The charts that matter: inflation, bubbles, and booze

As US stocks head higher into bubble territory, John Stepek looks at the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

A quick reminder, if you haven’t yet registered to watch Merryn’s upcoming interview with Charles Plowden of Baillie Gifford, don’t miss out – sign up here. It’s free, and promises to be extremely pertinent given BG’s deep understanding of the companies that have led the bull market of the last decade. Don’t miss it (you don’t have to tune in live, just register to make sure you can watch it in your own time).

In the magazine this week, Matthew Lynn suggests that the FTSE 100 is heading for a major tech makeover; Jonathan Compton looks at the best bets in the booze business; and we look at the sticky issue of inflation. If you’re not already a regular reader, then sign up now – you get your first six mags free when you subscribe.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the latest podcast, Merryn and I discuss all the signs of a bubble in markets, ranging from leveraged bets soaring to 12-year olds swapping stock tips in the playground. We also spot an ESG snag for bitcoin and ask our more mature readers to share their tales of what it was like to own a house during the inflation of the 1970s. Have a listen, leave a review, and send us your war stories!

Our latest “Too Embarrassed To Ask” video looks at one specific measure of a company’s worth, and one that is particularly associated with value investors. “Book value” has its uses – but it also has plenty of flaws. Find out more here.

Here are the links for this week’s editions of Money Morning and other web stories you may have missed.

- Monday: It's not just the UK – we're seeing pandemic housing booms across the globe

- Merryn’s blog: Why we won’t see a house-price crash in 2021

- Tuesday: Inflation looks likely to take off this year – but there’s one key risk

- Wednesday: Gold has had a tough start to 2021, but we’ve been here before

- Thursday: The world’s fund managers are getting very bullish – be careful out there

- Friday: Inflation is the easiest way out of this – just don’t expect politicians to admit it

Now for the charts of the week.

The charts that matter

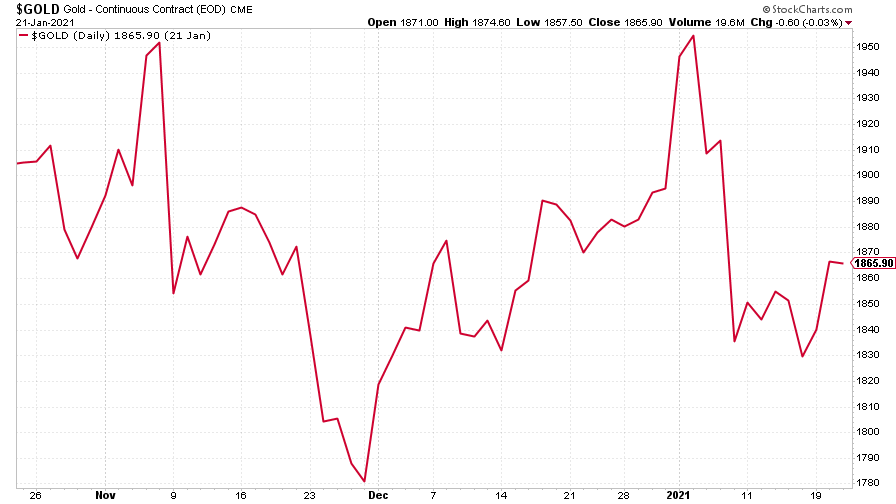

Gold has another mediocre week, as Dominic noted in his most recent Money Morning. The main issue for gold right now is that US interest rates have crept higher. That means “real” (after-inflation) rates have perked up. That makes gold look less appealing. I don’t think it will last; In the longer run, I think inflation will rise more rapidly than interest rates, meaning that real rates will fall again. But we’ll see how it all unfolds.

(Gold: three months)

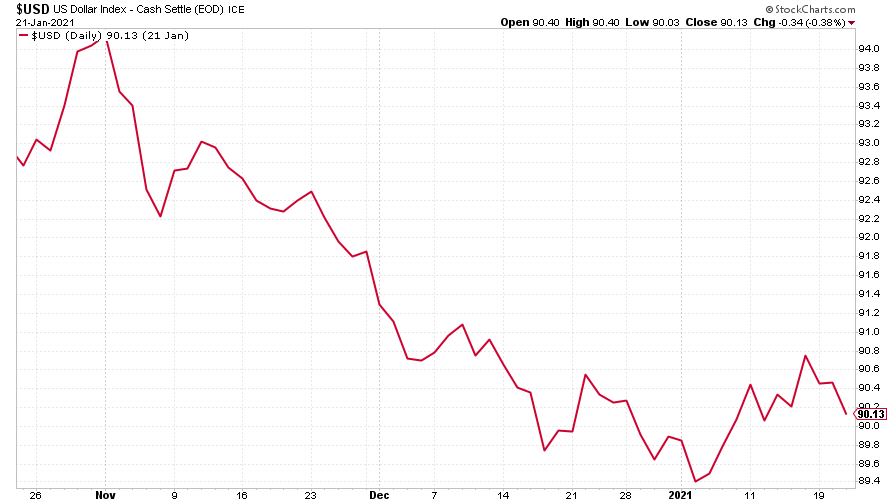

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) was little changed in the past week.

(DXY: three months)

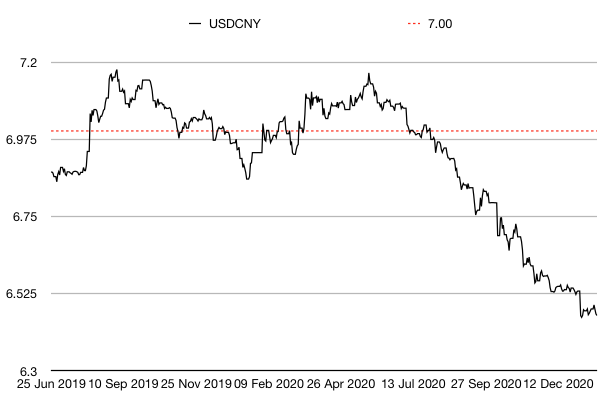

The Chinese yuan (or renminbi) continues to be strong against the US dollar (when the black line is falling, the yuan is strengthening). China has helped to buoy demand for commodities and the like over the past few months as it recovers from the pandemic. Might that shudder to a halt? I’m not sure, but it’s a risk.

(Chinese yuan to the US dollar: since 25 Jun 2019)

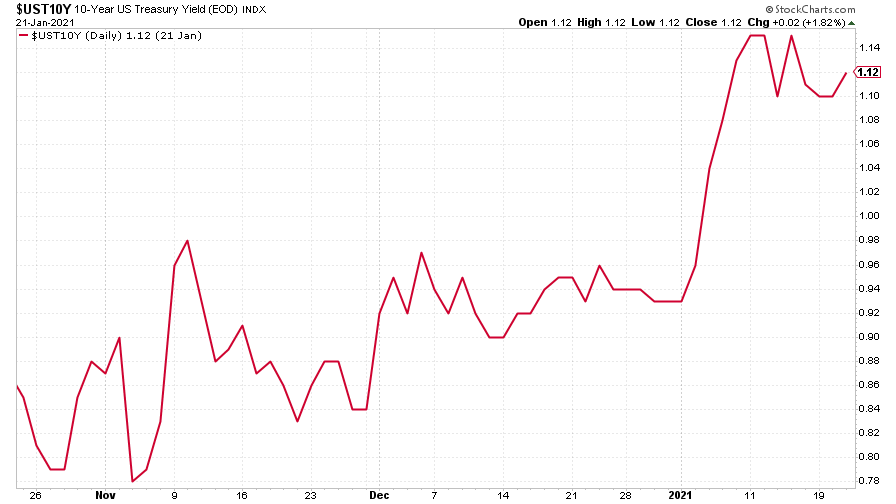

The yield on the ten-year US government bond remains close to year-long highs. Given Joe Biden and Janet Yellen’s desire to spend more money, this shouldn’t be a surprise. The question is how high it can rise before it unnerves the Federal Reserve – or sparks a market reaction.

(Ten-year US Treasury yield: three months)

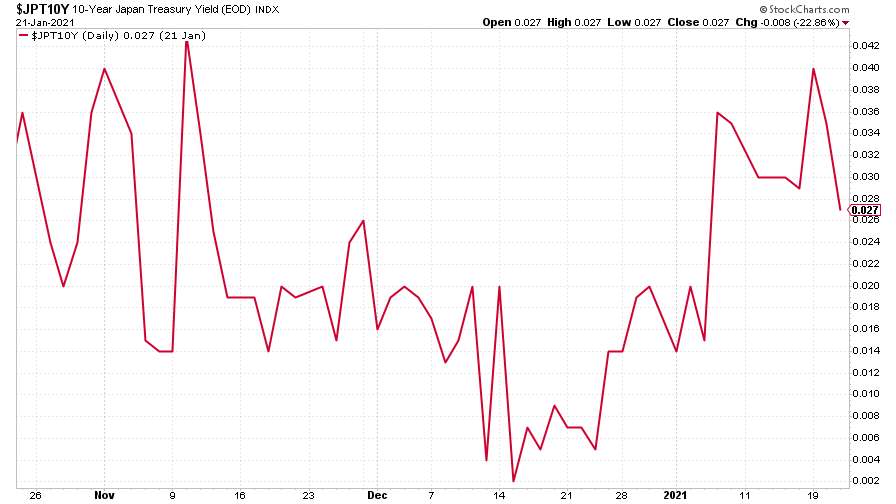

The yield on the Japanese ten-year moved in the opposite direction – it’s still being pinned to near 0% by the Bank of Japan.

(Ten-year Japanese government bond yield: three months)

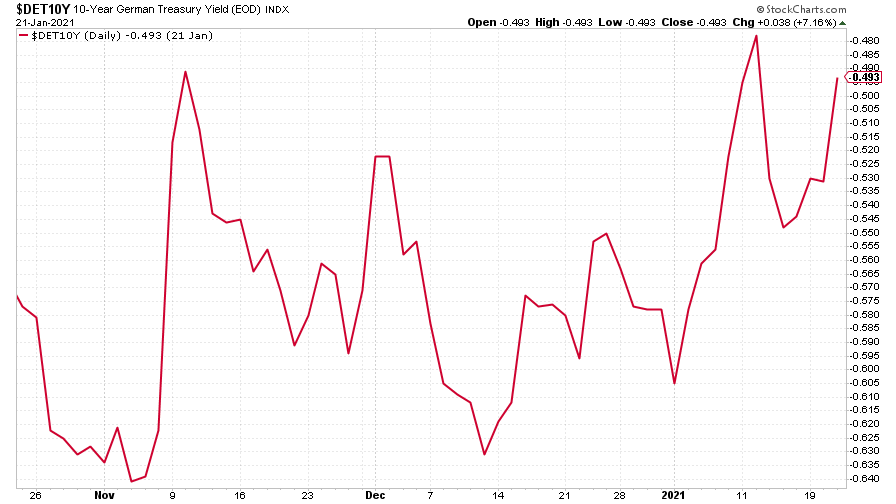

And the yield on the ten-year German Bund was modestly higher on the week.

(Ten-year Bund yield: three months)

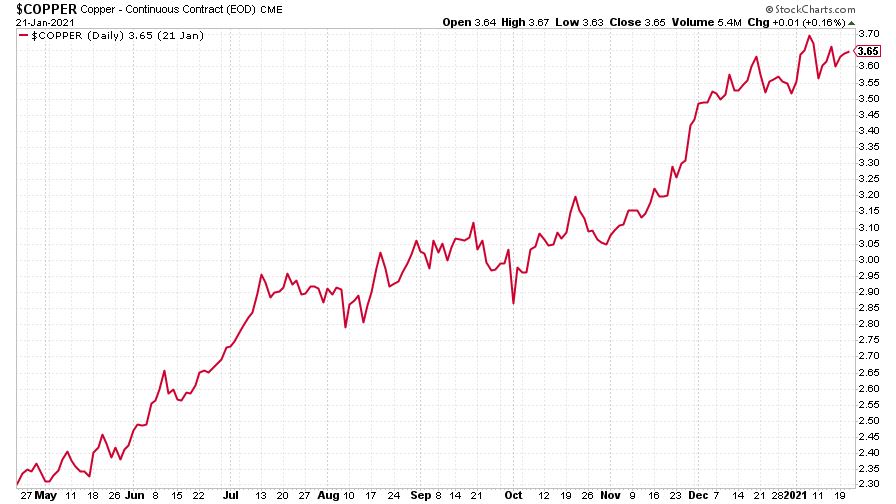

Copper appears to be taking a breather for the time being.

(Copper: nine months)

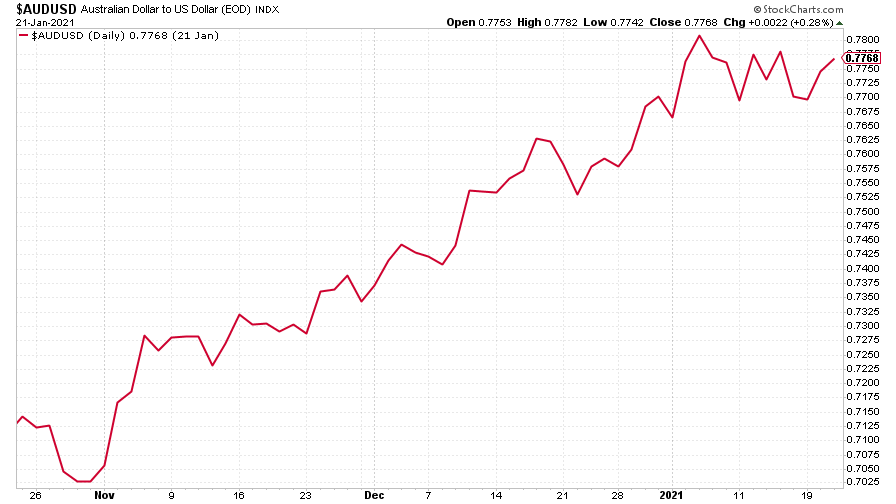

It’s a similar story for the commodities-and-China-dependent Aussie dollar.

(Aussie dollar vs US dollar exchange rate: three months)

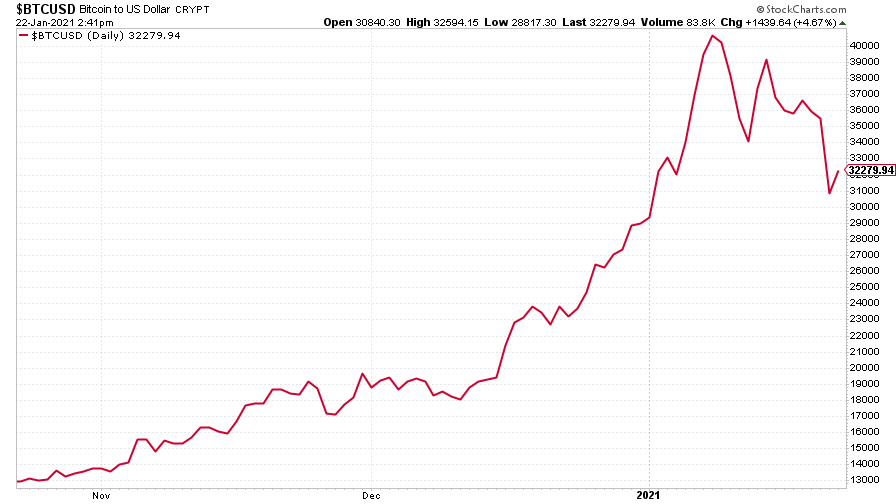

Cryptocurrency bitcoin fell hard this week, dipping below the $30,000 mark at one point. This looks like a deeper, more serious correction than before. Does it mean that bitcoin is going back into long bear market mode? That seems a little premature, but let’s see how it unfolds.

(Bitcoin: three months)

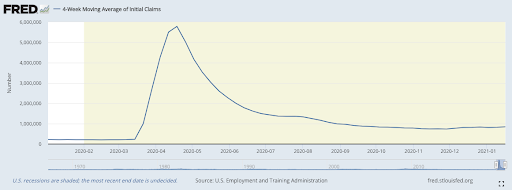

US weekly jobless claims slipped back to 900,000, compared to 926,000 last week (which was revised down from 965,000). The four-week moving average rose to 848,000 from 824,500 (which was revised down from 834,250) the week before.

(US jobless claims, four-week moving average: since Jan 2020)

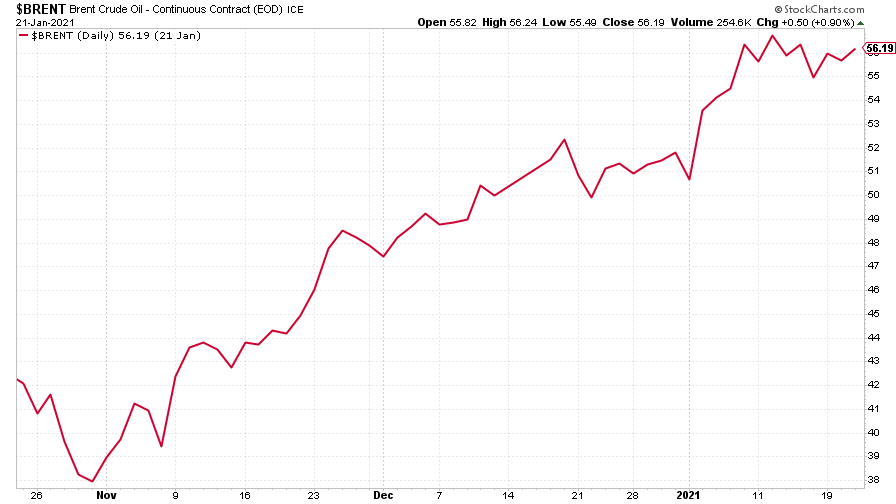

The oil price (as measured by Brent crude) remained above the $55 mark, with Saudi Arabia’s surprise production cut continuing to prop up prices.

(Brent crude oil: three months)

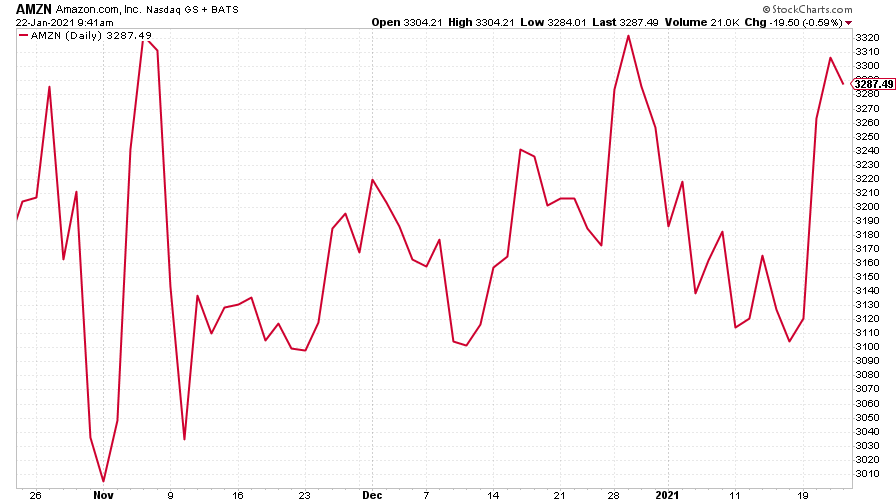

Amazon moved higher this week. Amazon hit a top at the start of September last year, and has been trading in a pretty tight range since then, between about $2,950 and $3,500 per share. It’ll break out eventually – but which way?

(Amazon: three months)

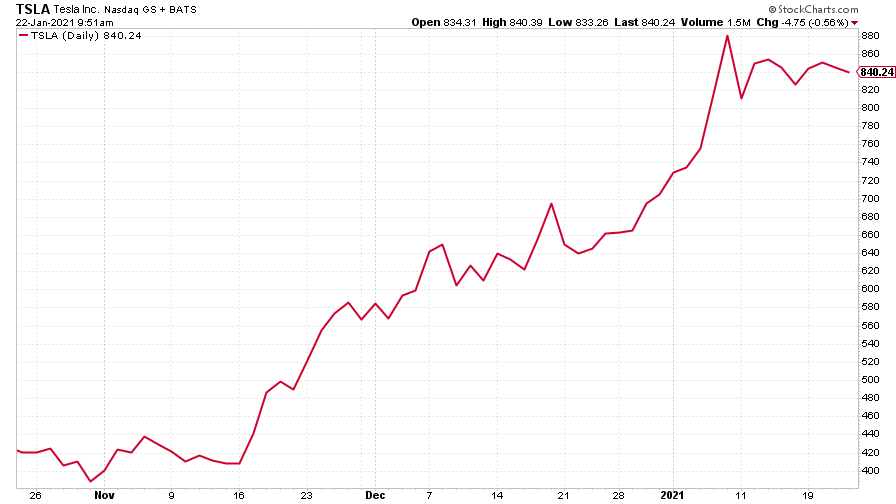

Meanwhile Tesla had a relatively quiet week by its standards, closing the week little changed.

(Tesla: three months)

Have a great weekend. Remember to register for Merryn’s interview!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.