Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Bovis's rivals are trying to make a meal of its assets on the cheap. It should hold out for a better deal, says Ben Judge.

Until last Christmas, Bovis Homes was a fairly unremarkable, and underperforming, FTSE 250 housebuilder. In a trading update last November, it announced that it expected to enjoy "record revenues" and "increased profit". By the end of December, however, things had changed. The company issued a surprise profit warning. Completions would be "lower than previously anticipated", leading to lower-than-expected profits. Less than two weeks later, chief executive David Ritchie resigned after eight years at the helm, to be replaced by finance director Earl Sibley.

Towards the end of January, Dominic Walsh said in The Times that Andy Brough of Schroder Investment Management, which owns 8.1% of Bovis, was trying to engineer a merger with rival housebuilder Berkeley. That was seen as "an attempt to flush out bid interest" after the profit warning, according to Walsh.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In late February, the annual report revealed that profits were lower than even the revised figure down 3% on the previous year. It also had to set aside £7m to fix problems with homes completed in haste. The shares fell by 9% to leave the housebuilder languishing at the bottom of the FTSE 250, trading at less than the value of its assets.

Last Sunday, it emerged that both Galliford Try and Redrow had made bids an all-share proposal from Galliford and a cash-and-stock offer from Redrow. Galliford's bid valued Bovis at 886p a share, while Redrow's bid valued it at 814p a share. On the Friday before the bids became public, Bovis shares were trading at 774p. Both bids were rejected for being too low, says Ben Martin in The Daily Telegraph, although Bovis remained in talks with Galliford. Redrow isn't giving up, however, according to Conor Sullivan in the Financial Times. It will "persist in its pursuit" of Bovis, claiming "the potential combination offers a compelling opportunity".

It's "good news for Bovis shareholders", says James Moore on Independent.co.uk. Good news for the City, too, "generating fees for bankers, lawyers, accountants, PR agencies and other assorted hangers on". But for the bidders? "That remains to be seen." Whoever wins "is not only going to have to sort out a merger", says Moore, "they're going to have to sort out a mess". They're not interested in sorting out the business, says Jim Armitage in the Evening Standard. It would be "hard to imagine a more opportunistic set of bids".

Sure, Bovis "has been run shockingly badly and is lacking a chief executive", but the offers are "transparent efforts to get Bovis's 25,000 plots of land in the booming south and southeast cheekily cheap". Bovis would be "better off hiring a good chief executive and trading its way out of this crisis".

Wood Group's timely takeover

Aberdeen-based oil services company John Wood Group has agreed a £2.2bn takeover bid for rival Amec Foster Wheeler, which has been recommended by Amec's board, reports Nathalie Thomas in the Financial Times. Wood is offering 0.75 of its shares for each Amec share, which values Amec's shares at 564p, 15.3% above Amec's closing share price last Friday.

The offer comes "just in time", says Thomas. Amec has been struggling under a £1bn debt burden after its ill-timed takeover in 2014, when the then Amec paid $3.3bn for US group Foster Wheeler just before the oil price began to tank. The deal will combine two of the UK's biggest energy service companies to create an organisation with a value of some £5bn. Wood says the merger will deliver "significant sustainable synergies" resulting in a "leaner and more competitive" group.

That implies yet more pain ahead for staff "who have already been through relentless redundancy programmes", according to Jim Armitage in the Evening Standard, but it makes a lot of sense.

Amec's staff will "doubtless be the most nervous", but then they've been nervous since former chief executive and "Davos-loving showman", Samir Brikho, undertook the "disastrous" takeover of Foster Wheeler. Amec shareholders will be relieved to accept the premium for their shares.

City talk

Charlotte Hogg, former deputy governor of the Bank of England, has finally fallen on her sword after her insistence that she was "in compliance with all of our codes of conduct" turned out not to be true. She had failed to mention a potential conflict of interest to her new employers when she started at the Bank a few weeks ago: her brother worked at Barclays. "At best Ms Hogg has been negligent," says the Financial Times. "At worst, it suggests she thought she was writing rules for other people." She was really undone by her insistence that she didn't think a conflict of interest would arise, says Nils Pratley in The Guardian. "Really?" In her new post, she "would have sat on the Prudential Regulation Committee that has day-to-day oversight of Barclays."

"Gin-loving vegan cyclists are the new drivers of consumer spending in the UK," says Nicholas Megaw in the FT. Or so we can infer from the news that the Office for National Statistics has rejigged the "shopping basket" of goods and services used to calculate the UKs CPI and RPI inflation figures. Out goes uncool bottled apple cider; in comes canned apple cider and those fruity bottles of cider so loved by the fashionable young things on their nights out. Gin also makes a comeback with the growth of artisanal distilleries. Cycle helmets are in, as are "non-dairy milk drinks" such as soya and almond milk.

The gender pay gap appears to be alive and well at GlaxoSmithKline, says Alex Ralph in The Times. New chief executive Emma Walmsley may now be "the most powerful woman in the FTSE 100", but that hasn't stopped her getting paid 25% less than her predecessor Andrew Witty. Walmsley will receive a salary of £1m; Witty was on £1.1m. Her pension, bonus and long-term share incentives are also lower. What's the fuss, wonders GSK? After all, "this isEmma's first CEO role".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why you shouldn't pay full-price for a shoddy new-build house

Why you shouldn't pay full-price for a shoddy new-build houseFeatures Housebuilder Persimmon is to allow buyers to hold back some of the purchase price of their new-build home until problems are resolved. It's a start, but it's hardly revolutionary.

-

If you'd invested in: Bovis Homes and Crest Nicholson

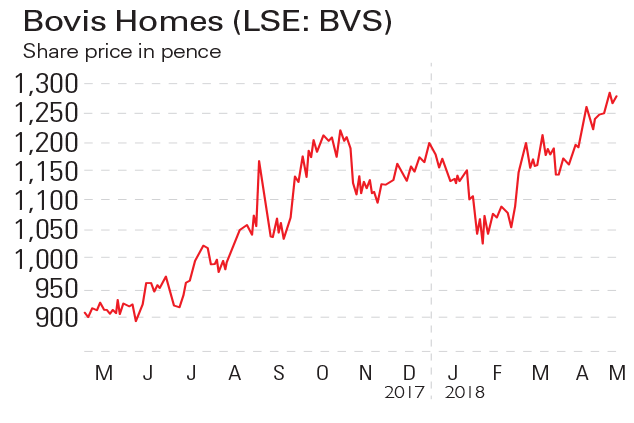

If you'd invested in: Bovis Homes and Crest NicholsonFeatures Regional housebuilder Bovis has seen its shares rise by 40% in the last year, while Crest Nicholson's have slid by 20%.

-

Shares in focus: Should you buy Bovis?

Shares in focus: Should you buy Bovis?Features The housebuilder’s profits are booming, but is there anything left still to play for? Phil Oakley investigates.

-

It’s time to sell out of the housebuilding sector – here’s why

It’s time to sell out of the housebuilding sector – here’s whyFeatures Shares in housebuilders have done very well in the last few years. But it's time to sell. Ed Bowsher explains why, and picks a more attractive sector to buy.