If you'd invested in: Bovis Homes and Crest Nicholson

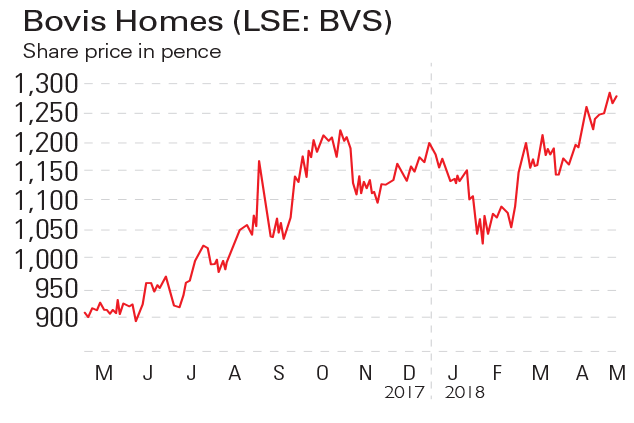

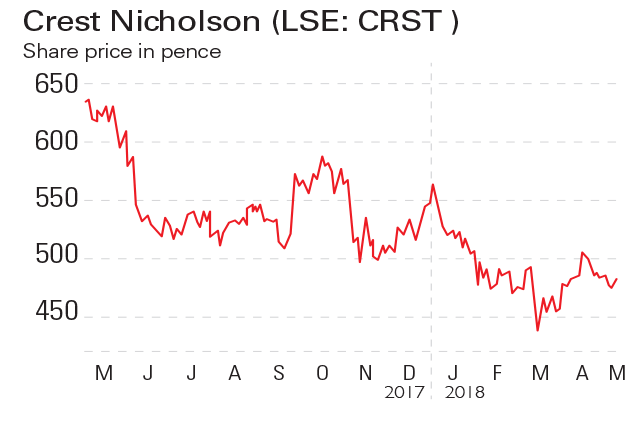

Regional housebuilder Bovis has seen its shares rise by 40% in the last year, while Crest Nicholson's have slid by 20%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Bovis Homes (LSE: BVS) operates three regional housebuilding businesses in the UK. Shares of the firm, which fought off a bid from rival Galliford Try last April, have risen by roughly 40% in the past year. In March, Bovis reported results for 2017 during which turnover fell by 3% to £1.03bn, despite a 7% increase in the average selling price to £272,400 from £254,900 the year before. Pre-tax profit met expectations at £124.3m, down from £154.7m in 2016. However, the firm also ended the year with a net cash balance of £145m, up from £38.6m a year earlier.

Be glad you didn't buy

Crest Nicholson (LSE: CRST) develops sustainable housing and mixed-use communities. Its shares have declined by roughly 20% over the past year. This is despite reporting solid results in January for the year to 31 October 2017, during which sales were up 7% to £1.1bn. It also posted a 5% rise in revenues, from £997m to £1bn, as well as a 6% rise in pre-tax profits, from £207m to £195m. The results were boosted by demand for new homes being underpinned by rising employment and low interest rates. The shares currently yield 7%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Despite cooling UK house prices, builders are charging ahead

Despite cooling UK house prices, builders are charging aheadTips The rate of UK house price growth is slowing. But demand for new houses remains high, and housebuilders are firing on all cylinders. Rupert Hargreaves picks the best stocks in the sector.

-

Why you shouldn't pay full-price for a shoddy new-build house

Why you shouldn't pay full-price for a shoddy new-build houseFeatures Housebuilder Persimmon is to allow buyers to hold back some of the purchase price of their new-build home until problems are resolved. It's a start, but it's hardly revolutionary.

-

Sharks circle Bovis

Sharks circle BovisFeatures Bovis’s rivals are trying to make a meal of its assets on the cheap. It should hold out for a better deal, says Ben Judge.

-

Shares in focus: Should you buy Bovis?

Shares in focus: Should you buy Bovis?Features The housebuilder’s profits are booming, but is there anything left still to play for? Phil Oakley investigates.

-

It’s time to sell out of the housebuilding sector – here’s why

It’s time to sell out of the housebuilding sector – here’s whyFeatures Shares in housebuilders have done very well in the last few years. But it's time to sell. Ed Bowsher explains why, and picks a more attractive sector to buy.