Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

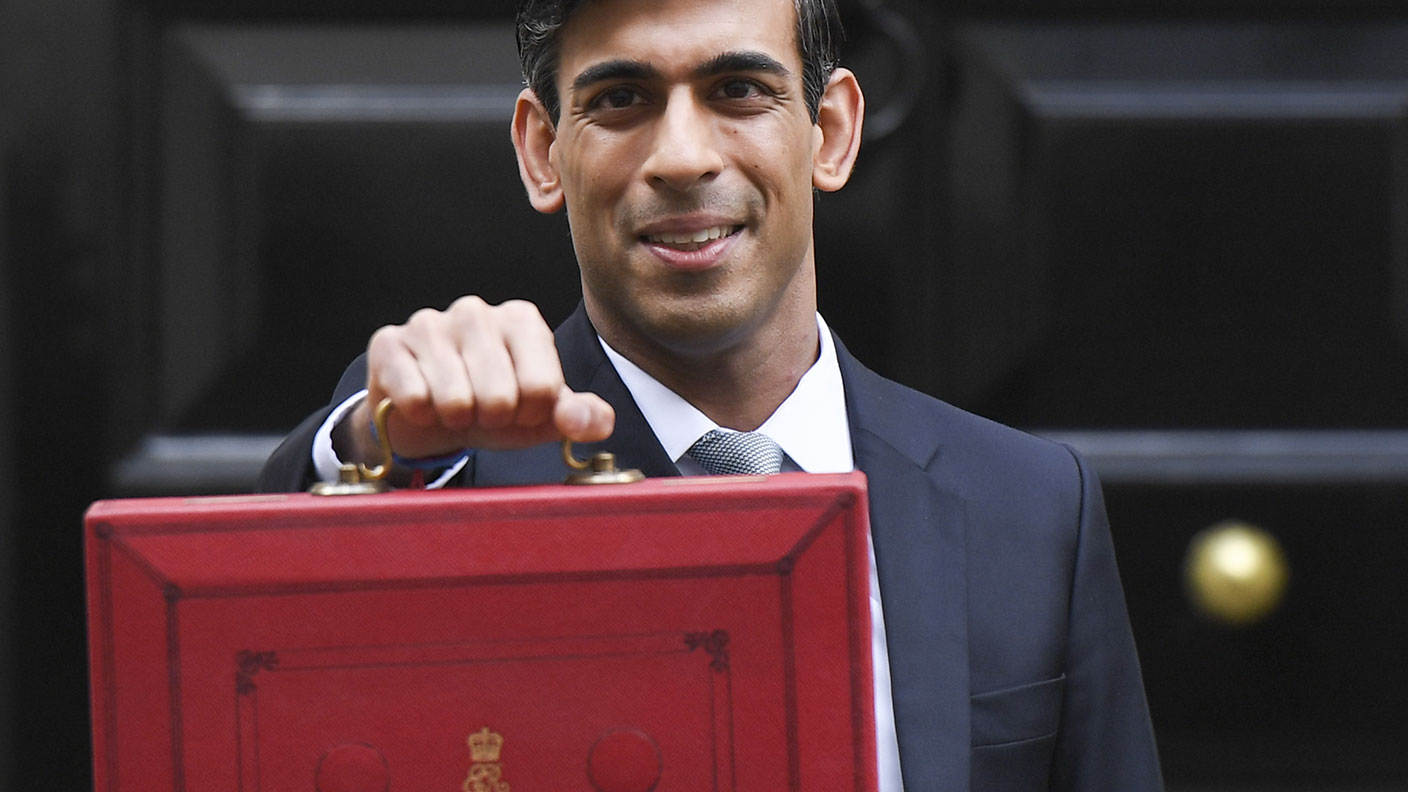

In his first Budget, Rishi Sunak was in a generous mood, pledging £30bn to counter the coronavirus epidemic plus money for business, infrastructure, and education.

The biggest threat to the economy right now is the coronavirus, with up to 20% of the workforce expected to be out of action and global supply chains disrupted. Building on the Bank of England’s interest-rate cut this morning, Sunak met the challenge head on. Statutory sick pay (SSP)will be paid from day one, not day four. It will be available to employees who self-isolate, even if they have no symptoms. And it will be possible to get a sick note by calling 111, rather than visiting your GP.

To help small businesses cope with the extra expense, the cost of providing SSP for the first 14 days will be borne by the government for all businesses with fewer than 250 employees. He introduced temporary “coronavirus business interruption loans” of up to £1.2m, provided by commercial banks, but 80% guaranteed by the government. The removal of business rates for retail businesses valued below £50,000 will be extended to the leisure and hospitality sectors. And any business eligible for small business relief will get a cash grant of £3,000.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

For low-paid workers, the national living wage will rise to £10.50 an hour by 2024, and the national insurance threshold will rise from £8,632 to £9,500.

VAT will be removed from women’s sanitary products, and from digital publications (ebooks, newspapers, etc) Duty increases on all alcohol products have been cancelled. And fuel duty remains frozen for another year.

And, while he admitted he had come under pressure to remove entrepreneurs tax relief, he said he had decided not to fully abolish it, Instead, he will reduce the lifetime limit from £10m to £1m, saving £6bn over fiveyears.

Environment

To bolster the country’s green credentials, he raised the levy on gas, while freezing it on electricity. He introduced a new plastics and packaging tax of £200 per tonne, if less than 30% of it is recycled. And he abolished the “red diesel” tax break for all but farmers railways domestic heating and the fishing industry. He promised £1bn for green transport, including £500m to support the rollout of a fast-charging network for electric vehicles, and promised to establish “two or more” carbon capture and storage facilities by 2030.

Infrastructure and regions

He was in a generous mood when it came to infrastructure and the regions, too, promising that “if the country needs it, we will build it”.He pledged £5bn to roll out cable broadband nationwide and £510m to upgrade the rural mobile phone network to provide 4G coverage. Plus, £27bn for road-building, including a £2.5bn “pothole fund”, and funding for rail.

Regional parliaments get extra cash, with £640m to Scotland, £360m to Wales and £210 to Northern Ireland. Around 22,000 civil servants will be pushed out of London and a new economic campus will be built in the north with 750 staff moved from Whitehall.

Housing and health

In housing, Sunak extended the affordable homes programme to £12bn; cut interest rates on lending for social housing by one percentage point;and pledged £650m to help rough sleepers into permanent accommodation.

He introduced a stamp duty surcharge of 2% from April 2021 for non-residents buying property. And a £1bn building safety fund to help remove unsafe cladding from high-rise buildings.

As for health, he promised that £6bn of “new” funding would be available, which would provide for 50,000 nurses, more GP appointments and 40 new hospitals. And to address the pensions anomaly where doctors and consultants are effectively punished for working more hours by heavy tax penalties on their pension contributions, he reduced the “taper threshold” by £90,000.

How it affects you

Enter your details into the form below, from leading accounting and tax advisory firm Blick Rothenberg to see how much better or worse off you'll be.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.