Have we reached the end of the road for petrol cars?

The prime minister has said that all new sales of vehicles with internal combustion engines will be banned from 2035. Is that achievable?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What has happened?

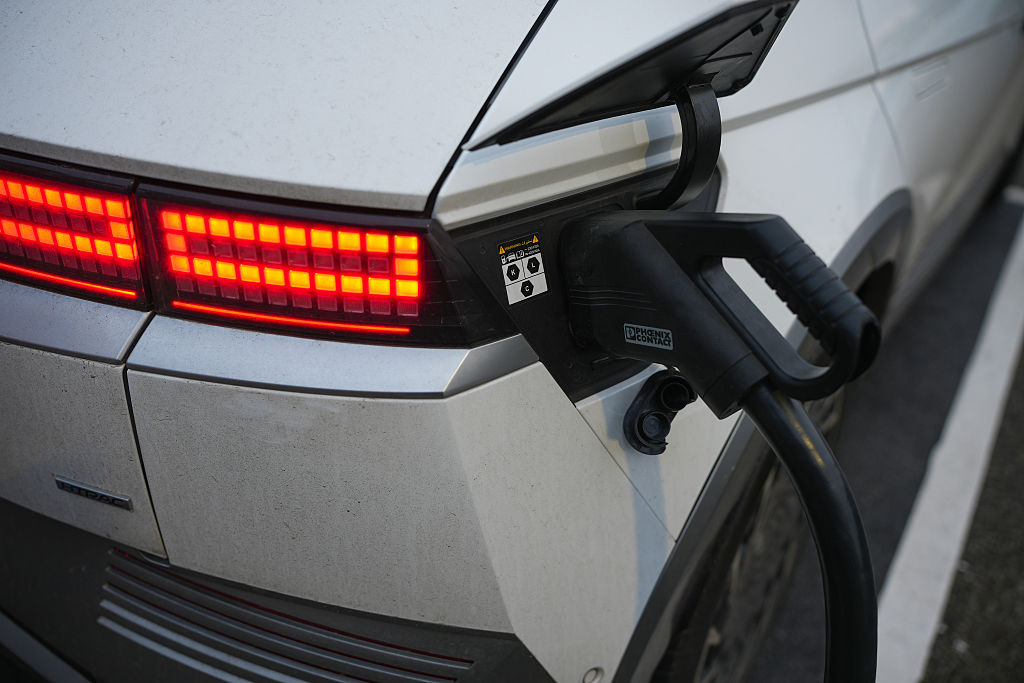

Last week Boris Johnson shocked the motor industry by announcing a ban on sales of new petrol, diesel and hybrid cars (including plug-in hybrids) from 2035, rather than 2040 as previously announced. From then, new cars must be fully electric or hydrogen-powered (though you will still be able to drive existing petrol and diesel vehicles, and buy them second-hand).

Five years may not sound like much, but given that planning for new car models takes about five years, and the projected production lifetime of a model is around seven years, the earlier date change radically alters the planning assumptions for car makers selling into the UK – and has put the industry in a spin. Whether this will actually become law remains unclear. The PM’s announcement was contradicted by briefings from the Department for Business, Energy and Industrial Strategy, which suggested it was more a consultation process. Either way, it’s a wake-up call for the industry.

How popular are electric vehicles now?

They account for a tiny proportion of the market (2.7% of the UK’s new car market on last month’s figures), but it’s growing fast – tripling in the past year (from 1,334 cars sold in January 2019 to 4,054 in January 2020). But once you include hybrids (see below), the sector accounted for 20% of January car sales in a market that fell 7% year-on-year. For many consumers, though, electric cars suffer from the same catch as other fast-evolving high-tech sectors: why should I buy one today given that they’ll almost certainly be much cheaper and better within a few years? That makes it hard for the sector to build critical mass.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

How long will it take?

Analysis (from the Committee on Climate Change, and separately from McKinsey) reckons the purchase cost of electric vehicles will fall to parity with petrol/diesel by 2025 as the sector scales up and battery prices fall. Every major car maker is launching a fully electric car within the next 12 months (if they haven’t already). Deloitte reckons price parity on total ownership cost – factoring in the lower price of electricity compared with petrol, but allowing for higher purchase prices – will be reached by 2024. At that point, the market is expected to take off.

So the 2035 deadline is realistic?

Car makers don’t think so. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, said the shift was “extremely concerning”. According to Hawes, manufacturers are already “fully invested in a zero-emissions future”, with some 60 plug-in models now on the market and 34 more coming over the course of this year. But with demand for this emerging and still expensive technology making up just a fraction of overall sales, it’s “clear that accelerating an already very challenging ambition will take more than industry investment”, he argues. In particular, building a charging infrastructure that gives drivers the confidence to buy electric vehicles will be critical.

How much will that cost?

Conceivably about as much as HS2. According to Scottish Power, the UK would need 25.3 million charging points in order to meet the 2050 net-zero target – or about 4,000 new points every day. That compares to a total of 30,000 public charging points now, spread across 11,000 locations. The cost of building the new infrastructure is estimated at £45.9bn. And the cost of beefing up the UK’s electricity grid and power generation infrastructure to meet the new demand would cost another £48.5bn, Scottish Power estimates. That’s a massive sum that will require public investment as well as higher bills. Meanwhile, the government will also have to factor in a £28bn loss in annual revenues from fuel duty, the IFS reckons. It suggests road pricing will be the obvious replacement.

But why ban hybrids?

That decision looks especially rash. Hybrid vehicles have both a battery and an internal combustion engine and use regenerative braking technology to convert the vehicle’s kinetic energy into electrical energy stored in the battery. As such, they eliminate the “range anxiety” associated with electric vehicles and are widely seen by the industry as vital to the process of shifting consumers to EVs, since they facilitate lower emissions and long journeys without long stops for recharging. Until now, hybrid electric vehicles have been encouraged by the government, especially plug-in (PHEV) 48-volt technology, where the combustion engine acts as a back-up when the battery is low. But if sales of hybrids are to be banned from 2035, a key plank of the car industry’s transition planning has been knocked from under it and untold millions of research and development investment wasted.

But all this will help the environment?

It is not axiomatic, argues Nick Rufford in The Sunday Times. Electric cars don’t emit carbon when you drive them, or pump out particulates and noxious nitrogen oxides into city streets. But ultimately they are only as green as the electricity that charges them – and for now half our electricity is still generated by burning fossil fuels. Once you factor in the carbon associated with manufacturing them (including the batteries that require the mining of lithium and cobalt) the case for electric vehicles is not conclusive. Indeed, a study by Volkswagen estimates that an electric Golf has to travel 77,000 miles on average to have less overall impact on the climate compared with a diesel model.

On the other hand, say Claire Jones and Jamie Powell in the FT, VW also reckon the environmental benefits of electric vehicles will be far greater by 2030 due to increased ranges, greener batteries and charging systems, and an overall energy mix that will have heavily shifting towards renewables. “The internal combustion engine is nearing its death,” they say. “To claim otherwise is to place faith in a status quo that will not only kill the planet, but German car manufacturers too.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Electric vehicle drivers to be charged new per mile tax from 2028

Electric vehicle drivers to be charged new per mile tax from 2028Electric vehicle drivers will be forced to pay a 3p per mile tax, as taxation will be brought closer in line with petrol and diesel cars

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?