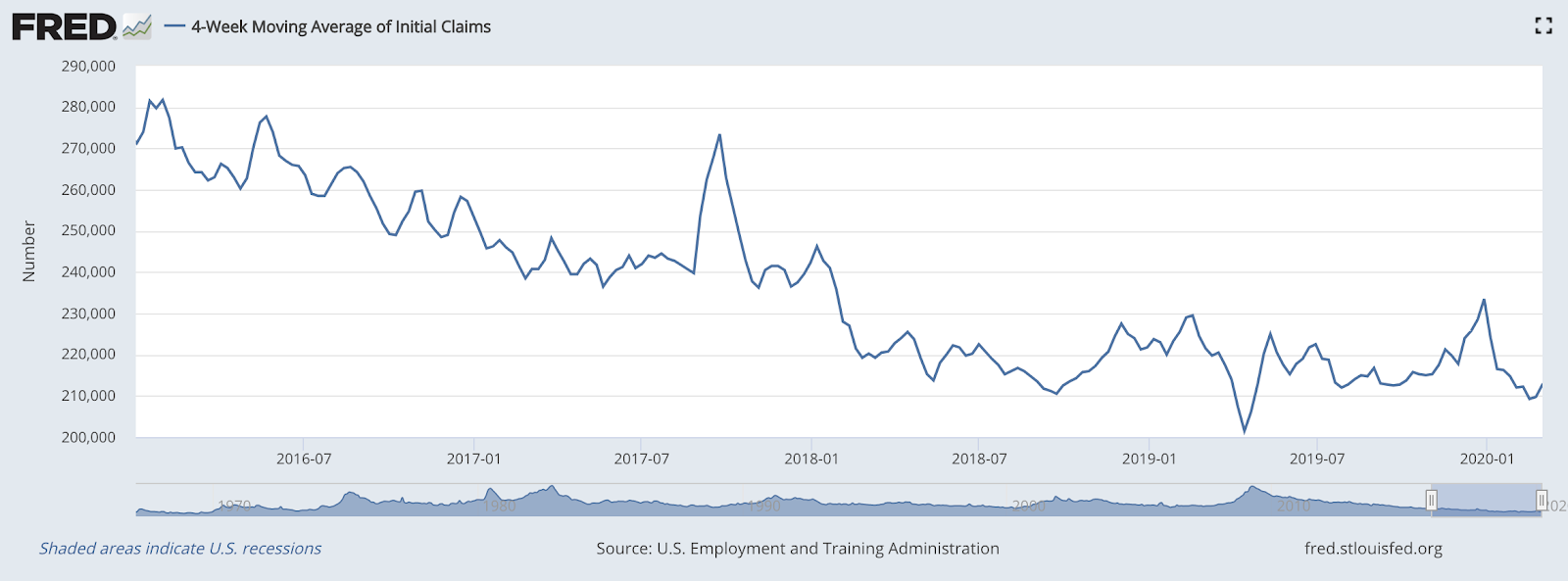

US weekly jobless claims edged lower to 211,000. The four-week moving average now sits at 214,000. When the four-week moving average troughs, the market often hits a top soon after.

This is all good. But here’s the problem: I can’t imagine that we aren’t about to see this number start to rise. Almost every company in America must be looking at a hiring freeze. Some of them will already be laying people off. I suspect that this number is about to rise quite sharply over the coming months.

(US jobless claims, four-week moving average: since January 2016)

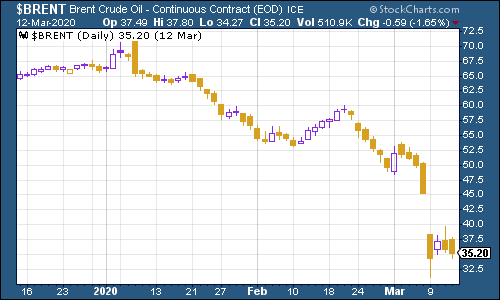

The oil price (as measured by Brent crude, the international/European benchmark) toppled as Saudi Arabia and Russia declared an oil price war. I discussed this in The Week Unwrapped podcast mentioned above, and it’s on the front cover of this week’s MoneyWeek magazine (do subscribe now if you don’t already, it’s well worth it).

(Bonus points for anyone old enough or market history-obsessed enough to get our slightly geeky cover reference this week).

(Brent crude oil: three months)

Amazon fell back but not as sharply as many companies – I mean, I suspect they have the opportunity to do a lot of business if we’re all sitting at home, assuming anyone turns up to work.

(Amazon: three months)

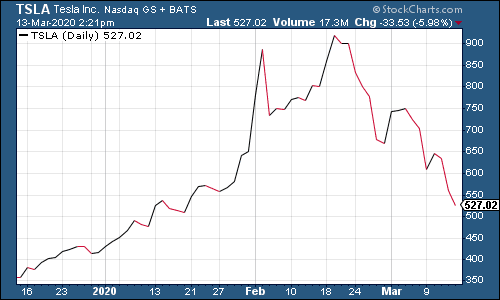

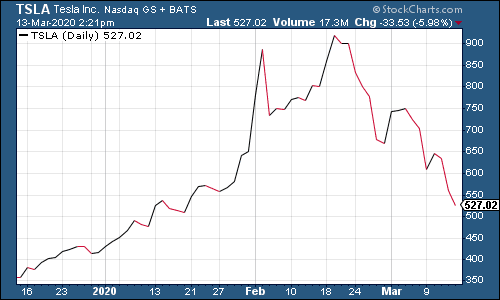

Electric car group Tesla fell hard but it still hasn’t given up anywhere near the gains that it made during its mania phase. Will it fall all the way? Will Elon Musk mark the bottom in some way, just as Aramco marked the top? I wonder.

(Tesla: three months)

Have a good weekend and, while I know it’s not easy, try not to fret too much about all this.

For what it’s worth, it might help to write down a list of exactly what you’re worried about, so that you can figure out what you can and cannot control.

You then look at how you can affect and improve the things that lie within your control, which helps to distract from the things that you cannot control.

That helps me, but then I’m a writer. You may find another method suits you better.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.