Quiz of the week 15–21 August

Test your recollection of the week's events with MoneyWeek's quiz of the week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

1. Which Oceanic airline reported annual losses of nearly £1bn this week?

a. Sunstate Airlines,

b. Qantas,

c. Virgin Australia,

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

d. Fly Pelican

2 .Which British restaurant chain announced this week that it would be closing 73 UK outlets?

a. Pizza Express,

b. Franca Manca,

c. Yo-Sushi,

d. Tortilla

3. SpaceX completed its latest funding round this week, to the tune of $1.9bn, bringing the start-up unicorn to what overall valuation?

a. $34bn,

b. $43bn,

c. $46bn,

d. $55bn

4. Amid economic turbulence and a growing food shortage, what controversial policy has the North Korean government taken on to stem public discontent and feed its people?

a. Trading nuclear armaments for potato rations,

b. Requisitioning pet dogs to be served in restaurants,

c. Promoting a Kim Jong Un endorsed weight loss programme,

d. Asking the USA for help.

5. Just two years after reaching a market capitalisation of $1trn, which US tech giant is now valued at over $2trn?

a. Microsoft,

b. Amazon,

c. Alphabet,

d. Apple

6. Betting on a cyber-focused future, high-street giant M&S is funding an internet expansion by laying off workers; how many is it letting go?

a. 4,400,

b. 5,890,

c. 6,200,

d. 7,700

7. After a colossal clerical error at Citigroup, the investment bank has inadvertently transferred hundreds of millions of dollars to creditors of perfume giant Revlon. How much money was lost?

a. $400m,

b. $550m,

c. $620m,

d. $900m

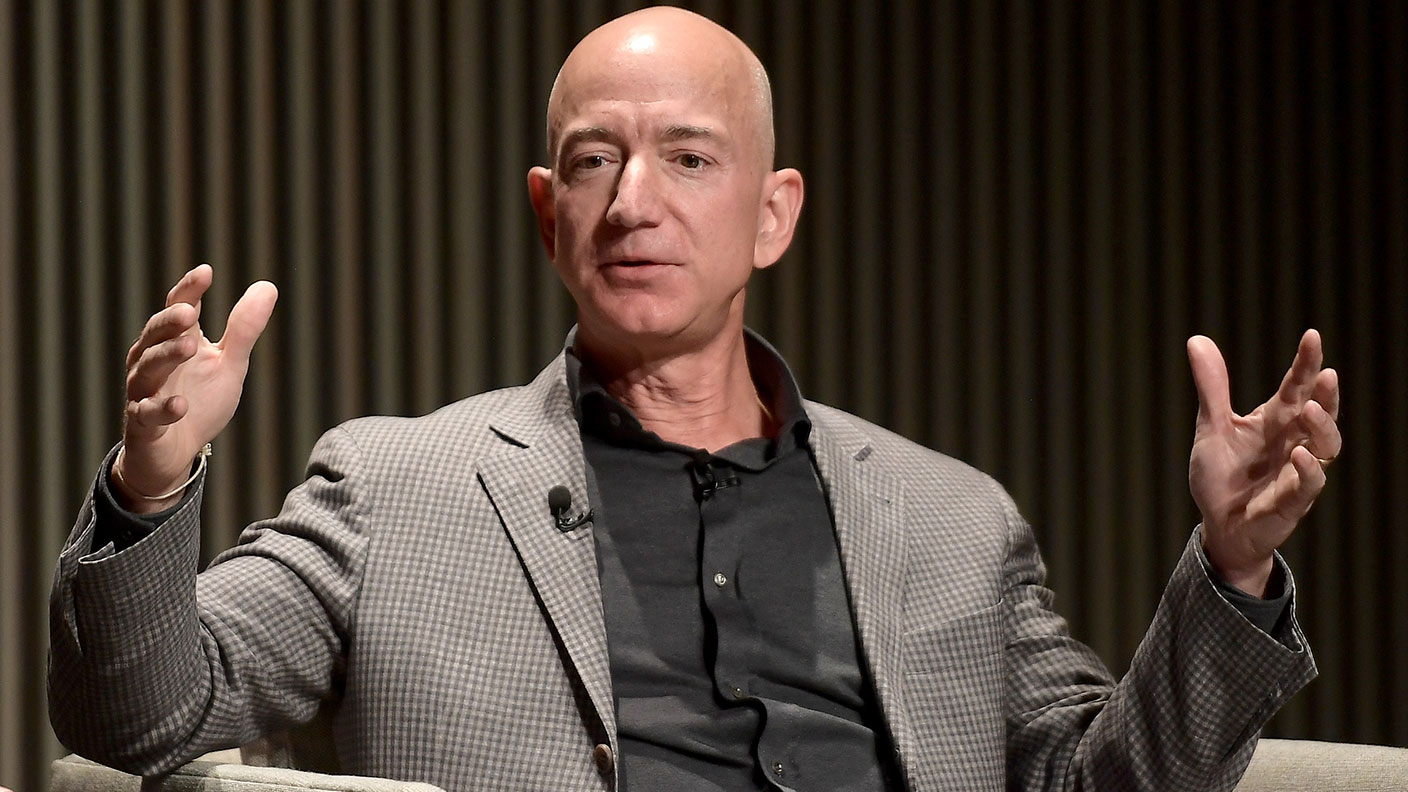

8. After shares in Tesla Motors rose 2.8% to $1,887.09 this week, founder and 21% shareholder Elon Musk has become the fourth richest person on earth, behind Jeff Bezos of Amazon, Microsoft’s Bill Gates and Mark Zuckerberg of Facebook. How much is he now worth?

a .$78bn,

b. $80bn,

c. $85bn,

d. $97bn

9. After laying off 25% of its workforce in preparation, which online accommodation booking company is predicted to make a multi-billion-dollar public offering later this year?

a. Booking.com,

b. Tripadvisor,

c. Airbnb,

d. Expedia

10 Amazon founder and CEO Jeff Bezos has recently sold one million of his company shares, adding to his already enormous wealth as the world’s richest man. What was the total value of the shares sold?

a. $1.8bn,

b. $2.4bn,

c. $2.7bn,

d. $3.2bn

Answers

1. b. Qantas. The effects of the Covid-19 lockdown on the aviation industry around the world has seen Australian airline Qantas report a near A$2bn annual loss this week, after announcing 6,000 job cuts in June this year.

2. a. Pizza Express. British restaurant business Pizza Express announced this week that it would be closing 73 out of its 454 UK outlets, with the loss of up to 1,100 jobs.

3. c. $46bn. Now taking its place as the third highest valued start-up in the world, Elon Musk’s space-tech company SpaceX is currently valued at $46 bn.

4. b. Requisitioning pet dogs to be served in restaurants. Though dog-meat restaurants have traditionally been available throughout Korea and China, North Korea’s government has recently taken to forcing wealthy pet owners to give up their “bourgeois” canines, so they can be placed into zoos or served up to eat.

5. d. Apple. Climbing to $477.67 a share on Wednesday morning, Apple Inc. hit an overall market capitalisation of $2trn, growing in value by 50% this year, despite the challenges of the Covid-19 pandemic.

6. d. $900m. Paying debtors over 100 times what they were owed, conglomerate investment bank Citigroup bungled $900m to various accounts crediting Revlon this week, and is yet to recoup the vast majority of the cash.

7. d. 7,700. Aiming to save over £100m a year, Marks & Spencer plans to lay off 7,700 workers in 2020, looking to move away from a “pre-corona” business model, and into the future.

8. c. $85bn. Musk is now worth $85bn, having gained an extraordinary $57bn in value this year alone.

9. c. Airbnb. Predicted by the Financial Times to have an implied valuation of $18bn, online booking company Airbnb is set to make its initial public offering in the coming months.

10. d. $3.2bn. Though it is unclear as to exactly why Bezos has chosen to sell his shares now, their liquidation earned him $3.2bn before tax, contributing to his estimated net worth of $188bn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jasper is a former writer for the MoneyWeek and he wrote on an array of topics including travel, investing in crypto and bitcoin, as well as cars. Previous to that he freelanced at The Art Newspaper, PORT Magazine and The Spectator. Jasper is currently a freelance writer at FAD magazine and he has an English literature degree from the University of Exeter, and a Master's degree from UCL.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

What's behind the big shift in Japanese government bonds?

What's behind the big shift in Japanese government bonds?Rising long-term Japanese government bond yields point to growing nervousness about the future – and not just inflation

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?